Professional Documents

Culture Documents

Analyzing Consolidated Financial Statements

Uploaded by

Bryle Jay LapeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing Consolidated Financial Statements

Uploaded by

Bryle Jay LapeCopyright:

Available Formats

Bryle Jay P.

Lape

Let’s Analyze.

1.

Investment in Sally Wood Products Company 160,000

Cash 160,000

To record acquisition of Sally Wood Products Company stocks.

Cash 8,000

Dividend Income 8,000

To record share in dividends paid by Sally Company.

2.

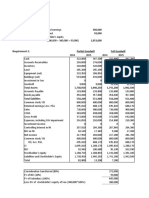

Total Parent (80%) NCI (20%)

Fair value of subsidiary P200,000 160,000 40,000

Less: Book value of interest acquired:

Common Stock- Sally WP Company 100,000

Retained Earnings- Sally WP 50,000

Company

Total P150,000 P150,000 P150,000

Interest acquired 80% 20%

Book value P120,000 P30,000

Excess P50,000 P40,000 P10,000

Allocations (adjustment)

Buildings and Equipment (50,000)

--- -

Journal Entries:

Dividend Income 8,000

Non-controlling Interest 2,000

Dividends declared – Sally WP Company 10,000

To eliminate inter-company dividends and minority share of

dividends.

Common stock – Sally WP Company 100,000

Retained Earnings, 1/1 –Sally WP Company 50,000

Investment in Sally WP Company 120,000

Non-controlling Interest 30,000

To eliminate equity accounts of subsidiary and the investment

account for the parent’s share and recognize NCI on date of

acquisition.

Building and Equipment 50,000

Investment in Sally Products 40,000

Non-controlling Interest 10,000

To allocate excess.

Depreciation Expense (50,000/10 yrs.) 5,000

Accumulated depreciation– Building. & Equipment 5,000

To amortize allocated excess.

Accounts Payable 10,000

Cash and Receivables 10,000

To record inter-corporate payable and receivables.

Non-controlling Interest in CI of Subsidiary 5,000

Non-controlling Interest 5,000

To recognize NCI in subsidiary’s adjusted net

income for 2020as follows:

CI of Subsidiary P 30,000

Amortization (5,000)

Adjusted CI of Subsidiary 25,000

NCI Share (P25, 000 x 20%) P 5,000

3.

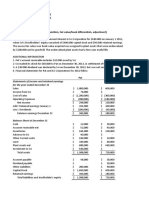

Pilar Corporation and Subsidiary

Working Paper for Consolidated

Financial Statements Year Ended

December 31, 2020

Pilar Sally WP Eliminations & Consolidated

Corporation Company Adjustments

Debit Credit

Statement of CI

Sales 200,000 100,000 300,000

Dividend income 8,000 - (1) 8,000

Total revenue 208,000 100,000 300,000

Cost of Goods Sold 120,000 50,000 170,000

Depreciation expense 25,000 15,000 (4) 5,000 45,000

Inventory losses 15,000 5,000 20,000

Total costs and expenses 160,000 ,000 235,000

Net/ consolidated income 48,000 30,000 65,000

NCI in CI of subsidiary (6) 5,000 (5,000)

CI to RE 48,000 30,000 60,000

Statement of

Retained Earnings

Retained earnings, 1/1 298,000 90,000 (2) 50,000 338,000

CI from above 48,000 30,000 60,000

Total 346,000 120,000 398,000

Dividends declared 30,000 10,000 (1) 10,000 30,000

Retained earnings, 12/31

Carried forward 316,000 110,000 368,000

Statement of FP

Cash and receivables 81,000 65,000 (5) 10,000 136,000

Inventory 260,000 90,000 350,000

Land 80,000 80,000 160,000

Buildings and Equipment 500,000 150,000 (3) 50,000 700,000

Investment in Sally WP Co. 160,000 (2) 120,000

(3) 40,000 ____________

Total 1,081,000 385,000 1,346,000

Accumulated Depreciation 205,000 105,000 (4) 5,000 315,000

Accounts payable 60,000 20,000 (5) 10,000 70,000

Notes payable 200,000 50,000 250,000

Common stock:

Pilar Corporation 300,000 300,000

Sally WP Company 100,000 (2) 100,000

Retained earnings, 12/31

From above 316,000 110,000 368,000

NCI (1) 2,000 (2) 30,000 43,000

(3) 10,000

(6) 5,000

Total 1,081,000 385,000 230,000 230,000 1,346,000

You might also like

- Learn To Hear The Voice of GodDocument110 pagesLearn To Hear The Voice of Godtrue prophet100% (1)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Surge arrester protects electrical equipmentDocument25 pagesSurge arrester protects electrical equipmentSyed Ahsan Ali Sherazi100% (3)

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- 7 - NIBL - G.R. No. L-15380 Wan V Kim - DigestDocument1 page7 - NIBL - G.R. No. L-15380 Wan V Kim - DigestOjie SantillanNo ratings yet

- Research Dept Monthly Meeting AnnouncementDocument1 pageResearch Dept Monthly Meeting AnnouncementBryle Jay LapeNo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Lape - ACP312 - ULOa - Let's Check Week6Document2 pagesLape - ACP312 - ULOa - Let's Check Week6Bryle Jay LapeNo ratings yet

- Consolidated Financial Statements Working Paper Pilar CorporationDocument1 pageConsolidated Financial Statements Working Paper Pilar CorporationShaira GampongNo ratings yet

- PT Ortu PT Bocah Comprehensive Income RP RPDocument8 pagesPT Ortu PT Bocah Comprehensive Income RP RPNcim PoNo ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Statement of CIDocument4 pagesStatement of CIMarvin CaliwaganNo ratings yet

- Consolidated Financial Statements Worked ExampleDocument5 pagesConsolidated Financial Statements Worked ExampleEnalem OtsuepmeNo ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- CONSO FS LESSONDocument54 pagesCONSO FS LESSONdbpcastro8No ratings yet

- Business Combination - EM Sample ProblemDocument32 pagesBusiness Combination - EM Sample ProblemJohn Stephen PendonNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Singapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice QuestionsDocument6 pagesSingapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice Questionsduong duongNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- chp3 Practice Problem 1Document1 pagechp3 Practice Problem 1api-557861169No ratings yet

- Consolidate Peanut and Snoopy FinancialsDocument4 pagesConsolidate Peanut and Snoopy FinancialsYandra Febriyanti0% (1)

- Buscom 1Document4 pagesBuscom 1dmangiginNo ratings yet

- Module 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Extra session 2 (30 Sept 2022) spreadsheet (Ch 3)Document2 pagesExtra session 2 (30 Sept 2022) spreadsheet (Ch 3)georgius gabrielNo ratings yet

- Advanced Acct - II ProblemsDocument4 pagesAdvanced Acct - II ProblemsSamuel DebebeNo ratings yet

- B CorporationDocument11 pagesB CorporationMelizze MejicoNo ratings yet

- Exchange Gain On DonationDocument11 pagesExchange Gain On DonationDinindu SahanNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Here are the capital account changes for each partner:C: P 3,000 decrease P: P 25,500 decreaseA: P 7,500 decreaseDocument8 pagesHere are the capital account changes for each partner:C: P 3,000 decrease P: P 25,500 decreaseA: P 7,500 decreasetide podsNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Is Consolidation Acc312Document4 pagesIs Consolidation Acc312Richard SantosNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- BA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsDocument23 pagesBA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsRed Ashley De LeonNo ratings yet

- Parent Company Purchase of Subsidiary StockDocument3 pagesParent Company Purchase of Subsidiary StockZeinab MohamadNo ratings yet

- Prelim Bring Home Exam ResultsDocument12 pagesPrelim Bring Home Exam ResultsMary Joy CabilNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Exercise 5.1Document12 pagesExercise 5.1Stephanie XieNo ratings yet

- ComputationDocument5 pagesComputationgzyville630No ratings yet

- CH 9 ExamplesDocument2 pagesCH 9 ExamplesAisha PatelNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Lax Co Cash Flows 2020Document4 pagesLax Co Cash Flows 2020moreNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Lape - ACP312 - ULOb - in A Nutshell Week 4Document1 pageLape - ACP312 - ULOb - in A Nutshell Week 4Bryle Jay LapeNo ratings yet

- Eliminating unrealized gainsDocument3 pagesEliminating unrealized gainsBryle Jay LapeNo ratings yet

- Lape, Bryle Jay - Let's Analyze!Document1 pageLape, Bryle Jay - Let's Analyze!Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A Nutshell Weel 8-9Document1 pageLape - ACP312 - ULOa - in A Nutshell Weel 8-9Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay (ULOa&b)Document2 pagesLape, Bryle Jay (ULOa&b)Bryle Jay LapeNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Lape - ACP312 - ULOa - in A NutshellDocument1 pageLape - ACP312 - ULOa - in A NutshellBryle Jay LapeNo ratings yet

- Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheDocument3 pagesAccounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheBryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A Nutshell Week6Document1 pageLape - ACP312 - ULOa - in A Nutshell Week6Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay (ULOa&b)Document2 pagesLape, Bryle Jay (ULOa&b)Bryle Jay LapeNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsBryle Jay LapeNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Lape, Bryle Jay - in NutshellDocument1 pageLape, Bryle Jay - in NutshellBryle Jay LapeNo ratings yet

- Lape, Bryle Jay - Let's Check!Document1 pageLape, Bryle Jay - Let's Check!Bryle Jay LapeNo ratings yet

- Proposal LetterDocument1 pageProposal LetterBryle Jay LapeNo ratings yet

- Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheDocument3 pagesAccounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheBryle Jay LapeNo ratings yet

- Financial Statement Analysis - Reconstruction ActivityDocument4 pagesFinancial Statement Analysis - Reconstruction ActivityBryle Jay LapeNo ratings yet

- Proposal Letter - LapeDocument1 pageProposal Letter - LapeBryle Jay LapeNo ratings yet

- Unsolicited Application Letter - LapeDocument1 pageUnsolicited Application Letter - LapeBryle Jay LapeNo ratings yet

- Case StudyDocument15 pagesCase StudyBryle Jay LapeNo ratings yet

- Final Exam - LAPEDocument5 pagesFinal Exam - LAPEBryle Jay LapeNo ratings yet

- Solicited Application Letter - LapeDocument1 pageSolicited Application Letter - LapeBryle Jay LapeNo ratings yet

- Funding RequestDocument14 pagesFunding RequestBryle Jay LapeNo ratings yet

- Almico - Drug - 2 Market ResearchfinalDocument12 pagesAlmico - Drug - 2 Market ResearchfinalBryle Jay LapeNo ratings yet

- Almico - Drug - 2 Market ResearchfinalDocument12 pagesAlmico - Drug - 2 Market ResearchfinalBryle Jay LapeNo ratings yet

- A&V Safety, Inc.: (Case Analysis)Document11 pagesA&V Safety, Inc.: (Case Analysis)Bryle Jay LapeNo ratings yet

- Tips On How To Improve PhotographyDocument18 pagesTips On How To Improve PhotographyBryle Jay LapeNo ratings yet

- Tiresocks CatalogDocument19 pagesTiresocks CatalogAshBossNo ratings yet

- Bai Tap Bo TroDocument6 pagesBai Tap Bo TroKhiết TrangNo ratings yet

- Cla IdmaDocument160 pagesCla Idmacurotto1953No ratings yet

- CB4 BBC Interviews EXTRA UnitDocument1 pageCB4 BBC Interviews EXTRA UnitCristianNo ratings yet

- Desk PiDocument21 pagesDesk PiThan LwinNo ratings yet

- Definition and Scope of Public FinanceDocument2 pagesDefinition and Scope of Public FinanceArfiya MubeenNo ratings yet

- bk978 1 6817 4068 3ch1Document28 pagesbk978 1 6817 4068 3ch1fysmaNo ratings yet

- Automatic Repeat Request (Arq)Document15 pagesAutomatic Repeat Request (Arq)Rahul RedkarNo ratings yet

- Contemporary Issue in StrategyDocument13 pagesContemporary Issue in Strategypatrick wafulaNo ratings yet

- Research on Comparisons between Sabah and Diesel CyclesDocument8 pagesResearch on Comparisons between Sabah and Diesel CyclesjorgeNo ratings yet

- MKTG 2126 - Assignment 3Document2 pagesMKTG 2126 - Assignment 3omar mcintoshNo ratings yet

- Application of Gis in Electrical Distribution Network SystemDocument16 pagesApplication of Gis in Electrical Distribution Network SystemMelese Sefiw100% (1)

- Factory Test Report For OPzS 800 EED-20041724 2VDocument3 pagesFactory Test Report For OPzS 800 EED-20041724 2VmaherNo ratings yet

- Mercury Poisoning Symptoms and TreatmentsDocument1 pageMercury Poisoning Symptoms and TreatmentsRakheeb BashaNo ratings yet

- Shooting ScriptDocument12 pagesShooting Scriptapi-544851273No ratings yet

- Engr2227 Apr03Document10 pagesEngr2227 Apr03Mohamed AlqaisiNo ratings yet

- M.Com Second Semester – Advanced Cost Accounting MCQDocument11 pagesM.Com Second Semester – Advanced Cost Accounting MCQSagar BangreNo ratings yet

- Bareos Manual Main ReferenceDocument491 pagesBareos Manual Main ReferenceAlejandro GonzalezNo ratings yet

- Comparative Media SystemsDocument10 pagesComparative Media SystemsJoram MutwiriNo ratings yet

- Medication Calculation Examination Study Guide: IV CalculationsDocument2 pagesMedication Calculation Examination Study Guide: IV Calculationswaqas_xsNo ratings yet

- Plant Disease Detection Using Deep LearningDocument5 pagesPlant Disease Detection Using Deep LearningIJRASETPublicationsNo ratings yet

- M.Sc. Agriculture (Agronomy)Document23 pagesM.Sc. Agriculture (Agronomy)Abhishek MauryaNo ratings yet

- Manual PDFDocument9 pagesManual PDFRuth ResuelloNo ratings yet

- LTG 04 DD Unit 4 WorksheetsDocument2 pagesLTG 04 DD Unit 4 WorksheetsNguyễn Kim Ngọc Lớp 4DNo ratings yet

- Science MELCsDocument42 pagesScience MELCsRanjell Allain TorresNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementSanna KazmiNo ratings yet