Professional Documents

Culture Documents

Examination Paper Fall 2017

Uploaded by

Talha Ahmed0 ratings0% found this document useful (0 votes)

13 views1 pageThe document contains an exam with multiple choice and short answer questions about mergers and acquisitions, cost of equity calculation, definitions of financial terms, methods of valuing M&As, options, dividend payout policy, and corporate restructuring. It asks the student to describe examples of why M&As happen, define various types of mergers and contracts, explain ways M&As are valued, distinguish call and put options, discuss dividend irrelevance and tax preference theories, and explain different forms of corporate restructuring.

Original Description:

Original Title

Examination paper Fall 2017.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains an exam with multiple choice and short answer questions about mergers and acquisitions, cost of equity calculation, definitions of financial terms, methods of valuing M&As, options, dividend payout policy, and corporate restructuring. It asks the student to describe examples of why M&As happen, define various types of mergers and contracts, explain ways M&As are valued, distinguish call and put options, discuss dividend irrelevance and tax preference theories, and explain different forms of corporate restructuring.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageExamination Paper Fall 2017

Uploaded by

Talha AhmedThe document contains an exam with multiple choice and short answer questions about mergers and acquisitions, cost of equity calculation, definitions of financial terms, methods of valuing M&As, options, dividend payout policy, and corporate restructuring. It asks the student to describe examples of why M&As happen, define various types of mergers and contracts, explain ways M&As are valued, distinguish call and put options, discuss dividend irrelevance and tax preference theories, and explain different forms of corporate restructuring.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

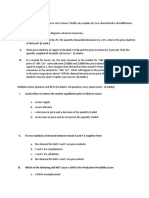

Student Name: __________________ Student I.D.

______________

Q1. Describe with an example why do merger and Acquisition Happen? (08 marks)

Q2. If the risk-free rate is 3%, the expected market risk premium is 5%, and the company’s

stock beta is 1.2, what is the company’s cost of equity? (4 marks)

Q3. Define the following terms. Any five (20 marks)

a. Horizontal Merger

b. Vertical Merger

c. Conglomerate Merger

d. Forward contract

e. Future contract

f. Stock Dividend

g. Stock split

Q4. Describe various ways in which Mergers and Acquisitions are valued? (07 marks)

Q10. What is an Option? Distinguish between Call option and Put option by giving

Appropriate Example. (12 marks)

Q.11.What do we mean by Dividend payout policy? Briefly explain Dividend Irrelevance and

Tax Preference Theory? (10 marks)

Q12. What is Corporate Restructuring? Explain different forms of corporate restructuring?

(13 marks)

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- General Motors - Class Summary 3rd Aug-1401001 PDFDocument5 pagesGeneral Motors - Class Summary 3rd Aug-1401001 PDFSravya DoppaniNo ratings yet

- Chapter 9 Managing Strategy: Management, 14e (Robbins/Coulter)Document40 pagesChapter 9 Managing Strategy: Management, 14e (Robbins/Coulter)Mohannad Elabbassi100% (2)

- Mergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketFrom EverandMergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketRating: 1 out of 5 stars1/5 (1)

- Midterm FSMG ADocument2 pagesMidterm FSMG ATalha AhmedNo ratings yet

- 3rd Sem FINDocument9 pages3rd Sem FINPradeep MuthayalaNo ratings yet

- ECN358Document3 pagesECN358reddepedoNo ratings yet

- Howie Business Studies Review Unit 1Document2 pagesHowie Business Studies Review Unit 1Roger MuNo ratings yet

- Assignment QuestionsDocument2 pagesAssignment QuestionsPankaj GoplaniNo ratings yet

- CM21 Finance 2 Mock Final ExamDocument9 pagesCM21 Finance 2 Mock Final Examkoala.jacyNo ratings yet

- Paper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDocument3 pagesPaper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDivakara ReddyNo ratings yet

- Third Year B.B.A (Sem-VI) Examination April 2022 Business Policy and Strategic Management (New Course)Document2 pagesThird Year B.B.A (Sem-VI) Examination April 2022 Business Policy and Strategic Management (New Course)Ananya BhansaliNo ratings yet

- Assignments M&ADocument3 pagesAssignments M&AdkathrotiyaNo ratings yet

- Emst VSTDocument1 pageEmst VSTSIDDHARTHA SAMALNo ratings yet

- Part A (Long Answer Type Questions) : (15×2 30 Marks)Document9 pagesPart A (Long Answer Type Questions) : (15×2 30 Marks)Kulshrestha Shwta SNo ratings yet

- MCOM 1st Year English PDFDocument8 pagesMCOM 1st Year English PDFakshaykr1189No ratings yet

- Assignments M Com PGDIBO English - 2012-13Document8 pagesAssignments M Com PGDIBO English - 2012-13Minakshi KukrejaNo ratings yet

- Investment BankingDocument1 pageInvestment BankingmbabbhumikaNo ratings yet

- Semester One Final ExaminFinal - Examinationsations 2014 FINM7403Document5 pagesSemester One Final ExaminFinal - Examinationsations 2014 FINM7403williewanNo ratings yet

- QP CODE: 18103380: Third SemesterDocument2 pagesQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYNo ratings yet

- Engineering Economics and Financial AccountingDocument5 pagesEngineering Economics and Financial AccountingAkvijayNo ratings yet

- Assignment Questions International Business Environment: Each Question Carries 10 MarksDocument7 pagesAssignment Questions International Business Environment: Each Question Carries 10 MarksKetan PatelNo ratings yet

- FIN 515 Final ExamDocument3 pagesFIN 515 Final ExamDeVryHelpNo ratings yet

- POC PaperDocument3 pagesPOC Paperaahmed459No ratings yet

- IBO - English Assign.Document8 pagesIBO - English Assign.Browse PurposeNo ratings yet

- Business Economics and Financial Analysis Course File: Deshmukhi, HyderabadDocument14 pagesBusiness Economics and Financial Analysis Course File: Deshmukhi, HyderabadDeepthi YadavNo ratings yet

- Final All Important Question of Mba IV Sem 2023Document11 pagesFinal All Important Question of Mba IV Sem 2023Arjun vermaNo ratings yet

- Fin 515 WK 8Document3 pagesFin 515 WK 8PetraNo ratings yet

- Chapter 10Document13 pagesChapter 10Uyen Nhi NguyenNo ratings yet

- All Chapters CompensationDocument43 pagesAll Chapters Compensationactuarialscience99No ratings yet

- Students - Revision Questions Financial Derivatives - 4539222Document2 pagesStudents - Revision Questions Financial Derivatives - 4539222Arpita PatelNo ratings yet

- Financial MGMNT Sample Final ExamDocument4 pagesFinancial MGMNT Sample Final ExamJonty0% (1)

- Lab8 - 203 - 2023 ExerciseDocument1 pageLab8 - 203 - 2023 Exercisehongsik kimNo ratings yet

- PROJ 598 Contract and Procurement Week 8 Final ExamDocument5 pagesPROJ 598 Contract and Procurement Week 8 Final ExamTom Cox100% (1)

- MEFA Imp QuestionsDocument5 pagesMEFA Imp QuestionsSunilKumarNo ratings yet

- Economics of Pakistan Important QuestionsDocument7 pagesEconomics of Pakistan Important QuestionsKhalid MahmoodNo ratings yet

- Cost and Management AccountingDocument3 pagesCost and Management AccountingVirat KholiNo ratings yet

- Economic QuesDocument2 pagesEconomic QuesYasodha ChithuNo ratings yet

- Group-B 2010Document4 pagesGroup-B 2010Mudassir Ahsan AnsariNo ratings yet

- New 3rd Semester English (MCO-03,07,15, IBO-02) PDFDocument6 pagesNew 3rd Semester English (MCO-03,07,15, IBO-02) PDFAkash Peter MishraNo ratings yet

- FM Theory Questions VtuDocument4 pagesFM Theory Questions VtuGururaj AvNo ratings yet

- FN3092 - Corporate Finance - 2015 Exam - Zone-ADocument9 pagesFN3092 - Corporate Finance - 2015 Exam - Zone-AAishwarya PotdarNo ratings yet

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- EC201 ST 2020 Paper - CommentaryDocument23 pagesEC201 ST 2020 Paper - CommentarySwaggyVBros MNo ratings yet

- 441.html: CBSE, Class XI Business Studies, CBSE Sample Papers ..Document5 pages441.html: CBSE, Class XI Business Studies, CBSE Sample Papers ..ybbvvprasada raoNo ratings yet

- Paper AccountsDocument2 pagesPaper AccountsAx AmNo ratings yet

- Business Studies IGCSE Standards BookletDocument72 pagesBusiness Studies IGCSE Standards BookletAhmed Raza UmerNo ratings yet

- Question Bank - Engineering EconomicsDocument18 pagesQuestion Bank - Engineering EconomicsRAMESH BABU S MECNo ratings yet

- Business Strategy Solved at HTTPDocument1 pageBusiness Strategy Solved at HTTPSateeshNo ratings yet

- International Business Q Bank Prof Bharat Nadkarni Nov 2020Document2 pagesInternational Business Q Bank Prof Bharat Nadkarni Nov 2020Vivek AdateNo ratings yet

- Entrepreneurial Development CPTX 8403Document3 pagesEntrepreneurial Development CPTX 8403Mohammad SazidNo ratings yet

- Course Outline Me 2016-18 v1.0Document8 pagesCourse Outline Me 2016-18 v1.0viewpawanNo ratings yet

- Test Bank For Essentials of Entrepreneurship and Small Business Management 9th by ScarboroughDocument24 pagesTest Bank For Essentials of Entrepreneurship and Small Business Management 9th by Scarboroughashleyhaaswxcbmagsde100% (28)

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Document202 pagesMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNo ratings yet

- Dms All Subjects Questions 2016Document6 pagesDms All Subjects Questions 2016mstfahmed76No ratings yet

- Model Exam DATE: 29/05/2013 Time: 3 Hours PART A - Answer All The Question (2 10 20)Document2 pagesModel Exam DATE: 29/05/2013 Time: 3 Hours PART A - Answer All The Question (2 10 20)Ram VasuNo ratings yet

- Introduction To Corporate Finance 4th Edition Booth Test BankDocument38 pagesIntroduction To Corporate Finance 4th Edition Booth Test Bankgabrielnt3me100% (15)

- Advertising and Imc Principles and Practice 10Th Edition Moriarty Test Bank Full Chapter PDFDocument29 pagesAdvertising and Imc Principles and Practice 10Th Edition Moriarty Test Bank Full Chapter PDFjames.graven613100% (18)

- Advertising and IMC Principles and Practice 10th Edition Moriarty Test Bank 1Document40 pagesAdvertising and IMC Principles and Practice 10th Edition Moriarty Test Bank 1barry100% (31)

- Introduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFDocument60 pagesIntroduction To Corporate Finance 4Th Edition Booth Test Bank Full Chapter PDFpandoratram2c2100% (10)

- Responsible Business: How to Manage a CSR Strategy SuccessfullyFrom EverandResponsible Business: How to Manage a CSR Strategy SuccessfullyNo ratings yet

- Blanchard-3203 Mihaela 2019springDocument5 pagesBlanchard-3203 Mihaela 2019springTalha AhmedNo ratings yet

- MICRO 2 Assignment 2Document1 pageMICRO 2 Assignment 2Talha AhmedNo ratings yet

- Lecture 2 Financial AnalysisDocument38 pagesLecture 2 Financial AnalysisTalha Ahmed100% (1)

- Varian9e LecturePPTs Ch03Document54 pagesVarian9e LecturePPTs Ch03Talha AhmedNo ratings yet

- TERM REPORT: Students Are Required To Give Industry Specific Reports. Student in The Class Will Break Into Groups ofDocument2 pagesTERM REPORT: Students Are Required To Give Industry Specific Reports. Student in The Class Will Break Into Groups ofTalha AhmedNo ratings yet

- Maths Macro MidtermDocument1 pageMaths Macro MidtermTalha AhmedNo ratings yet

- Malik Liquidity PakistanDocument16 pagesMalik Liquidity PakistanTalha AhmedNo ratings yet