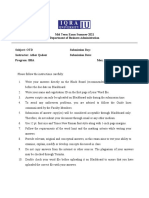

Professional Documents

Culture Documents

Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With The

Uploaded by

Bryle Jay LapeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Related Jobs. Their Duty Is To Ensure That The Business Complied With The

Uploaded by

Bryle Jay LapeCopyright:

Available Formats

1.

The various areas of accounting practices are public, private, government

accounting and academe. These main areas provide different fields and services

where a CPA get to choose to practice their profession.

Public accounting mostly are the practitioners, or firms that offer independent

and accounting services to the public. Their commitments are to help those

businesses and agencies with their financial statements and other accounting related

matters that may influence or for the benefit of the public. Accountants in this field

usually offer auditing services, taxation and management consultancy services.

On the other hand, private accounting refers to those CPA’s that engaged in

companies and other business entities as a staff, internal auditor and other

accounting related jobs. Their duty is to ensure that the business complied with the

laws and rules provided by the government agencies and standard-setting bodies

and meet all the requirements needed to operate a business.

Government accounting is different from public and private accounting because

CPA’s in this area perform accounting activities that involve the utilization of

government funds and property. They are authorized to safe keep and administer

public funds. These practitioners can be found in government branches like COA, BIR,

SEC, BSP, etc.

Lastly, academe is where accountants engaged themselves in institutions that

provide learning and education. This field requires Certified Public Accountants to

impart their knowledge and wisdom to aspiring individuals who choose accounting

related courses.

2. )

If I were to pass the CPA Licensing Examination, I would like to engage myself in

area that would utilize my skills and passion. The field of academe is where I want to

practice my profession because I want to inspire others and to impart my knowledge

to those aspiring accountants as well. It is my pleasure to see hope in every student’s

eyes as they take the same journey that I took and hear different stories from them.

However, if a great opportunity comes, I am also eager to experience the

different areas of accounting practices. In this way, I can explore my profession well

and gain expertise from the different services provided by these various areas of

accounting practices.

1. )

Assurance and non-assurance services offered by Certified Public Accountants both

undertake engagements between professional accountants and the intended user.

Both services require the CPA to perform accounting activities to improve the quality

of information presented in the financial statements.

On the contrary, assurance services focus more on CPA stating their conclusions that

provide level of assurance to the intended user on the subject matter. These services

is more on letting an auditor to critically perform auditing services to present the

financial statements that conforms with the standards and meet the requirements of

regulatory agencies in favor of the intended user.

Non-assurance services does not totally require the professional verdict of a CPA and

the reports to be presented in these services or engagements are limited as

compared to the reports of assurance engagements.

2. )

Elements of an Assurance Engagement

A. Three Party Relationship. Three parties are always involved in an assurance

engagement. These parties are the practitioner, the responsible party and the

intended users. This relationship works when a responsible party wanted to assure,

by a practitioner, the reliability or credibility of his/her postulation of a subject

matter that will meet the needs of the intended users.

B. Appropriate Subject Matter. This pertains to a document, or financial conditions,

etc. that is identifiable and can be evaluated by a practitioner.

C. Suitable Criteria. This refer to the measurement or basis to conclude a level of

assurance to a subject matter. These criteria are made available, in some ways, to

the intended users to assimilate the reliability of the subject matter being evaluated.

D. Sufficient Appropriate Evidence. Upon conducting the evaluation, an accountant

should be skeptic and should take considerations of the materiality and the risks

involved in providing these enough evidences to support the conclusion.

E. Assurance Report. This report is provided by the practitioner about his/her

conclusion about the assurance of the subject matter under a suitable criteria

provided by sufficient appropriate evidences.

3. )

Materiality. A practitioner should consider materiality in gathering evidences to

support his/her claims. This concept will guide the practitioner about how the

presentation of such information could affect the interest of the intended users. This

will help the practitioner to assess if misstatements or errors in the presentation

could significantly influence the decisions of the users of information or not.

Professional Skepticism. It is necessary for a practitioner to be rational in evaluating

a subject matter. Being professionally skeptic enables the practitioner to provide

critical assessment and conclusion and to ensure that the subject matter are

presented as clear, complete, reliable and faithful as it can be.

Assurance Engagement Risk. Having this kind of engagement might impose some

risks. A practitioner might provide a misleading conclusion about a subject matter.

These risks should be considered by the practitioner to come up with the most

suitable conclusion that will influence the decisions and interests of the intended

users.

You might also like

- CMPC 312 M1Document32 pagesCMPC 312 M1Jonnette DamasoNo ratings yet

- 01 JournalDocument5 pages01 JournalJohn CPANo ratings yet

- Into To World of CPAsDocument22 pagesInto To World of CPAsKristine WaliNo ratings yet

- Lape, Bryle Jay (ULOa&b)Document2 pagesLape, Bryle Jay (ULOa&b)Bryle Jay LapeNo ratings yet

- Introduction To PractitionersDocument3 pagesIntroduction To PractitionersIrish SanchezNo ratings yet

- Module 1 - Fundamental Principles of Assurance EngagementsDocument10 pagesModule 1 - Fundamental Principles of Assurance EngagementsLysss EpssssNo ratings yet

- What Is The Difference Between Attestation Engagement and Direct Reporting Engagement in AuditingDocument13 pagesWhat Is The Difference Between Attestation Engagement and Direct Reporting Engagement in AuditingJennybabe PetaNo ratings yet

- Expanded Services of Accountants-FABM Chapter 2Document8 pagesExpanded Services of Accountants-FABM Chapter 2Jeannie Lyn Dela CruzNo ratings yet

- Classification of Assurance EngagementDocument3 pagesClassification of Assurance EngagementJennybabe PetaNo ratings yet

- Lesson 1 - Overview of Assurance, Auditing and Non-Assurance Services OverviewDocument30 pagesLesson 1 - Overview of Assurance, Auditing and Non-Assurance Services OverviewC XNo ratings yet

- Concepts of AuditDocument4 pagesConcepts of AuditMarilou BonaguaNo ratings yet

- 01 JournalDocument5 pages01 Journalits me keiNo ratings yet

- Activity Sheet - Module 2Document4 pagesActivity Sheet - Module 2Elisabeth HenangerNo ratings yet

- Philippine Framework For Assurance EngagementsDocument9 pagesPhilippine Framework For Assurance EngagementsKlo MonNo ratings yet

- Aguanta Princess Nicole Allyson 01 JournalDocument4 pagesAguanta Princess Nicole Allyson 01 JournalNicole Allyson AguantaNo ratings yet

- Focus Notes Philippine Framework For Assurance EngagementsDocument6 pagesFocus Notes Philippine Framework For Assurance EngagementsThomas_Godric100% (1)

- FOCUS NOTES - Philippine Framework For Assurance EngagementsDocument5 pagesFOCUS NOTES - Philippine Framework For Assurance EngagementsLance UrichNo ratings yet

- Philippine Framework For Assurance EngagementsDocument6 pagesPhilippine Framework For Assurance Engagementsjoyce KimNo ratings yet

- 01 - Activity - 1 - AuditingDocument4 pages01 - Activity - 1 - AuditingMillania ThanaNo ratings yet

- Auditing MCQS 1-7Document18 pagesAuditing MCQS 1-7IL HAmNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Activity Sheet - Module 2Document5 pagesActivity Sheet - Module 2Chris JacksonNo ratings yet

- Auditing and Assurance PrinciplesDocument125 pagesAuditing and Assurance PrinciplesAaron Joy Dominguez Putian38% (34)

- 03 JournalDocument5 pages03 JournalJohn CPANo ratings yet

- CRR BK 5thed.2015 10.27Document402 pagesCRR BK 5thed.2015 10.27Ching RasalanNo ratings yet

- Fundamentals of Auditing and Assurance ServicesDocument11 pagesFundamentals of Auditing and Assurance ServicesABIGAIL DAYOTNo ratings yet

- Audit I CHAPTER 2Document38 pagesAudit I CHAPTER 2Samuel GirmaNo ratings yet

- WV&PE Lesson 3Document14 pagesWV&PE Lesson 3Daniel S. GonzalesNo ratings yet

- Introduction and Overview of Audit and Assurance: Chapter Learning ObjectivesDocument30 pagesIntroduction and Overview of Audit and Assurance: Chapter Learning ObjectivesTarro NguyenNo ratings yet

- Chapter#2 True and Fair View: Assurance EngagementsDocument4 pagesChapter#2 True and Fair View: Assurance EngagementsArham khanNo ratings yet

- Fundamentals of Auditing and Assurance ServicesDocument37 pagesFundamentals of Auditing and Assurance Servicesnicolebrixx100% (1)

- DYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFDocument10 pagesDYBSAAap313 - Auditing & Assurance Principles (PRELIM MODULE) PDFJonnafe Almendralejo IntanoNo ratings yet

- Chapter One An Overview of AuditingDocument9 pagesChapter One An Overview of AuditingMulatu LombamoNo ratings yet

- Fundamentals of Assurance EngagementsDocument9 pagesFundamentals of Assurance EngagementsAlfredSantos100% (2)

- Chapter 2Document24 pagesChapter 2Ram KumarNo ratings yet

- AUDITINGDocument13 pagesAUDITINGGrace AlolorNo ratings yet

- International Framework For Assurance EngagementsDocument5 pagesInternational Framework For Assurance EngagementsUsman SaleemNo ratings yet

- A&a Unit 2 NotesDocument8 pagesA&a Unit 2 NotesMohanrajNo ratings yet

- AT EscalaDocument249 pagesAT EscalaAM83% (6)

- Summary - Chapter Notes Combined With Lecture Notes - Chapter 1,2,4,5,8-10 Summary - Chapter Notes Combined With Lecture Notes - Chapter 1,2,4,5,8-10Document44 pagesSummary - Chapter Notes Combined With Lecture Notes - Chapter 1,2,4,5,8-10 Summary - Chapter Notes Combined With Lecture Notes - Chapter 1,2,4,5,8-10Ma. Lyriana MangenteNo ratings yet

- Chapter One: Ethical Issues and Financial Statement Fraud in Advanced AccountingDocument74 pagesChapter One: Ethical Issues and Financial Statement Fraud in Advanced AccountingYismawNo ratings yet

- Auditing and Assurance Services Learning ObjectivesDocument15 pagesAuditing and Assurance Services Learning Objectiveshuma1208No ratings yet

- Chapter 3Document5 pagesChapter 3Janah MirandaNo ratings yet

- CH 02Document8 pagesCH 02Jolina I. BadoNo ratings yet

- Code of Ethics/MB/CAP II/AOC: Assurance Provided by AuditDocument17 pagesCode of Ethics/MB/CAP II/AOC: Assurance Provided by AuditMandeep BashisthaNo ratings yet

- Journal 1Document6 pagesJournal 1Sittie Ainna A. UnteNo ratings yet

- Module 1 - Introduction To Assurance Services PDFDocument10 pagesModule 1 - Introduction To Assurance Services PDFglobeth berbanoNo ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingNicole_Gella_G_1555No ratings yet

- Auditing TheoryDocument3 pagesAuditing TheoryJereza Joy LastreNo ratings yet

- Conceptual FrameworkDocument33 pagesConceptual FrameworkzillxsNo ratings yet

- AUD 15 Professional Responsibilities 2021Document43 pagesAUD 15 Professional Responsibilities 2021nicgNo ratings yet

- Who Are The Users of Accounting Information and How Do They Benefit From This Information?Document4 pagesWho Are The Users of Accounting Information and How Do They Benefit From This Information?Marco PaulNo ratings yet

- Topic 1 AaaDocument5 pagesTopic 1 AaaIsaac OsoroNo ratings yet

- Epa-Std-Tm 8-9Document16 pagesEpa-Std-Tm 8-9fikrifaf91No ratings yet

- UNIT 2 Professional Ethics of AuditorsDocument4 pagesUNIT 2 Professional Ethics of AuditorsKhalid MuhammadNo ratings yet

- Summary Chapter Notes Combined With Lecture Notes Chapter 12458 10Document44 pagesSummary Chapter Notes Combined With Lecture Notes Chapter 12458 10Ramon AbsinNo ratings yet

- Ac19 Module 1 - DGCDocument10 pagesAc19 Module 1 - DGCMaricar PinedaNo ratings yet

- Auditing Completed NotesDocument68 pagesAuditing Completed NotesArnoldQuiranteJustinianaNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Lape - ACP312 - ULOa - Let's Check! Week 8Document3 pagesLape - ACP312 - ULOa - Let's Check! Week 8Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - Let's Check Week6Document2 pagesLape - ACP312 - ULOa - Let's Check Week6Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay - in NutshellDocument1 pageLape, Bryle Jay - in NutshellBryle Jay LapeNo ratings yet

- Lape - ACP312 - ULOa - in A Nutshell Weel 8-9Document1 pageLape - ACP312 - ULOa - in A Nutshell Weel 8-9Bryle Jay LapeNo ratings yet

- Lape, Bryle Jay - Let's Analyze!Document1 pageLape, Bryle Jay - Let's Analyze!Bryle Jay LapeNo ratings yet

- Final Exam - LAPEDocument5 pagesFinal Exam - LAPEBryle Jay LapeNo ratings yet

- Lape, Bryle Jay - Let's Check!Document1 pageLape, Bryle Jay - Let's Check!Bryle Jay LapeNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Proposal LetterDocument1 pageProposal LetterBryle Jay LapeNo ratings yet

- A&V Safety (A Case Study)Document15 pagesA&V Safety (A Case Study)Bryle Jay Lape100% (2)

- Funding RequestDocument14 pagesFunding RequestBryle Jay LapeNo ratings yet

- Financial Statement Analysis - Reconstruction ActivityDocument4 pagesFinancial Statement Analysis - Reconstruction ActivityBryle Jay LapeNo ratings yet

- Unsolicited Application Letter - LapeDocument1 pageUnsolicited Application Letter - LapeBryle Jay LapeNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsBryle Jay LapeNo ratings yet

- Almico - Drug - 2 Market ResearchfinalDocument12 pagesAlmico - Drug - 2 Market ResearchfinalBryle Jay LapeNo ratings yet

- A&V Safety, Inc.: (Case Analysis)Document11 pagesA&V Safety, Inc.: (Case Analysis)Bryle Jay LapeNo ratings yet

- Case StudyDocument15 pagesCase StudyBryle Jay LapeNo ratings yet

- Feasibility StudyDocument13 pagesFeasibility StudyBryle Jay LapeNo ratings yet

- Announcement MemoDocument1 pageAnnouncement MemoBryle Jay LapeNo ratings yet

- Mid Term Exam Summer-2021 Department of Business AdministrationDocument3 pagesMid Term Exam Summer-2021 Department of Business Administrationshaikh yasirNo ratings yet

- Ems P2 8 Question Paper Final 2023Document5 pagesEms P2 8 Question Paper Final 2023vutshilaashton52No ratings yet

- Is A Global Grassroots Network of Workers Active in Workplaces and CommunitiesDocument1 pageIs A Global Grassroots Network of Workers Active in Workplaces and CommunitiesCHERRY ANN OLAJAYNo ratings yet

- Mr. Saroj K. Datta: - Executive DirectorDocument5 pagesMr. Saroj K. Datta: - Executive DirectorKarun GakkharNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Mbamission MIT Sloan Insiders Guide 2020 2021Document99 pagesMbamission MIT Sloan Insiders Guide 2020 2021sunbabaphuNo ratings yet

- Exam in Statistics 1Document2 pagesExam in Statistics 1Ako Si Vern Ö100% (1)

- 301 SM MCQ 2019Document46 pages301 SM MCQ 2019Pratik GawaiNo ratings yet

- Corporate Governance by Christine A. MallinDocument437 pagesCorporate Governance by Christine A. MallinSaeed ahmed100% (2)

- Business To Business Marketing Session 2Document26 pagesBusiness To Business Marketing Session 2akriti bawaNo ratings yet

- Danina Mabel M. Lim OTGE01: B B B C C C H H ODocument2 pagesDanina Mabel M. Lim OTGE01: B B B C C C H H ONina Lim83% (6)

- Schools Division of Tarlac ProvinceDocument40 pagesSchools Division of Tarlac ProvinceMarc Aaron GarciaNo ratings yet

- A Study On The Entrepreneurial Intention Among StudentDocument6 pagesA Study On The Entrepreneurial Intention Among StudentLøvély SûryãNo ratings yet

- List of Internship Report PDFDocument41 pagesList of Internship Report PDFShafayet JamilNo ratings yet

- Aiesec Recommendation LetterDocument3 pagesAiesec Recommendation LetterOruc MeherremliNo ratings yet

- References 3Document7 pagesReferences 3John Cyriel LubatonNo ratings yet

- Wiley - The Architect's Handbook of Professional Practice, 15th Edition - 978!1!118-66713-2Document2 pagesWiley - The Architect's Handbook of Professional Practice, 15th Edition - 978!1!118-66713-2mandamina workNo ratings yet

- 1A Syllabus - Fall 2015Document13 pages1A Syllabus - Fall 2015felicialimantoroNo ratings yet

- Recruiter's Guide 2020: The Journey Towards Professional Excellence The Journey Towards Professional ExcellenceDocument28 pagesRecruiter's Guide 2020: The Journey Towards Professional Excellence The Journey Towards Professional Excellenceadriana vgNo ratings yet

- 1689366830954Document1 page1689366830954gohugurselfNo ratings yet

- Final Annual Research Report 2017Document133 pagesFinal Annual Research Report 2017Muhammad AliNo ratings yet

- Learning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs) Iii. Content/Core ContentDocument4 pagesLearning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs) Iii. Content/Core ContentKim VpsaeNo ratings yet

- Week 6 Entrepreneurial Marketing PDFDocument29 pagesWeek 6 Entrepreneurial Marketing PDFAsifIsmayilovNo ratings yet

- A Comprehensive Study of Talent Management Process Adopted by Tata Consultancy Services (TCS)Document16 pagesA Comprehensive Study of Talent Management Process Adopted by Tata Consultancy Services (TCS)Ramuk HsitasNo ratings yet

- Tle - Ia (Electrical Installation Maintenance) : Activity Sheet-Quarter 1-4-MELC 2Document13 pagesTle - Ia (Electrical Installation Maintenance) : Activity Sheet-Quarter 1-4-MELC 2Reinier Paclibar Federizo100% (1)

- Responsibilities and Accountabilities of Entrepreneurs: Quarter, 2 Semester)Document4 pagesResponsibilities and Accountabilities of Entrepreneurs: Quarter, 2 Semester)Nicole ConcepcionNo ratings yet

- ENTREP 4 HandoutsDocument23 pagesENTREP 4 HandoutsMae-ann Enoc SalibioNo ratings yet

- BICs Policy 2021 - FinalDocument8 pagesBICs Policy 2021 - FinalIrfan U ShahNo ratings yet

- The Mediation Effect of Job Satisfaction and Organizational Commitment On The Organizational Learning Effect of The Employee PerformanceDocument27 pagesThe Mediation Effect of Job Satisfaction and Organizational Commitment On The Organizational Learning Effect of The Employee PerformanceNely Noer SofwatiNo ratings yet

- GELP BrochureDocument3 pagesGELP Brochureandrea rodriguesNo ratings yet