Professional Documents

Culture Documents

Buscom 1

Uploaded by

dmangiginOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buscom 1

Uploaded by

dmangiginCopyright:

Available Formats

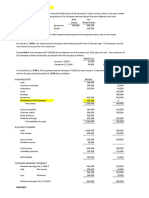

I. Big Corp purchases the net assets of Small Corporation for P500,000 cash.

Prior to the combination, Small Corporation has the following statement of

financial position :

Assets Liabilities and Equity

Accounts receivable 120,000 Current liabilities 50,000

Inventories 100,000 Common Stock,P10 par 200,000

PPE 280,000 Retained earnings 250,000

Total 500,000 500,000

Fair market values agree with book values except for inventories and ppe

which have market values of P140,000 and P300,000 respectively. To

consummate the transaction, Big Corp incurs P5,000 acquisition related

costs.

Required ;

1. Record the acquisition on Big Corp’s books.

2. Record the sale on the books of Small Corp. and the subsequent total

liquidation of the corporation.

Solution : Req 1

Price paid 500,000

Less: FMV of net assets acquired :

Accounts receivable 120,000

Inventories 140,000

PPE 300,000

Total 560,000

Less: Current liabilities 50,000 510,000

Gain on business acquisition ( 10,000 )

Journal entries ( Books of Big Corp)

Accounts receivable 120,000

Inventories 140,000

PPE 300,000

Current liabilities 50,000

Cash 500,000

Gain on acquisition 10,000

Acquisition expense 5,000

Cash 5,000

Req 2 ( Books of Small Corp)

Cash 500,000

Current liabilities 50,000

Retained earnings 50,000

Accounts receivable 120,000

Inventories 100,000

PPE 280,000

To close the assets and liabilities of Small.

Common stock 200,000

Retained earnings(250,000 + 50,000) 300,000

Cash 500,000

To record the liquidation of Small.

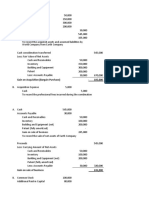

II. Dog Company acquired the net assets of Cat Corp. on January 3,2023, for

P565,000 cash. In addition, P5,000 of professional fees were incurred in

consummating the combination. At the time of acquisition, Cat Corp reported

the following book values and current market data :

BV FV

Cash and receivables 50,000 50,000

Inventory 100,000 150,000

Building and equipment net 200,000 300,000

Patent 200,000

Total 350,000 700,000

Accounts payable 30,000 30,000

Common stock 100,000

APIC 80,000

Retained earnings 140,000

Total 350,000

Required : Give the journal entries required on the books of Dog Company

and Cat Company.

Books of Dog Company :

Cash and receivables 50,000

Inventory 150,000

Building and equipment, net 300,000

Patent 200,000

Accounts payable 30,000

Cash 565,000

Gain on acquisition 105,000

To record acquisition.

Acquisition expense 5,000

Cash 5,000

Books of Cat Company

Cash 565,000

Accounts payable 30,000

Cash and receivables 50,000

Inventory 100,000

Building and equipment 200,000

Retained earnings 245,000

Common stock 100,000

APIC 80,000

Retained earnings (140,000 +245,000) 385,000

Cash 565,000

III. On January 1, 2021, Tagalog Corp issued 6,000 shares of its P10 par value

common stock to acquire the assets and liabilities of Visaya Corp. Tagalog

shares were selling at P90 on that date. Carrying values and fair value data

for Visaya Corp at the time of acquisition were as follows :

CV FV

Cash and receivables 50,000 50,000

Inventory 100,000 200,000

Building and equipment ,net 270,000 300,000

Total 420,000 550,000

Accounts payable 50,000 50,000

Common stock ,P20 par 200,000

Retained earnings 170,000

Total 420,000

Tagalog Corp paid P25,000 for Sec registration and issuance of its new

shares and paid professional fees of P15,000.

Required : Record the entries on the books of Tagalog and Visaya Corp in

connection with the business combination.

Price paid (6,000 x P90) 540,000

Less: FMV of NA acquired :

(550,000-50,000) 500,000

Goodwill 40,000

Books of Tagalog:

Cash and receivables 50,000

Inventory 200,000

Building and equipment 300,000

Goodwill 40,000

Accounts payable 50,000

Common stock 60,000

Share premium (6,000 x80) 480,000

To record acquisition

Share premium 25,000

Acquisition expense 15,000

Cash 40,000

Books of Visaya Corp:

Stocks of Tagalog 540,000

Accounts payable 50,000

Retained earnings 170,000

Cash and receivables 50,000

Inventory 100,000

Building and equipment 270,000

Common stock 200,000

Retained earnings(170,000 +170,000) 340,000

Stocks of Tagalog 540,000

To record subsequent liquidation.

You might also like

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- Government Owned Fixed Asset Management ManualDocument171 pagesGovernment Owned Fixed Asset Management ManualSteven Kisamo Ambrose100% (8)

- Exercise Answers - Consolidated FS - Statement of Financial PositionDocument3 pagesExercise Answers - Consolidated FS - Statement of Financial PositionJohn Philip L ConcepcionNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Partnership Exercise 12 PDFDocument2 pagesPartnership Exercise 12 PDFFrancis CabasNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Accounting For Fixed Assets I. Property, Plant and EquipmentDocument45 pagesAccounting For Fixed Assets I. Property, Plant and EquipmentLayNo ratings yet

- Finance1 Problem1 121013094019 Phpapp01 PDFDocument13 pagesFinance1 Problem1 121013094019 Phpapp01 PDFMauro SacamayNo ratings yet

- Statement of Cash Flow by KiesoDocument85 pagesStatement of Cash Flow by KiesoSiblu HasanNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- 10 IFRS 3 Business CombinationDocument2 pages10 IFRS 3 Business CombinationDM BuenconsejoNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Flexible Urba TransportationDocument261 pagesFlexible Urba Transportationruss007100% (2)

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 2nd Yr Midterm (2nd Sem) ReviewerDocument19 pages2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- ABC ReviewDocument21 pagesABC ReviewJr Reyes PedidaNo ratings yet

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- Gain On Acquisition (Bargain Purchase) - 105,000Document2 pagesGain On Acquisition (Bargain Purchase) - 105,000Junzen Ralph YapNo ratings yet

- WEEK 4-5 ULOb Lets Check SolutionDocument1 pageWEEK 4-5 ULOb Lets Check SolutionAnifahchannie PacalnaNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsRobin ScherbatskyNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument9 pagesQuiz 1 - Statement of Financial PositionJonathan SolerNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- Ansay, Allyson Charissa T - Activity 3Document9 pagesAnsay, Allyson Charissa T - Activity 3カイ みゆきNo ratings yet

- Book Value Market Value Pole Co. Sole Co. Sole CoDocument7 pagesBook Value Market Value Pole Co. Sole Co. Sole CoJericho SumagueNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Abc ProbsDocument12 pagesAbc ProbsZNo ratings yet

- Problem 1: 105,000 - Correct AnswerDocument1 pageProblem 1: 105,000 - Correct AnswerSophia MilletNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Chapter 14 Business CombinationDocument5 pagesChapter 14 Business CombinationAshNor Randy0% (1)

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

- Mergers and Inv in SubsDocument4 pagesMergers and Inv in Subsmartinfaith958No ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- AFAR04-10 Business Combination Date of AcquisitionDocument3 pagesAFAR04-10 Business Combination Date of AcquisitioneildeeNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- Case 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookDocument3 pagesCase 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookkimkimNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Business Combination - EM Sample ProblemDocument32 pagesBusiness Combination - EM Sample ProblemJohn Stephen PendonNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- Sample ProblemDocument3 pagesSample ProblemZaldy Magante MalasagaNo ratings yet

- Answer To ExercisesDocument40 pagesAnswer To ExercisesmarieieiemNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- Prelim Exam Business CombinationDocument3 pagesPrelim Exam Business CombinationHyakkimura GamingNo ratings yet

- Corp. BankruptcyDocument7 pagesCorp. BankruptcyLorifel Antonette Laoreno TejeroNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Arabic Lessons.,.,PDFDocument9 pagesArabic Lessons.,.,PDFdmangiginNo ratings yet

- Buscom Activity 11227979968Document2 pagesBuscom Activity 11227979968dmangiginNo ratings yet

- Strat EssayDocument7 pagesStrat EssaydmangiginNo ratings yet

- Dayag 9Document2 pagesDayag 9dmangiginNo ratings yet

- Module 1 The Nature of Strategic ManagementDocument7 pagesModule 1 The Nature of Strategic ManagementdmangiginNo ratings yet

- Cost and Equity MethodDocument11 pagesCost and Equity MethoddmangiginNo ratings yet

- buscom 4Document6 pagesbuscom 4dmangiginNo ratings yet

- Buscom 8Document11 pagesBuscom 8dmangiginNo ratings yet

- FinMan Module 4 Analysis of FSDocument11 pagesFinMan Module 4 Analysis of FSerickson hernanNo ratings yet

- Audit of Intangible AssetDocument3 pagesAudit of Intangible Assetd.pagkatoytoyNo ratings yet

- Engineering EconomyDocument53 pagesEngineering EconomyPaulo Emmanuele BetitaNo ratings yet

- Activity #3 Separate and Consolidated FS - Date of AcquisitionDocument4 pagesActivity #3 Separate and Consolidated FS - Date of AcquisitionLorelie I. RamiroNo ratings yet

- Nasr City Cons 12 2020EDocument48 pagesNasr City Cons 12 2020EAly A. SamyNo ratings yet

- Practice Numericals FSADocument15 pagesPractice Numericals FSAHaripriyaNo ratings yet

- CF 12th Edition Chapter 02Document38 pagesCF 12th Edition Chapter 02Ashekin MahadiNo ratings yet

- Modeling Investments - in - TaxEquityPartnerships - Bloomberg Oct 2012Document7 pagesModeling Investments - in - TaxEquityPartnerships - Bloomberg Oct 2012Gary McKayNo ratings yet

- You Have Been Provided With The Following Summarised Accounts of Golden Times LTDDocument4 pagesYou Have Been Provided With The Following Summarised Accounts of Golden Times LTDNelsonMoseM100% (1)

- BLOCK 2 Unit II Equity ValuationDocument18 pagesBLOCK 2 Unit II Equity ValuationASHWININo ratings yet

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaDocument22 pagesIndian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- MG T 401 Short Notes by Khalid BilalDocument33 pagesMG T 401 Short Notes by Khalid BilalhayyaNo ratings yet

- Nov 20Document139 pagesNov 20sachin kumarNo ratings yet

- Sarkar Et Al-2000-International Review of FinanceDocument34 pagesSarkar Et Al-2000-International Review of FinanceGUNA SEKHARNo ratings yet

- G10489 EC Advanced Financial Accounting PrimerDocument64 pagesG10489 EC Advanced Financial Accounting PrimerAlmira ReyesNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDanny DrinkwaterNo ratings yet

- Piedmont Lithium LTD: Location, Location, Location..Document33 pagesPiedmont Lithium LTD: Location, Location, Location..AshokNo ratings yet

- Declining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30Document13 pagesDeclining Balance Method of Depreciation: - Sajan Mahat Roll No.: 30Python SMNo ratings yet

- GmmpfaudlerDocument16 pagesGmmpfaudlerJay PatelNo ratings yet

- Financial Statement Analysis: Assignment OnDocument6 pagesFinancial Statement Analysis: Assignment OnMd Ohidur RahmanNo ratings yet

- Rothschild Annual Report 2007 - 08 - FinalDocument61 pagesRothschild Annual Report 2007 - 08 - FinalellokosNo ratings yet

- 4 6016903642987107601Document165 pages4 6016903642987107601Talab OsmanNo ratings yet

- Engineering Economy 16th Edition Sullivan Test BankDocument9 pagesEngineering Economy 16th Edition Sullivan Test Bankjohnquyzwo9qa100% (31)