Professional Documents

Culture Documents

Is Consolidation Acc312

Uploaded by

Richard SantosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is Consolidation Acc312

Uploaded by

Richard SantosCopyright:

Available Formats

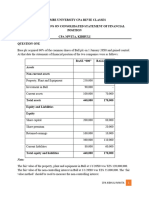

Pete Corporation purchases 80% of the common stock of Sake Company on January 2, 2017 for P300,000.

Assume that all the assets and liabilities

of Sake Company have fair market values equal to their book values, except the following:

Carrying amount Fair Value

Inventory 60,000 65,000

Property, Plant & Equipment 300,000 360,000

Totals 60,000 76,000

All the inventory on January 2, 2017 was sold. The Property, Plant & Equipment have a remaining useful life of 10 years from the date of acquisition,

and a straight-line depreciation method is used.

For the year immediately after the acquisition, Sake Company reported the following:

Comprehensive Income P50,000

Dividends paid 30,000

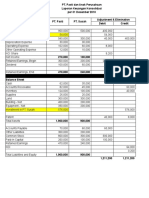

Financial Statements of Pete and Sake for 2017:

Pete Corporation and Subsidiary

Working Paper Consolidated Financial Statements

Year Ended December 31, 2017

Pete Corp. Sake Corp.

Statement of CI

Sales 400,000 200,000

Dividend Income 24,000

Total revenue 424,000 200,000

Cost of Goods Sold 170,000 115,000

Operating Expenses 50,000 20,000

Other Expenses 40,000 15,000

Total Costs and Expenses 260,000 150,000

Net/consolidated CI 164,000 50,000

NCI CI of Sake Co.

CI to RE 164,000 50,000

Statement of Retained Earnings

Retained Earnings, January 1

Pete Corporation 300,000

Sake Corporation 100,000

CI from above 164,000 50,000

Total 464,000 150,000

Dividends Declared

Pete Corporation 60,000

Sake Corporation 30,000

Retained Earnings, December 31 (SFP) 404,000 120,000

Statement of Financial Position

Cash 204,000 75,000

Accounts Receivable 75,000 50,000

Inventory 100,000 75,000

Property and Equipment(net) 525,000 320,000

Investment in Sake Company 300,000

Goodwill

Total Assets 1,204,000 520,000

Accounts payable 100,000 100,000

Bonds payable 200,000 100,000

Common Stock:

Pete Corporation 500,000

Sake Corporation 200,000

Retained Earnings 404,000 120,000

NCI

Total Liabilities and Equity 1,204,000 520,000

Requirements:

How much is the Conso Income attributable Parent? How much is the Conso Income attributable to NCI(NCINIS)?

Prepare Working Paper Elimination Entries

Prepare Consolidated Financial Statements

Pete Corporation and Subsidiary

Working Paper Consolidated Financial

Statements

Year Ended December 31, 2017

Working Paper Elimination Entries

Pete Sake

Corp. Corp. Debit Credit Consolidated FS

Statement of CI

Sales 400,000 200,000 600,000

Dividend Income 24,000 (4)24,000

Total revenue 424,000 200,000 600,000

Cost of Goods Sold 170,000 115,000 (5)5,000 2,900,000

Operating Expenses 50,000 20,000 (5)6,000 76,800

Other Expenses 40,000 15,000 55,000

Total Costs and Expenses 260,000 150,000 421,000

Net/consolidated CI 164,000 50,000

NCI CI of Sake Co. (6)7,800 (7,800 )

CI to RE 164,000 50,000 171,200

Statement of Retained Earnings

Retained Earnings, January 1

Pete Corporation 300,000 300,000

Sake Corporation 100,000 (1) 100,000

CI from above 164,000 50,000 171,200

Total 464,000 150,000 471,200

Dividends Declared

Pete Corporation 60,000 (60,000)

Sake Corporation 30,000 (4)30,000

Retained Earnings, December 31 to SFP 404,000 120,000 411,200

Statement of Financial Position

Cash 204,000 75,000 279,000

Accounts Receivable 75,000 50,000 125,000

Inventory 100,000 75,000 (2) 5,000 (5)5,000 175,000

Property and Equipment(net) 525,000 320,000 (2) 60,000 (5)6,000 899,000

(1)240,000;

Investment in Sake Company 300,000 (2)52,000;(3)8,000

Goodwill (3)10,000 10,000

Total Assets 1,204,000 520,000 1,488,000

Accounts payable 100,000 100,000 200,000

Bonds payable 200,000 100,000 300,000

Common Stock:

Pete Corporation 500,000 500,000

Sake Corporation 200,000 (1) 200,000

Retained Earnings 404,000 120,000 411,200

(1)60,000;

(2)13,000;(3)2,000;

NCI (4)6,000 (6) 7,800 76,800

Total Liabilities and Equity 1,204,000 520,000 423,800 423,800 1,488,000

You might also like

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Business Combination - EM Sample ProblemDocument32 pagesBusiness Combination - EM Sample ProblemJohn Stephen PendonNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- B CorporationDocument11 pagesB CorporationMelizze MejicoNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Buscom Subsequent MeasurementDocument6 pagesBuscom Subsequent MeasurementCarmela BautistaNo ratings yet

- Advanced Accounting 2 Consolidated FsDocument90 pagesAdvanced Accounting 2 Consolidated FsrichelledelgadoNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Tugas 5 - InventoryDocument11 pagesTugas 5 - InventoryMuhammad RochimNo ratings yet

- ShortproblemDocument2 pagesShortproblemLabLab ChattoNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Business Combination Illustration 3Document57 pagesBusiness Combination Illustration 3Ash CastroNo ratings yet

- Accounting For Business Combinations (PRE7) - FINALSDocument3 pagesAccounting For Business Combinations (PRE7) - FINALSMay P. HuitNo ratings yet

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Problem 7-15 Part ADocument7 pagesProblem 7-15 Part AImelda100% (1)

- PT Ortu PT Bocah Comprehensive Income RP RPDocument8 pagesPT Ortu PT Bocah Comprehensive Income RP RPNcim PoNo ratings yet

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- Discussion 1 Second Sem PDFDocument11 pagesDiscussion 1 Second Sem PDFRNo ratings yet

- I. Income Statement: Income Statement Beccoe Sweet Corporation Year Ended October 2017Document3 pagesI. Income Statement: Income Statement Beccoe Sweet Corporation Year Ended October 2017Jeth Vigilla NangcaNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Seatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Document4 pagesSeatwork #2: What Is The Capital Balances of All The Partners in The New Partnership?Tifanny MallariNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Consolidated Statement of Financial Position Part 1Document16 pagesConsolidated Statement of Financial Position Part 1Frank AlexanderNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 4Document8 pagesTania Maharani - C1C019071 - Tugas AKL 4Tania MaharaniNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Key UNIT II B SubsequentDocument6 pagesKey UNIT II B SubsequentDaisy TañoteNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Firda Arfianti - LC53 - Equity Method, Two Consecutive YearsDocument5 pagesFirda Arfianti - LC53 - Equity Method, Two Consecutive YearsFirdaNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- Conso FS LessonDocument54 pagesConso FS Lessondbpcastro8No ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Aporte Al IPSS Del Empleador Por TrabajadorDocument4 pagesAporte Al IPSS Del Empleador Por Trabajadorvagonet21No ratings yet

- My Cook BookDocument66 pagesMy Cook BookAkshay KumariNo ratings yet

- Baccolini, Raffaela - CH 8 Finding Utopia in Dystopia Feminism, Memory, Nostalgia and HopeDocument16 pagesBaccolini, Raffaela - CH 8 Finding Utopia in Dystopia Feminism, Memory, Nostalgia and HopeMelissa de SáNo ratings yet

- Sample Information For Attempted MurderDocument3 pagesSample Information For Attempted MurderIrin200No ratings yet

- Binder1 CARENCRODocument27 pagesBinder1 CARENCROAddisu TsehayNo ratings yet

- Lesson 20 PerdevDocument7 pagesLesson 20 PerdevIvan Joshua RemosNo ratings yet

- Masters Thesis Oral Reading For Masters in Education ST Xavier ED386687Document238 pagesMasters Thesis Oral Reading For Masters in Education ST Xavier ED386687Bruce SpielbauerNo ratings yet

- RMK Akl 2 Bab 5Document2 pagesRMK Akl 2 Bab 5ElineNo ratings yet

- Simile ListDocument3 pagesSimile ListFiona SohNo ratings yet

- Youth Policy Manual: How To Develop A National Youth StrategyDocument94 pagesYouth Policy Manual: How To Develop A National Youth StrategyCristinaDumitriuAxyNo ratings yet

- Pros and Cons of AbortionDocument14 pagesPros and Cons of AbortionSuman SarekukkaNo ratings yet

- Individualism in Marketing CampaignDocument6 pagesIndividualism in Marketing CampaignTrần Nguyễn Khánh TrangNo ratings yet

- NMAT PRACTICE SET 0619 - Rationale - TEST D. ChemistryDocument10 pagesNMAT PRACTICE SET 0619 - Rationale - TEST D. ChemistryMianella RosalesNo ratings yet

- Mahindra and Mahindra Limited - 24Document12 pagesMahindra and Mahindra Limited - 24SourabhNo ratings yet

- Chemistry: Presented By: Mrs. Marie Nella T. VictoriaDocument75 pagesChemistry: Presented By: Mrs. Marie Nella T. VictoriaJESPHER GARCIANo ratings yet

- HVAC Installation ManualDocument215 pagesHVAC Installation Manualmeeng2014100% (5)

- ERF 2019 0128 H160 Noise CertificationDocument10 pagesERF 2019 0128 H160 Noise CertificationHelimanualNo ratings yet

- RCM Pricelist Online Store 2Document14 pagesRCM Pricelist Online Store 2OJ Alexander NadongNo ratings yet

- Kohn v. Hollywood Police, Einhorn, Knapp, Perez, Sheffel, Cantor, BlattnerDocument30 pagesKohn v. Hollywood Police, Einhorn, Knapp, Perez, Sheffel, Cantor, Blattnerkohn5671No ratings yet

- Business Management Business ManagementDocument31 pagesBusiness Management Business ManagementDoyieNo ratings yet

- Taking RPA To The Next LevelDocument48 pagesTaking RPA To The Next LevelRPA Research100% (1)

- Understanding The School Curriculum Close Encounter With The School Curriculum SPARK Your InterestDocument12 pagesUnderstanding The School Curriculum Close Encounter With The School Curriculum SPARK Your InterestJoshua Lander Soquita CadayonaNo ratings yet

- Analyzing Text - Yuli RizkiantiDocument12 pagesAnalyzing Text - Yuli RizkiantiErikaa RahmaNo ratings yet

- AKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Document2 pagesAKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Sunarto HadiatmajaNo ratings yet

- SH Case3 Informants enDocument1 pageSH Case3 Informants enHoLlamasNo ratings yet

- Sustainable Building: Submitted By-Naitik JaiswalDocument17 pagesSustainable Building: Submitted By-Naitik JaiswalNaitik JaiswalNo ratings yet

- Rhavif's ResumeDocument1 pageRhavif's ResumeRhavif BudiboyNo ratings yet

- Out To Lunch: © This Worksheet Is FromDocument1 pageOut To Lunch: © This Worksheet Is FromResian Garalde BiscoNo ratings yet

- Online Book Store System: Bachelor of Computer EngineeringDocument31 pagesOnline Book Store System: Bachelor of Computer Engineeringkalpesh mayekarNo ratings yet