Professional Documents

Culture Documents

SYM Company incomplete accounts updated through May 2015

Uploaded by

Princess SibugOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SYM Company incomplete accounts updated through May 2015

Uploaded by

Princess SibugCopyright:

Available Formats

Downstream Manufacturing Company realized too late that it had made a mistake locating its controller’s office and

its electronic data processing system in the

basement. Because of the Typhoon, the Pasig River overflowed on May 2 and flooded the company’s basement. Electronic data storage was beyond retrieval, and

the company had not provided off-site storage of data. Some of the paper printouts were located but were badly faded and only partially legible. On May 3, when

the river subsided, company accountants were able to assemble the following factory-related data from the debris and from discussions with various knowledgeable

personnel. Data about the following accounts were found:

• Raw Material (includes indirect material) Inventory: Balance April 1 was P4,800.

• Work in Process Inventory: Balance April 1 was P7,700.

• Finished Goods Inventory: Balance April 30 was P6,600.

• Total company payroll cost for April was P29,200.

• Accounts payable balance April 30 was P18,000.

• Indirect material used in April cost P5,800.

• Other nonmaterial and non-labor overhead items for April totalled P2,500.

Payroll records, kept at an across-town service center that processes the company’s payroll, showed that April’s direct labor amounted to P18,200 and represented

4,400 labor hours. Indirect factory labor amounted to P5,400 in April. The president’s office had a file copy of the production budget for the current year. It revealed

that the predetermined manufacturing overhead application rate is based on planned annual direct labor hours of 50,400 and expected factory overhead of

P151,200.

Discussion with the factory superintendent indicated that only two jobs remained unfinished on April 30. Fortunately, the superintendent also had copies of the job

cost sheets that showed a combined total of P2,400 of direct material and P4,500 of direct labor. The direct labor hours on these jobs totalled 1,072. Both of these

jobs had been started during the current period. A badly faded copy of April’s Cost of Goods Manufactured and Sold schedule showed cost of goods manufactured

was P48,000, and the April 1 Finished Goods Inventory was P8,400.

The treasurer’s office files copies of paid invoices chronologically. All invoices are for raw material purchased on account. Examination of these files revealed that

unpaid invoices on April 1 amounted to P6,100; P28,000 of purchases had been made during April; and P18,000 of unpaid invoices existed on April 30.

1. Calculate the cost of direct material used in April.

2. Calculate the cost of raw material issued in April.

3. Calculate the April 30 balance of Raw Material Inventory.

4. Determine the amount of under applied or over applied overhead for April.

5. What is the Cost of Goods Sold for April?

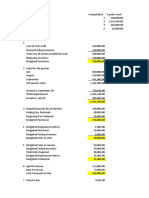

Problem 2: You are asked to bring the following incomplete accounts of SYM Company updated through May 2015.

Direct Materials Accounts Payable Finished Goods

| 5/31/15 P20,000 | 4/30/15 P 10,000 4/30/15 P25,000|

| | |

Work in Process Factory overhead control Cost of Goods Sold

4/30/15 P2,000| P55,000 | |

| | |

Additional information:

(a) The overhead is applied by using a budgeted rate that is set at the beginning of each year by forecasting the

years overhead and relating it to forecasted machine hours. The budget for 2015 called for a total of 15,000

machine hours and P750,000 of factory overhead.

(b) The accounts payable is for direct materials purchases only. The balance on May 31, was P12,000. Payment of

P78,000 were made during May.

(c) The finished goods inventory as of May 31 was P7,000.

(d) The cost of goods sold during the month was P165,000.

(e) On May 31, there was only one unfinished Job in the factory. Cost record shows that P1,000 (40 hours) of direct

labor and P2,000 of direct materials had been charged to Job. Thirty machine hours were used on that Job.

(f) Total of 940 direct labor hours were worked during the month of May. All factory workers earn the same rate of

pay.

(g) All ‘actual” overhead incurred during May has already been posted.

(h) A total of 1,000 machine hours was used during May.

Required: 1) Cost of Goods Sold Statement; 2) Compute for the under/over applied overhead; 3) Prepare all necessary journal entries

You might also like

- Ben and Jerry's Homemade Ice Cream IncDocument8 pagesBen and Jerry's Homemade Ice Cream IncHashim Ayaz KhanNo ratings yet

- Intangible AssetDocument21 pagesIntangible AssetKenn Adam Johan Gajudo100% (4)

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- Intangible Assets CourseworkDocument3 pagesIntangible Assets CourseworkNezer VergaraNo ratings yet

- COGS statement and journal entries for SYM CompanyDocument3 pagesCOGS statement and journal entries for SYM CompanyClarisse Angela PostreNo ratings yet

- Take Home Quiz Chapters 7 9Document5 pagesTake Home Quiz Chapters 7 9Hillarie Albano RarangolNo ratings yet

- True or False Costing QuizDocument5 pagesTrue or False Costing Quizretchiel love calinogNo ratings yet

- CH 30 - First Time Adoption of PFRSDocument2 pagesCH 30 - First Time Adoption of PFRSJoyce Anne GarduqueNo ratings yet

- AFAR 2 Quiz 1 Solution (BSA)Document11 pagesAFAR 2 Quiz 1 Solution (BSA)Lawrence YusiNo ratings yet

- Activity 1 MAS1 AnswersDocument2 pagesActivity 1 MAS1 Answersangel mae cuevasNo ratings yet

- List Accounting 2 2013Document5 pagesList Accounting 2 2013Ondoy PorlaresNo ratings yet

- FUNAC TheoriesDocument5 pagesFUNAC TheoriesAlvin QuizonNo ratings yet

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- Solution Chapter 5Document22 pagesSolution Chapter 5Roselle Manlapaz LorenzoNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- PPE HandoutsDocument12 pagesPPE HandoutsChristine Joy PamaNo ratings yet

- Chapter 6 - JITDocument14 pagesChapter 6 - JITAyra BernabeNo ratings yet

- Analyze petty cash fund Perlita CompanyDocument16 pagesAnalyze petty cash fund Perlita CompanyRie CabigonNo ratings yet

- Discussion Problems: FAR.2935-Income Taxes OCTOBER 2020Document4 pagesDiscussion Problems: FAR.2935-Income Taxes OCTOBER 2020Alexander DimaliposNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- HW 2. Problems Cash and Cash Equivalents - StudentDocument2 pagesHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroNo ratings yet

- MAS-02 Cost Terms, Concepts and BehaviorDocument4 pagesMAS-02 Cost Terms, Concepts and BehaviorMichael BaguyoNo ratings yet

- ACC 1802 Partneship OperationsDocument3 pagesACC 1802 Partneship OperationsronnelNo ratings yet

- Aje 1bsa Abm1Document7 pagesAje 1bsa Abm1Ej UlangNo ratings yet

- Acc 30 CorporationDocument8 pagesAcc 30 CorporationGerlie BonleonNo ratings yet

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaNo ratings yet

- Units To Account For: 635,000: L2-Practice Problem: EUP-WADocument2 pagesUnits To Account For: 635,000: L2-Practice Problem: EUP-WAlalalalaNo ratings yet

- Process CostingDocument3 pagesProcess CostingenzoNo ratings yet

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Document2 pagesGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- BBDocument3 pagesBBJoshua WacanganNo ratings yet

- Accounting for Receivables, Freight Charges, and Sales DiscountsDocument2 pagesAccounting for Receivables, Freight Charges, and Sales DiscountsJEFFERSON CUTENo ratings yet

- 04sol-Investments WB 1stDocument21 pages04sol-Investments WB 1stNJ SyNo ratings yet

- Cost ManagementDocument4 pagesCost ManagementTrọng ĐỗNo ratings yet

- Compensation Swot Analysis of Bdo Unibank, Inc. Company ProfileDocument3 pagesCompensation Swot Analysis of Bdo Unibank, Inc. Company ProfileChari Ty TabafaNo ratings yet

- Accounting For Business Combination ReviewerDocument21 pagesAccounting For Business Combination ReviewerJoyce MacatangayNo ratings yet

- Road To NC3 - 1Document1 pageRoad To NC3 - 1Mabelle Dabu Facturanan100% (2)

- PGP (2016)- Sales Operations Planning (SOP) Practice ProblemsDocument3 pagesPGP (2016)- Sales Operations Planning (SOP) Practice ProblemsSanjeev Ranjan25% (4)

- Accounting ReportDocument19 pagesAccounting ReportEdward Glenn BaguiNo ratings yet

- Conceptual FrameworkDocument22 pagesConceptual Frameworkkleen bautistaNo ratings yet

- UCP: CVP Analysis and ExercisesDocument10 pagesUCP: CVP Analysis and ExercisesDin Rose GonzalesNo ratings yet

- Chapter 4 2020Document17 pagesChapter 4 2020JAEHYUK YOONNo ratings yet

- Review TestDocument1 pageReview TestKristine Joy Mendoza InciongNo ratings yet

- Final Exam SBAC 2B 1 Cost CCTG ControlDocument5 pagesFinal Exam SBAC 2B 1 Cost CCTG ControlMaria Erica TorresNo ratings yet

- 3 Week Activity Job Order CostingDocument2 pages3 Week Activity Job Order CostingAlrac Garcia0% (1)

- BA 118.1 SME Exercise Set 5Document1 pageBA 118.1 SME Exercise Set 5Ian De DiosNo ratings yet

- Answers - V2Chapter 6 2012Document6 pagesAnswers - V2Chapter 6 2012Rhei BarbaNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Journalizing Exercise 2Document1 pageJournalizing Exercise 2DZEJLA REYELE PEREZNo ratings yet

- (G1) Highlights of The Train Law Ra 10963 and NIRCDocument37 pages(G1) Highlights of The Train Law Ra 10963 and NIRCFiliusdeiNo ratings yet

- Journal ProblemsDocument2 pagesJournal ProblemsAccounting Files100% (1)

- Pas 2 - Inventories (Continuation of Part 1)Document3 pagesPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangNo ratings yet

- Auditing Problems and SolutionsDocument45 pagesAuditing Problems and SolutionsRonnel TagalogonNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Advanced Financial Accounting and Reporting (CPALE Review)Document3 pagesAdvanced Financial Accounting and Reporting (CPALE Review)Micko LagundinoNo ratings yet

- AISDocument11 pagesAISJezeil DimasNo ratings yet

- Adv2 QUIZ3Document3 pagesAdv2 QUIZ3husney botawanNo ratings yet

- DLSU CPA Cash and Cash EquivalentsDocument3 pagesDLSU CPA Cash and Cash EquivalentsEuniceChungNo ratings yet

- Cost Accumulation - AssignmentDocument2 pagesCost Accumulation - AssignmentLayla GomezNo ratings yet

- Seatwork A331Document1 pageSeatwork A331Ella SingcaNo ratings yet

- Cost Acc Q1Document4 pagesCost Acc Q1Lica CiprianoNo ratings yet

- Backflush Costing1Document3 pagesBackflush Costing1Mitzi EstelleroNo ratings yet

- Finals Quiz SolutionsDocument21 pagesFinals Quiz SolutionsPrincess SibugNo ratings yet

- SW AnsDocument2 pagesSW AnsPrincess SibugNo ratings yet

- Haber Co leases new machine from Gregg Corp calculates capital lease liabilityDocument10 pagesHaber Co leases new machine from Gregg Corp calculates capital lease liabilityPrincess SibugNo ratings yet

- Process CostingDocument8 pagesProcess CostingPrincess SibugNo ratings yet

- QuizDocument2 pagesQuizPrincess SibugNo ratings yet

- Cpar - Ap 07.28.13Document12 pagesCpar - Ap 07.28.13KwonyoongmaoNo ratings yet

- Takehome AnswersDocument1 pageTakehome AnswersPrincess SibugNo ratings yet

- Materials EOQ Stock CardDocument4 pagesMaterials EOQ Stock CardPrincess SibugNo ratings yet

- FQ1 BudgetingDocument1 pageFQ1 BudgetingPrincess SibugNo ratings yet

- Payables FinancingDocument15 pagesPayables FinancingArem CapuliNo ratings yet

- Rizal ReviewerDocument4 pagesRizal ReviewerAsmc100% (2)

- Mktg1294 Asn02 Nguyenlethuyduyen s3891453 03Document25 pagesMktg1294 Asn02 Nguyenlethuyduyen s3891453 03Duyen NguyenNo ratings yet

- Gimenez Ventura 2003 PDFDocument21 pagesGimenez Ventura 2003 PDFHerman SjahruddinNo ratings yet

- Module 06 - Policy and Procedure ManualDocument6 pagesModule 06 - Policy and Procedure ManualBea Reen BurgosNo ratings yet

- Terms of Audit EngagementsDocument1 pageTerms of Audit EngagementsA R AdIL100% (1)

- Bansi Khakhkhar PDFDocument74 pagesBansi Khakhkhar PDFVishu MakwanaNo ratings yet

- Business Plan For Startup BusinessDocument26 pagesBusiness Plan For Startup BusinessPuneet Kashyap100% (1)

- Tri 4 Time TableDocument1 pageTri 4 Time TableRaja Babu SharmaNo ratings yet

- Eco & MRKTG - 7 To 9Document13 pagesEco & MRKTG - 7 To 9shilpaNo ratings yet

- Training Brochure - Advance Financial Management in Power BI (B34) CorporateDocument18 pagesTraining Brochure - Advance Financial Management in Power BI (B34) CorporateDr CashNo ratings yet

- 9 PMP - ProcurementDocument14 pages9 PMP - Procurementdrsuresh26No ratings yet

- Activity Based BillingDocument34 pagesActivity Based BillingArun Minnasandran100% (1)

- HR Challenges in RecruitmentDocument2 pagesHR Challenges in RecruitmentVidya1986No ratings yet

- Document GhjkjhghjkoihugyhyhjiklDocument3 pagesDocument GhjkjhghjkoihugyhyhjikleuqehtbNo ratings yet

- Citymall Promoting Patronage Among Locals PreviewDocument7 pagesCitymall Promoting Patronage Among Locals PreviewSamael LightbringerNo ratings yet

- FOB Faculty Microeconomics ChapterDocument71 pagesFOB Faculty Microeconomics ChapterMr AyieNo ratings yet

- Coffee Shop Financial Plan Template (2023 Guide)Document2 pagesCoffee Shop Financial Plan Template (2023 Guide)mokinyui emmanuelNo ratings yet

- Change AgentDocument3 pagesChange AgentAlamin SheikhNo ratings yet

- Acido Sulfanilico Pub2526Document134 pagesAcido Sulfanilico Pub2526Armando PerezNo ratings yet

- Binomial Option Pricing in A One-Period Model: Stock Price Bond PriceDocument36 pagesBinomial Option Pricing in A One-Period Model: Stock Price Bond PriceSyed Ameer Ali ShahNo ratings yet

- Imtiaz Store's Retail Format, Merchandising and AtmosphericsDocument8 pagesImtiaz Store's Retail Format, Merchandising and AtmosphericsArpana PunshiNo ratings yet

- Accounting Fundamentals: Dr. Reena Agrawal Assistant Professor-Accounting, Finance, Entrepreneurship, Design ThinkingDocument14 pagesAccounting Fundamentals: Dr. Reena Agrawal Assistant Professor-Accounting, Finance, Entrepreneurship, Design Thinkingharsh mauruaNo ratings yet

- Pas 12Document6 pagesPas 12AnneNo ratings yet

- Khaled Hosseini: The Kite RunnerDocument44 pagesKhaled Hosseini: The Kite RunnersanjayfrnzNo ratings yet

- HRM 21 Collective BargainingDocument16 pagesHRM 21 Collective BargainingMahima MohanNo ratings yet

- Perhitungan Kriteria Investasi: Net Present Value (NPV)Document12 pagesPerhitungan Kriteria Investasi: Net Present Value (NPV)Nurul FitrianaNo ratings yet

- Business Ethics and Corporate Governance PDFDocument7 pagesBusiness Ethics and Corporate Governance PDFSHIVANSHUNo ratings yet

- For The Exclusive Use of N. TAKEZAWA, 2019.: Nike, Inc.: Cost of CapitalDocument8 pagesFor The Exclusive Use of N. TAKEZAWA, 2019.: Nike, Inc.: Cost of CapitalVidura Dilshan HewagamaNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementFrancis Edgardo LavarroNo ratings yet