Professional Documents

Culture Documents

Consolidated Financial Statements Working Paper Pilar Corporation

Uploaded by

Shaira GampongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Financial Statements Working Paper Pilar Corporation

Uploaded by

Shaira GampongCopyright:

Available Formats

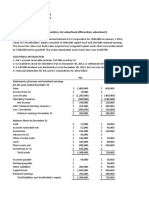

C.

Pilar Corporation and Subsidiary

Working Paper for Consolidated Financial Statement

December 31,2017

Pilar Sally Wood Adjustments & Eliminations

Consolidated

Corporation Products Debit Credit

Income Statement

Sales 200,000 100,000 300,000

Dividend income 8,000 (1) 8,000 -

Total revenue 208,000 100,000 300,000

Cost of goods sold 120,000 50,000 170,000

Depreciation expense 25,000 15,000 (4) 5,000 45,000

Inventory losses 15,000 5,000 20,000

Total cost and expenses 160,000 70,000 235,000

Net/Consolidated income to RE 48,000 30,000 65,000

NCI in net income of subsidiary (6) 5,000 -5,000

Net income carried forward 48,000 30,000 60,000

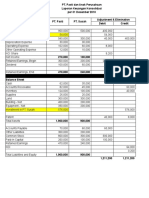

Statement of Retained Earnings

Retained earnings, 1/1 298,000 90,000 (2) 50,000 326,000

(4) 5,000

(7) 7,000

Net loss from above 48,000 30,000 60,000

Total 346,000 120,000 386,000

Dividends declared 30,000 10,000 (1) 10,000 30,000

Retained earnings, 12/31

carried forward 316,000 110,000 356,000

Statement of FP

Cash and receivables 81,000 65,000 (5) 10,000 136,000

Inventory 260,000 90,000 350,000

Land 80,000 80,000 160,000

Buildings and equipment-net 295,000 45,000 (3) 50,000 (4) 10,000 380,000

Investment in Sally Wood Products Company 160,000 (2) 120,000 -

(3) 40,000

Total Assets 876,000 280,000 1,026,000

Accounts payable 60,000 20,000 (5) 10,000 70,000

Notes payable 200,000 50,000 250,000

Common stock 300,000 100,000 (2) 100,000 300,000

Retained earnings from above 316,000 110,000 356,000

NCI (2) 30,000

(3) 10,000

(1) 2,000 50,000

(6) 5,000

(7) 7,000

Total Liabilities and Equity 876,000 280,000 242,000 242,000 1,026,000

You might also like

- Configuring Group Reporting With S/4 Hana 1909.Document5 pagesConfiguring Group Reporting With S/4 Hana 1909.suryaNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- FCCS Admin GuideDocument553 pagesFCCS Admin GuideSuneelKumarNo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- Test Bank - Aa Part 2 (2015 Ed)Document162 pagesTest Bank - Aa Part 2 (2015 Ed)PutmehudgJasd79% (19)

- Prac I InvestmentsDocument16 pagesPrac I InvestmentsJohn PasquitoNo ratings yet

- Financial Statement Analysis: Consolidated Balance SheetDocument6 pagesFinancial Statement Analysis: Consolidated Balance SheetUdit RajNo ratings yet

- Chapter 07 XLSolDocument9 pagesChapter 07 XLSolZachary Thomas CarneyNo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Analyzing Consolidated Financial StatementsDocument3 pagesAnalyzing Consolidated Financial StatementsBryle Jay LapeNo ratings yet

- chp3 Practice Problem 1Document1 pagechp3 Practice Problem 1api-557861169No ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Case Study Analysis of Accounting Transactions and Financial StatementsDocument21 pagesCase Study Analysis of Accounting Transactions and Financial StatementsTalib Hussain RajaNo ratings yet

- 9.1 2. SOLUTIONS - Course ChallengeDocument21 pages9.1 2. SOLUTIONS - Course Challengedrey baxterNo ratings yet

- Advanced Financial Individual Project - Keating FinalDocument36 pagesAdvanced Financial Individual Project - Keating FinalAshleyNo ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- ARA Galleries Financial ReportsDocument4 pagesARA Galleries Financial ReportsBáchHợpNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Income Statement and Financial Position for Multinational CompanyDocument3 pagesIncome Statement and Financial Position for Multinational CompanyAway To PonderNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- For Year Ending December 31, 2018: Lakeside Company Income StatementDocument8 pagesFor Year Ending December 31, 2018: Lakeside Company Income StatementMark Christian Cutanda VillapandoNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Solution To R Haque Associates ProblemDocument8 pagesSolution To R Haque Associates ProblemHasanNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- 5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016Document6 pages5.1 Kunci Jawaban Minggu 5 Lap Konsol 15 - 19 Feb 2016agustadivNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- PT Pasti dan Anak Perusahaan Laporan Keuangan Konsolidasi 2010Document19 pagesPT Pasti dan Anak Perusahaan Laporan Keuangan Konsolidasi 2010Kurrniadi AndiNo ratings yet

- Safe Payment Schedule Liquidation PlanDocument6 pagesSafe Payment Schedule Liquidation PlanTivo AtmajaNo ratings yet

- Solution DDL Partnership Practice Problem Cash Priority Program v2Document1 pageSolution DDL Partnership Practice Problem Cash Priority Program v2Josephine YenNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Accounting 3 4 Module 3aDocument2 pagesAccounting 3 4 Module 3aMnriMinaNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- IA Chapter-11-14Document7 pagesIA Chapter-11-14Christine Joyce EnriquezNo ratings yet

- 2010 11 03 - 043737 - P6 16Document5 pages2010 11 03 - 043737 - P6 16Ayuu MonaLisa100% (1)

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- 2021 SM2 Tutorial 02 InClass SolutionDocument3 pages2021 SM2 Tutorial 02 InClass SolutionZhu ZiRuiNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- P2-22, 28, 32Document8 pagesP2-22, 28, 32jyraEB9390No ratings yet

- Computational multiple choice partnership liquidation problemsDocument4 pagesComputational multiple choice partnership liquidation problemsmhikeedelantarNo ratings yet

- Paw & Saw Downstream ConsolidationDocument3 pagesPaw & Saw Downstream ConsolidationLorie Roncal JimenezNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Matching problems and liquidation computationsDocument8 pagesMatching problems and liquidation computationsSherryl DumagpiNo ratings yet

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- Chapter 13 Corporations CACP - XLSX - Sheet1Document1 pageChapter 13 Corporations CACP - XLSX - Sheet1mhrzyn27No ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Steps to consolidate financial statementsDocument5 pagesSteps to consolidate financial statementsIlham FaridNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- ABC Sample ProbDocument4 pagesABC Sample ProbangbabaeNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Prelim Bring Home Exam ResultsDocument12 pagesPrelim Bring Home Exam ResultsMary Joy CabilNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Statement of CIDocument4 pagesStatement of CIMarvin CaliwaganNo ratings yet

- AdlawDocument3 pagesAdlawShaira GampongNo ratings yet

- MCD intensive strategies improve competitive advantageDocument1 pageMCD intensive strategies improve competitive advantageShaira GampongNo ratings yet

- HaveDocument1 pageHaveShaira GampongNo ratings yet

- Absorption Costing vs. Variable CostingDocument8 pagesAbsorption Costing vs. Variable CostingShaira GampongNo ratings yet

- CVP Analysis in One ProductDocument6 pagesCVP Analysis in One ProductShaira GampongNo ratings yet

- Cost LossDocument1 pageCost LossShaira GampongNo ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Levi Tomol0% (2)

- IPSAS PSAS ComparisonDocument7 pagesIPSAS PSAS Comparisonwr KheruNo ratings yet

- Acctg for Business CombosDocument10 pagesAcctg for Business CombosFaye EnrileNo ratings yet

- Name: DEC. 17, 2020 Buscom ScoreDocument4 pagesName: DEC. 17, 2020 Buscom ScoreErica DaprosaNo ratings yet

- Chapter Four: Mcgraw-Hill/Irwin 4-1Document18 pagesChapter Four: Mcgraw-Hill/Irwin 4-1John SnowNo ratings yet

- Merger and Amalgamation Rules Under Companies Act 2013Document7 pagesMerger and Amalgamation Rules Under Companies Act 2013Mukesh MadanNo ratings yet

- Amalgamation TreatmentDocument283 pagesAmalgamation TreatmentMalkeet SinghNo ratings yet

- Equity Securities and Associates ReviewerDocument45 pagesEquity Securities and Associates Reviewerjhie boter100% (1)

- Merger and Acquisition of CompaniesDocument5 pagesMerger and Acquisition of CompaniesSathish RajasekaranNo ratings yet

- CHAPTER 15 Business CombinationDocument58 pagesCHAPTER 15 Business Combinationlo jaNo ratings yet

- Chapter 9: Indirect and Mutual HoldingsDocument36 pagesChapter 9: Indirect and Mutual HoldingsAimer RainNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- MBA Syllabus: Department of Accounting and Information Systems Jagannath University, DhakaDocument18 pagesMBA Syllabus: Department of Accounting and Information Systems Jagannath University, Dhakasakib990100% (1)

- Modern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDF DownloadDocument8 pagesModern Advanced Accounting in Canada Canadian 7th Edition Hilton Test Bank PDF DownloadSpencerMoorenbds100% (23)

- Detailed Contents of Chapter 2 Investments in Equity SecuritiesDocument39 pagesDetailed Contents of Chapter 2 Investments in Equity SecuritiesJunNo ratings yet

- DR Lal Pathlabs ARDocument203 pagesDR Lal Pathlabs ARAkash DhimanNo ratings yet

- Baf SyllabusDocument12 pagesBaf SyllabusJana MakNo ratings yet

- Company Law RajaDocument2 pagesCompany Law RajaRaja MedaNo ratings yet

- FYBCom 2012 Pune University Question PapersDocument136 pagesFYBCom 2012 Pune University Question PapersAnant DivekarNo ratings yet

- Us Gaap vs. PRC Gaap1Document22 pagesUs Gaap vs. PRC Gaap1Sun Neng FanNo ratings yet

- BADVAC1X Answers PDFDocument4 pagesBADVAC1X Answers PDFHero CourseNo ratings yet

- P Company Acquires 80Document5 pagesP Company Acquires 80hus wodgyNo ratings yet

- Consolidated Financial StatementsDocument51 pagesConsolidated Financial Statementscaztinahernandez100% (4)

- MergersDocument7 pagesMergersjNo ratings yet

- CFAP-01 CA PakistanDocument630 pagesCFAP-01 CA PakistanMuhammad ShehzadNo ratings yet