Professional Documents

Culture Documents

Chap04 Time Value of Money

Uploaded by

Mikaela Samonte0 ratings0% found this document useful (0 votes)

7 views10 pagesnotes

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views10 pagesChap04 Time Value of Money

Uploaded by

Mikaela Samontenotes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

10/10/2019

Review of the

Time Value of

Money

Solving for Future Value of a

Lump Sum

Method 1: FORMULA Method

FV=PV x (1+r)"

Method 3: SPREADSHEET Method

=FV(rate,nper,pmt,pv,type)

Method 4: Time Value Table Method

FV=PV x FVIF 5: 1% torn pas

Solving for Future Value of a

Lump Sum

Example

Let’s say you want to know how much

money you will have accumulated in

your bank account after 4 years, if you

deposit all 5,000 of your high-school

graduation gifts into an account that

pays a fixed interest rate of 5% per

year. You leave the money untouched

for all four of your college years.

T) Solving for Future Value of a

Lump Sum

Method 1 Formula Method

FV=PVx (1 +r)"

‘Substituting the ven values

FV=P5,000 x (1 + 5%)*

FV=P5,000 x (1.05)4

FV=PS5,000 x (1.21550625)

FV=P6,077.53

Solving for Future Value of a

Lump Sum

Method 3 Spreadsheet Method

=FV(rate,nper,pmt,pv,type)

Using Excel, key inthe t:

V(5%,4,0,-5000,0) then press enter

6,077.53.

7) Solving for Future Value of a

Lump Sum.

Method 4 Time Value Table Method

FV = PV X FVIFic596 for pds

Using the Future Value Interest Factor (FVIF) table,

find the FACTOR at the intersection of 5% and 4

periods.

FV=P5,000 x (1.2155)

FV=P6,077.50

F) Solving for Present Value of a

Lump Sum

Method 1: FORMULA Method

PV=FV x [1/(4+r)"]

Method 3: SPREADSHEET Method

=PV(rate,nper,pmt,fv,type)

Method 2: Time Value Table Method

PV=FV x PVIF,

‘at r% for n pds

Solving for Present Value of a

Lump Sum

Example

Your retirement goal is P2,000,000.

BDO is offering you a certificate of

deposit that is good for forty years at

6%. What initial deposit do you need to

make today to reach your P2,000,000

goal at the end of forty years?

4, Solving for Present Value of a

Lump Sum

Method 1 Formula Method

PV=FV x [1/(14r)"]

Substituting the given values

PV=P2,000,000 x [1/(1+6%)*°]

PV=P2,000,000 x [1/(1.06)*°]

PV=P2,000,000 x (0.0972)

PV=P194,444.38

Solving for Future Value of a

Lump Sum

Method 3 Spreadsheet Method

=PV(rate,nper,pmt,fv,type)

Using Excel, key inthe

'V(6%,40,0,-2000000,0)

194,444.38

7) Solving for Present Value of a

Lump Sum

Method 4 Time Value Table Method

PVEFV X PVIF 9:65 for 40 pas

Using the Present Value Interest Factor (PVIF) table,

find the FACTOR at the intersection of 6% and 40

periods.

PV=P2,000,000 x (0.0972)

PV=P194,444.38

The Time Value

of Money

(Part 2)

Learning Objectives

1. Compute the future value of multiple cash

flows,

2, Determine the future value of an annuity.

3. Determine the present value of an annuity.

4. Adjust the annuity equation for present

value and future value for an annuity due

and understand the concept of a perpetuity.

5, Distinguish between the different types of

loan repayments: discount loans, interest-

only loans and amortized loans.

6. Build and analyze amortization schedules.

Future Value of Multiple Payment

Streams

* With unequal periodic cash flows,

treat each of the cash flows as a

lump sum and calculate its future

value over the relevant number of

periods.

*Sum up the individual future

values to get the future value of

the multiple payment streams.

KA The time line of a nest egg

Future Value of Multiple

Payment Streams (continued)

Example 1: Future Value of an Uneven

Cash Flow Stream:

Jim deposits P3,000 today into an account

that pays 10% per year, and follows it up

with 3 more deposits at the end of each of

the next three years. Each subsequent

deposit is P2,000 higher than the previous

one. How much money will Jim have

accumulated in his account by the end of

three years?

Future Value of Multiple Payment

Streams (Example 1 Answer)

FV = Px (14ry"

3000 (1.10) = P3600 1.331 2992.00

500 (410) = p,000 x 1210 =P 250.00

009 (3.30) = 7,900 1.100 = F7700.00

000 (110) = 9,000 1000 = P9000.00

Future Value of an Annuity

“Annuities are equal, _ periodic

outflows/inflows., e.g. rent, lease,

mortgage, car loan, and retirement

annuity payments.

*An annuity stream can begin at the

start of each period (annuity due) as is

true of rent and insurance payments

or at the end of each period, (ordinary

annuity) as in the case of mortgage

and loan payments.

10/10/2019

Future Value of an Annuity

The formula for calculating the future

value of an annuity stream is as follows

FV=PMT x aa

where PMT is the term used for the

equal periodic cash flow, r is the rate of

interest, and n is the number of periods

involved.

Future Value of an Annuity

Other methods of computing for the

future value of an annuity

FVIFA Table Method:

FV=PMT x FVIFAg¢ 59% for n pds

SPREADSHEET Method:

=FV(rate,nper,pmt,pv,type)

Future Value of an Annuity

Example 2: Future Value of an

Ordinary Anni Stream

Jill has been faithfully depositing

P2,000 at the end of each year

since the past 10 years into an

account that pays 8% per year.

How much money will she have

accumulated in the account?

Future Value of an Annuity

Example 2_ Answer

LONG METHOD.

P3998.01

Future Vu of Payment One = 72,000 1.0

ture Vie of Payment Tres = 2,000 2

Future ale of Payment Four = P2,000 1088 ~

Future Vale of Payment Seven = £2000 1.08" = P2519.42

Foti Val of Payment ght ~ 2,000 182 = P2.332.80

Future Valin of Payment ne = P2000 1.084 = p2.160.00

cue Valeo Payment Tn =P2,000% 1.08" = P.000 00

‘otal ale of acount ate endo 20 years P2BS73.13

Future Value of an Annuity

Example 2 (Answer)

FORMULA METHOD

FvepMr x tO? = 1

‘Substituting the given values:

a (1 + 8%)10- 1

FV=2,000 x sae

FV=P28,973.13

Future Value of an Annuity

Example 2 (Answer)

FVIFA TABLE METHOD

FV=PMT X FVIFAs: 6% for 10 pds

where

PuIT=F2,000; and using the FVIFA table, find the

factor at the intersection of 8% and 10 periods

FV=P2,000*14.486562

FV=P28,973.13

TO/M0/2019

ly Future Value of an Annuity

USING A SPREADSHEET

Syntax is =FV(rate,nper,pmt,pv,type)

Using your favorite spreadsheet solution, enter the f:

=FV(.08,10,-2000,0,0)

Then press the enter key, the output is

P28,973.13

Type is 0 for ordinary annuities and 1 for

annuities due

Present Value of an Annuity

To calculate the value of a series of equal

Periodic cash flows at the current point in

time, we can use the following simplified

formula:

PV

7

|S@ Present Value of an Annuity

Other methods of computing for the

Present value of an annuity:

PVIFA Table Method:

PV=PMT x PVIFAs¢ 536 for n pds

SPREADSHEET Method:

=PV(rate,nper,pmt,fv,type)

Time line of present value of annuity

stream.

ww Present Value of an Annuity

Example 3: Present Value of an Annuity.

John wants to make sure that he has saved up

fenough money prior to the year In which his

daughter begins college. Based on current

estimates, he figures that college expenses. will

‘amount to P40,000 per year for 4 years (ignoring

any inflation or tuition’ increases during. the 4

years of college). How much money wll John

eed to have accumulated in an account that

earns 7% per year, just prior to the year that his

daughter starts college?

Present Value of an Annuity

Example 3 Answer

FORMULA METHOD.

1

1

nena le]

‘Substituting the given values:

PV=P40,000 x 3.387211

PV=P135,488.45

ss

is Present Value of an Annuity

Example 3 Answer

PVIFA TABLE METHOD

PV=PMT x PVIFA,

Lat 7% for 4 pds

where,

PMT=P40,000; and using the PVIFA table, find the factor

at the intersection of 796 and 4 periods

PV=P40,000 x 3.3872

PV=P135,488

ES a ee

Present Value of an Annuity

USING AN EXCEL SPREADSHEET

Syntax is =PV(rate,nper,pmt,fv,type)

Using your favorite spreadsheet solution, enter the ff

=PV(7%,4,-40000,0,0)

‘Then press the enter key, the output is

P135,488.45

led Annuity Due

A cash flow stream such as rent, lease, and

insurance payments, which involves equal periodic

ash flows that begin right away or at the beginning

of each time interval is known as an annuity due.

‘An ordinary annuity versus an annuity due.

rT Ty ee ah

ah »

1 S100 $100. $100 $100 Oatinary annuity

100 $100—$100 Ansty

Annuity Due vs. Ordinary Annuity

Example 4:

Let's say that you are saving up for retirement

and decide to deposit P3,000 each year for

the next 20 years into an account which pays

a rate of interest of 8% per year. By how

much will your accumulated nest egg vary if

you make each of the 20 deposits at the

beginning of the year, starting right away,

rather than at the end of each of the next

‘twenty years?

Annuity Due vs. Ordinary Annuity

Example 4 Answer (for Ordinary Annuity)

FV,=PMT xGtoron

Substituting the given values:

z, (4 + 8%)?0~4

FV,=3,000 aa

FV,=P137,285.89

Annuity Due vs. Ordinary Annuity

Example 4 Answer (for Annuity Due)

FVg=FV, x (1 + r)

Substituting the given values:

FV4=137,285.89 x (1 + 8%)

FV=P148,268.76

NOIVUOEO TS

|S Three Loan Payment Methods

Loan payments

of 3 ways

1) Discount loan

* Principal and intere

end

can be structured in one

st Is paid In lump sum at

2) Interest-only loan

* Periodic interest-only

at end,

3) Amortized loan

* Equal periodic payments of principal and

interest. eae

ty payments, principal due

7

[gd Three Loan Payment Methods

Example 5

"YOU want to borrow P40,000 for a period ofS years. The

lenders offer YOU a choice of three payment strvtures

1: Pay al ofthe interest (10% per year) and principal in

ane lump sum atthe end of 5 years,

2, Pay intrest atthe rate of 10% per year for 4 years and

then 2 final payment of interest and principal at the end

3. Pay’ equal payments atthe end of each yeer inclusive

of terest and part ofthe principal.

Under which of the three options will YOU pay the least

Interest and ‘wt? Caleuate the total amount. of the

ayments and the amount of Interest pald under each

ternative

7] Three Loan Payment Methods

Option scount Loan.

Since all the interest and the principal is paid at the

end of 5 years, you must use the FV of @ lump sum

equation to calculate the payment requlred

FVSPVx (1 +r)"

A

i Three Loan Payment Methods

Option 2: Interest-Only Loan.

Annual Interest Payment (Years 1-4)

10,000 x 0.10

+=P4,000 (P26,000 for 4 yrs)

Year 5 payment

‘Annual interest payment + Principal payment

=P4,000 + P40,000 = 44,000

‘Total payment = P16,000 + P44,000 = P60,000

Interest paid = P20,000

ete ETE

lg Three Loan Payment Methods

Option 3: Amortized Loan.

Given the following:

n=5; r=10%; PV=P40,000;

0

Compute for the PMT (or the annual payment)

using the PVIFA Table Method:

PV=PMT x PVIFAy¢ 10% tor 5 pds

P40,000=PMT x 3.7908

PMT=P10,551.86

ig Three Loan Payment Methods

Option 3: Amortized Loan.

Given the followin«

n=5; r=10%} PV=P40,000; FV=0

Compute for the PMT (or the annual payment)

using Excel:

‘=PMT(rate,nper pv,fv, type)

=PMT(.1,5,-40000,0,0)

=P10,551.90

otal Payments ~ Lo,

an Amoun

52,759.31 - pap,ogg Unt

=P12,759,31

10/10/2019

Three Loan Payment Methods

loan Tyce Total Payments

Interest Baia

Discount Loan 64,420.40 24,420.40,

Tnterest-onlyLoanP60,000.00 20,000.00,

Amortized Loan 52,759.31 12,759.31

Amortization Schedules

Tabular listing of the allocation of each Ioan payment

{owards interest and principal reduction

Helps borrowers and lenders gure out the poy balance

‘on an outstanding oan,

Procedure:

4, Compute tne amount ot each equal periodic payment

(oun,

2, Galculate Interest on unpaid balance at the end of

teach period, minus it from the PMT, reduce the loan

Balance by the remaining amount.

3. Continue the process for each payment period, until we

(get a Zero loan Balance.

Example 6: Loan amortization schedule.

Prepare a loan amortization schedule for the

amortized loan option given in Example 5 above.

What is the loan payoft amount at the end of 2

years?

Given the following

'n=5; r=10%; PV=P40,000; FV=0

‘We computed

Por

0,551.89

Loan Amortization Schedule

eo: Bal Payment Interest Prlacps! End al

4 40,000.00 10,551.89 4000.00 6551.99 33,448.11

2 3344081 1055189 334481 7320708 26,241.02

3 2624103 10,551.89 226810 792779 1991224

4 1921328 1055199 1931.32 972057 9.59267

5 9359267 1055189 959.27 989267 0

an payoff amount at the end of 2

fs P26,241.09

Problems and Lrercives

Problems and Exercises 1

* YOU wish to

earning 6%

invest the m:

your account:

00 nto

compoundeg?® Nt an account

‘oney today, how Tf you

me ta how much wil pee

* Explain your answer

tono2019

Solution 1

FV=PVx(1 +R)"

FV = P8,000 (1 + 6%)6

FV = P11,348.15

Interest earned = p3,348.15

FV=PVx(1 +R)"

FV = P8,000 (1 + 6%)3

FV = 9,528.13,

Interest earned = 1,528.13,

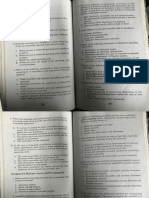

Problems and Exercises 2

+ YOU made your first P3,000 deposit today

into a retirement fund earning an average

annual rate of 6%. How long will it take

your deposit to reach a value of P50,0007

‘= How long will it take if instead you invest,

the money into an account earning 10% per

year?

+ After making your calculations, how does

this information affect your decision-making

regarding long-term investments?

Solution

Using any spreadsheet solution

At 6% At 10%

Rate 0.08 0.10

Pmt ° 0

Pv (3,000) (3,000)

Fv 50,000 50,000

Type ° °

Nper 48.28 yrs 29.52 yrs

4 Problems and Exercises 3

= YOUR parents offered you today a P10,000

high schoo! graduation gift with an option

for another P20,000 upon graduation from

college in four years. Your friends tell you

this is a P30,000 gift from your parents, but

you already know something about the time

Yalue of money. If the expected inflation

rate over the next four years Is expected to

be 4% per year, what do you think the gift

is worth in today’s peso? How should you

‘explain this to your friends?

Solution

You must calculate the PV of the gifts

The PV of the P10,000 is P10,000

The PV of the P20,000 to be received

after 4 years is

PV=FVx[1/(1+)"]

PV = P20,000 x [ 1/ (1 + 4%)4)

PV = P17,096.08

Total PV = P27,096.08

fewer

+ Tf you had the money now

Opportunity to invest it, so

value would exceed P20/000,

‘You would have the

‘that in four years the

Problems and Exercises 4

* You visited Motor Image sho

forte 2 Subaru Forester. You were satisfied mre

Prgeatures and decided to get'one amounting

P1.868M,

* You do not have enough money to buy the

forester. So you opted to finance the vehicle ths

PT Auto Loan,

* After the usual credit and background investigation,

‘your loan application was approved at the rate of

1.5% per month for 5 years

* How much is your monthly loan amortization?

Solution

Using Excel spreadsheet:

=PMT(rate,nper,pv,fv,type)

=PM1(.015,60,-1868000,0,0)

=P47,434.92

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Corporation 2Document3 pagesCorporation 2Dianne BallonNo ratings yet

- Relebus 1STDocument4 pagesRelebus 1STMikaela SamonteNo ratings yet

- Law On PC 7TH MeetingDocument5 pagesLaw On PC 7TH MeetingRyan CapistranoNo ratings yet

- BSMAC 2019 FlowchartDocument1 pageBSMAC 2019 FlowchartMikaela SamonteNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument20 pagesChapter 3 Dissolution and Winding UpMikaela SamonteNo ratings yet

- Corporation 1Document5 pagesCorporation 1Mikaela SamonteNo ratings yet

- Law On PC 4th MeetingDocument3 pagesLaw On PC 4th MeetingMikaela SamonteNo ratings yet

- Specific Format 1. Tables and Figures Must Fit Within MarginDocument3 pagesSpecific Format 1. Tables and Figures Must Fit Within MarginMikaela SamonteNo ratings yet

- BSA 2019 FlowchartDocument1 pageBSA 2019 FlowchartMikaela SamonteNo ratings yet

- Every Partner Must Account To The PartnershipDocument3 pagesEvery Partner Must Account To The PartnershipNadie LrdNo ratings yet

- Monetary Policy1Document6 pagesMonetary Policy1Mikaela SamonteNo ratings yet

- LN02Titman 449327 12 LN02Document48 pagesLN02Titman 449327 12 LN02Nasrudin Insaf Bin Jaafarali100% (1)

- Advanced Accounting - Volume 1Document4 pagesAdvanced Accounting - Volume 1Samantha Cabugon23% (26)

- NDNDJDDocument15 pagesNDNDJDMikaela SamonteNo ratings yet

- LN06Titman 449327 12 LN06Document78 pagesLN06Titman 449327 12 LN06mehmetgungormus100% (1)

- 1st Quiz Intacc5 PDFDocument37 pages1st Quiz Intacc5 PDFMikaela SamonteNo ratings yet

- BSA SubjectsDocument4 pagesBSA SubjectsMikaela SamonteNo ratings yet

- Chap03 Time Value of MoneyDocument9 pagesChap03 Time Value of MoneyMikaela SamonteNo ratings yet

- 1st Quiz Intacc5Document37 pages1st Quiz Intacc5Mikaela SamonteNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationMikaela Samonte100% (3)

- Correlational Research - Definition With Examples - QuestionProDocument5 pagesCorrelational Research - Definition With Examples - QuestionProMikaela SamonteNo ratings yet

- Intermediate Accounting 5Document2 pagesIntermediate Accounting 5Mikaela SamonteNo ratings yet

- Proof of CashDocument4 pagesProof of CashMikaela Samonte100% (1)

- GHHDocument1 pageGHHMikaela SamonteNo ratings yet

- Former Cfo of Autonomy Guilty of Accounting FraudDocument3 pagesFormer Cfo of Autonomy Guilty of Accounting FraudMikaela SamonteNo ratings yet

- Accounts ReceivableDocument11 pagesAccounts ReceivableMikaela SamonteNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:13 AMDocument1 pageSafari - Aug 9, 2019 at 7:13 AMMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)