Professional Documents

Culture Documents

Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37

Uploaded by

Malar SrirengarajahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37

Uploaded by

Malar SrirengarajahCopyright:

Available Formats

……………………………………..

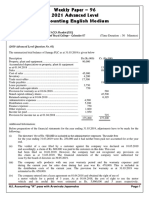

1PAPER BASED REVISION PROGRAMME

Marking Guide - Revision Paper – 37

Advanced Level - 2021

Accounting English Medium

Aravinda Jayamaha

BBA (Colombo)

BSc Accounting and Finance/ACCA Finalist (UK)

Former Accounting Teacher of Royal College – Colombo 07

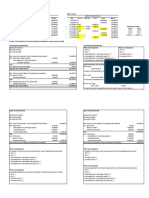

(01) (a)

Bank Reconciliation Statement

Balance as per cash control 01.01.21 8,000

(+) Un presented cheque (Dec. – (1842) 2,000 2,000

10,000

(-) Unrealized deposit (Dec.) 8349 1,000 (1,000)

Balance as per bank statement Jan, 2020 9,000

Adjusted Cash Control

B.c.f. 31,600 Bank charges 900

Direct deposit 2,000

Error (deposited cheque) 14,400 B.c.d. 47,100

48,000 48,000

B.c.f. 47,100

Bank Reconciliation Statement

Balance as per adjusted cash control account 47,100

(+) Unpresented cheque (1846) 1,600 1,600

48,700

(-) Unrealized deposit (1849) (13,000) (13,000)

Balance as per bank statement Jan. 2021 35,700

(a) Unrecorded transaction

Bank charges 900

Direct deposit 2,000

(b) Timing differences

(a) Unpresented cheque (1846) 1,600

(b) Unrealized deposit (1849) 13,000

(c) Deposited cheque (1848) Rs. 16,000 was recorded as Rs. 1,600 in receipt cash journal

A/L Accounting “A” pass with Aravinda Jayamaha Page 1

(01) (b) (i) Trade debtor reconciliation statement

Debtors ledger balance ................................... 42,000

(+) Sales ......................................................... 8,000

Sales return ............................................... 2,000 10,000

52,000

(-) Cash ........................................................... 6,000

Credit balance................................................... 3,000 9,000

Debtors control before correction) ................... 43,000

(ii) Revised trade debtors control account

B.c.f. 43,000 Sale 8,000

Sales return 2,000

Discount allowed 500

B.c.f. 32,500

43,000 43,000

B.c.f. 32,500

(iii) Revised trade debtors list

Debtors ledger balance ........................................ 42,000

(+) Credit balance ............................................... (3,000) (3,000)

39,000

(-) Cash ................................................................ 6,000

Discount allowed .................................................. 500 (6,500)

Revised debtors list .............................................. 32,500

(iv) General Journal

Date Description Dr Cr

(1) Sales (P/L) 8,000

Trade debtors control 8,000

(Overcasted sales Rs.8,000)

(2) Sales return 2,000

Debtors control 2,000

(Sales return undercasted 2,000)

(3) Discount received 500

Discount allowed 500

Trade debtors control 500

Trade creditors control 500

(Discount allowed was recorded as discount

received correction)

(v) Sale (8,000)

Sales return (2,000) If above errors were not correcting profit increased

Discount allowed (500) by Rs. 11,000

Discount received (500)

Revised profit 11,000

A/L Accounting “A” pass with Aravinda Jayamaha Page 2

(i) General Journal

Date Description Dr Cr

(1) Cash 700

Share issue 700

(Recording cash received for share issue)

(2) Share issue 700

Stated capital 500

Cash 200

(Issue of 50000 shares at Rs. 10 each)

(ii) Changers in Equity Statement (Rs.000)

Stated Revaluation General Retain

Total

capital reserve reserve profit

B.c.f x x x x x

Share issue 500 500

Capitalization of reserve 500 (500)

dividends (80) (80)

General reserve 100 (100) -

Total comprehensive income 100 500 600

(iii) Reserves will convert in to stated capital

(03) (a) Daham Sports Club

Income & Expenditure account for the year ended 31.03.2021

Income

Life subscription .............................................................. 40

Subscription (60 « 5000) ................................................. 300

Donation used ................................................................. 200

Building fund used .......................................................... 360 900

Expenses

Discount allowed ............................................................. 20

Depreciation .................................................................... 20

Operational expense ........................................................ 195 (235)

Surplus ............................................................................ 665

Discount 40 « 5000 « 0.1 = 20

(ii) Equity as at 01/04/2020 - 280

Surplus 665

Life fund 320

Sport fund 50

Building fund 240

1,555

A/L Accounting “A” pass with Aravinda Jayamaha Page 3

(03) (b) Kavindu Ama Partnership

Trading, Profit & Loss for the year ended 31.03.2021 (Rs.000)

Sale ..................................................................................... 5,000

(-) Cost of sale (2200 + 50 -60) ......................................... (2,190)

Gross profit ........................................................................ 2,810

Expenses

License fee ........................................................................ 20

Operational expense (900-600) ........................................ 300

Loan interest ..................................................................... 75 395

2,415

Appropriations

Salary - Kavindu .............................................................. 600

Ama .................................................................... 600 (1,200)

Capital interest - Kavindu ................................................ 200

Amal ..................................................... 100 (300)

Profit share – Kavindu ....................................................... 549

Amal ........................................................... 366 (915)

Partners Capital Account (Rs.000)

Kavindu Amal Ama Kavindu Amal Ama

Goodwill 150 90 60 B.c.f. 2,000 1,000 -

Cash 1,200

B.c.d. 2,030 1,030 1,140 Goodwill 180 120

2,180 1,120 1,200 2,180 1,120 1,200

B.c.f. 2,030 1,030 1,140

Partners Current Account (Rs.000)

Kavindu Amal Kavindu Amal

Drawing 140 20 B.c.f. 300 250

Operational expense 300 300 License fee 20

Salary 600 600

Capital interest 200 100

B.c.d. 1,209 1016 Profit share 549 366

1,649 1,336 1,649 1,336

B.c.f. 1,209 1016

A/L Accounting “A” pass with Aravinda Jayamaha Page 4

(04) (i) Property, Plant, Equipment (Rs.000)

Motor

Land Building Total

vehicle

Opening 01.04.2020 ................................ 2,000 5,000 3,000 10,000

Revaluation ............................................. 800 1,000 1,800

Disposal .................................................. (3,000) (3,000)

Adj. Accumulated depreciation .............. (2,000) (2,000)

2,800 4,000 6,800

Opening .................................................. - 2,000 1,000 3,000

Depreciation ........................................... 400 450 850

Disposal .................................................. (1,450) (1,450)

Adj. Accumulated depreciation (2,000) (2,000)

400 - 400

Carrying value ........................................ 2,800 3,600 - 6,400

(04) (b) (ii) P & L Extraction

Distribution Administration Other

Depreciation

Building ............................. 400

Motor vehicle .................... 450

Disposal loss ..................... 250

(iii) General Journal

Dr Cr

Disposal account 3,000

Motor vehicle 3,000

(Recording cost of the disposed asset)

Provision for depreciation 1,450

Disposal account 1,450

(Recording accumulated depreciation until

disposal date)

Sales 1,300

Disposal account 1,300

(Recording sales proceed)

P&L 250

Disposal account 250

(Recording disposal loss)

Depreciation expense 450

Provision for depreciation 450

(Recording depreciation for the year)

(i) Changers in Equity Statement (Rs.000)

Stated Revaluation General Retain

Total

capital reserve reserve profit

B.c.f. 2,000 800 200 100 3,100

(1) Share issue 1,000 1,000

(2) Capitalization of reserve 200 (200) -

(3) Total comprehensive income (150) 750 600

(4) Transfer general reserve 200 (200) -

3,200 450 400 650 4,700

A/L Accounting “A” pass with Aravinda Jayamaha Page 5

(ii) General Journal (Rs.000)

Dr Cr

(i) Cash 1,300

Share issue 1,300

(Recording application money received)

(ii) Share issue 300

Cash 300

(Rejection of excess application ........)

(iii) Share issue 1,000

Stated capital 1,000

(Recording issue of shares)

(iii) Capitalization of reserve

Reserves will decreased

Stated capital will increase

Finally no impact on equity

A/L Accounting “A” pass with Aravinda Jayamaha Page 6

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Cashew ProblemDocument2 pagesCashew ProblemJoyNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- CASH FLOW ExampleDocument4 pagesCASH FLOW ExampleBiancaNo ratings yet

- Scarry CompanyDocument3 pagesScarry CompanyBuenaventura, Elijah B.No ratings yet

- Ventura, Mary Mickaella R - Cashflowp.321 - Group 3Document5 pagesVentura, Mary Mickaella R - Cashflowp.321 - Group 3Mary Ventura100% (1)

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- (03B) Cash SPECIAL Quiz ANSWER KEYDocument6 pages(03B) Cash SPECIAL Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- FAR - 02 LOANS AND RECEIVABLES With AnswerDocument17 pagesFAR - 02 LOANS AND RECEIVABLES With AnswerAndrei Nicole Mendoza Rivera91% (11)

- 01 Quiz On Topic 02 With Answer KeyDocument7 pages01 Quiz On Topic 02 With Answer KeyNye NyeNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Chapter 1Document12 pagesChapter 1Kyllar HizonNo ratings yet

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- Exa Final ACCO500 5 6 8 10 13 Jun 2020Document9 pagesExa Final ACCO500 5 6 8 10 13 Jun 2020Omar PerezNo ratings yet

- Soal Akuntansi OSN Ekonomi Dan PembahasaDocument6 pagesSoal Akuntansi OSN Ekonomi Dan PembahasaQurrotul AyuniNo ratings yet

- Financial Accounting & Reporting: Answer: A Trade ReceivableDocument17 pagesFinancial Accounting & Reporting: Answer: A Trade ReceivableFerb CruzadaNo ratings yet

- COGS - Cash Basis: Accounts Payable 3,000,00 0Document2 pagesCOGS - Cash Basis: Accounts Payable 3,000,00 0Febby SabNo ratings yet

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Worksheet: Zainy-Arif Endaila BSA-1Document4 pagesWorksheet: Zainy-Arif Endaila BSA-1Zainy EndailaNo ratings yet

- 2 Corporate LiquidationDocument5 pages2 Corporate LiquidationSamantha0% (1)

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Problem-Solving-1-4 Audit ProblemsDocument15 pagesProblem-Solving-1-4 Audit ProblemsRomina LopezNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- GE 01.FCAB - .L Solution JUNE 2020 ExamDocument5 pagesGE 01.FCAB - .L Solution JUNE 2020 ExamTameemmahmud rokibNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Depreciation Expense, Rp. 25.000.000Document12 pagesDepreciation Expense, Rp. 25.000.000Roni SinagaNo ratings yet

- FAR Test BankDocument24 pagesFAR Test BankMaryjel17No ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Adobe Scan Mar 16, 2023Document20 pagesAdobe Scan Mar 16, 2023Renalyn Ps MewagNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- Raine SDocument6 pagesRaine Sapi-664248097No ratings yet

- Chapter 4. Illustrating The Accounting ProcessDocument5 pagesChapter 4. Illustrating The Accounting ProcessJhon WickNo ratings yet

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Teresita Buenaflor ShoesDocument1 pageTeresita Buenaflor ShoesmonomagicshopNo ratings yet

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- Comprehensiveproblemset#8Document15 pagesComprehensiveproblemset#8DEO100% (1)

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- 3 - Recording of Transaction IDocument13 pages3 - Recording of Transaction IMai SalehNo ratings yet

- BANK RECON MS Excel Discussion NotesDocument2 pagesBANK RECON MS Excel Discussion NotesCamilla Marel D. TABIOS,No ratings yet

- 17 - Accounting For Incomplete Records (Single Entry)Document7 pages17 - Accounting For Incomplete Records (Single Entry)KAMAL POKHRELNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Revision Paper - 37Document5 pagesAccounting English Medium: Paper Based Revision Programme Revision Paper - 37Malar SrirengarajahNo ratings yet

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Revision Paper - 35Document5 pagesAccounting English Medium: Paper Based Revision Programme Revision Paper - 35Malar SrirengarajahNo ratings yet

- Cash Flow StatementDocument41 pagesCash Flow StatementMalar SrirengarajahNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Malar SrirengarajahNo ratings yet

- Beyond "The Arc of Freedom and Prosperity": Debating Universal Values in Japanese Grand StrategyDocument9 pagesBeyond "The Arc of Freedom and Prosperity": Debating Universal Values in Japanese Grand StrategyGerman Marshall Fund of the United StatesNo ratings yet

- Knee JointDocument28 pagesKnee JointRaj Shekhar Singh100% (1)

- Participants ListDocument13 pagesParticipants Listmailway002No ratings yet

- QP 12math Term 1Document11 pagesQP 12math Term 1sarthakNo ratings yet

- Production of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmDocument26 pagesProduction of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmcelestavionaNo ratings yet

- Focus Edition From GC: Phosphate Bonded Investments For C&B TechniquesDocument35 pagesFocus Edition From GC: Phosphate Bonded Investments For C&B TechniquesAlexis De Jesus FernandezNo ratings yet

- Dwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFDocument35 pagesDwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFgebbielean1237100% (12)

- Bad Memories Walkthrough 0.52Document10 pagesBad Memories Walkthrough 0.52Micael AkumaNo ratings yet

- TraceDocument5 pagesTraceNorma TellezNo ratings yet

- Virtual Assets Act, 2022Document18 pagesVirtual Assets Act, 2022Rapulu UdohNo ratings yet

- Modern School For SaxophoneDocument23 pagesModern School For SaxophoneAllen Demiter65% (23)

- SreenuDocument2 pagesSreenuSubbareddy NvNo ratings yet

- Practising Modern English For Life Sciences Students Caiet Exercitii-1Document77 pagesPractising Modern English For Life Sciences Students Caiet Exercitii-1Robert BobiaNo ratings yet

- Previous Year Questions - Macro Economics - XIIDocument16 pagesPrevious Year Questions - Macro Economics - XIIRituraj VermaNo ratings yet

- DMIT - Midbrain - DMIT SoftwareDocument16 pagesDMIT - Midbrain - DMIT SoftwarevinNo ratings yet

- Project Formulation and Appraisalpdf PDFDocument12 pagesProject Formulation and Appraisalpdf PDFabhijeet varadeNo ratings yet

- Ajmera - Treon - FF - R4 - 13-11-17 FinalDocument45 pagesAjmera - Treon - FF - R4 - 13-11-17 FinalNikita KadamNo ratings yet

- Instructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Document4 pagesInstructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Lailatur RahmiNo ratings yet

- Walking in Space - Lyrics and Chord PatternDocument2 pagesWalking in Space - Lyrics and Chord Patternjohn smithNo ratings yet

- Google Tools: Reggie Luther Tracsoft, Inc. 706-568-4133Document23 pagesGoogle Tools: Reggie Luther Tracsoft, Inc. 706-568-4133nbaghrechaNo ratings yet

- National Football League FRC 2000 Sol SRGBDocument33 pagesNational Football League FRC 2000 Sol SRGBMick StukesNo ratings yet

- UM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Document154 pagesUM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Antony Jacob AshishNo ratings yet

- Who Trs 993 Web FinalDocument284 pagesWho Trs 993 Web FinalAnonymous 6OPLC9UNo ratings yet

- EKRP311 Vc-Jun2022Document3 pagesEKRP311 Vc-Jun2022dfmosesi78No ratings yet

- Report FinalDocument48 pagesReport FinalSantosh ChaudharyNo ratings yet

- 1916 South American Championship Squads - WikipediaDocument6 pages1916 South American Championship Squads - WikipediaCristian VillamayorNo ratings yet

- Understanding and Teaching Fractions: Sybilla BeckmannDocument26 pagesUnderstanding and Teaching Fractions: Sybilla Beckmannjhicks_mathNo ratings yet

- Solubility Product ConstantsDocument6 pagesSolubility Product ConstantsBilal AhmedNo ratings yet

- Open Letter To Hon. Nitin Gadkari On Pothole Problem On National and Other Highways in IndiaDocument3 pagesOpen Letter To Hon. Nitin Gadkari On Pothole Problem On National and Other Highways in IndiaProf. Prithvi Singh KandhalNo ratings yet

- SABRE MK-3 CFT Gel SpecDocument1 pageSABRE MK-3 CFT Gel Specseregio12No ratings yet