Professional Documents

Culture Documents

Multiple Choices Chap7 and 8

Uploaded by

Princess SibugOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multiple Choices Chap7 and 8

Uploaded by

Princess SibugCopyright:

Available Formats

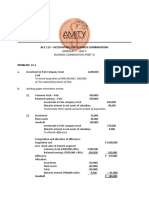

On December 30 of the current year, Haber Co. leased a new machine from Gregg Corp.

The following data relate to the lease transaction at the inception

of the lease:

Lease term 10 years

Annual rental payable at the end of each lease year $100,000

Estimated life of machine 12 years

Implicit interest rate 10%

Present value of an annuity of $1 in advance for

10 periods at 10% 6.76

Present value of an annuity of $1 in arrears for

10 periods at 10% 6.15

Fair value of the machine $700,000

The lease has no renewal option, and the possession of the machine reverts to Gregg when the lease terminates. At the inception of the lease, Haber

should record a lease liability of:

A.

$0

B.

$615,000

C.

$630,000

Incorrect D.

$676,000

You answered D. The correct answer is B.

This lease qualifies as a capital lease because the lease term of 10 years exceeds 75% of the asset’s useful life of 12 years (10 > 0.75 × 12 = 9). When a

lease is considered a capital lease, then the lessee capitalizes the lease property and recognizes a lease obligation for the present value of the minimum

lease payments.

The minimum lease payments here are the $100,000 a year at the end of each year, and their present value is 100,000 × 6.15 (present value of an annuity

in arrears or ordinary annuity, for 10 periods at 10%). Thus, the answer is $615,000:

100,000 × 6.15 = $615,000

You might also like

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Intacc Finals Sw&QuizzesDocument57 pagesIntacc Finals Sw&QuizzesIris FenelleNo ratings yet

- Chapter 28 LeaseDocument5 pagesChapter 28 LeaseGelmar GloriaNo ratings yet

- Arpia Lovely Quiz Chapter 8 Leases Part 2Document5 pagesArpia Lovely Quiz Chapter 8 Leases Part 2Lovely ArpiaNo ratings yet

- HHHDocument4 pagesHHHmitakumo uwu67% (6)

- AnnounceDocument14 pagesAnnounceskydawn0% (1)

- TBCH 17Document41 pagesTBCH 17Tornike Jashi100% (5)

- p1 24 Bonds PayableDocument5 pagesp1 24 Bonds PayablePrincess MangudadatuNo ratings yet

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- MAS Risk and Rates of Returns Practice Problems AnswerDocument29 pagesMAS Risk and Rates of Returns Practice Problems AnswerMJ YaconNo ratings yet

- LeasesDocument5 pagesLeasesElla Montefalco50% (2)

- Quiz Bee - Leases (With Ans)Document3 pagesQuiz Bee - Leases (With Ans)Richard Sarra Mantilla88% (8)

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Document4 pagesPage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- Directions: Highlight in Yellow Color Your Answer.: Employment Benefits TheoryDocument3 pagesDirections: Highlight in Yellow Color Your Answer.: Employment Benefits TheoryTracy Ann Acedillo100% (1)

- SheDocument12 pagesSheMark Anthony Tibule80% (5)

- Batch 17 1st Preboard (P1) No AnswerDocument6 pagesBatch 17 1st Preboard (P1) No AnswerAngelica manaoisNo ratings yet

- Liabilities QuizDocument13 pagesLiabilities QuizRizia Feh Eustaquio100% (1)

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Accounting 122 Final ExamDocument6 pagesAccounting 122 Final ExamMethly MorenoNo ratings yet

- Chapter 13 - Sh. Based PaymentsDocument4 pagesChapter 13 - Sh. Based PaymentsXiena75% (4)

- Earnings Per Share: Name: Date: Professor: Section: Score: QuizDocument5 pagesEarnings Per Share: Name: Date: Professor: Section: Score: QuizLovErsMaeBasergo0% (1)

- Chapter 7 - Leases Part 1Document4 pagesChapter 7 - Leases Part 1JEFFERSON CUTE100% (1)

- She Bsa 4-2Document7 pagesShe Bsa 4-2Justine GuilingNo ratings yet

- Chapter 11 - She Part 2Document4 pagesChapter 11 - She Part 2XienaNo ratings yet

- Toa 1406 Presentation and Preparation of FS and DisclosureDocument25 pagesToa 1406 Presentation and Preparation of FS and DisclosureYani100% (1)

- Reviewer FinalsDocument23 pagesReviewer FinalsMark AloysiusNo ratings yet

- Retirement Seatwork New Answer Key - With Asset CeilingDocument25 pagesRetirement Seatwork New Answer Key - With Asset CeilingsweetEmie031No ratings yet

- DocxDocument119 pagesDocxRene Lopez100% (1)

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionChristian Acab Gracia0% (1)

- Interim Financial Reporting: Indoyon - JaniolaDocument11 pagesInterim Financial Reporting: Indoyon - JaniolaCaryl JANIOLANo ratings yet

- This Study Resource Was Shared Via: Financial AssetsDocument2 pagesThis Study Resource Was Shared Via: Financial AssetsMichael Brian TorresNo ratings yet

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- 85560539Document2 pages85560539Garp BarrocaNo ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- 2nd Yr Midterm 2nd Sem ReviewerDocument19 pages2nd Yr Midterm 2nd Sem Reviewerchiji chzzzmeowNo ratings yet

- Sol. Man. - Chapter 6 Employee Benefits 2Document17 pagesSol. Man. - Chapter 6 Employee Benefits 2Miguel Amihan100% (1)

- Orca Share Media1577676537770-1Document3 pagesOrca Share Media1577676537770-1Jayr BV100% (1)

- Quiz On Pfrs 16 LeaseDocument4 pagesQuiz On Pfrs 16 LeaseCielo Mae Parungo56% (16)

- Intermediate Accounting, True or FalseDocument3 pagesIntermediate Accounting, True or FalseJelly Mea Villena100% (1)

- FX FINACC 2 A KeyDocument9 pagesFX FINACC 2 A KeyEzekiel MalazzabNo ratings yet

- D. Cost To Gather Information Is Increased: Section 2 Theories Chapter 20Document50 pagesD. Cost To Gather Information Is Increased: Section 2 Theories Chapter 20Fernando III PerezNo ratings yet

- PAS37 ProbsDocument4 pagesPAS37 ProbsAngelicaNo ratings yet

- Acc 113 - Accounting For Business CombinationsDocument8 pagesAcc 113 - Accounting For Business CombinationsAlthea CagakitNo ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- 28 - Accounting For Income TaxesDocument2 pages28 - Accounting For Income TaxesralphalonzoNo ratings yet

- Employee Benefits Part 1: Name: Date: Professor: Section: Score: Quiz 1Document4 pagesEmployee Benefits Part 1: Name: Date: Professor: Section: Score: Quiz 1Jamie Rose Aragones83% (6)

- LIABDocument5 pagesLIABLorie Jae DomalaonNo ratings yet

- Employee Benefits Part 2 pROBLEM 3-8Document2 pagesEmployee Benefits Part 2 pROBLEM 3-8Christian QuidipNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Problem 3 LessorDocument7 pagesProblem 3 LessorGelo Owss33% (9)

- Abcd 2Document4 pagesAbcd 2Kath LeynesNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasHavanah Erika L. Dela CruzNo ratings yet

- CD 3Document3 pagesCD 3Kath LeynesNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- St. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)Document7 pagesSt. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)temedebereNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- 65Document25 pages65Mark RevarezNo ratings yet

- Quiz Chapter 7 Leases Part 1 2021Document2 pagesQuiz Chapter 7 Leases Part 1 2021Jennifer Reloso100% (1)

- Finals Quiz SolutionsDocument21 pagesFinals Quiz SolutionsPrincess SibugNo ratings yet

- Process CostingDocument8 pagesProcess CostingPrincess SibugNo ratings yet

- QuizDocument2 pagesQuizPrincess SibugNo ratings yet

- SW AnsDocument2 pagesSW AnsPrincess SibugNo ratings yet

- Materials EOQ Stock CardDocument4 pagesMaterials EOQ Stock CardPrincess SibugNo ratings yet

- Seat Chapter 3 and 4Document2 pagesSeat Chapter 3 and 4Princess SibugNo ratings yet

- Cpar - Ap 07.28.13Document12 pagesCpar - Ap 07.28.13KwonyoongmaoNo ratings yet

- Takehome AnswersDocument1 pageTakehome AnswersPrincess SibugNo ratings yet

- FQ1 BudgetingDocument1 pageFQ1 BudgetingPrincess SibugNo ratings yet

- Rizal ReviewerDocument4 pagesRizal ReviewerAsmc100% (2)

- Payables FinancingDocument15 pagesPayables FinancingArem CapuliNo ratings yet