Professional Documents

Culture Documents

Book Value Market Value Pole Co. Sole Co. Sole Co

Uploaded by

Jericho SumagueOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book Value Market Value Pole Co. Sole Co. Sole Co

Uploaded by

Jericho SumagueCopyright:

Available Formats

On January 2, 2018, Pole Company purchased 100% of the outstanding capital shares of

Sole Company for P950,000 payable in cash. On that date, the assets and liabilities of

Sole Company had fair market value as shown below:

BOOK VALUE MARKET VALUE

Pole Co. Sole Co. Sole Co.

Cash 300,000 50,000 50,000

Accounts Receivable 200,000 100,000 100,000

Inventory 150,000 60,000 90,000 30,000

Land 70,000 120,000 50,000

Equipment (net) 600,000 470,000 600,000 130,000

Investments in Sole Co. 950,000

Totals 2,200,000 750,000

Accounts Payable 100,000 50,000 50,000

Ordinary Share Capital - Pole Co. 600,000

Ordinary Share Capital - Sole Co. 200,000

Additional Paid-in Capital 100,000

Retained Earnings - Pole Co. 1,500,000

Retained Earnings - Sole Co. 400,000

Totals 2,200,000 750,000

Requirements:

1.) a. Prepare an allocation schedule to compute goodwill (gain on bargain purchase)

b. Prepare the eliminatory entry

c. Prepare the consolidated working paper

2.) Assuming that only 90% of the outstanding shares of Sole Company was acquired by

Pole Company for P810,000 payable in cash and all other information remain the same:

nci 91,000

a. Prepare an allocation schedule to compute goodwill (gain on bargain

purchase) assuming the non-controlling interest is measured proportionate to

the identifiable net assets

b. Prepare the eliminatory entry

c. Prepare the consolidated working paper

3.) Assuming that only 40% of the outstanding shares of Sole Co. was acquired by Pole

Co. for P400,000 payable in cash and all other information remain the same. Pole

Company, though, holds a substantive option to acquire the majority shares that is

exercisable and deeply in the money nci 546,000

a. Prepare an allocation schedule to compute goodwill (gain on bargain

purchase) assuming the non-controlling interest is measured proportionate to

the identifiable net assets

a. Prepare an allocation schedule to compute goodwill (gain on bargain

purchase) assuming the non-controlling interest is measured proportionate to

the identifiable net assets

b. Prepare the eliminatory entry

c. Prepare the consolidated working paper

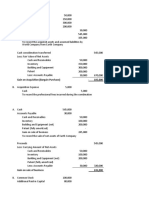

1.) a. Prepare an allocation schedule to compute goodwill (gain on bargain purchase)

Consideration transferred 950,000

Less: BV of acquired investment 700,000

Excess of cost over BV 250,000

Less: Increase in MV 210,000

Goodwill 40,000

c. Prepare the consolidated working paper

Pole Co. Sole Co. Adjustments and Eliminations Consolidated FS

BV BV DEBIT CREDIT

Cash 300,000 50,000 350,000

Accounts Receivable 200,000 100,000 300,000

Inventory 150,000 60,000 30,000 240,000

Land 70,000 50,000 120,000

Equipment (net) 600,000 470,000 130,000 1,200,000

Goodwill 40,000 40,000

Investments in Sole Co. 950,000 950,000 -

Total Assets 2,200,000 750,000 2,250,000

Accounts Payable 100,000 50,000 150,000

Ordinary Share Capital - Pole Co. 600,000 600,000

Ordinary Share Capital - Sole Co. 200,000 200,000 -

Additional Paid-in Capital - Sole Co. 100,000 100,000 -

Retained Earnings - Pole Co. 1,500,000 1,500,000

Retained Earnings - Sole Co. 400,000 400,000 -

Total Liab & Equity 2,200,000 750,000 950,000 950,000 2,250,000

2.) Assuming that only 90% of the outstanding shares of Sole Company was acquired by

Pole Company for P810,000 payable in cash and all other information remain the same:

a. Prepare an allocation schedule to compute goodwill (gain on bargain

purchase) assuming the non-controlling interest is measured proportionate to

the identifiable net assets

Consideration transferred 810,000

Less: BV of acquired investment 630,000

Excess of cost over BV 180,000

Less: Increase in MV 189,000

Gain on Bargain Purchase 9,000

c. Prepare the consolidated working paper

Pole Co. Sole Co. Adjustments and Eliminations Consolidated FS

BV BV DEBIT CREDIT

Cash 440,000 50,000 490,000

Accounts Receivable 200,000 100,000 300,000

Inventory 150,000 60,000 30,000 240,000

Land 70,000 50,000 120,000

Equipment (net) 600,000 470,000 130,000 1,200,000

Investments in Sole Co. 810,000 810,000 -

Total Assets 2,200,000 750,000 2,350,000

Accounts Payable 100,000 50,000 150,000

Ordinary Share Capital - Pole Co. 600,000 600,000

Ordinary Share Capital - Sole Co. 200,000 200,000 -

Additional Paid-in Capital - Sole Co. 100,000 100,000 -

Retained Earnings - Pole Co. 1,500,000 9,000 1,509,000

Retained Earnings - Sole Co. 400,000 400,000 -

Non-Controlling Interest 91,000 91,000

Total Liab & Equity 2,200,000 750,000 910,000 910,000 2,350,000

3.) Assuming that only 40% of the outstanding shares of Sole Co. was acquired by Pole

Co. for P400,000 payable in cash and all other information remain the same. Pole

Company, though, holds a substantive option to acquire the majority shares that is

exercisable and deeply in the money

a. Prepare an allocation schedule to compute goodwill (gain on bargain

purchase) assuming the non-controlling interest is measured proportionate to

the identifiable net assets

Consideration transferred 400,000

Less: BV of acquired investment 280,000

Excess of cost over BV 120,000

Less: Increase in MV 84,000

Goodwill 36,000

c. Prepare the consolidated working paper

Pole Co. Sole Co. Adjustments and Eliminations Consolidated FS

BV BV DEBIT CREDIT

Cash 850,000 50,000 900,000

Accounts Receivable 200,000 100,000 300,000

Inventory 150,000 60,000 30,000 240,000

Land 70,000 50,000 120,000

Equipment (net) 600,000 470,000 130,000 1,200,000

Goodwill 36,000 36,000

Investments in Sole Co. 400,000 400,000 -

Total Assets 2,200,000 750,000 2,796,000

Accounts Payable 100,000 50,000 150,000

Ordinary Share Capital - Pole Co. 600,000 600,000

Ordinary Share Capital - Sole Co. 200,000 200,000 -

Additional Paid-in Capital - Sole Co. 100,000 100,000 -

Retained Earnings - Pole Co. 1,500,000 1,500,000

Retained Earnings - Sole Co. 400,000 400,000 -

Non-Controlling Interest 546,000 546,000

Total Liab & Equity 2,200,000 750,000 946,000 946,000 2,796,000

b. Prepare the eliminatory entry

Inventory 30,000

Land 50,000

Equipment 130,000

Goodwill 40,000

Ordinary Share Capital - Sole Co. 200,000

Additional Paid-in Capital - Sole Co. 100,000

Retained Earnings - Sole Co. 400,000

Investment in Subsidiary 950,000

b. Prepare the eliminatory entry

Inventory 30,000

Land 50,000

Equipment 130,000

Ordinary Share Capital - Sole Co. 200,000

Additional Paid-in Capital - Sole Co. 100,000

Retained Earnings - Sole Co. 400,000

Investment in Subsidiary 810,000

Gain on Bargain Purchase 9,000

Non-Controlling Interest 91,000

b. Prepare the eliminatory entry

Inventory 30,000

Land 50,000

Equipment 130,000

Goodwill 36,000

Ordinary Share Capital - Sole Co. 200,000

Additional Paid-in Capital - Sole Co. 100,000

Retained Earnings - Sole Co. 400,000

Investment in Subsidiary 400,000

Non-Controlling Interest 546,000

You might also like

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- Buscom 1Document4 pagesBuscom 1dmangiginNo ratings yet

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsRobin ScherbatskyNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- Answer To ExercisesDocument40 pagesAnswer To ExercisesmarieieiemNo ratings yet

- Conso FS LessonDocument54 pagesConso FS Lessondbpcastro8No ratings yet

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Consolidated Statement of Financial PositionDocument2 pagesConsolidated Statement of Financial PositionEvita Ayne TapitNo ratings yet

- ABC Company DEF Company: Book Fair Book FairDocument15 pagesABC Company DEF Company: Book Fair Book FairJonas Avanzado TianiaNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument3 pagesAccounting 315 - Quiz Business CombinationJoshua HongNo ratings yet

- Prelim Exam Business CombinationDocument3 pagesPrelim Exam Business CombinationHyakkimura GamingNo ratings yet

- Gain On Acquisition (Bargain Purchase) - 105,000Document2 pagesGain On Acquisition (Bargain Purchase) - 105,000Junzen Ralph YapNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- MergerDocument3 pagesMergerJohn BalanquitNo ratings yet

- Unit II CFS Subsequent To Date of AcquisitionDocument10 pagesUnit II CFS Subsequent To Date of AcquisitionDaisy TañoteNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Abc ProbsDocument12 pagesAbc ProbsZNo ratings yet

- Wan Aidi Pra Uts Adv. AccDocument10 pagesWan Aidi Pra Uts Adv. AccWan Aidi AbdurrahmanNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- ABC ReviewDocument21 pagesABC ReviewJr Reyes PedidaNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Formation of Partnership1Document3 pagesFormation of Partnership1itik meowmeowNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Mock Test 201 KeyDocument12 pagesMock Test 201 Keydengdeng2211No ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Activity #3 Separate and Consolidated FS - Date of AcquisitionDocument4 pagesActivity #3 Separate and Consolidated FS - Date of AcquisitionLorelie I. RamiroNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- Malabanan - Activity Chapter 2 2 PDFDocument5 pagesMalabanan - Activity Chapter 2 2 PDFJv MalabananNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Problem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksDocument2 pagesProblem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksArtisanNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Problem ADocument3 pagesProblem AadieNo ratings yet

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- Assignment 2Document43 pagesAssignment 2Judy ZhangNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Problem 1 Adv. Acct. IIDocument4 pagesProblem 1 Adv. Acct. IISamuel DebebeNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- Jericho G. Sumague BSMA 3-1Document2 pagesJericho G. Sumague BSMA 3-1Jericho SumagueNo ratings yet

- Dalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Document1 pageDalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Jericho SumagueNo ratings yet

- They Help An International School in Cavite Achieve Its Aims of Being A WellDocument1 pageThey Help An International School in Cavite Achieve Its Aims of Being A WellJericho SumagueNo ratings yet

- Dalmacio A. Sumague Brgy. Pantay Matanda Tanauan City TIN: 295-749-653-000Document1 pageDalmacio A. Sumague Brgy. Pantay Matanda Tanauan City TIN: 295-749-653-000Jericho SumagueNo ratings yet

- Lyceum of The Philippines Laguna Lyceum St. Cabrini College of Allied MedicineDocument1 pageLyceum of The Philippines Laguna Lyceum St. Cabrini College of Allied MedicineJericho SumagueNo ratings yet

- Soil Hauling: Dalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Document1 pageSoil Hauling: Dalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Jericho SumagueNo ratings yet

- Img 20210418 0002Document1 pageImg 20210418 0002Jericho SumagueNo ratings yet

- Dalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Document1 pageDalmacio A. Sumague Brgy. Pantay Matanda Tanauan City Tin: 295-749-653-000Jericho SumagueNo ratings yet

- Sunague PT3 HRMDocument5 pagesSunague PT3 HRMJericho SumagueNo ratings yet

- Sumague OE4 HRMDocument2 pagesSumague OE4 HRMJericho SumagueNo ratings yet

- Stratman WODocument1 pageStratman WOJericho SumagueNo ratings yet

- Sumague Jericho G. BSMA 3-1 Human Resource Management OE No. 2Document2 pagesSumague Jericho G. BSMA 3-1 Human Resource Management OE No. 2Jericho SumagueNo ratings yet

- Sumague AIS Assignment2Document2 pagesSumague AIS Assignment2Jericho SumagueNo ratings yet

- Sumague OE4 HRMDocument2 pagesSumague OE4 HRMJericho SumagueNo ratings yet

- Sumague PT4 HRMDocument5 pagesSumague PT4 HRMJericho SumagueNo ratings yet

- Sumague PT4 HRMDocument5 pagesSumague PT4 HRMJericho SumagueNo ratings yet

- Sunague PT3 HRMDocument5 pagesSunague PT3 HRMJericho SumagueNo ratings yet

- Sumague AssignmentDocument2 pagesSumague AssignmentJericho SumagueNo ratings yet

- BINTDocument2 pagesBINTJericho SumagueNo ratings yet

- Groupmates EvaluationDocument1 pageGroupmates EvaluationJericho SumagueNo ratings yet

- Sumague AIS Assignment2Document2 pagesSumague AIS Assignment2Jericho SumagueNo ratings yet

- Grab Food BackgroundDocument2 pagesGrab Food BackgroundJericho SumagueNo ratings yet

- Sunague PT3 HRMDocument5 pagesSunague PT3 HRMJericho SumagueNo ratings yet

- Ais Peer EvalDocument2 pagesAis Peer EvalJericho SumagueNo ratings yet

- Ais Peer EvalDocument2 pagesAis Peer EvalJericho SumagueNo ratings yet

- Background and A PT3 HRMDocument12 pagesBackground and A PT3 HRMJericho SumagueNo ratings yet

- Stratman WODocument1 pageStratman WOJericho SumagueNo ratings yet

- Sumague AIS Assignment2Document2 pagesSumague AIS Assignment2Jericho SumagueNo ratings yet

- Strat - PT 1 1Document90 pagesStrat - PT 1 1Jericho SumagueNo ratings yet

- What Holds Japan BackDocument6 pagesWhat Holds Japan BackMaryamNo ratings yet

- Saju George V Mohammed SherifDocument11 pagesSaju George V Mohammed SherifAditya SharmaNo ratings yet

- Rationale As1099C Has Been Reaffirmed To Comply With The Sae Five-Year Review PolicyDocument3 pagesRationale As1099C Has Been Reaffirmed To Comply With The Sae Five-Year Review PolicyLarry HareNo ratings yet

- Cos Sample Cover Letter PDFDocument1 pageCos Sample Cover Letter PDFninthsevenNo ratings yet

- Jobs in Poland 2021...Document4 pagesJobs in Poland 2021...Boma IpaliboNo ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Important!: Flights Hotel CAR Rentals Manage MY BookingDocument3 pagesImportant!: Flights Hotel CAR Rentals Manage MY BookingAlena FediakinaNo ratings yet

- 6.2 Labour Law IIDocument6 pages6.2 Labour Law IIDevvrat garhwalNo ratings yet

- Expenses SheetDocument31 pagesExpenses SheetVinay SinghNo ratings yet

- ITMP Policy Addendum Ver.12Document5 pagesITMP Policy Addendum Ver.12Piyush MishraNo ratings yet

- Ground RulesDocument2 pagesGround RulespulithepogiNo ratings yet

- UntitledDocument4 pagesUntitledPhillips West News OutletNo ratings yet

- IMaster NCE-T V100R021C00 Product Description (Arm) 04-CDocument401 pagesIMaster NCE-T V100R021C00 Product Description (Arm) 04-CGhallab Alsadeh100% (1)

- PRO Taxing The ChurchDocument5 pagesPRO Taxing The ChurchLhem-Mari Japos NavalNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- The Future Is Calling (Part Two) Secret Organizations and Hidden AgendasDocument19 pagesThe Future Is Calling (Part Two) Secret Organizations and Hidden AgendasAndemanNo ratings yet

- Articles of Incorporation of Kasurog Care FoundationDocument10 pagesArticles of Incorporation of Kasurog Care FoundationJohn B BarbonioNo ratings yet

- Cailles vs. BonifacioDocument2 pagesCailles vs. BonifacioLAIZA TRISHA M MONTALLANo ratings yet

- The Modern Prince: A Review of The Prince and On Machiavellianism of TodayDocument7 pagesThe Modern Prince: A Review of The Prince and On Machiavellianism of TodayRafael Kieran MondayNo ratings yet

- Arguments For The Ban LajjaDocument3 pagesArguments For The Ban Lajjapizzabythebay kNo ratings yet

- Superposition TheoremDocument9 pagesSuperposition TheoremAditya SinghNo ratings yet

- Mount Sinai Eye and Ear 2018 FinancialsDocument47 pagesMount Sinai Eye and Ear 2018 FinancialsJonathan LaMantiaNo ratings yet

- Asian Parliamentary Debate RulesDocument2 pagesAsian Parliamentary Debate RulesBabylen BahalaNo ratings yet

- F.miklosich - Chronica NestorisDocument258 pagesF.miklosich - Chronica NestorisДжу ХоNo ratings yet

- Uthman Ibn AffanDocument44 pagesUthman Ibn Affanguest_7314No ratings yet

- Sale Deed 1Document4 pagesSale Deed 1Tanvir AHMEDNo ratings yet

- 2022-1046 N-LIMA BGC PROPERTIES (F)Document1 page2022-1046 N-LIMA BGC PROPERTIES (F)Mary Grace CanjaNo ratings yet

- #1. Register: Steps in Becoming A Lazada SellerDocument5 pages#1. Register: Steps in Becoming A Lazada SellerblessingNo ratings yet

- DMC Leap 1a 72 00 0151 01a 930a D - 004 00 - SX UsDocument14 pagesDMC Leap 1a 72 00 0151 01a 930a D - 004 00 - SX UsJason Lape100% (1)

- General Arguments Against Protective DiscriminationDocument1 pageGeneral Arguments Against Protective DiscriminationSonatan PaulNo ratings yet