Professional Documents

Culture Documents

001 - Total (Philippines) Corporation vs. CIR

Uploaded by

Romela Eleria GasesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

001 - Total (Philippines) Corporation vs. CIR

Uploaded by

Romela Eleria GasesCopyright:

Available Formats

Case digest

Total (Philippines) Corporation vs. CIR

CTA EB No. 1154 (CTA Case Nos. 7898, 7890 and 8008), April 21, 2015

Castaneda, Jr., J:

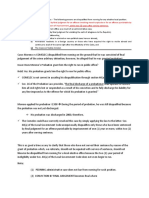

Facts: Petitioner is a VAT-registered entity licensed by the SEC to acquire, assemble, install… and otherwise

deal with oil terminals and service station networks. Petitioner filed various ADMINISTRATIVE CLAIMS for

refund with the BIR. Prior to the resolution of the BIR of the said administrative claim, petitioner filed

JUDICIAL CLAIMS for refund on the ff. dates:

Date of Filing

Case No. Period Covered Date of Filing (Administrative Claim)

(Judicial Claim)

CTA Case No. 7898 1st & 2nd Qtrs, 2007 March 31, 2009 March 31, 200

CTA Case No. 7980 3rd Qtr, 2007 June 2, 2009 September 30, 2009

CTA Case No. 8008 4th Qtr., 2007 October 27, 2009 December 21, 2009

CIR raises similar arguments and defences in her separate Answers (nos. 1-7)

#1- petitioner’s alleged claim for refund is subject to administrative routinary investigation by the

BIR

#2- the subject of petitioner’s refund claims in CTA cases as alleged unutilized VAT input taxes were

not properly documented.

#3-In an action for refund, the burden of proof is on the taxpayer to establish its right to refund,

and failure to sustain the burden is fatal to the claim for refud/credit.

#4-

#5-ALL the PETITIONS for Review in the instant consolidated cases were prematurely filed in

contravention of Section 112(D) of the NIRC of 1997

#6

#7

CTA Special Division denied the Petitions for review. Hence, this petition for review.

Issues

Held:

1. Petitioner failed to prove its sales were zero-rated sales.

2. Input Tax carried over from the previous quarter was not validated.

3. Valid disallowance of petitioner’s input VAT in the amount of P99,993,863.07

4. Refund of Input VAT is proper when INPUT VAT, attributable to zero-rated sales, exceeds output VAT.

You might also like

- Document 4Document8 pagesDocument 4Romela Eleria GasesNo ratings yet

- (A.C. No. 12875, January 26, 2021) Prudencio B. Portuguese, JR., Complainant, vs. Atty. Jerry R. Centro, Respondent. Decision Hernando, J.Document4 pages(A.C. No. 12875, January 26, 2021) Prudencio B. Portuguese, JR., Complainant, vs. Atty. Jerry R. Centro, Respondent. Decision Hernando, J.Romela Eleria GasesNo ratings yet

- Document 3Document9 pagesDocument 3Romela Eleria GasesNo ratings yet

- Document 4Document8 pagesDocument 4Romela Eleria GasesNo ratings yet

- (A.C. No. 12875, January 26, 2021) Prudencio B. Portuguese, JR., Complainant, vs. Atty. Jerry R. Centro, Respondent. Decision Hernando, J.Document4 pages(A.C. No. 12875, January 26, 2021) Prudencio B. Portuguese, JR., Complainant, vs. Atty. Jerry R. Centro, Respondent. Decision Hernando, J.Romela Eleria GasesNo ratings yet

- Document 3Document9 pagesDocument 3Romela Eleria GasesNo ratings yet

- Sevilla Vs Court of AppealsDocument3 pagesSevilla Vs Court of AppealsRomela Eleria GasesNo ratings yet

- SEC. JUSTICE vs. HON. LANTIONDocument2 pagesSEC. JUSTICE vs. HON. LANTIONRomela Eleria GasesNo ratings yet

- Document 7Document11 pagesDocument 7Romela Eleria GasesNo ratings yet

- Ra 11201 - Dhsud ActDocument19 pagesRa 11201 - Dhsud ActRomela Eleria GasesNo ratings yet

- 001 - Total (Philippines) Corporation vs. CIRDocument1 page001 - Total (Philippines) Corporation vs. CIRRomela Eleria GasesNo ratings yet

- Document 5Document12 pagesDocument 5Romela Eleria GasesNo ratings yet

- 2015 Labor Case List (Jan-Jun)Document1 page2015 Labor Case List (Jan-Jun)Romela Eleria GasesNo ratings yet

- Shewaram Versus Philippine Air LinesDocument5 pagesShewaram Versus Philippine Air LinesRomela Eleria GasesNo ratings yet

- LGU Distraint vs LevyDocument1 pageLGU Distraint vs LevyRomela Eleria GasesNo ratings yet

- Persons Are Disqualified From Running For Any Elective Local PositionDocument2 pagesPersons Are Disqualified From Running For Any Elective Local PositionRomela Eleria GasesNo ratings yet

- Affidavit of IndigencyDocument1 pageAffidavit of IndigencySebastian GarciaNo ratings yet

- Usa Cop22cmp12cma1 HlsDocument2 pagesUsa Cop22cmp12cma1 HlsRomela Eleria GasesNo ratings yet

- People V de Leon 2015 CaseDocument6 pagesPeople V de Leon 2015 CaseRomela Eleria GasesNo ratings yet

- LGU Distraint vs LevyDocument1 pageLGU Distraint vs LevyRomela Eleria GasesNo ratings yet

- 001 - Vir-Jen Shpping and Marine Services, Inc. vs. NLRCDocument1 page001 - Vir-Jen Shpping and Marine Services, Inc. vs. NLRCRomela Eleria GasesNo ratings yet

- Index For Application For Taxpayer Identification Number (TIN)Document6 pagesIndex For Application For Taxpayer Identification Number (TIN)Romela Eleria GasesNo ratings yet

- Income Taxation TableDocument11 pagesIncome Taxation TableRomela Eleria GasesNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- ACKNOWLEDGEMENT RECEIPT FormDocument1 pageACKNOWLEDGEMENT RECEIPT FormRomela Eleria GasesNo ratings yet

- SPOUSES ROMULO AND SALLY EDUARTE Vs CADocument8 pagesSPOUSES ROMULO AND SALLY EDUARTE Vs CARomela Eleria GasesNo ratings yet

- 2015 Labor Case List (Jan-Jun)Document1 page2015 Labor Case List (Jan-Jun)Romela Eleria GasesNo ratings yet

- Deed of Self Adjudication and SaleDocument2 pagesDeed of Self Adjudication and SaleRomela Eleria GasesNo ratings yet

- What Is Research MethodologyDocument3 pagesWhat Is Research MethodologyRomela Eleria GasesNo ratings yet

- Deed of Donation FormDocument2 pagesDeed of Donation FormRomela Eleria GasesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)