Professional Documents

Culture Documents

Assignment

Uploaded by

SHASHWAT MISHRAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment

Uploaded by

SHASHWAT MISHRACopyright:

Available Formats

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

Multinational Companies and Their Effects on Indian

Economy

*Dr. Amit Kumar Khare,

MBA, Ph.D

Lucknow University, Lucknow,

Associate Professor

Rameshwaram Institute of Technology and Management

ABSTRACT: Since independence, India has gone through many changes firstly India based on socialist model, but now

it bases its government on a democratic model. During this period India had a very protectionist stance against foreign

investment in the country, because of this India fell behind in technology and in economy. The collapse of the Soviet

Union (India’s largest trading partner), the Persian Gulf crisis (higher world prices), and an increase in foreign dept led

to problems for India throughout the eighties. The liberalization of Indian economy has started during tenure of Dr.

Mamohan Singh in the year 1991 as a Finance Minister and carried out by Mr. Yashwant Sinha and Mr. Jaswant Singh

simultaneously. The markets are being flooded with a lot of brands from old and new brands from within the country and

multinationals who have ventured into India as a result of globalization of Indian economy. This has resulted in a fight

amongst competitors for survival and growth and also led them to provide value to their product for customer’s

satisfaction through quality and service. Indian economy had experienced major policy changes in early 1990s. The new

economic reform, popularly known as, Liberalization, Privatization and Globalization (LPG model) aimed at making the

Indian economy as fastest growing economy and globally competitive. While multinational companies played a

significant role in the promotion of growth and trade in South-East Asian countries they did not play much role in the

Indian economy where import-substitution development strategy was followed. Since 1991 with the adoption of industrial

policy of liberalization and privatization rote of private foreign capital has been recognized as important for rapid

growth of the Indian economy. Global markets, global technology, global ideas are seen as symbolizing enormous

potential to change the world through more wealth than at any time before. A number of companies worldwide are

coming together by way of mergers and joint ventures in order to consolidate their strengths and to take advantage of

opportunities of global trade. After adopting new economic policy many global corporations entered in the Indian

economy. This article highlights on trend of growth of foreign companies in India, their country wise distribution and

their impact on Indian economy. More specifically the objectives of the study are: To study the trend of growth of global

corporations in India, to analysis country wise distribution of global corporations in India and to study the impact of

increasing global corporate on Indian economy with special reference to Procter and Gamble (P&G).

KEYWORDS: Multinational, Wealth, Economy, Global, Development, India, Globalization etc.

OBJECTIVES:

To Study the trend of growth of Multinational corporations in India

To analyse the market share of Multinationals and their investments in India

To study the impact of global corporations on Indian economy

INTRODUCTION: The domestic market is increasing because of the increasing of standard of living.

The multinationals are trying their best to bring in more modernize product at a higher price in the Indian

consumer market. The Indian consumer is very price conscious yet is willing to pay for quality products and

comfort. The object of this study is to find out the impact of the entry of multinational companies in the Indian

Market and economic growth of India. This topic is of great importance, as the entry of Multinational in India

will have a great effect on the Indian producers as they have to make efforts to exist in this competitive

622 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

environment. To overcome this competition Indian producers will have to have greater innovation and

creativity so that the products can match those made by the multinationals. Many countries are opening their

borders and reducing trade barriers. Multinational corporations are taking advantage of these inexpensive

trade barriers and moving in to these developing economies. The major way that these multinational

corporations capitalize on these opportunities is by engaging in direct foreign investment. Foreign direct

investment can be done in one of three ways. First a company can acquire a foreign firm. The second way of

engaging in foreign direct investment is to create a new foreign subsidiary .Finally a company can get a

partner and together they would start a business in a foreign country. This is known as a joint venture, and is

probably the most popular way to gain local support.

India also has an attractive resource base .The two main resources it has low labour cost and an educated pool

of management and technical personnel. These benefit makes India a competitor for foreign investment

unfortunately for India, it is not only competitor in the world but also china who is main rival of India. This

has been a classic rivalry since India began its reform. The object of this study is to find out the impact of the

entry of multinational companies in Indian Market. The purpose of this research project was to explore

management practices that successful multinationals doing in India to manage economical growth and

diversity."Success" in this study is measured in terms of revenue growth through foreign direct investment

ability and the extent to which the multinational meets corporate expectations. Multinationals was selected as

the research topic because the country’s national economical growth and diversity adds a new perspective to

the study of cross-cultural management. Moreover, India has been assuming a new role within the Asian and

the global economy since the liberalization plan in 1991. The international community has become

increasingly interested in developing awareness in this complex Indian culture. India is currently one of the

main receptors of foreign direct investment in Asia. The enterprises involved in international business are

referred to in various ways: multinational corporations, transnational corporations, global corporations, and so

on. Sometimes, the terms are intended to designate a specific type of operation, strategic approach or spatial

location, but often such terms are used interchangeably. It also happens that the meaning of the terms varies

from author to author and even changes over a period of time. MNC may be defined as a company, which

operates in number of countries and has production and service facilities out-side the country of its origin.

They are also called Trans National Company (TNC) their activities have both good and bad impacts on the

economy. According to Spero and Hart “a multinational corporation (MNC) as a business enterprise that

maintains direct investments overseas and that upholds value-added holdings in more than one country. They

take decisions on a global context or basis. Their maximum profit objectives take no account of the reactions

produced in the countries felling in their orbit. They operate in different institutional forms some are:

Subsidiaries companies wholly owned by MNC in other countries Subsidiary company enter into joint venture

with a company another company Agreement among companies of different countries regarding production

and discussion of market. Development and Activities: Soon after independence foreign capital entered India

in the form of direct investments through MNC's Companies had been formed in advanced countries with the

specific purpose of operating in India. Such companies started their subsidiaries, branches and affiliates in

India. At times government gave some tax concession to them with in the FERA (Foreign Exchange

Regulation Act) and streamlined the licensing procedures. The purpose was to secure advanced, technical and

industrial know how. During the janata rule the policy was outright purchase of technical know-how skills and

machinery. They took two major decisions. Coco cola was asked to wind up their operations. Asked IBM to

reduce their foreign equity to 40%. They did not agree, so asked to wind up MNC's operate in several sectors

like tobacco, toiletries beverages etc. Industrial Policy of 1991 accepted foreign investment essential for

modernization technology up gradation and industrial development. Several concessions were given FERA

regulations were liberalized and permitted to use their trademarks in the domestic market. Now it has become

a wide spread phenomena with USA the biggest among them. In the report of the International Labour

Organization (ILO), it is observed that “the essential of the MNCs lies in the fact that the managerial

headquarters are located in the home country, while the enterprise carries out operations in a number of other

countries (Host Countries).” The early decades of the twentieth century witnessed the multinational expansion

623 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

of European companies such as Unilever, Royal Dutch Shell, Imperial Chemical Industries and Philips. In the

1950s and 1960s, following the emergence of the USA as the world’s dominant industrial power at the end of

the Second World War, multinationals such as General Motors Corporation, Ford Motor Company,

International Business Machines, Coca- Cola and Procter & Gamble took on a prominent role in international

business expansion through foreign subsidiaries. The Japanese multinational expansion of the 1970s and

1980swas characterized by global strategies commanded by home based headquarters and manufacturing

facilities. A number of companies worldwide are coming together by way of mergers and joint ventures in

order to consolidate their strengths and to take advantage of opportunities of global trade.

The world's largest consumer goods company, Procter & Gamble (P&G), appears to be slowly but steadily

getting its act together in India, after announcing recently that it was moving away from unprofitable

businesses. The latest financial results of Gillette India, one of its two listed companies, had it reporting

double-digit revenue growth for the three months ended March, after consecutive quarters of single-digit

growth. Procter & Gamble Hygiene and Healthcare, the other listed company, reported double-digit revenue

growth for a second quarter in a row. Its earlier single-digit sales growth was for the three months ended

September 2015. Both listed entities follow a July-June accounting period. Results for a third firm, Procter &

Gamble Home Products, are not available in the public domain. On profit, Gillette reported triple-digit growth

for the March quarter; P&G Hygiene and Healthcare reported double-digit growth. A company spokesperson,

when asked, said, "India remains a critical market for P&G. In the past 18 months, P&G India has become

profitable. The results that India has delivered have contributed positively to the health of the parent

company." In an analyst call last month, its global finance head, Jon Moeller, said the firm had made a choice

to de-prioritise several unprofitable lines of business which negatively impacted short-term revenue growth

rates in India. "The strategic portion of our India business is growing at a high single-digit pace. Sales in the

portions we're fixing or exiting have been down more than 30 per cent. This top line pain is worth it. We're

making significant progress in improving local profit margins, up about 700 basis points," Moeller had said.

Strategic categories for P&G in India include baby care, where it has the Pampers brand; male grooming,

where Gillette sits; feminine care, which includes Whisper; health care, which includes Vicks; fabric care,

which has detergents such as Ariel and Tide; skin care, with brands such as Olay, and hair care, which

includes products such as Pantene and Head & Shoulders. Abneesh Roy, associate director at Edelweiss

Financial Services, had said in a report last month that P&G would probably exit Duracell (batteries),

AmbiPure (air fresheners), Old Spice (men's after-shave lotion) and Oral-B toothpaste in India. "Also, it could

defocus on lower-end Tide (detergent) and Wella (hair care products)." The company has in the past few

quarters attempted to move away from lower priced stock-keeping units in detergents and cut shampoo prices

by 25 per cent to shore up domestic market share, analysts said. The firm, which crossed Rs 10,000 crore in

turnover in financial year ended June 2015, is among the top three in most of its core categories. The

spokesperson said P&G would continue to focus on core brands and variants in India, in line with global

strategy. Internationally, P&G is exiting 105 brands. These include Duracell batteries, which it sold to

Berkshire Hathaway, and 43 beauty products which sold to New-York-based Coty Inc. last year.

GROWTH TREND OF MULTINATIONALS IN INDIA RECENT DEVELOPMENT

The object of this study is to find out the impact of the entry of multinational companies in Indian Market.

This topic is of great importance, as the entry of Multinationals in India will have great effects on the Indian

producers as they have to make efforts to exist in this competitive environment. Most of the Indian consumer

belongs to the lower and lower middle class for mass consumption. They are many big enterprises in India

who are successfully marketing their products to the Indian masses. They will in due course of time face the

challenges that will be posed by the multinationals. The upper and middle classes are also consumers of costly

goods, which are essential for their comfort and luxury. The multinational will be targeting the consumer of

the all classes.

624 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

Indian consumer segment is broadly segregated into urban and rural markets, and is attracting marketers from

across the world. The sector comprises of a huge middle class, relatively large affluent class and a small

economically disadvantaged class, with spending anticipated to more than double by 2025.

India stood first among all nations in the global consumer confidence index with a score of 133 points for the

quarter ending September 2016. Further, in the discretionary spending category, 68 per cent respondents from

India indicated the next 12 months as being good to buy, thus ensuring once again that India leads the global

top 10 countries for this parameter during the quarter.

Global corporations view India as one of the key markets from where future growth is likely to emerge. The

growth in India’s consumer market would be primarily driven by a favourable population composition and

increasing disposable incomes. A recent study by the McKinsey Global Institute (MGI) suggests that if India

continues to grow at the current pace, average household incomes will triple over the next two decades,

making the country the world’s fifth-largest consumer economy by 2025, up from the current 12th position.

India’s robust economic growth and rising household incomes are expected to increase consumer spending to

US$ 3.6 trillion by 2020. The maximum consumer spending is likely to occur in food, housing, consumer

durables, and transport and communication sectors. The report further stated that India's share of global

consumption would expand more than twice to 5.8 per cent by 2020.

Market size

The growing purchasing power and rising influence of the social media have enabled Indian consumers to

splurge on good things. The Indian consumer sector has grown at an annual rate of 5.7 per cent between

FY2005 to FY 2015. Annual growth in the Indian consumption market is estimated to be 6.7 per cent during

FY2015-20 and 7.1 per cent during FY2021-25.

The Indian fast-moving consumer goods (FMCG) companies have performed better than their multinational

peers as the combined revenue of country's seven leading FMCG companies stood at US$ 11.1 billion in FY

2015-16, as compared with US$ 9.4 billion revenue generated by select seven Multinational Companies

(MNCs).

A study by US-based networking solution giant CISCO, reveals that in India, the second-largest smart phone

market globally, the number of smart phones is expected to grow strongly to over 650 million by 2019. Indian

smart phone shipments reached 103.6 million in 2015, thus crossing the 100 million mark, and becoming one

of the fastest growing smart phone markets in Asia Pacific region. Smartphone shipments rose to 30 million in

July-September 2016 quarter, maintaining its healthy traction with 11 per cent YoY growth. It is estimated

that smart phone sales in India will grow about 15 per cent to 125 million in 2017. The number of tablets is

625 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

estimated to reach more than 18 million by 2019 in India, one of the world’s fastest growing Internet market.

The online retail sector in India is expected to be a US$ 1 trillion (Rs 660,000 crore) market by 2020.

Amazon expects India to become its quickest market to reach US$ 10 billion in gross merchandise value

(GMV) and to become its largest overseas market surpassing Japan, Germany and the UK. The Indian beauty,

cosmetic and grooming market is likely to reach US$ 20 billion by 2025 from the current US$ 6.5 billion, on

the back of growing aspirations and rising disposable income of middle class.

Investments

Following are some major investments and developments in the Indian consumer market sector. US-based

food company Cargill Inc, aims to double its branded consumer business in India by 2020, by doubling its

retail reach to about 800,000 outlets. Yum! Brand, plans to open 100 Taco Bell outlets in India over the next

five years, which makes Indian expansion a key part of its plan to triple its outlets outside US to 1,000.

Hamleys has stated that India is one of the most important markets for Hamleys globally, and outlined plans

of opening six more stores, taking its total store count in the country to 32 by the end of March 2017. Roche

Bobois Group, outlined plans of opening new stores in cities like Hyderabad, Chennai, Pune, Kolkata and

Ahmedabad, in order to make India one of its top five markets by 2021. Diageo, the world’s largest spirit

maker, has announced opening of a new business service centre called Diageo Business Services India (DBSI)

in Bengaluru, which aims to increase its workforce to 1,000 from 100 currently. Amway, India’s largest

company in the Rs 7,500 crore (US$ 1.12 billion) direct-selling market, plans to invest Rs 400 crore (US$ 60

million) over the next five years to expand its product portfolio and open 50 ‘express’ stores in top 20 cities of

India, in addition to strengthening its e-commerce website.

BALANCED GROWTH AND LEADERSHIP VALUE CREATION IS TOP PRIORITY

P&G is focused on four key areas of transformation to deliver balanced growth and leadership value Creation:

• Accelerating Top-Line Growth

• Improving Productivity and Cost Structure

• Streamlining the Product Portfolio

• Strengthening Organization and Culture

626 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

Furlenco, an online furniture rental company, has raised US$ 30 million in series B round of funding led by

Light Box Ventures, Axis Capital and a number of high net-worth individuals, which will be used to expand

its geographical presence and product offerings in the next 12 months.

Dyson, the UK-based manufacturer of innovative vacuum cleaners and air purifiers, plans to enter Indian

consumer market by 2017 and invest GBP 154 million (US$ 190 million) over the next five years in areas of

retail infrastructure, marketing, promotion and taxes to the government.

Zefo, a Bengaluru-based refurbished goods marketplace, has raised Rs 40 crore (US$ 6 million) in a funding

round led by Sequoia India, with participation from Beenext and Helion Venture Partners, which will be used

to expand its team, invest in technology, and expand its presence in Mumbai and Delhi, which were recent

additions. Adidas India Private Limited, outlined plans of opening around 30-40 big flagship stores across

Delhi, Mumbai and Bengaluru, by 2020.

Swiss watchmaker Montres Corum Sàrl, better known as Corum, has partnered with the luxury watch retailer

Ethos Watch Boutiques to sell Corum watches in India, in order to strengthen its presence in India by

rebuilding its distribution network and boosting revenues.

627 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

AO Smith, a US based water technology and air purification solutions company, sees India as one of key

markets and plans to grow at double-digit growth rate, having invested US$ 75 million so far. Crocs India Pvt

Ltd, outlined plans of increasing its store count in India from 38 to 100 by the end of 2017, and increasing its

focus on the casual footwear category to expand its consumer base and thereby boost its overall revenue.

Government Initiatives

The Government of India has allowed 100 per cent Foreign Direct Investment (FDI) in online retail of goods

and services through the automatic route, thereby providing clarity on the existing businesses of e-commerce

companies operating in India. With the demand for skilled labour growing among Indian industries, the

government plans to train 500 million people by 2022 and is also encouraging private players and

entrepreneurs to invest in the venture. Many governments, corporate and educational organisations are

working towards providing training and education to create a skilled workforce. The Government of India has

drafted a new Consumer Protection Bill with special emphasis on setting up an extensive mechanism to ensure

simple, speedy, accessible, affordable and timely delivery of justice to consumers.

In the Union Budget 2017, the government has proposed to spend more on the rural side with an aim to double

the farmer’s income in five years; as well as the cut in income tax rate targeting mainly the small tax payers,

focus on affordable housing and infrastructure development will provide multiple growth drivers for the

consumer market industry.

Union Cabinet reforms like implementation of the Goods and Services Tax (GST) and Seventh Pay

Commission are expected to give a boost to consumer durable sector in India.

Procter and Gamble (P&G), Gillette India trends of Growth in India:

Your Company’s positive performance results for the Financial Year 2015-16, against a backdrop of

challenging market environment, are testament to our focus on winning with the consumer. As I share with

you, your Company's annual performance for the Financial Year 2015-16, I take pride in the fact that the

Company’s net sales went up by 4% versus last year, driven by Company’s focus on brand fundamentals and

strength of product portfolio. Profit After Tax (PAT) for the Financial Year went up by 35% behind focus on

productivity and cost optimization. As one of the world’s largest consumer products Company, we have both

a responsibility and an opportunity to do the right thing and create change. This strategy has inspired an

enduring CSR strategy supported by two pillars – P&G Shiksha and Timely Disaster Relief. While P&G

Shiksha provides children from underprivileged backgrounds with an access to a holistic education, P&G's

disaster relief activities aim to rehabilitate and empower the victims of natural disasters by providing them

with daily essential commodities and safe drinking water. By the end of Financial Year 2015-16, P&G

Shiksha built and supported over 1,000 (+550 since last year) schools across the country that will impact the

lives of over 1 million (+200,000 since last year) children. P&G, over the last year, continued its efforts to

provide timely aid and relief to families affected by natural disasters. P&G sent out relief aid to over 10,000

families affected by the Tamil Nadu floods comprising of P&G products. Any company that wants to drive

growth and create value in the long run needs to adopt a mindset of ‘winning’.

Company’s positive performance results for the Financial Year 2015-16, against a backdrop of challenging

market environment, are testament to our focus on winning with the consumer. Driven by the Company’s

focus on brand fundamentals and strength of product portfolio, net sales increased to 2,052 crores, up 4%

versus last year. Your Company made strategic portfolio choices that have resulted in strong margin

improvement as Profit After Tax (PAT) for the Financial Year stood at 213 crores versus 158 crores last year,

behind continued focus on productivity, operational excellence and cost optimization. The Company has

benefited from the portfolio optimization, even as it continues to focus on productivity and cost efficiency.

628 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

FINANCIAL RESULTS

(Figures in Crores)

2015-16 2014-15

Sales including excise 2071 1981

Net sales (less excise duty) 2052 1971

Profit before tax 327 246

Profit after tax 213 158

Proposed dividend plus tax thereon 78 59

Transfer to general reserve 21 16

Balance carried forward 421 341

Corporate Social Responsibility

The only way to build a sustainable business is to improve lives At P&G, sustainability means making every

day better for people through how we innovate and how we act. As one of the world’s largest consumer

products Company, we have both a responsibility and an opportunity to do the right thing and create change.

P&G’s sustainability objective is to create long-term value for our consumers and shareholders by growing

our brands and operations responsibly to conserve resources and improve life in the communities we impact

across the world. This strategy has inspired an enduring CSR strategy supported by two pillars – P&G Shiksha

and Timely Disaster Relief. While P&G Shiksha provides children from underprivileged backgrounds with an

access to a holistic education, P&G's Timely Disaster Relief activities aim to rehabilitate and empower the

victims of natural disasters by providing them with daily essential commodities and safe drinking water.

629 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

Source: Annual Report Gillette India Limited 2015-16

630 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

631 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

Source: Annual Report Gillette India Limited 2015-16

Source: Annual Report Gillette India Limited 2015-16

632 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

GROWTH OF INDIAN ECONOMY

India has become the sixth largest manufacturing country in the world, rising up from the previous ninth

position, and thus retaining its bright spot in the world economic landscape. Post the demonetization

announcement, the pace of remonetisation has picked up, and it is expected that the effects of demonetisation

will not spill over into the next financial year. The IMF expects the Indian economy to grow by 6.6% in 2016–

17, which is not only a significant one percentage point lower than the previous estimate, but also brings India

back to the status of the second-fastest growing economy, especially as China is expected to outgrow by 6.7%.

However, this is cited as the result of short-term disruption caused by the government’s move to invalidate

high-value currencies, which dampened the economy’s biggest growth drivers – consumption and investment

demand. Recognising the strength of Indian economic fundamentals, the IMF expects the impact of

demonetization to fade away gradually, as it pegs the 2017–18 growth at 7.2%, overtaking China again by a

good 0.7 percentage points. The World Bank, however, is more optimistic and has projected a GDP growth of

7% in 2016–17, 7.6% in 2017–18 and 7.8% in 2018–19. Clearly, what makes India resilient to global flurries,

to a great extent, is its rock-solid domestic demand, accounting for about 60% of the GDP. This figure is 37%

for China, and this has led the Chinese economy’s restructuring and rebalancing to rely less on exports and

investment and more on consumption demand. The broad macroeconomic indicators, based on latest data, are

as follows:

Inflation: The retail inflation stayed above the comfort zone of 5% till August 2016, but it started moderating

thereafter during the normal monsoon, dropping to a two-year low of 3.4%. The average for the year-to-date

(April-December 2016) stood at 4.85%, a tad higher than 4.8% during the same period of the previous year.

Fiscal Deficit: The fiscal deficit as a percentage of GDP was budgeted at 3.5% for 2016–17 in the previous

year’s budget. This is revised to 3.2% for 2017–18.

Trade Deficit: India’s trade deficit narrowed by 25% in the cumulative period of April to December 2016

when it stood at $76.5 billion, as against $100.1 billion in the corresponding period of the previous year. This

is on the back of a 7.4% decline in imports coupled with a meagre growth of 0.75% in exports during said

period. Imports of both oil and non-oil products dropped during this period by 10.76% and 6.42%,

respectively, reflecting the subdued gross capital formation.

Currency: The rupee saw a depreciation of 3.3%, as it stood at an average of ₹67.21 per US dollar during

April 2016 to January 2017 against an average of ₹65.03 per US dollar during the same period in the previous

year.

Future Outlook: According to the Central Statistical Organisation’s first advance estimates for 2016–17, the

GDP is expected to grow by 7.1%, which is slower than 7.6% in the previous year. However, this discounts

the impact of demonetization. Factoring in this impact, we expect the growth to decline by another about 50

basis points.

Impact of Global Corporations on Indian Economy

The operation of the global corporations increases with the reduction of barriers to trade and investment. The

benefit of larger world trade, larger incomes, lower cost and prices due to economy scale follow for their

operations. The share of global capital raises productivity and wages by shifting employment from local to

global market. The vast amount of unused resources can be diverted to productive purposes. The inflow of

funds would have simultaneously led to the growth of allied industries that also help to increase employment

opportunities indirectly. The functioning of global corporate has been said to make its impact on the economic

structure and social systems in the country. Impact of global corporate can be examined on the basis of the

parameters as follows.

633 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

i) Increasing flow of Goods and Services

The observation of the total foreign trade, the exports are increasing at a decreasing rate but the imports are

increasing at an increasing rate during the period of 1991-2012. India’s total trade increased from Rs. 91893

crore in 1991-92 to Rs. 22205809 crore in 2015-16.

ii) Balance of Trade in Services

Services trade surplus which increased steadily in this decade to reach US$53.9 billion in 2008-09, fell

drastically in the global crisis year of 2009-10 to US$ 35.7 billion. This was caused by the collapse in exports

of non-software services, particularly business services, the slow growth of software services, and the rise in

import of non software services, particularly business and financial services. The low service trade surplus

situation continued in the first half of 2010-11.

iii) Increasing Flow of Capital

It is observed that with increase in number of foreign companies the amount of FDI also goes on increasing

but it is in many folds. In 1991 number of foreign companies was 489and FDI was $129 mn. In 2001 number

of foreign companies increased as 1141the amount of FDI was US $ 4031 Million that increased more than

seven times i.e. US $ 29029 Million and in 2012 number of foreign companies increased as 3191, the amount

of FDI also increased as US $ 32952Million.

iv) Information and Technology

7,941 technology transfer approvals sanctioned by the government during 1991 -2011. USA ranks number one

in providing technology to India with 1750 approvals since 1991. The sector wise technology transfers out of

the total technology transfer approvals. Electrical equipment including computer hardware and software sector

made highest technology transfers i.e.1255 technology transfer agreements concluded from the rest of the

world over a period of 18 years i.e.1991 – 2008.

Many MNCs help in improving the infrastructure and provision of basic needs in their specific areas of

operation. They either do so directly or provide funds for this purpose to civil society organizations. This also

improves business conditions within and in the vicinity of the areas where they are operating. In some cases,

large-scale economies, quality control and a healthy competition lead to price cuts and other benefits for the

end-user. People have more access to the comforts of life with a large variety of choices. Another significant

advantage of foreign companies is its contribution to government revenues.

CONCLUSION:

When we consider an overall picture of the MNCS, the beneficial role is much limited in the limited stages of

development they are helpful in area of needed technology and global marketing. They care only to the need

of upper middle and affluent classes. It creates a new culture of colas, jams, ice-creams and processed goods.

Another threat to Indian economy is the manipulation on the capital market to suit their goals. They are

increasing the shareholding in Indian companies swallowing them. They transfer attractive and profitable

business to these newly started subsidiaries so a large number of Indian share holders get cheated. Summing

up over dependence on MNC may be harmful in terms of economic dependence and political interference.

Capital flow of MNC's may be permitted but not at the cost of national interest. At present the world economy

is an integrated economy i.e. a world without borders, a world in which all goods and factors can be

transported across different regions at negligible cost. Some industries spread their production process across

many regions searching for the ideal environment for each specific phase of production. The magnitude and

dimensions of human activities are squarely rising. The concept like 'closed economy' and protectionist

policies are being gradually replaced by 'market based global corporate economy’.

Thus the most significant development in international economic scenario during the past two decades has

been spectacular rise in power and influence of giant global corporate. It may be said that the role of the

global corporate is crucial and their existence is indispensable. However, their functioning needs proper

634 Dr. Amit Kumar Khare

International Journal of Engineering Technology, Management and Applied Sciences

www.ijetmas.com June 2017, Volume 5, Issue 6, ISSN 2349-4476

regulation so as to ensure protection of national interests and to maintain the character of national economy as

a separate family of the global economy. In the present international environment, though, it seen difficult to

follow a close door policy, yet it should not be an open policy as well. We have to be selective for allowing

the foreign investment and at the same time we must encourage the indigenous industry.

REFERENCES:

http://www.unido.org/fileadmin/user_media/Publications/Pub_free/Alliances_and_joint_ ventures_part_1.pdf

Rosman Md. Yusaff and others (2012): ‘A Critical Review of Multinational Companies, Their Structures and

Strategies and Their Link with International Human Resource Management’,IOSR Journal of Business and

Management (IOSRJBM) ISSN: 2278-487X

Volume 3, Issue 5 (Sep,-Oct. 2012), PP 28-37 www.iosrjournals.org

Mithani D. M. (2002): International Economics, Himalaya Publishing House, Mumbai, p.405.

Aswathappa K., (2006): ‘Essentials of Business Environment’, Himalaya Publishing House, Mumbai, p. 40.

Gangrade K. D., (2005): ‘Gandhian Approach to Development and Social Work’, Concept Publishing Company,

New Delhi, p. 44.

http://unctad.org/en/Docs/wir2009 overview_en.pdf.

http://www.ips.org.pk/globalization/1007-mncs-and their-role-and-socioeconomic -impact -on-host-societies.html

UNCTAD report 2007

S.A. Hamed Hosseini (2010): ‘Globalization and Capitalism’, Available on

http://globalalternatives.wordpress.com/2010/04/01/globalization-and-nation-state

Murthy S. (1999): ‘Foreign Investment and Economic Growth through Multinational Corporation and their Multiple

Impact’ in Arya P. P. and Tandon B. B. ‘Multinational Vresus Swadeshi Today’ (ed), Deep and Deep Publication

Pvt. Ltd., New Delhi, p. 113.

Government of India, Ministry of Corporate Affairs, 57th Annual Report on the Working & Administration of the

Companies Act, 1956, New Delhi, p.32, available onhttp://www.mca.gov.in/Ministry/pdf/57AR_English.pdf

635 Dr. Amit Kumar Khare

You might also like

- Project On MNCDocument31 pagesProject On MNCswati1991100% (4)

- India's outward FDI emerging under state policy influenceDocument20 pagesIndia's outward FDI emerging under state policy influencePrashant RaiNo ratings yet

- Multinational Corporations, 2nd SemesterDocument3 pagesMultinational Corporations, 2nd SemesterShoulder ShhhNo ratings yet

- ECONOMICSDocument21 pagesECONOMICSdivya rajNo ratings yet

- Role and Significance of International Business On The Indian EconomyDocument19 pagesRole and Significance of International Business On The Indian EconomyKodai RiderNo ratings yet

- competitive-advantages-of-global-finance-in-indian-companies_April_2023_1762686153_1917739Document2 pagescompetitive-advantages-of-global-finance-in-indian-companies_April_2023_1762686153_1917739Shaikh SaqibNo ratings yet

- MNCDocument10 pagesMNCvinoth_17588No ratings yet

- M&as Project Aishwarya ShankarDocument38 pagesM&as Project Aishwarya ShankarAishwarya ShankerNo ratings yet

- Modules in Internationa Business and TradeDocument133 pagesModules in Internationa Business and TradeCRISTINE JOY LAUZ100% (1)

- FBM-354 - Unit (9-14)Document23 pagesFBM-354 - Unit (9-14)Shubham Satish WakhareNo ratings yet

- Role of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Document445 pagesRole of Multinational Corporations (MNCS) in Globalising Indian Economy-A Case Study of Hindustan Lever Limited (HLL)Arka DasNo ratings yet

- International BusinessDocument271 pagesInternational Businesschu39548No ratings yet

- Challenges Faced by Indian EntrepreneursDocument36 pagesChallenges Faced by Indian EntrepreneursPrashu171091No ratings yet

- 1-International Business - Meaning & ScopeDocument14 pages1-International Business - Meaning & ScopeKaushal ShethNo ratings yet

- 1-International Business - Meaning & ScopeDocument14 pages1-International Business - Meaning & ScopeMegha SolankiNo ratings yet

- A Comparative Analysis of Foreign Direct Investment in China and IndiaDocument10 pagesA Comparative Analysis of Foreign Direct Investment in China and IndiaAlexander DeckerNo ratings yet

- Fdi in India Phd. ThesisDocument5 pagesFdi in India Phd. Thesisdianawalkermilwaukee100% (1)

- Xs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyDocument7 pagesXs - Zu: Multinational Companies (MNC'S) Impact On Indian EconomyNur AbibahNo ratings yet

- IB ChandranDocument270 pagesIB Chandrangurpreet_83sainiNo ratings yet

- Multinational CorporationsDocument9 pagesMultinational CorporationsRamapriyaiyengarNo ratings yet

- Multinational Companies in India - An Analysis: January 2015Document7 pagesMultinational Companies in India - An Analysis: January 2015Ashish pariharNo ratings yet

- Modules In: Rizal Technological University College of Business and Entrepreneural TechnologyDocument133 pagesModules In: Rizal Technological University College of Business and Entrepreneural TechnologySuello Andrea Mae DNo ratings yet

- Critical Thinking:-Indian Economic TransformationDocument6 pagesCritical Thinking:-Indian Economic TransformationkaranNo ratings yet

- Fdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiDocument6 pagesFdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiArvind NayakaNo ratings yet

- Are MNCs devils in disguise in IndiaDocument26 pagesAre MNCs devils in disguise in IndiaMekhla MittalNo ratings yet

- Project of M&a 2005Document16 pagesProject of M&a 2005Manish RavatNo ratings yet

- Data Link Institute of Business and TechnologyDocument6 pagesData Link Institute of Business and TechnologySonal AgarwalNo ratings yet

- Final PrintDocument24 pagesFinal PrintSwapnil AmbawadeNo ratings yet

- Scope and strategies of Indian PSUs in international businessDocument12 pagesScope and strategies of Indian PSUs in international businessVishant KushNo ratings yet

- Fdi in Multi Brand Retail: Project ReportDocument23 pagesFdi in Multi Brand Retail: Project ReportRajkumari AgrawalNo ratings yet

- Fdi in Retail in India ThesisDocument6 pagesFdi in Retail in India Thesisafcmtjcqe100% (1)

- Capital Budgeting Ultratech SysnopsisDocument9 pagesCapital Budgeting Ultratech Sysnopsisanon_510302204No ratings yet

- Multinational Corporation-Project ReportDocument58 pagesMultinational Corporation-Project ReportAbhishek Agarwal79% (133)

- WORKING CAPITAL MANAGEMENTDocument70 pagesWORKING CAPITAL MANAGEMENTAnand SudarshanNo ratings yet

- IM Proj Done...Document31 pagesIM Proj Done...Sohham ParingeNo ratings yet

- Evolution and Impact of Multinational Corporations in IndiaDocument37 pagesEvolution and Impact of Multinational Corporations in IndiaSwati Milind RajputNo ratings yet

- West needs East for sustainable growthDocument5 pagesWest needs East for sustainable growthPARTHA SARATHI DATTANo ratings yet

- Multinational Corporations (MNC'S) : Business OrganizationDocument42 pagesMultinational Corporations (MNC'S) : Business OrganizationAmit bailwalNo ratings yet

- Chapter 2: GLOBALISATION: Q.1.Globalisation of Indian BusinessDocument5 pagesChapter 2: GLOBALISATION: Q.1.Globalisation of Indian BusinessdigvijaymisalNo ratings yet

- Rise of MNCs in India and their impactDocument2 pagesRise of MNCs in India and their impactMohit KalalNo ratings yet

- 02 Global ConsultingDocument9 pages02 Global Consultinganeetamadhok9690No ratings yet

- Impact of GlobalizationDocument3 pagesImpact of GlobalizationpalakNo ratings yet

- Impact of Global Is at Ion On Business and Management EducationDocument9 pagesImpact of Global Is at Ion On Business and Management Educationhi_am_balajiNo ratings yet

- 1-International Business - Meaning & ScopeDocument14 pages1-International Business - Meaning & Scopesnehakanade100% (1)

- Bracing For MNC Competition Through Inno PDFDocument38 pagesBracing For MNC Competition Through Inno PDFShashi Shekhar DixitNo ratings yet

- Unit 5 Role of Multinational Companies in IndiaDocument12 pagesUnit 5 Role of Multinational Companies in IndianikhilnamburiNo ratings yet

- Globalisation strategies and challenges for Indian businessDocument8 pagesGlobalisation strategies and challenges for Indian businessdummy12345No ratings yet

- An Indian RenaissanceDocument6 pagesAn Indian Renaissancericha360No ratings yet

- Ppa Final DraftDocument4 pagesPpa Final DraftNeha AnanthNo ratings yet

- Indian J V AbroadDocument21 pagesIndian J V AbroadD Attitude KidNo ratings yet

- K.C. College International Business ProjectDocument6 pagesK.C. College International Business ProjectNimanshi JainNo ratings yet

- Impact Ofglobalization in Indian Business and CultureDocument9 pagesImpact Ofglobalization in Indian Business and CultureAshi SharmaNo ratings yet

- Indian Stock Market and Investors StrategyFrom EverandIndian Stock Market and Investors StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- The Future of Entrepreneurship: Trends and Opportunities in a Rapidly Changing WorldFrom EverandThe Future of Entrepreneurship: Trends and Opportunities in a Rapidly Changing WorldNo ratings yet

- The Drive of Business: Strategies for Creating Business AnglesFrom EverandThe Drive of Business: Strategies for Creating Business AnglesNo ratings yet

- Dubai: the grand deception?: Yes, without proper preparationFrom EverandDubai: the grand deception?: Yes, without proper preparationNo ratings yet

- Demystifying Venture Capital: How It Works and How to Get ItFrom EverandDemystifying Venture Capital: How It Works and How to Get ItNo ratings yet

- Evolving Competition Jurisprudence in IndiaDocument3 pagesEvolving Competition Jurisprudence in IndiaSHASHWAT MISHRANo ratings yet

- Witness Competency & CompellabilityDocument22 pagesWitness Competency & CompellabilityPrashant MahawarNo ratings yet

- Patent System Study India PCT TreatyDocument10 pagesPatent System Study India PCT TreatySHASHWAT MISHRANo ratings yet

- Details of Payment of Exam FeesDocument2 pagesDetails of Payment of Exam FeesSHASHWAT MISHRANo ratings yet

- In The Court of The Civil Judge Senior Division LucknowDocument4 pagesIn The Court of The Civil Judge Senior Division LucknowSHASHWAT MISHRANo ratings yet

- IPR Assignment PDFDocument10 pagesIPR Assignment PDFSHASHWAT MISHRANo ratings yet

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRANo ratings yet

- Title: Author: Sarthak Sharma: Abuse of The Right of Private Defence: Case Based AnalysisDocument3 pagesTitle: Author: Sarthak Sharma: Abuse of The Right of Private Defence: Case Based AnalysisSHASHWAT MISHRANo ratings yet

- IPR Assignment ON PATENT LAWDocument10 pagesIPR Assignment ON PATENT LAWSHASHWAT MISHRANo ratings yet

- TPA S 41Document19 pagesTPA S 41SHASHWAT MISHRANo ratings yet

- Transfer by Ostensible OwnerDocument7 pagesTransfer by Ostensible OwnerMOHIT100% (2)

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRANo ratings yet

- Stare DecisisDocument12 pagesStare DecisisSHASHWAT MISHRA100% (5)

- MBA April 2010: Assignment 1 Miss Shivani MalikDocument14 pagesMBA April 2010: Assignment 1 Miss Shivani MalikSHASHWAT MISHRANo ratings yet

- Accounting StandardDocument11 pagesAccounting StandardSHASHWAT MISHRANo ratings yet

- IpcDocument4 pagesIpcSHASHWAT MISHRANo ratings yet

- IpcDocument11 pagesIpcSHASHWAT MISHRANo ratings yet

- Unsound MindDocument13 pagesUnsound MindSHASHWAT MISHRANo ratings yet

- Accounting StandardDocument11 pagesAccounting StandardSHASHWAT MISHRANo ratings yet

- IpcDocument11 pagesIpcSHASHWAT MISHRANo ratings yet

- Supply Chain ManagementDocument26 pagesSupply Chain Managementzahid_497No ratings yet

- ERC Guidelines on FIT-All Collection and DisbursementDocument33 pagesERC Guidelines on FIT-All Collection and DisbursementCarl ScottNo ratings yet

- ECN 201 Principles of MicroeconomicsDocument17 pagesECN 201 Principles of MicroeconomicsZonayed HasanNo ratings yet

- Consumer Preference StudyDocument60 pagesConsumer Preference StudyKedharnath Goud50% (2)

- Tru EarthDocument5 pagesTru Earthabhijitdas007No ratings yet

- Chap6 MicroeconomicsDocument14 pagesChap6 MicroeconomicsLinhCaoSuNo ratings yet

- Service Delivery in A Supply ChainDocument11 pagesService Delivery in A Supply ChainRobertha Lynn B. GroveNo ratings yet

- IBM SWOT Analysis and Business StrategyDocument6 pagesIBM SWOT Analysis and Business StrategySahil ShahNo ratings yet

- MCQ'S: EconomicsDocument73 pagesMCQ'S: EconomicsHabib MughalNo ratings yet

- Marks N SpencerDocument22 pagesMarks N SpencerJyoti PathrejaNo ratings yet

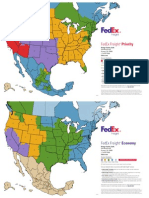

- Fedex Freight: PriorityDocument2 pagesFedex Freight: PriorityTrent CharltonNo ratings yet

- Assignment 4 TrabsportationDocument2 pagesAssignment 4 TrabsportationabbasNo ratings yet

- The Price: Buyer Based ApproachDocument2 pagesThe Price: Buyer Based Approachmsanne3No ratings yet

- Cat Logistics 20100126Document40 pagesCat Logistics 20100126Santosh Kumar PandeyNo ratings yet

- Chief Executive Officer CPG in West Palm Beach FL Resume James MercerDocument2 pagesChief Executive Officer CPG in West Palm Beach FL Resume James MercerJames MercerNo ratings yet

- Global Retail E-Commerce IndexDocument19 pagesGlobal Retail E-Commerce IndexAnusha MahendrakarNo ratings yet

- Retail Locations: Sources - Berman-Evans, Sinha-Uniyal, Secondary Research, Prof - Ranjan Chaudhuri's InputsDocument46 pagesRetail Locations: Sources - Berman-Evans, Sinha-Uniyal, Secondary Research, Prof - Ranjan Chaudhuri's Inputsgarimadhamija02No ratings yet

- Interactive CH 05 Elasticity and Its Application 9ev2Document60 pagesInteractive CH 05 Elasticity and Its Application 9ev2says RitaNo ratings yet

- Ch 1 Marketing OverviewDocument6 pagesCh 1 Marketing OverviewWaynestonne DrizNo ratings yet

- Paper Presentation On "Role of Analytical CRM in Maximizing Customer Profitability"Document16 pagesPaper Presentation On "Role of Analytical CRM in Maximizing Customer Profitability"Maarid Fazili100% (1)

- Gartner Marketing Predictions For 2021 and Beyond: Marketing Hits ResetDocument16 pagesGartner Marketing Predictions For 2021 and Beyond: Marketing Hits Resethansolo1974No ratings yet

- Final Report On LifebuoyDocument41 pagesFinal Report On LifebuoyNawaz TanvirNo ratings yet

- Business Ethics Ensure That A Certain Required Level of Trust ExistsDocument3 pagesBusiness Ethics Ensure That A Certain Required Level of Trust Existsczaria jeeline bautistaNo ratings yet

- Microeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test BankDocument11 pagesMicroeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test Bankjamesgregoryfzwjdynogt100% (26)

- Brand Position of Prism CementDocument38 pagesBrand Position of Prism CementPrashant MishraNo ratings yet

- Lean Manufacturing Production Flow and Activities AX2012Document51 pagesLean Manufacturing Production Flow and Activities AX2012Susan Wong100% (1)

- Questionnaire On NikeDocument7 pagesQuestionnaire On NikeHardikpriyankari0% (1)

- Walmart Shipping Pass Impact on RivalsDocument4 pagesWalmart Shipping Pass Impact on RivalsaruunstalinNo ratings yet

- Consumer Behavior: Women and ShoppingDocument19 pagesConsumer Behavior: Women and ShoppingBusiness Expert Press75% (4)

- Intel Corporation International Marketing FinalDocument9 pagesIntel Corporation International Marketing FinalSõúmëñ AdhikaryNo ratings yet