Professional Documents

Culture Documents

Lape, Bryle Jay (ULOa&b)

Uploaded by

Bryle Jay Lape0 ratings0% found this document useful (0 votes)

15 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesLape, Bryle Jay (ULOa&b)

Uploaded by

Bryle Jay LapeCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

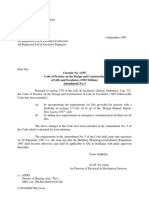

Bryle Jay P.

Lape BSA-III

In a Nutshell (UNIT 1: ULOa)

1. Accountancy profession upon the theories and assumptions that form part of its

practice standards - accounting and reporting standards, assurance and non-assurance

standards, and advisory standards.

2. Accountancy Law and Code of Ethics for Professional Accountants implemented

rules, legal codes and ethical measures to prevent misuse of profession and to

discipline the accountants in practice.

3. CPA in public practice provide services to the public. They are the ones who

represent their clients when it comes to accounting and auditing related matters.

4. Academe as a field of practice require CPA’s to engaged under institutions that

provide learning and education.

In a Nutshell (UNIT 1: ULOb)

1. A Certified Public Accountant in the practice of accountancy may offer assurance

and non-assurance services. Assurance services include independent financial

statement audit, reviews and other assurance services. Non-assurance services include

agreed-upon procedures, compilations, tax services, consultancy services and other

non-assurance services.

2. Both assurance and non-assurance services undertake engagements between the

parties and perform accounting and other activities that could improve the quality of

the subject matter.

3. Assurance services differ from non-assurance services because a practitioner under

assurance services expressed their conclusions that give a level of assurance to the

subject matter that meet the needs of the intended user.

4. A final verdict, from a practitioner, is not needed in a non-assurance services. The

practitioner’s report follows the interest of the intended users.

5. One element of assurance engagements is the relationship of three parties namely:

the practitioner; responsible party; and the intended users.

6. Suitable criteria must also be presented for a practitioner to evaluate the subject

matter under it to meet the needs of the intended users.

7. Materiality is one thing to be considered by the practitioner in gathering sufficient

evidences supporting his/her conclusion to the subject matter. This concept will serve

as a guide to determine whether misstatements/errors and omissions will influence the

decisions of the intended users.

8. Professional skepticism is an attitude a practitioner must have in order to provide a

rational conclusion and critical assessment of the subject matter. It plays a vital role in

evaluating the subject matter under the given suitable criteria and to fully express the

level of assurance of the subject matter to the intended users.

9. CPA under public practice also faced challenges in their profession. The

emergence of technology brings more complexity to the accounting and auditing

procedures. It might be efficient if used properly, but misuse of such might create

additional risks. Also, auditing processes always put time pressure to the auditors.

10. Firms have adopted public regulations to ensure that auditors and the users

(potential investors) will not experience expectation gap. Examples are: establishing

standards and measures to improve auditing procedures; maintaining discipline in the

practice of profession; and utilizing programs that will improve services under public

practice.

You might also like

- Auditing and Assurance PrinciplesDocument125 pagesAuditing and Assurance PrinciplesAaron Joy Dominguez Putian38% (34)

- IDinsight 2020 Associate Program - Writing ExerciseDocument4 pagesIDinsight 2020 Associate Program - Writing ExerciseSaudamini Sharma0% (1)

- Solutions Manual: 1st EditionDocument23 pagesSolutions Manual: 1st EditionJunior Waqairasari67% (3)

- Auditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions ManualDocument25 pagesAuditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions ManualMelanieThorntonbcmk100% (51)

- Project On Accounting EThicsDocument40 pagesProject On Accounting EThicsChidi EmmanuelNo ratings yet

- Legislative Drafting Paper - Writing SampleDocument35 pagesLegislative Drafting Paper - Writing Sampleapi-219280740No ratings yet

- Individual Income TaxDocument7 pagesIndividual Income TaxNadi Hood100% (3)

- ACCT1111 Topic 1 v2Document12 pagesACCT1111 Topic 1 v2Mariann Jane GanNo ratings yet

- Into To World of CPAsDocument22 pagesInto To World of CPAsKristine WaliNo ratings yet

- International Framework For Assurance EngagementsDocument5 pagesInternational Framework For Assurance EngagementsUsman SaleemNo ratings yet

- AUDITINGDocument11 pagesAUDITINGprecious turyamuhakiNo ratings yet

- Ch.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryDocument6 pagesCh.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryAndi PriatamaNo ratings yet

- Principles of Auditing ZicaDocument431 pagesPrinciples of Auditing ZicaDixie CheeloNo ratings yet

- Adverse Opinions, Which States That The Financial Statement Do Not Present Fairly, in Conformity inDocument3 pagesAdverse Opinions, Which States That The Financial Statement Do Not Present Fairly, in Conformity inbcruelaNo ratings yet

- Differentiate Assurance From Non-Assurance EngagementsDocument3 pagesDifferentiate Assurance From Non-Assurance EngagementsSomething ChicNo ratings yet

- Philippine Framework For Assurance EngagementsDocument6 pagesPhilippine Framework For Assurance Engagementsjoyce KimNo ratings yet

- Introduction - What Is AuditingDocument29 pagesIntroduction - What Is AuditingMoinul HossainNo ratings yet

- Đề cương ôn tập KTTCDocument11 pagesĐề cương ôn tập KTTCLâm NhiNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- XXX AT ExxM ACTIVITYDocument2 pagesXXX AT ExxM ACTIVITYDiane LorenzoNo ratings yet

- Philippine Framework For Assurance EngagementsDocument9 pagesPhilippine Framework For Assurance EngagementsKlo MonNo ratings yet

- AAA - Assignment 2 (BEN)Document7 pagesAAA - Assignment 2 (BEN)Benson KamphaniNo ratings yet

- 2021 M2IAEF Audit Compliance MaterialsDocument53 pages2021 M2IAEF Audit Compliance MaterialsLamis ShalabiNo ratings yet

- CH 3Document24 pagesCH 3Ram KumarNo ratings yet

- A&a Unit 2 NotesDocument8 pagesA&a Unit 2 NotesMohanrajNo ratings yet

- Edited Chapter IIDocument8 pagesEdited Chapter IISeid KassawNo ratings yet

- Audit 08 JournalDocument9 pagesAudit 08 Journalkris salacNo ratings yet

- Audit and Assurance ReportDocument4 pagesAudit and Assurance ReportLovely Jane Raut CabiltoNo ratings yet

- Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheDocument3 pagesAccounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheBryle Jay LapeNo ratings yet

- Philippine Framework For Assurance EngagementsDocument16 pagesPhilippine Framework For Assurance EngagementsJoffrey UrianNo ratings yet

- Solution Manual For Auditing A Business Risk Approach 8th Edition by Rittenburg Complete Downloadable File atDocument35 pagesSolution Manual For Auditing A Business Risk Approach 8th Edition by Rittenburg Complete Downloadable File atmichelle100% (1)

- Auditing and Assurance Notes 1Document237 pagesAuditing and Assurance Notes 1Sam Mac'ObonyoNo ratings yet

- Delivering Excellence in Insurance Claims HandlingDocument15 pagesDelivering Excellence in Insurance Claims HandlingBui Xuan PhongNo ratings yet

- APPLIED AUDITING Module 1Document3 pagesAPPLIED AUDITING Module 1Paul Fajardo CanoyNo ratings yet

- Statutory Audit QuestionDocument2 pagesStatutory Audit QuestionAayush GamingNo ratings yet

- CRR BK 5thed.2015 10.27Document402 pagesCRR BK 5thed.2015 10.27Ching RasalanNo ratings yet

- Auditing Principles and PracticesDocument58 pagesAuditing Principles and PracticeskainatNo ratings yet

- Activity Sheet - Module 2Document5 pagesActivity Sheet - Module 2Chris JacksonNo ratings yet

- Aguanta Princess Nicole Allyson 01 JournalDocument4 pagesAguanta Princess Nicole Allyson 01 JournalNicole Allyson AguantaNo ratings yet

- Auditing and AssuranceDocument220 pagesAuditing and AssuranceHosea KanyangaNo ratings yet

- Audit MidDocument9 pagesAudit MidAldrin PrimagunaNo ratings yet

- Focus Notes Philippine Framework For Assurance EngagementsDocument6 pagesFocus Notes Philippine Framework For Assurance EngagementsThomas_Godric100% (1)

- CMPC 312 M1Document32 pagesCMPC 312 M1Jonnette DamasoNo ratings yet

- Assurance Auditing and Related ServicesDocument182 pagesAssurance Auditing and Related Servicesmoon2fielNo ratings yet

- Full Download Auditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions ManualDocument36 pagesFull Download Auditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions Manualzickshannenukus100% (37)

- Dwnload Full Auditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions Manual PDFDocument36 pagesDwnload Full Auditing and Assurance Services A Systematic Approach 11th Edition Messier Solutions Manual PDFpetrorichelle501100% (13)

- Audit StandardsDocument10 pagesAudit StandardsNishant NarangNo ratings yet

- Audit Planning and Analytical ProceduresDocument6 pagesAudit Planning and Analytical ProceduresAlo Nzo ALNo ratings yet

- Framework For Assurance Engagements, Para. 7) - Assurance Practitioner, UsersDocument5 pagesFramework For Assurance Engagements, Para. 7) - Assurance Practitioner, Usersericsammy94No ratings yet

- WV&PE Lesson 3Document14 pagesWV&PE Lesson 3Daniel S. GonzalesNo ratings yet

- Auditing Ch1 by MekaDocument7 pagesAuditing Ch1 by MekaEbsa AbdiNo ratings yet

- Chapter9Document3 pagesChapter9Keanne ArmstrongNo ratings yet

- Auditing TheoryDocument3 pagesAuditing TheoryJereza Joy LastreNo ratings yet

- @audit CW1Document8 pages@audit CW1bujernest7No ratings yet

- (UK) External AuditDocument6 pages(UK) External AuditDiana TuckerNo ratings yet

- Chapter 06 - Answer PDFDocument6 pagesChapter 06 - Answer PDFjhienellNo ratings yet

- AUDITINGDocument13 pagesAUDITINGGrace AlolorNo ratings yet

- Project On Accounting EThicsDocument39 pagesProject On Accounting EThicsChidi EmmanuelNo ratings yet

- What Are Assurance Services?Document4 pagesWhat Are Assurance Services?Sheila Mae AramanNo ratings yet

- Expanded Services of Accountants-FABM Chapter 2Document8 pagesExpanded Services of Accountants-FABM Chapter 2Jeannie Lyn Dela CruzNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Textbook of Urgent Care Management: Chapter 37, Setting Up a Health-Care Compliance ProgamFrom EverandTextbook of Urgent Care Management: Chapter 37, Setting Up a Health-Care Compliance ProgamNo ratings yet

- Lape - ACP312 - ULOa - Let's Check Week6Document2 pagesLape - ACP312 - ULOa - Let's Check Week6Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A NutshellDocument1 pageLape - ACP312 - ULOa - in A NutshellBryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - Let's Check! Week 8Document3 pagesLape - ACP312 - ULOa - Let's Check! Week 8Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOb - in A Nutshell Week 4Document1 pageLape - ACP312 - ULOb - in A Nutshell Week 4Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A Nutshell Weel 8-9Document1 pageLape - ACP312 - ULOa - in A Nutshell Weel 8-9Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A Nutshell Week6Document1 pageLape - ACP312 - ULOa - in A Nutshell Week6Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay (ULOa&b)Document2 pagesLape, Bryle Jay (ULOa&b)Bryle Jay LapeNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Lape, Bryle Jay - Let's Analyze!Document1 pageLape, Bryle Jay - Let's Analyze!Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay - in NutshellDocument1 pageLape, Bryle Jay - in NutshellBryle Jay LapeNo ratings yet

- Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheDocument3 pagesAccounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheBryle Jay LapeNo ratings yet

- Lape, Bryle Jay - Let's Check!Document1 pageLape, Bryle Jay - Let's Check!Bryle Jay LapeNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheDocument3 pagesAccounting Related Jobs. Their Duty Is To Ensure That The Business Complied With TheBryle Jay LapeNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsBryle Jay LapeNo ratings yet

- Solicited Application Letter - LapeDocument1 pageSolicited Application Letter - LapeBryle Jay LapeNo ratings yet

- Final Exam - LAPEDocument5 pagesFinal Exam - LAPEBryle Jay LapeNo ratings yet

- Proposal LetterDocument1 pageProposal LetterBryle Jay LapeNo ratings yet

- Proposal Letter - LapeDocument1 pageProposal Letter - LapeBryle Jay LapeNo ratings yet

- Unsolicited Application Letter - LapeDocument1 pageUnsolicited Application Letter - LapeBryle Jay LapeNo ratings yet

- Financial Statement Analysis - Reconstruction ActivityDocument4 pagesFinancial Statement Analysis - Reconstruction ActivityBryle Jay LapeNo ratings yet

- Almico - Drug - 2 Market ResearchfinalDocument12 pagesAlmico - Drug - 2 Market ResearchfinalBryle Jay LapeNo ratings yet

- Case StudyDocument15 pagesCase StudyBryle Jay LapeNo ratings yet

- Funding RequestDocument14 pagesFunding RequestBryle Jay LapeNo ratings yet

- Tips On How To Improve PhotographyDocument18 pagesTips On How To Improve PhotographyBryle Jay LapeNo ratings yet

- Almico - Drug - 2 Market ResearchfinalDocument12 pagesAlmico - Drug - 2 Market ResearchfinalBryle Jay LapeNo ratings yet

- Announcement MemoDocument1 pageAnnouncement MemoBryle Jay LapeNo ratings yet

- A&V Safety, Inc.: (Case Analysis)Document11 pagesA&V Safety, Inc.: (Case Analysis)Bryle Jay LapeNo ratings yet

- Wacana Vol 18 Issue 1 Tjiook Liem PDocument23 pagesWacana Vol 18 Issue 1 Tjiook Liem PZhangZaoNo ratings yet

- CSJDM Zoning Ordinance 2016-2025Document79 pagesCSJDM Zoning Ordinance 2016-2025Xette FajardoNo ratings yet

- Lea 2 Lecture 1Document21 pagesLea 2 Lecture 1Angelica GarciaNo ratings yet

- Preliminary Chapter Criminal ProcedureDocument9 pagesPreliminary Chapter Criminal ProcedurewalnutwitchNo ratings yet

- Adv. Kiran Write-UpDocument6 pagesAdv. Kiran Write-UpSaket SubhamNo ratings yet

- Aime CesaireDocument23 pagesAime CesaireJepter LordeNo ratings yet

- Rizal: and Filipino NationalismDocument9 pagesRizal: and Filipino NationalismGleison Bancolita100% (15)

- SO Vs LEEDocument3 pagesSO Vs LEERajkumariNo ratings yet

- Procurement Fraud Red Flags & Investigative TechniquesDocument32 pagesProcurement Fraud Red Flags & Investigative TechniquesNdumiso ShokoNo ratings yet

- SGS Corpcom Business Principles A1 EN 15 PDFDocument1 pageSGS Corpcom Business Principles A1 EN 15 PDFSamir Baran BeraNo ratings yet

- Complete Module in Understanding Culture Society and PoliticsDocument123 pagesComplete Module in Understanding Culture Society and PoliticsFahad AbdullahNo ratings yet

- A Case Study On TelanganaDocument3 pagesA Case Study On TelanganadvsundeepNo ratings yet

- Justification NotesDocument4 pagesJustification NotesJohn Rey FerarenNo ratings yet

- The Case of Nancy Cruzan (ANTIPORDA)Document1 pageThe Case of Nancy Cruzan (ANTIPORDA)ALEXANDRA VICTORIA ANTIPORDANo ratings yet

- Writers and Essayists and The Rise of Magyar Nationalism in The 1820s and 1830sDocument18 pagesWriters and Essayists and The Rise of Magyar Nationalism in The 1820s and 1830sAdamNo ratings yet

- Dipak Kumar Maity Vs The State of West Bengal and WB2020060320161257330COM949910Document4 pagesDipak Kumar Maity Vs The State of West Bengal and WB2020060320161257330COM949910sid tiwariNo ratings yet

- Salazar vs. CA GR No. 118203Document16 pagesSalazar vs. CA GR No. 118203Jumar RanasNo ratings yet

- Trial BalDocument5 pagesTrial BalAneel kumarNo ratings yet

- PDS TineDocument4 pagesPDS TineMarah AquinoNo ratings yet

- Governance of Cyber Security Research ProposalDocument1 pageGovernance of Cyber Security Research ProposalAleksandar MaričićNo ratings yet

- Standard and Conditions Governing Accounts: TermsDocument26 pagesStandard and Conditions Governing Accounts: TermsroymondusNo ratings yet

- Laman - Spa To Sell A Parcel of LandDocument2 pagesLaman - Spa To Sell A Parcel of LandMATEO JULIUS ALMOJUELA LAMANNo ratings yet

- Miscellaneous Criminal Application 11 of 2016Document5 pagesMiscellaneous Criminal Application 11 of 2016wanyamaNo ratings yet

- How To Set Up A Business in The UAEDocument27 pagesHow To Set Up A Business in The UAEAbdel BenzerNo ratings yet

- (Lift) EMSD 12 - 97Document6 pages(Lift) EMSD 12 - 97CescyCowCowNo ratings yet

- Q. Nursery Care Corp vs. AcevedoDocument13 pagesQ. Nursery Care Corp vs. AcevedoCarlo GarciaNo ratings yet

- Matrix 2 (Amendments To Republic Act No. 9184 Comments On House Bill (HB) No. 3704, HB No. 2682, HB No. 0648 and HB No. 1503) .Document60 pagesMatrix 2 (Amendments To Republic Act No. 9184 Comments On House Bill (HB) No. 3704, HB No. 2682, HB No. 0648 and HB No. 1503) .anfernee maitemNo ratings yet