Professional Documents

Culture Documents

Capital Allocation Line

Uploaded by

Ajit BhojaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Allocation Line

Uploaded by

Ajit BhojaneCopyright:

Available Formats

SAPM

Capital Allocation Line

Slope of the CAL is known as reward-to-variability ratio.

Asset allocation is the allotment of funds across different types of assets with varying expected risk

and return levels.

Capital allocation is the allotment of funds between risk-free assets, such as certain Treasury

securities, and risky assets, such as equities.

The standard deviation of the Treasury bill is 0%

Sharpe Ratio:

Help investors understand the return of an investment compared to its risk.

The ratio is the average return earned in excess of the risk-free rate per unit volatility or total risk

The greater the value of the sharpe ratio, the more attractive the risk-adjusted return

Sharpe Ratio = Rp – Rf / σp

Excess Return over risk free return / SD of returns

Rp = Return of portfolio

Rf = risk-free rate

Sigma p = standard deviation of the portfolio’s excess return

Co-efficient of Variation

( Standard Deviation / Mean )

Lower the better

What is Co-efficient of Variation?

Risk taken to earn 1 percentage return is the Co-efficient of return

Jensen’s Alpha

Information Ratio

Although compared funds may be different in nature, the IR standardizes the returns by dividing the

difference in their performances, known as their expected active return, by their tracking error

IR = (Portfolio Return – Benchmark Return) / Tracking Error

where:

IR=Information ratio

Portfolio Return=Portfolio return for period

Benchmark Return=Return on fund used as benchmark

Tracking Error=Standard deviation of difference between portfolio and benchmark returns

The information ratio (IR) is a measurement of portfolio returns above the returns of a benchmark,

usually an index such as the S&P 500, to the volatility of those returns

The information ratio is used to evaluate the skill of a portfolio manager at generating returns in

excess of a given benchmark

A higher IR result implies a better portfolio manager who's achieving a higher return in excess of the

benchmark, given the risk taken

ER of portfolio = ER of risk-free asset x weight of risk-free asset + ER of risky asset x (1- weight of risk-

free asset)

Risk of portfolio = weight of risky asset x standard deviation of risky asset

Capital Market Line is a special case of the CAL where the portfolio of risky assets is the market

portfolio.

Volatility is a total risk.

E (Rp) = Rf + sigma p * ( E (Rm)- Rf/ sigma m)

The risk free return Rf represents the reward for waiting.

(Rm- Rf) / Sigma m

i.e., the excess return earned per unit of risk or standard deviation

Expected Return = price of time + price of risk* amount of risk

The required rate of return on a Portfolio.

= risk free rate + portfolio risk premium

Portfolio risk premium = standard deviation of the portfolio * market risk premium

Rp = rf + σp* (Rm- rf/ σm)

where:

Rp = Portfolio return

rf = Risk free rate

Rm = Market return

σp = Standard deviation of portfolio returns

σm = Standard deviation of market returns

It’s standard deviation.

Treynor ratio

Reward per unit of systemic risk

Treynor ratio best used with well-diversified portfolios. Because in those portfolios nonsystematic

risk has been diversified away.

the CML is used to express the risk and return relationship for diversified portfolios only,

whereas the SML can be used to show the relationship between risk and return for any asset.

But CML uses standard deviation as the risk measure whereas the SML uses beta

Jensen’s Measure

P rP r f P ( rM r f )

Only considers the systemic risk

Information Ratio = Average Alpha of the portfolio / Standard Deviation of the Alpha

The information ratio (IR) is a measurement of portfolio returns beyond the returns of a benchmark,

usually an index, compared to the volatility of those returns. The benchmark used is typically an

index that represents the market or a particular sector or industry.

IR = (Portfolio Return – Benchmark Return) / Tracking Error

Tracking Error = Take the standard deviation of the difference between the portfolio returns and the

index returns.

M squared measure = SR * σbenchmark + (rf)

Performance Attribution

Contribution of Asset Allocation to performance

= market return * ( Actual Weight – Benchmark Weight)

Contribution of Selection to Total performance

= portfolio weight* ( Actual return – Index return )

Security Market Line is derived from Capital Market Line

Required rate of return on Security i = risk free rate of return + risk premium to invest in the risky

security i

In CML the risk is defined as total risk and is measured by standard deviation

In SML the risk is defined as systemic risk and is measured by Beta

Measure of risk in the CML is the standard deviation of returns (total risk)

The risk measure in the SML is systemic risk or beta

Optimal Risky Portfolios

1. Capital allocation between the risky portfolio and risk-free asset

2. Asset allocation across broad asset classes

3. Security selection of individual assets within each asset class

Market risk remains even after extensive diversification aka systemic or non-diversifiable risk

Firm-specific risk: Risk that can be eliminated by diversification aka diversifiable or non-systemic

risk

Portfolio risk depends on the correlation between the returns of the assets in the portfolio

Covariance and the correlation coefficient provide a measure of the way returns of two assets

vary

Portfolio Performance Evaluation

You might also like

- Portfolio Performance Evaluation (1285)Document6 pagesPortfolio Performance Evaluation (1285)Nahid AhmedNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Session 18 & 19: Instructor: Nivedita Sinha Email: Nivedita - Sinha@nmims - EduDocument23 pagesSession 18 & 19: Instructor: Nivedita Sinha Email: Nivedita - Sinha@nmims - EduHitesh JainNo ratings yet

- Mutual Fund Evaluation/Model: Ranpreet KaurDocument14 pagesMutual Fund Evaluation/Model: Ranpreet KaurmuntaquirNo ratings yet

- Additional ReadingDocument4 pagesAdditional ReadingVishwas TripathiNo ratings yet

- Portfolio EvaluationDocument19 pagesPortfolio EvaluationAKHIL SAVIOUR URK18COM039No ratings yet

- Evaluate Portfolio Performance with Treynor, Sharpe, Jensen and Information MeasuresDocument20 pagesEvaluate Portfolio Performance with Treynor, Sharpe, Jensen and Information Measuresrajin_rammsteinNo ratings yet

- Sharpe Ratio: R R E (R RDocument17 pagesSharpe Ratio: R R E (R Rvipin gargNo ratings yet

- PortfolioevaluationDocument18 pagesPortfolioevaluationDhananjay SharmaNo ratings yet

- Performance Evaluation of Mutual Fund/ PortfolioDocument14 pagesPerformance Evaluation of Mutual Fund/ Portfoliojazzy123No ratings yet

- Portfolio EvaluationDocument14 pagesPortfolio EvaluationShalini HSNo ratings yet

- Gitman 08Document30 pagesGitman 08Samar Abdel RahmanNo ratings yet

- Group Members Roll No: Abhi Jain 103 Rajesh Chaurasia 105 Anil Agarwal 106 Tannavi Rani 107 Kundan Thakur 108Document10 pagesGroup Members Roll No: Abhi Jain 103 Rajesh Chaurasia 105 Anil Agarwal 106 Tannavi Rani 107 Kundan Thakur 108Tahir HussainNo ratings yet

- Measure and Evaluate Portfolio PerformanceDocument28 pagesMeasure and Evaluate Portfolio Performanceleolau2015No ratings yet

- Risk and Return Basics: Portfolio Risk, CAPM, SMLDocument66 pagesRisk and Return Basics: Portfolio Risk, CAPM, SMLMomenul Islam Mridha MuradNo ratings yet

- MFI Lecture 2Document17 pagesMFI Lecture 2Okba DNo ratings yet

- Chapter - 4 Data AnalysisDocument56 pagesChapter - 4 Data AnalysisSAGAR KHATUANo ratings yet

- SAPM M6 (3)Document6 pagesSAPM M6 (3)Aarushi GuptaNo ratings yet

- Risk and Return S1 2018Document9 pagesRisk and Return S1 2018Quentin SchwartzNo ratings yet

- CH 7 Portfolio RiskDocument5 pagesCH 7 Portfolio RiskPravin MandoraNo ratings yet

- Risk and ReturnDocument5 pagesRisk and ReturnJose Emmanuel Ca�eteNo ratings yet

- Capital Asset Pricing Model Written ReportDocument7 pagesCapital Asset Pricing Model Written Reportgalilleagalillee0% (1)

- Portfolio Theory's Key ConceptsDocument7 pagesPortfolio Theory's Key ConceptsaanillllNo ratings yet

- Chapter 7Document7 pagesChapter 7bobby brownNo ratings yet

- Module 2 CAPMDocument11 pagesModule 2 CAPMTanvi DevadigaNo ratings yet

- #01 Session1Document36 pages#01 Session1YisraelaNo ratings yet

- Members: Deepak Sharma Manu Sadashiv Vishwambhar Singh Shruti Shetty Manjunath Patil Keshav BhatDocument33 pagesMembers: Deepak Sharma Manu Sadashiv Vishwambhar Singh Shruti Shetty Manjunath Patil Keshav BhatKeshav BhatNo ratings yet

- Graham3e ppt07Document31 pagesGraham3e ppt07Lim Yu ChengNo ratings yet

- Thursday, December 06, 2012 2:27 PM: Portfolio Management Page 1Document2 pagesThursday, December 06, 2012 2:27 PM: Portfolio Management Page 1passionmarketNo ratings yet

- Risk, Return, and Security Market LineDocument15 pagesRisk, Return, and Security Market LineMSA-ACCA100% (2)

- CAPM TheoryDocument11 pagesCAPM TheoryNishakdasNo ratings yet

- Portfolio Performance Measures GuideDocument12 pagesPortfolio Performance Measures GuideChristopher KipsangNo ratings yet

- 8.3 NeweloDocument6 pages8.3 NeweloOlwen IrawanNo ratings yet

- EC3333 NotesDocument25 pagesEC3333 Notesxqhuang99No ratings yet

- Mutual Fund Performance Risk-to-Return: Your Complete Guide To Investing in Mutual FundsDocument3 pagesMutual Fund Performance Risk-to-Return: Your Complete Guide To Investing in Mutual FundsSiddhartha RoyNo ratings yet

- FinalrisknreturnDocument86 pagesFinalrisknreturnpriya nNo ratings yet

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990No ratings yet

- FINC1302 - Risk & Return Formulae PDFDocument11 pagesFINC1302 - Risk & Return Formulae PDFfaqehaNo ratings yet

- Unit5 SapmDocument4 pagesUnit5 SapmBhaskaran BalamuraliNo ratings yet

- Portfolio ManagementDocument6 pagesPortfolio ManagementAbhijit SinghNo ratings yet

- Standard Deviation and VarianceDocument2 pagesStandard Deviation and VarianceJOshua VillaruzNo ratings yet

- Risk and Returns AnalysisDocument40 pagesRisk and Returns AnalysisNikkiAndreaCarononganGuicoNo ratings yet

- Lecture Notes On Risks and ReturnsDocument20 pagesLecture Notes On Risks and ReturnsAngelica AllanicNo ratings yet

- Chapter 8 Risk and Rates of ReturnDocument32 pagesChapter 8 Risk and Rates of ReturnHammad KamranNo ratings yet

- Understanding Hedge Fund Performance (3)_compressedDocument9 pagesUnderstanding Hedge Fund Performance (3)_compressedAbhinav AgrawalNo ratings yet

- Risk - ReturnDocument20 pagesRisk - ReturnAli SallamNo ratings yet

- Single Index ModelDocument4 pagesSingle Index ModelNikita Mehta DesaiNo ratings yet

- Investments Chapter 5Document11 pagesInvestments Chapter 5b00812473No ratings yet

- Capm 2Document39 pagesCapm 2rocky bayasNo ratings yet

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument35 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition ZutterThomasStoutqpoa100% (40)

- BE Sols - FM14e - SM - Ch06Document34 pagesBE Sols - FM14e - SM - Ch06Rishabh SharmaNo ratings yet

- Portfolio Management 1Document28 pagesPortfolio Management 1Sattar Md AbdusNo ratings yet

- Risk and Return SolDocument34 pagesRisk and Return SolAyesha Bareen.No ratings yet

- Chap 3 TCFDocument20 pagesChap 3 TCFMuhammad Umer SaigolNo ratings yet

- Risk and ReturnDocument10 pagesRisk and ReturnMJ BotorNo ratings yet

- Top Risk-Adjusted Return Ratios for Fund PerformanceDocument15 pagesTop Risk-Adjusted Return Ratios for Fund PerformancevenugopalNo ratings yet

- Treynor Performance MeasureDocument8 pagesTreynor Performance MeasureAshadur Rahman JahedNo ratings yet

- Portfolio TheoryDocument10 pagesPortfolio TheorysingarajusarathNo ratings yet

- Week 4 Lecture PDFDocument69 pagesWeek 4 Lecture PDFAkshat TiwariNo ratings yet

- 08-Regulations Governing Business Trip A..ty - Higher School of EconomicsDocument13 pages08-Regulations Governing Business Trip A..ty - Higher School of EconomicsCha Icha NathaNo ratings yet

- Vinamilk'SCMDocument63 pagesVinamilk'SCMTrinh Hai AnhNo ratings yet

- Pile cp13Document73 pagesPile cp13casarokar100% (1)

- Global IME BankDocument29 pagesGlobal IME BankSujan Bajracharya100% (2)

- ContractsDocument11 pagesContractsAtulNo ratings yet

- MoaDocument11 pagesMoaanon-798485100% (1)

- Pay FixationDocument4 pagesPay FixationMayank PrakashNo ratings yet

- Matrix of Acp CPG and Separation of PropertyDocument7 pagesMatrix of Acp CPG and Separation of PropertyDenver Dela Cruz PadrigoNo ratings yet

- BillDocument1 pageBillreetakamboj278No ratings yet

- Yanis Varoufakis - A Letter To My Daughter About The Black Magic of BankingDocument8 pagesYanis Varoufakis - A Letter To My Daughter About The Black Magic of BankingSasko MateskiNo ratings yet

- Customers' perception of insuranceDocument48 pagesCustomers' perception of insuranceYogendraNo ratings yet

- CV1 Maclene Andrade 61920681Document1 pageCV1 Maclene Andrade 61920681Harmandeep singhNo ratings yet

- A Young Mortgage Fraud Letter 10092013Document31 pagesA Young Mortgage Fraud Letter 10092013mikekvolpe50% (2)

- Financial Markets and Institutions SyllabusDocument4 pagesFinancial Markets and Institutions SyllabusLilyNo ratings yet

- Paid By/Date: Processed By/DateDocument3 pagesPaid By/Date: Processed By/DateLim MakaraNo ratings yet

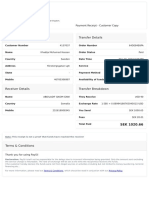

- Sender Details Transfer Details: Payment Receipt - CustomerDocument1 pageSender Details Transfer Details: Payment Receipt - CustomerAbshira Abdi AliNo ratings yet

- Complete Freedom: Statement of AccountDocument5 pagesComplete Freedom: Statement of AccountWenjie6567% (3)

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDocument12 pagesJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesNo ratings yet

- Pre-Approved Xpress Credit LoanDocument1 pagePre-Approved Xpress Credit LoanArjunNo ratings yet

- 1213 16 SI OG Communidade CodeDocument237 pages1213 16 SI OG Communidade CodeFrederick NoronhaNo ratings yet

- Company Name ChangeDocument145 pagesCompany Name Changesan_lookNo ratings yet

- PNB Metlife BbaDocument53 pagesPNB Metlife BbaAJAYNo ratings yet

- Economic Value AddedDocument9 pagesEconomic Value AddedLimisha ViswanathanNo ratings yet

- Comprehensive Candlestick Patterns Trading GuideDocument17 pagesComprehensive Candlestick Patterns Trading GuideaaryinfoNo ratings yet

- Exercises on Utility Functions, Risk Aversion, and Portfolio ChoiceDocument22 pagesExercises on Utility Functions, Risk Aversion, and Portfolio ChoicemattNo ratings yet

- LSPU College of Business, Management and Accountancy final examDocument3 pagesLSPU College of Business, Management and Accountancy final examRosejane EM100% (1)

- Florida LLC Operating Agreement TemplateDocument16 pagesFlorida LLC Operating Agreement TemplateCarol100% (2)

- Test Banks and Solutions For $28.99-$33Document17 pagesTest Banks and Solutions For $28.99-$33Solutions BooksNo ratings yet

- Disneyland, Hong KongDocument4 pagesDisneyland, Hong KongAbhipsa MallickNo ratings yet

- Zavyalova EkaterinaDocument82 pagesZavyalova EkaterinaPrashant SinghNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Streetsmart Financial Basics for Nonprofit Managers: 4th EditionFrom EverandStreetsmart Financial Basics for Nonprofit Managers: 4th EditionRating: 3.5 out of 5 stars3.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)