Professional Documents

Culture Documents

VanCampen IndonesiaGeothermalTariffs NZGW November2017

Uploaded by

Manajemen Gas UI 2018Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VanCampen IndonesiaGeothermalTariffs NZGW November2017

Uploaded by

Manajemen Gas UI 2018Copyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/320619618

Analysis of New Indonesian Geothermal Tariff System and impact of

Feasibility of Geothermal Plants in Eastern Indonesia in the Next Decade

Conference Paper · October 2017

CITATION READS

1 742

5 authors, including:

Bart Van Campen Aulia Rizky Pratama

University of Auckland Ministry of Energy and Mineral Resources

40 PUBLICATIONS 158 CITATIONS 1 PUBLICATION 1 CITATION

SEE PROFILE SEE PROFILE

Jim Lawless Rosalind Archer

Lawless Geo-Consulting University of Auckland

27 PUBLICATIONS 266 CITATIONS 83 PUBLICATIONS 487 CITATIONS

SEE PROFILE SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Southwest Pacific Island Geothermal Energy Development View project

Geothermal Energy in Latin America View project

All content following this page was uploaded by Bart Van Campen on 26 October 2017.

The user has requested enhancement of the downloaded file.

ANALYSIS OF NEW INDONESIAN GEOTHERMAL TARIFF SYSTEM AND IMPACT

OF FEASIBILITY OF GEOTHERMAL PLANTS IN EASTERN INDONESIA IN THE

NEXT DECADE

Campen Van B1, Rizky Pratama A1, 2*, Lawless J3, Randle J4 and Archer R1

1The Geothermal Institute, the University of Auckland, Private Bag 92019, Auckland, New Zealand

2 Directorate of Geothermal, Ministry of Energy and Mineral Resources, Jakarta, 10320, Indonesia

3 Lawless Geo-Consulting, Auckland, New Zealand

4 GT Management, Jakarta, Indonesia

b.vancampen@auckland.ac.nz ; aulia.ebtke@gmail.com

Keywords: Eastern Indonesia, PLN, geothermal tariff, than 5 US cent/kWh. Consequently, most geothermal

regulation, BPP, feasibility study, geothermal development. projects became unfeasible and many private geothermal

companies withdrew from Indonesia. Since then, several

ABSTRACT attempts have been made by the Indonesian Government to

In early 2017 the Indonesian government introduced a new find an optimal geothermal tariff system in Indonesia.

ceiling tariff for all renewable energy generation, including

geothermal. Geothermal ceiling tariffs are now linked to the Several regulations regarding geothermal tariffs were issued

annual Average Generation Costs (BPP for its Indonesian over time, including the latest MEMR Regulation No.

abbreviation) for each electrical island/(sub)grid. This will 12/2017 issued in early 2017.1 According to this new

result in very low ceiling tariffs in the main island grids regulation, the geothermal (or any other renewable energy)

(Java, Bali, and Sumatera) due to the dominance of cheap tariff negotiated in a Power Purchasing Agreement (PPA)

coal generation. The smaller grids of East Nusa Tenggara between developer and PLN must not exceed the existing

and Moluccas have much higher BPPs because these are Average Generation Cost (in Indonesian : Biaya Pokok

dominated by diesel-generation ( although diesel prices are Penyediaan or BPP) on the relevant local grid. If the average

relatively low at the moment). This study examines how the generation cost of the local grid is lower than the average

current tariff regime relates to potential geothermal project national generation cost, the tariff can be negotiated between

costs in East Nusa Tenggara and Moluccas regions. It also the geothermal developer and PLN.

explores what might influence future BPPs to provide some

insight for future economic feasibility of geothermal power This policy was designed to reduce the overall electricity

plants in these regions. subsidies but keep the electricity end-user costs in Indonesia

affordable to consumers. The resulting lower maximum

As background, first the new geothermal tariff regulations geothermal tariffs, make geothermal development become

are discussed, as well as Indonesia’s Geothermal Roadmap less attractive in several (most) regions with low BPPs,

2017-2026 and the latest Electricity Power Supply Business especially the main islands (Java, Bali, Sumatra) where

Plan (RUPTL) by the State Electricity Company PLN. To generation is dominated by cheap coal. Even so, the

estimate geothermal project costs, a Geothermal Production Government of Indonesia is still keen to promote geothermal

Cost Model (GPCM) is used that was originally developed and other renewable energy, particularly in Eastern

under sponsorship of both the Government of Indonesia and Indonesia, where BPPs are significantly higher due to

New Zealand. Subsequently, some key parameters are varied smaller grids and domination of diesel generation. The

in a sensitivity analysis to have a preliminary look at policy Government of Indonesia has issued the Electricity Power

options which could support the feasibility of geothermal Supply Business Plan (or RUPTL in Indonesian) and the

projects. Finally, the future BPPs are estimated for East Nusa Indonesian Geothermal Roadmap for the next decade, which

Tenggara and Moluccas, by analysing the component cost of aims at significant increases in geothermal generation: by

BPP and its relationship to future oil prices. 2026, the participation of renewable energy for electricity

generation is targeted to be 23% of total generation.

1. INTRODUCTION

2. BPP

The development of geothermal energy in Indonesia has had

a long history. The first geothermal power plant in Indonesia The average cost of electricity generation (BPP), is

was developed in 1983. To encourage the development of calculated by summating the total generation, transmission,

other geothermal fields, the Government of Indonesia and distribution costs for PLN divided by the total sales of

allowed private companies to participate by issuing electricity produced – for each island/(sub)grid. Annually the

Presidential Decree No. 45 of 1991 and during the 1990s Ministry of Energy and Mineral Resources (MEMR) sets the

PLN offered high geothermal tariffs (around 7-10 US ceiling geothermal tariff based on the BPP values of the

cent/kWh at that time). Unfortunately, the Asian Financial preceding year by referring to PLN’s proposal (RUPTL – see

Crisis of 1997 caused the Indonesian Rupiah to fall Table 1 below for the main island grids2).

dramatically with respect to the US Dollar and compromised

PLN’s financial position. The Government of Indonesia was The higher BPP values of Moluccas and East Nusa Tenggara

subsequently forced to decrease the geothermal tariff to less make these Eastern Indonesian regions more attractive for

geothermal development. However, Eastern Indonesia

1 2

In August 2017 a new RE-regulation came out (MEMR-No.50/2017), but Note that the islands often have many (sub)grids, which can have their own

this only seems to adjust the solar and wind tariffs. (lower) BPPs. Allocation of PLN costs to (sub)grids still seems to be

developing over time.

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

consists of small islands and grids, which tends to make for used in this study to assess the upcoming geothermal projects

more difficult and costly geothermal development there. in Eastern Indonesia.

Hence, our exploration of geothermal production costs and

development of tariffs/BPPs could shed a useful light on the 3.1 Upcoming Geothermal Projects in Eastern Indonesia

feasibility of selected projects in these locations. The Moluccas and East Nusa Tenggara regions have

significant geothermal potential distributed over the myriad

Table 1: Geothermal Ceiling Tariffs for the main Islands; of islands. RUPTL (2017-2026) and the Indonesian

2016 and 2017 based on the BPP values of preceding year. Geothermal Roadmap describe the development of 12

BPP / Geothermal geothermal areas in Moluccas and East Nusa Tenggara.

Ceiling Tariff Seven of the most promising geothermal areas were selected

Region (US cent/kWh) to be assessed with GPCM in this study (see figure 1).

2015 / 2016 2016 / 2017

West Java 5.6 6.51

Jakarta 5.7 6.51

East Java 5.8 6.54

Central Java 5.9 6.52

Bali 6.3 6.62

South Sumatera, Jambi,

6.9 7.86

Bengkulu

Lampung 6.9 7.77

West Sumatera 7.0 8.07

South and West Sulawesi 8.0 8.10

South and Central Borneo 8.8 9.04

Riau 9.0 10.14

East Borneo 10.0 10.20

Figure 1: Upcoming Geothermal Projects in Eastern

Gorontalo, North and Indonesia.

11.7 12.75

Central Sulawesi

North Sumatera 12.4 9.28

West Nusa Tenggara 13.5 13.68 3.2 Feasibility Study Results

Papua 13.7 13.54 Some input parameters were taken/updated from RUPTL,

Indonesian Geothermal Roadmap, and Indonesian Profile

Aceh 14.2 10.39 Books which are issued by MEMR (see Annex 1). In table 2

West Borneo 14.5 12.43 below, the results of the GPCM are compared with the

13.66 & current (2016/17) geothermal ceiling tariff of each (sub)grid

Bangka and Belitung 14.7 and island.

12.17

Moluccas 16.6 17.32 Table 2: Estimated tariff needed for each project

East Nusa Tenggara 16.9 17.52 Compared to BPP.

Estimated

National BPP 7.5 7.39

Location Tariff BPP

Name of

(Island and needed 2016

Project

3. FEASIBILITY OF UPCOMING GEOTHERMAL subgrid) (US /2017

PROJECTS IN EASTERN INDONESIA cent/kWh)

As part of an attempt to formulate a suitable geothermal tariff EAST NUSA TENGGARA 17.52

system, the Indonesian Government requested a joint-study Manggarai (West

in 2016 to develop a Geothermal Production Cost Model Ulumbu 5 8.67

Flores) 13.16

(GPCM) in conjunction with the Government of New Manggarai (West

Zealand. Ulumbu 6 9.20

Flores) 13.16

The GPCM is a financial model with detailed inputs for all Sokoria 1 Ende (East Flores) 45.26 15.55

relevant geothermal fields, and makes an accurate Sokoria 2 Ende (East Flores)

assessment of the estimated tariff needed to develop a certain 18.03 15.55

geothermal project. The GPCM was reviewed and discussed Sokoria 3 Ende (East Flores) 16.50 15.55

by/with the developers, Indonesia’s Ministry of finance,

Sokoria 4 Ende (East Flores) 16.64 15.55

MEMR, and representatives of INAGA. All the

stakeholders, especially the developers, came to a consensus Atadei Lembata (Lembata) 10.80 17.52

that the baseline GPCM results in estimated tariffs that could

Ngada (West

produce a realistic return for the developer. This GPCM is Mataloko 2 8.74

Flores) 13.16

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

NORTH MOLUCCAS 17.32 • Introduce a carbon price: at present Indonesia has

no carbon price, although in the past, geothermal

West Halmahera (and other RE) projects have benefitted from

Jailolo 22.90

(Halmahera) 12.67 selling carbon credits through the previous CDM

Songa South Halmahera mechanism. Based on a modest outlook on carbon

19.94

Wayaua (Bacan) 13.61 prices3, this study uses carbon prices from 6 to 9

MOLUCCAS 17.32 USD/tCO2e for the sensitivity analysis.

Tulehu Ambon (Ambon) 14.67 12.62 Preliminary results show that the most influential parameter

is the type of developer. The tariffs can decrease significantly

According to these results, there are only four geothermal by more than 30% by choosing an SOE as the developer

projects which would be economically feasible under the instead of an IPP. This is caused mainly by the different

current tariff regulation/BPP-2016/17. These projects are value of discount rates which SOE and IPP use. It is assumed

Ulumbu 5, Ulumbu 6, Mataloko 2, and Atedai. These are all that SOEs need discount rates/returns of 8% for brownfield

brownfield developments: either extensions of existing and 11% for greenfield, while IPP needs 13.5% and 16.5%

geothermal fields or re-development of geothermal projects. respectively. Using different assumptions, WestJEC (2016b)

The fields already have exploratory wells and more confident found a similar result that shows IRR values heavily impact

geoscience data. Moreover, these projects are to be the geothermal project cost. There are several options to

developed by PLN, an SOE with support from the national reduce the IRR value, e.g.: the government and/or

budget and some international development banks. The Development Banks could provide soft-loans to geothermal

lower costs and discount rates result in these projects developers or stimulate public-private joint ventures.

becoming more feasible. Meanwhile, the other projects, Another option could be that the government could conduct

Sokoria 1, Sokoria 2, Sokoria 3, Sokoria 4, Jailolo, Songa the exploration stage so the development risk is reduced and

Wayaua, and Tulehu, are either categorized as Greenfield IRR can decrease.

and/or developed by private developers/Independent Power

Producers (IPPs), with resulting higher costs and/or discount

rates.

3.3 Sensitivity/Policy Analysis on Geothermal Costs

A sensitivity analysis was subsequently conducted to see

how the costs could vary with regards to input parameters or

policy options. Four main parameters/policies were studied:

• Government initiated exploration, e.g. under the

new PT SMI initiative. This represents an effective

lowering of initial capital investment in the

exploration stage, which would only affect the

geothermal tariff on greenfield projects, because it

is assumed that brownfield projects have already

conducted this exploration stage.

Figure 2: the effect of developer on generation cost

• SOE or IPP developer, which would mainly affect (WestJEC, 2016b)

the rate of return (IRR/combined discount rate)

required. SOEs are usually able to fund projects The changes in drilling costs result in variable impacts on the

with lower finance costs, supported by different fields, as the number of wells required for each field

Government and Development Bank/ODA funds. will be different according to the characteristics of the

IPPs usually need more risk capital and resource and the total installed capacity. The bigger capacity

commercial debt to develop a geothermal project, installed or the smaller well productivity will require more

which leads to a higher expected discount rate and wells to be drilled, and hence, the impact on drilling costs

hence higher costs (higher tariff needed). will also increase.

• Lowering geothermal drilling cost : currently, the

geothermal drilling cost in Indonesia is more

expensive than the international market price, 4. PRELIMINARY ANALYSIS OF FUTURE BPP

partly because there are only few geothermal Electricity generation in Eastern Indonesia is dominated by

drilling companies in Indonesia reducing diesel power plants, leading to high regional BPP (see table

competition. Especially now that the oil market is 1) despite presently relatively low diesel prices. Figure 3

in a slump, the opportunity exists to attract more below shows how the NPPs for Moluccas and ENT (right-

drilling companies to Indonesia, and hence lower axis) correlate well with average Indonesia and World oil

the capital required for geothermal drilling prices (left-axis) over the last 7 years.

significantly.

3

According to World Bank (2016), in April 2016, the average carbon price on

New Zealand ETS was 8 USD/tCO2e, the EU ETS price was 6 USD/tCO2e,

and the Japan carbon tax was only 3 USD/tCO2e.

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

Figure 6 shows these first order estimates for the future BPPs

of East Nusa Tenggara and Moluccas regions according to

the projected oil price based on World Bank database (2017)

and BPP profile cost.

Figure 3: Comparison between national and regional

BPP with crude oil prices.

Looking closer at what constitutes the BPP in Moluccas and

ENT, figures 4 and 5 highlight PLN’s fuel cost, purchase of

electricity (a new phenomenon) and other/overhead costs

(O&M, administration, financial and other costs). The fuel

costs portion fluctuates and has decreased since 2014, largely

due to lower diesel prices, while other/overhead costs are Figure 6: Projected BPPs based on world oil price.

more stable. Changes in cost allocation are obscuring trend

analysis to some extent, especially PLN’s shift in 2017 to According to World Bank database (2017b), the average oil

purchase electricity from local generators (MEMR, 2017a), prices are estimated to gently increase for the next decade

instead of renting diesel-generators, buying the diesel fuel and will reach 71 USD/barrel (real prices) in 2025. Hence,

and operating these units themselves. It is likely much of the our BPP projections also gently increase to around 23 US

‘purchased electricity’ costs is still made up of diesel fuel cent/kWh in 2025. This level of BPP prices would still be

costs. The average portions of diesel costs over the last seven relatively high and might be interesting for geothermal

years in both regions is estimated at least 50% of the BPP. developers. Geothermal developers can estimate when they

are going to start generating electricity and can ask for tariff

renegotiation if there are any changes in the technical design

related to the capacity resources.

4.1 Sensitivity Analysis on Future Oil Prices

As future oil price projections are subject to considerable

uncertainty, a sensitivity analysis was conducted on the basis

of four scenarios: the baseline World Bank global oil price

scenario; 20% additional oil price reduction; 20% additional

oil price increase; and (an extreme) 50% additional oil price

increase. Figure 6 shows the resulting global oil prices for

each year.

Figure 4: The portion of fuel cost from regional BPP in

Moluccas.

Figure 7: Future Oil price projection for sensitivity

analysis.

Figure 5: The portion of fuel cost from regional BPP in

East Nusa Tenggara.

With the above background, we can make a first order

approximation, assuming that the average weight of diesel

costs in BPP will be 50% and other costs will be relatively

constant for the next ten years. A first order approximation

of future BPP can then be based on the existing BPP and the

expected variation in oil price, weighted by 50%:

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

even under presently low (global and Indonesian) oil prices.

Despite higher production/development costs for small,

remote geothermal power projects, 3 out of the 7 main

geothermal projects/fields reviewed for Moluccas and ENT

would be economically feasible under the present BPP

(2016/17).

A preliminary sensitivity analysis simulating some non-tariff

policy options, showed that policy options lowering

IRR/discount rates (especially SOE/state-sponsored

developers, but also low-rate financing for private

developers and public-private joint-ventures) would

significantly lower geothermal production costs for the 7

Figure 8: BPP projection for Moluccas and North fields reviewed and make several more economically viable.

Moluccas.

Other policy options include: government-initiated

exploration (depending on how exploration costs are

recuperated) and lowering/opening the market costs for

drilling, which should have a significant impact in the

present global environment of low global/petroleum drilling

activity and costs. The impact of introducing a carbon price

would seem limited, especially at the present, modest

international carbon prices (up to 9 USD/tCO2e), but could

increase significantly if global climate change initiatives

increase again.

To understand possible future BPP trajectories (and hence

geothermal ceiling tariffs) in Moluccas and ENT, a study was

made how the BPP is calculated over the years. This is made

more difficult because the method and cost allocations to

Figure 9: BPP projection for East Nusa Tenggara. calculate the (regional) BPPs still seem to change year-by-

year. With a conservative estimate that at least 50% of the

Figures 8 and 9 show that the future BPP values are likely to Moluccas and ENT BPPs are made up of diesel costs, and

increase in all scenarios. Even in the lowest oil price other costs will stay stable (in real terms) over the coming

scenario, 20% reduction of World Bank oil projection, our decade, a first-order-estimate was made about BPP-

BPP projections still reach 20 US cents/kWh. Meanwhile, in trajectories under different oil price scenarios out to 2025.

the higher oil price scenario, the BPP projections can reach Under all 4 scenarios (baseline World Bank global oil price

25 US cents/kWh for the 20% Increase Scenario and 35 US projections, +/-20%, and +50%), the BPPs for Moluccas and

cents/kWh for the 50% Increase Scenario, making most of ENT would be expected to increase from 2016-levels. In the

the projects in Table 2 potentially economically viable. +50% scenario, all-but-1 of the geothermal projects studied

would become economically feasible.

6. CONCLUSIONS AND RECOMMENDATIONS

Indonesia has a vast potential for geothermal power Some recommendations from this preliminary study include:

generation, both on the main and the Eastern Islands. Since - Further investigate the assumptions and opportunities

the 1990s the Government of Indonesia has been varying underlying the economics of geothermal power generation in

tariff regulations in search of an optimum between Eastern Indonesia, in collaboration with various government

promoting geothermal (and other renewable) resources, and agencies and developers (SOE and private);

limiting the amount of subsidies to keep power prices

affordable for end consumers and limit fiscal costs. - Create more clarity and transparency in the methods

underlying the BPP-calculations and potential future

In early 2017, the Government of Indonesia introduced a new (ceiling) price trajectories, as this would help developers

tariff system (MEMR regulation No.12/2017) that sets a (SOE and private) estimate future opportunities and

ceiling tariff for geothermal PPAs negotiated between PLN uncertainties better;

and developers in a certain year. This ceiling tariff is linked

to the Annual Average Costs of Generation (BPP) of the - An important contracting aspect is how escalation/inflation

previous year, to be calculated for each island/sub-system. is treated under the new regulation4 and PPAs. Escalation

Due to the predominance of cheap, coal-fired generation on clauses seem normally allowed during the contract term

the main islands, geothermal ceiling tariffs will likely be so (from COD/production onwards), but not necessarily

low as to make most future geothermal contracts/power between PPA signing and COD, which could mean a 3-5

plants economically unattractive. year 'inflationary erosion' of the negotiated tariff. There

seems to be some concern about the lack of transparency/

In the Eastern Islands, especially Moluccas and East Nusa consistency on how this is treated in contracts, which can

Tenggara, the local electricity generation is dominated by erode contract/tariff value and trust. This is worth further

diesel generation, which leads to significantly higher BPPs, investigation.

4

The previous (2014) ceiling tariffs had a predetermined inflation/escalation

trajectory to 2024, linked to COD-date.

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

- Further explore non-tariff policy options, especially those Ministry of Energy and Mineral Resources, Indonesia

relating to financial/discount costs, like SOE-development, [MEMR]. (2017c). “Virtual Pipeline – LNG for

public-private partnerships/joint ventures, soft loans to Power Concept.” [PowerPoint File].

reduce financial costs for developers; and those relating to

reducing drilling costs; Ministry of Energy and Mineral Resources, Indonesia

[MEMR]. (2017d). Berita Acara Rekonsiliasi

ACKNOWLEDGEMENTS Penyusunan Road Map Pengembangan Panas

Our sincere thanks go to Ministry of Energy and Mineral Bumi 2026 [Reconciliation of Geothermal

Resources (MEMR), Government of Indonesia and New Development Roadmap 2026]. West Java,

Zealand Ministry of Foreign Affair and Trade (MFAT) who Indonesia: Author.

provided an opportunity to finish this project.

Ministry of Energy and Mineral Resources, Indonesia

REFERENCES [MEMR]. (2017e). Average of Indonesian Crude

Oil Price [statistic data]. Retrieved from

Asian Development Bank & World Bank (2015). Unlocking http://statistik.migas.esdm.go.id/index.php?r=har

Indonesia’s Geothermal Potential. Retrieved from gaMinyakMentahIndonesia/index#

http://hdl.handle.net/11540/3311.

Ministry of Energy and Mineral Resources Regulation,

Bank Indonesia. (2017, May 5). Foreign Exchange Indonesia [MEMR Regulation] (2008). Harga

Reference Rate Jakarta Interbank Spot Dollar Patokan Penjualan Tenaga Listrik dari

Rate USD-IDR. Retrieved from Pembangkit Listrik Tenaga Panas Bumi [MEMR

http://www.bi.go.id/en/moneter/informasi- Regulation No. 14/2008, Ceiling Tariff for

kurs/transaksi-bi/Default.aspx Geothermal Power Plant]. Retrieved from

http://jdih.esdm.go.id/?page=home

Geothermal Law, Indonesia (2003). Panas Bumi

[Geothermal Law No. 27/2003]. Retrieved from Ministry of Energy and Mineral Resources Regulation,

http://jdih.esdm.go.id/?page=home Indonesia [MEMR Regulation] (2009). Pedoman

Harga Pembelian Tenaga Listrik oleh PT PLN

Government Law, Indonesia (2017). Panas Bumi untuk

[MEMR Regulation No. 5/2009, Electricity Power

Pemanfaatan Tidak Langsung [Geothermal Law

Purchase Tariff by PT PLN]. Retrieved from

No. 7/2017, Geothermal energy for Indirect-use].

http://jdih.esdm.go.id/?page=home

Retrieved from

http://jdih.esdm.go.id/?page=home Ministry of Energy and Mineral Resources Regulation,

Indonesia [MEMR Regulation] (2009). Pembelian

GT Management (2016). Proposed Methodology for

Tenaga Listrik oleh PT PLN dari Pembangkit

Determining Fixed Tariffs for Geothermal Power

Listrik yang Menggunakan Energy Baru

Projects in Indonesia. West Java, Indonesia:

Terbarukan Skala Kecil dan Menengah atau

Author.

Kelebihan Tenaga Listrik [MEMR Regulation No.

Hasan, M. & Wahjosoedibjo, A. S. (2016). An Update on 31/2009, Electricity Power Purchase Mechanism

Indonesia’s Geothermal Activities. 41st Workshop for Small and Medium Scale Renewable Energy

on Geothermal Reservoir Engineering and Excess Power]. Retrieved from

proceedings. Retrieved from IGA Geothermal http://jdih.esdm.go.id/?page=home

Conference Database.

Ministry of Energy and Mineral Resources Regulation,

Ministry of Energy and Mineral Resources, Indonesia Indonesia [MEMR Regulation] (2009). Harga

[MEMR]. (2015). Profil Potensi Panas Bumi Patokan Pembelian Tenaga Listrik oleh PT PLN

Indonesia [Indonesia Geothermal Resource dari Pembangkit Listrik Tenaga Panas Bumi

Profile]. Jakarta, Indonesia: Author. [MEMR Regulation No. 32/2009, Geothermal

Ceilling Tariff]. Retrieved from

Ministry of Energy and Mineral Resources, Indonesia http://jdih.esdm.go.id/?page=home

[MEMR]. (2016). Perhitungan Subsidi Listrik

Tahun 2016 [The Calculation of electricity Ministry of Energy and Mineral Resources Regulation,

subsidies in 2016, PowerPoint Slide]. Ministry of Indonesia [MEMR Regulation] (2011). Penugasan

Energy and Mineral Resources, Jakarta, Indonesia. PT PLN untuk Melakukan Pembelian Tenaga

Listrik dari Pembangkit Listrik Tenaga Panas

Ministry of Energy and Mineral Resources, Indonesia Bumi dan Harga Patokan Pembelian Tenaga

[MEMR]. (2017a). Rencana Usaha Penyediaan Listik oleh PT PLN dari Pembangkit Listrik

Tenaga Listrik PT. Perusahaan Listrik Negara Tenaga Panas Bumi [MEMR Regulation No.

(Persero) Tahun 2017 s.d. 2026 [Electricity Power 02/2011, Government Assignment to PLN for

Supply Business Plan PT. Perusahaan Listrik Purchasing Electricity from Geothermal Energy

Negara (Persero) 2017-2026]. Retrieved from and Ceiling Tariff Mechanism]. Retrieved from

http://www.djk.esdm.go.id/pdf/RUPTL/RUPTL% http://jdih.esdm.go.id/?page=home

20PLN%202017-2026

Ministry of Energy and Mineral Resources Regulation,

Ministry of Energy and Mineral Resources, Indonesia Indonesia [MEMR Regulation] (2012). Penugasan

[MEMR]. (2017b). Pengembangan Panas Bumi kepada PT PLN untuk Melakukan Pembelian

Indonesia [Indonesia Geothermal Development]. Tenaga Listrik dari Pembangkit Listrik Tenaga

Jakarta, Indonesia: Author. Panas Bumi dan Harga Patokan Pembelian Listrik

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

Oleh PT PLN dari Pembangkit Listrik Tenaga Presidential Decree, Indonesia (1981). Pemberian Kuasa

Panas Bumi [MEMR Regulation No. 22/2012, Pengusahaan Panas Bumi, Eksplorasi dan

Government Assignment to PLN for Purchasing Eksploitasi kepada Pertamina [Presidential

Electricity from Geothermal Energy and Ceiling Decree No. 22/ 1981, Authorization of geothermal

Tariff Mechanism]. Retrieved from concession to Pertamina]. Retrieved from

http://jdih.esdm.go.id/?page=home http://jdih.esdm.go.id/?page=home

Ministry of Energy and Mineral Resources Regulation, Presidential Decree, Indonesia (1991). Perubahan

Indonesia [MEMR Regulation] (2014). Pembelian Keputusan Presiden RI No. 22 Tahun 1981

Tenaga Listrik Panas Bumi untuk PLTP oleh PT [Presidential Decree No. 45/1991, Amendment of

PLN [MEMR Regulation No. 17/2014, Electricity Presidential Decree No. 22/1981]. Retrieved from

Power Purchase by PLN from Geothermal Power http://jdih.esdm.go.id/?page=home

Plant]. Retrieved from

http://jdih.esdm.go.id/?page=home Purwaningsih, F. O. & Hardiani, N. P. (2015).

Implementation of the “New Tariff” for

Ministry of Energy and Mineral Resources Regulation, Geothermal Energy Development in Indonesia.

Indonesia [MEMR Regulation] (2017). Pokok- 37th New Zealand Geothermal Workshop

pokok dalam Perjanjian Jual beli Tenaga Listrik proceedings. Taupo, New Zealand: Institut

[MEMR Regulation No. 10/2017, Main Principles Teknologi Bandung.

of Power Purchase Agreement]. Retrieved from

http://jdih.esdm.go.id/?page=home Siler, D. L. & Kennedy, B. M. (2015). Regional crustal-scale

structures as conduits for deep geothermal

Ministry of Energy and Mineral Resources Regulation, upflow. Geothermics, 59(A), 27-37. Doi:

Indonesia [MEMR Regulation] (2017). https://doi-

Pemanfaatan Gas Bumi untuk Pembangkit Tenaga org.ezproxy.auckland.ac.nz/10.1016/j.geothermic

Listrik [MEMR Regulation No. 11/2017, Natural s.2015.10.007

Gas Utilization for Electricity Power Generation].

Retrieved from Sundaryani, F. S. (2017, April 21). US, Indonesia sign $10b

http://jdih.esdm.go.id/?page=home deals. The Jakarta Post. Retrived from

http://www.thejakartapost.com/news/2017/04/21/

Ministry of Energy and Mineral Resources Regulation, us-indonesia-sign-10b-deals.html

Indonesia [MEMR Regulation] (2017).

Pemanfaatan Sumber Energi Terbarukan untuk U.S. Energy Information Administration [EIA]

Penyediaan Tenaga Listrik [MEMR Regulation (2016). Trends in US Oil and Natural Gas

No. 12/2017, Renewable Energy Utilization for Upstream Costs. Retrieved from

Electricity Power Generation]. Retrieved from https://www.eia.gov/analysis/studies/drilling/pdf/

http://jdih.esdm.go.id/?page=home upstream.pdf

Ministry of Energy and Mineral Resources Decree, West Japan Engineering Consultants, Inc. (2016a). Review

Indonesia [MEMR Decree] (2017). Besaran Biaya Report on Benefits of Geothermal Energy:

Pokok Penyediaan Pembangkit PT PLN (Persero) Avoided Cost by Geothermal Energy. Jakarta,

Tahun 2016 [MEMR Decree No. Indonesia: Author.

1404K/20/MEM/2017, Electricity Generation

Cost by PLN in 2016]. Retrieved from West Japan Engineering Consultants, Inc. (2016b). An

http://jdih.esdm.go.id/?page=home Analysis of Geothermal Power Generation Cost:

Generation cost structure and its characteristic.

Perusahaan Listrik Negara [PLN]. (2011). PLN Statistic Jakarta, Indonesia: Author.

2010 [Statistic report]. Jakarta, Indonesia: Author.

World Bank. (2016). Carbon Pricing Watch 2016. [PDF, An

Perusahaan Listrik Negara [PLN]. (2012). PLN Statistic advance bried from the State and Trend of Carbon

2011 [Statistic report]. Jakarta, Indonesia: Author. Pricing 2016 report]. Retrieved from

https://openknowledge.worldbank.org/handle/109

Perusahaan Listrik Negara [PLN]. (2013). PLN Statistic 86/24288

2012 [Statistic report]. Jakarta, Indonesia: Author.

World Bank. (2017a). CMO Historical Data Annual [Excel

Perusahaan Listrik Negara [PLN]. (2014). PLN Statistic file, World Bank Commodities Price Data in

2013 [Statistic report]. Jakarta, Indonesia: Author. nominal USD]. Retrieved from

http://pubdocs.worldbank.org/en/2263714860763

Perusahaan Listrik Negara [PLN]. (2015). PLN Statistic 91711/CMO-Historical-Data-Annual.xlsx

2014 [Statistic report]. Jakarta, Indonesia: Author

World Bank. (2017b). CMO April 2017 Forecasts [PDF,

Perusahaan Listrik Negara [PLN]. (2016). PLN Statistic World Bank Commodities Price Forecast in nominal

2015 [Statistic report]. Jakarta, Indonesia: Author USD]. Retrieved from

http://pubdocs.worldbank.org/en/6626414930469644

Perusahaan Listrik Negara [PLN]. (2017a). “Moluccas 12/CMO-April-2017-Forecasts.pdf

BPP.” [Statistic data].

Perusahaan Listrik Negara [PLN]. (2017b). “East Nusa

Tenggara BPP.” [Statistic data].

Proceedings 39th New Zealand Geothermal Workshop

22 - 24 November 2017

Rotorua, New Zealand

Annex 1. Input Parameters for Production Cost Model

Planned

Estimation Difficulty Type of Planned Planned Type of power Type of field

Name of Project Location (Island and Subsystem) Capacity

of COD of Access Enthalpy developer explorer plant development

(MW)

EAST NUSA TENGGARA

Ulumbu 5 Manggarai (West Flores) 2019 20 Medium High SOE Developer Modular Brownfield

Ulumbu 6 Manggarai (West Flores) 2024 20 Medium High SOE Developer Modular Brownfield

Sokoria 1 Ende (East Flores) 2018 5 Medium Medium IPP Developer Modular Greenfield

Sokoria 2 Ende (East Flores) 2019 5 Medium Medium IPP Developer Modular Brownfield

Sokoria 3 Ende (East Flores) 2020 10 Medium Medium IPP Developer Modular Brownfield

Sokoria 4 Ende (East Flores) 2021 10 Medium Medium IPP Developer Modular Brownfield

Atadei Lembata (Lembata) 2020 2x5 Medium Medium SOE Developer Modular Brownfield

Mataloko 2 Ngada (West Flores) 2020 2x10 Medium High SOE Developer Modular Brownfield

NORTH MOLUCCAS

Jailolo West Halmahera (Halmahera) 2025 20 Medium Medium IPP Developer Modular Greenfield

Songa Wayaua South Halmahera (Bacan) 2020 2x5 Medium Medium SOE Developer Modular Greenfield

MOLUCCAS

Tolehu Ambon (Ambon) 2020 2x10 Medium Medium SOE Developer Modular Greenfield

Annex 2. Sensitivity Analysis on Tariff Estimation

8

New Zealand Geothermal Workshop 2009 Proceedings

16 – 18 November 2009

Rotorua, New Zealand

View publication stats

You might also like

- Lolos Tes Seleksi Administrasi PDFDocument103 pagesLolos Tes Seleksi Administrasi PDFManajemen Gas UI 2018No ratings yet

- 170630-1201 MultiPoint-Flare-SS FINAL JZHCDocument4 pages170630-1201 MultiPoint-Flare-SS FINAL JZHCManajemen Gas UI 2018No ratings yet

- Bow-Tie Analysis of A Fatal Underground Coal Mine CollisionDocument5 pagesBow-Tie Analysis of A Fatal Underground Coal Mine CollisionManajemen Gas UI 2018No ratings yet

- Homework-7 Energy StorageDocument1 pageHomework-7 Energy StorageManajemen Gas UI 2018No ratings yet

- Viability of Underground Coal Gasification ReportDocument206 pagesViability of Underground Coal Gasification ReportManajemen Gas UI 2018No ratings yet

- Bruce Hill - Catf Wy Eori Coal Trans SlidesDocument49 pagesBruce Hill - Catf Wy Eori Coal Trans SlidesManajemen Gas UI 2018No ratings yet

- Contoh DrainageDocument2 pagesContoh DrainageManajemen Gas UI 2018No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ReymillWindmill Sta Rosa NEDocument8 pagesReymillWindmill Sta Rosa NEIssey Mari TiongcoNo ratings yet

- Fawaz FM BrochureDocument23 pagesFawaz FM BrochureSameer AmjadNo ratings yet

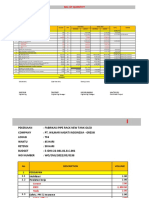

- RFQ Fabrikasi Pipe Rack New Tank OleoDocument22 pagesRFQ Fabrikasi Pipe Rack New Tank OleokamprettelanjangNo ratings yet

- Pre-Feasibility Study Report - 2023Document32 pagesPre-Feasibility Study Report - 2023RaedNo ratings yet

- Force Feed Lubricator Pump: PrimingDocument2 pagesForce Feed Lubricator Pump: Priminggustavofx21No ratings yet

- JD and JSDocument3 pagesJD and JSMd. Faisal BariNo ratings yet

- Taiwan Compressor Seminar: Schneider Electric - Solutions, Services and ExperienceDocument20 pagesTaiwan Compressor Seminar: Schneider Electric - Solutions, Services and ExperienceIkhtiander IkhtianderNo ratings yet

- Duke Energy Fast FactsDocument2 pagesDuke Energy Fast FactsetggrelayNo ratings yet

- Working Capital MGTDocument76 pagesWorking Capital MGTNSRanganathNo ratings yet

- Sahara Prime City LimitedDocument23 pagesSahara Prime City LimitedincognitorohitNo ratings yet

- Business Model Concept PaperDocument5 pagesBusiness Model Concept PaperRupesh ShahNo ratings yet

- WEG Three Phase Flameproof Motors w22x and Bfgc4 Series Technical European Market 125.71 Brochure EnglishDocument202 pagesWEG Three Phase Flameproof Motors w22x and Bfgc4 Series Technical European Market 125.71 Brochure EnglishVishal NarkhedeNo ratings yet

- PDFDocument2 pagesPDFPooja TiwariNo ratings yet

- Traceability ProcedureDocument21 pagesTraceability Procedurefadhlan hidayatNo ratings yet

- 2011 RMCMI Golf PairingsDocument4 pages2011 RMCMI Golf PairingsRMCMI (Rocky Mountain Coal Mining Institute)No ratings yet

- FeasibilityDocument2 pagesFeasibilitychixkyNo ratings yet

- NEC 2015 ReportDocument20 pagesNEC 2015 ReportNew Economy CoalitionNo ratings yet

- Onshore Pipeline Design Course BrochureDocument6 pagesOnshore Pipeline Design Course Brochureilze86No ratings yet

- Conceptual Design of Salt Cavern Based LNG TerminalDocument25 pagesConceptual Design of Salt Cavern Based LNG TerminalNurcahyo Djati W100% (3)

- Naval Reactor Handbook Vol 1Document1,562 pagesNaval Reactor Handbook Vol 1Peter AngeloNo ratings yet

- Aspen Plus Dynamics DatasheetDocument2 pagesAspen Plus Dynamics Datasheetatsomech132206No ratings yet

- Positive Isolaton: Prepared By: Bikash Keshari KhilarDocument16 pagesPositive Isolaton: Prepared By: Bikash Keshari KhilarBikash KhilarNo ratings yet

- Data KapasitorDocument7 pagesData KapasitorMuhammad Ardi AnggaraNo ratings yet

- Boreclad InformatioinDocument8 pagesBoreclad InformatioinnirmalmthpNo ratings yet

- Fpi11 R2.2Document5,655 pagesFpi11 R2.2Hugo Silva100% (1)

- Oil and Gas BookDocument41 pagesOil and Gas Bookramkumar_me0% (1)

- Solar Power FencingDocument19 pagesSolar Power FencingArghya deyNo ratings yet

- 3 X Frame 9E 95mw OverviewDocument8 pages3 X Frame 9E 95mw OverviewbananosnetNo ratings yet

- September 11, 2012 Wall Street JournalDocument32 pagesSeptember 11, 2012 Wall Street JournalEric Li CheungtasticNo ratings yet

- D. Strategies Formulated and Briefly Discussed/AssessedDocument6 pagesD. Strategies Formulated and Briefly Discussed/AssessedEphraim LingayuNo ratings yet