Professional Documents

Culture Documents

Sap Payroll Schema Components

Uploaded by

sushil kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sap Payroll Schema Components

Uploaded by

sushil kumarCopyright:

Available Formats

ndia Specific Bonus Calculations (HINCBON0)

Purpose

This function enables the calculation of employee bonus. This is a non-statutory report, which

you can run for the payment of bonus.

Using the report, you can also compute bonus for ex-employees.

Requirements

You must maintain the Organizational Assignment Infotype (0001), Planned Working Time

Infotype (0007) and Basic Pay Infotype (0008).

You must maintain the Evaluation Class 10 for all wage types, which constitute in the Monthly

Basis Salary for Bonus calculation prior to the Bonus run.

Payment wage type should be eligible for Additional Payments Infotype (0015) or One-Time

Payments Off-Cycle Infotype (0267) or both.

Features

This report calculates the bonus payable to an employee and generates a batch session.

Running the batch session updates the Additional Payments Infotype (0015) or One-Time

Payments Off-Cycle Infotype (0267) or both.

Selection

You can restrict the employees selected to an individual, or a range of:

Personnel number

Personnel area, Subarea

Employee group or subgroup

Payroll area

The bonus calculation can be configured by:

Bonus calculation period

Basis salary for bonus, which can be an Annual Basis Salary, or a Monthly Basis Salary.

Annual Basis Salary - The salary basis for bonus includes the wage types that you have entered

in the Wage Type field. The report displays the Wage Type field only when you select the Annual

Salary Basis option. Bonus computations are typically performed as per the Payment of Bonus

Act (POBA). You however, have the option of also computing bonus in excess of the amount

computed using POBA. Also, you can specify a maximum monthly basis amount to be

considered while calculating the bonus.

Monthly Basis Salary - The salary basis for bonus includes all the wage types that exist in the

Basic Pay Infotype (0008) on the specified Date of Basic salary, and having the Evaluation Class

10, Specification 1.

Factor to calculate Bonus

For Annual Basis Salary computations, you must specify the factor as a percentage, and the

report computes the bonus as a percentage of the annual basis.

For Monthly Basis Salary, you must specify the factor as number of months, and the report will

compute the bonus in multiples of the monthly basis salary.

The payment information can be configured by:

Wage type for storing the bonus amount in Additional Payments Infotype (0015), One-Time

Payments Off-Cycle Infotype (0267) or both, depending on the type of payroll run. You can select

the wage type in the Wage type for IT0015/IT0267 field.

Reason for bonus

You might also like

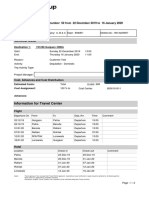

- Trip No. 567 PR03 Status After 1st ApprovalDocument3 pagesTrip No. 567 PR03 Status After 1st Approvalsushil kumarNo ratings yet

- Step-Wise Leave EncashmentDocument7 pagesStep-Wise Leave Encashmentsushil kumarNo ratings yet

- Trip No. 568, B1 City, 5B-Grade WBS With AdvanceDocument5 pagesTrip No. 568, B1 City, 5B-Grade WBS With Advancesushil kumarNo ratings yet

- LSMW TemplateDocument9 pagesLSMW Templatesushil kumarNo ratings yet

- Time Recording: - Recording of Clock in or Clock Out or Number of WorkingDocument2 pagesTime Recording: - Recording of Clock in or Clock Out or Number of Workingsushil kumarNo ratings yet

- Advantages of Time Management: Quota Driven AbsencesDocument6 pagesAdvantages of Time Management: Quota Driven Absencessushil kumarNo ratings yet

- HR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial ScreenDocument4 pagesHR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial Screensushil kumarNo ratings yet

- New Microsoft Word DocumentMMMKHBXHDocument1 pageNew Microsoft Word DocumentMMMKHBXHsushil kumarNo ratings yet

- DFGHJKLDFGHJMDocument1 pageDFGHJKLDFGHJMsushil kumarNo ratings yet

- TM - Absence - Absence Catalog - Define Absence Type - New EntryDocument3 pagesTM - Absence - Absence Catalog - Define Absence Type - New Entrysushil kumarNo ratings yet

- A.Holiday Calendars and Work Schedules: Feature SCHKZDocument5 pagesA.Holiday Calendars and Work Schedules: Feature SCHKZsushil kumarNo ratings yet

- Payroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of MetadataDocument22 pagesPayroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of Metadatasushil kumarNo ratings yet

- Travel Request: General DataDocument2 pagesTravel Request: General Datasushil kumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758Document5 pagesSem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758hussain shahidNo ratings yet

- Corporate Social Responsibility As An Employee Governance Tool: Evidence From A Quasi-ExperimentDocument21 pagesCorporate Social Responsibility As An Employee Governance Tool: Evidence From A Quasi-ExperimentSimonNo ratings yet

- Fund Fact Sheets - Prosperity Equity FundDocument1 pageFund Fact Sheets - Prosperity Equity FundJohh-RevNo ratings yet

- Student Loan Forgiveness For Frontline Health WorkersDocument20 pagesStudent Loan Forgiveness For Frontline Health WorkersKyle SpinnerNo ratings yet

- Fintech Report 2019Document28 pagesFintech Report 2019Nadeem KhanNo ratings yet

- 1.1 Spartan QuestionDocument1 page1.1 Spartan QuestionMohammed Akhtab Ul HudaNo ratings yet

- Loans WebquestDocument3 pagesLoans Webquestapi-288395960No ratings yet

- Dragline or Truck/Shovel? Some Technical and Business ConsiderationsDocument7 pagesDragline or Truck/Shovel? Some Technical and Business ConsiderationsKevin Satrio AdigunaNo ratings yet

- Final Draft Constitution and By-Laws January, 2011Document9 pagesFinal Draft Constitution and By-Laws January, 2011Hazel Torres BadayosNo ratings yet

- Major Assignment - FM303 PDFDocument5 pagesMajor Assignment - FM303 PDFfrancisNo ratings yet

- Week 5Document19 pagesWeek 5Darryl GoodwinNo ratings yet

- AshianaDocument43 pagesAshianaPraveen YampallaNo ratings yet

- A. Bank Rate PolicyDocument4 pagesA. Bank Rate PolicySIMRAN SHOKEENNo ratings yet

- Donor's Tax: Answer: DDocument6 pagesDonor's Tax: Answer: DAngela Miles DizonNo ratings yet

- Last Will and Testament: - 1. RecitalDocument4 pagesLast Will and Testament: - 1. RecitalSalomeNo ratings yet

- Agriculture Industrial SurveyDocument52 pagesAgriculture Industrial SurveyanburishiNo ratings yet

- Insider Trading at LordstownDocument8 pagesInsider Trading at LordstownKirk HartleyNo ratings yet

- Question and AnswersDocument13 pagesQuestion and AnswersBeebee ZainabNo ratings yet

- JP Morgan - Indonesia Coal Mining 2011Document39 pagesJP Morgan - Indonesia Coal Mining 2011KJPP ASRNo ratings yet

- Cashbook Tracking DivisionDocument61 pagesCashbook Tracking DivisionPatrick NdunguNo ratings yet

- Introduction To Financial ReportingDocument2 pagesIntroduction To Financial ReportingMariel DiazNo ratings yet

- Wealth-Insight - May 2021Document66 pagesWealth-Insight - May 2021vnmasterNo ratings yet

- 1india Top 100 CompaniesDocument10 pages1india Top 100 CompaniesfamtaluNo ratings yet

- Chapter 5Document2 pagesChapter 5Ynna RaymondNo ratings yet

- Working Capital Estimation ProblemsDocument3 pagesWorking Capital Estimation ProblemsBunny MathaiNo ratings yet

- Ds 3316063110100820221665188750035Document3 pagesDs 3316063110100820221665188750035rey lunaNo ratings yet

- 10 Steps To Start A Primary SchoolDocument10 pages10 Steps To Start A Primary SchoolShankar Jha0% (1)

- eDocumentFile 2Document2 pageseDocumentFile 29z8925bxm8No ratings yet

- Overpriced Jeans, Inc. - Transactions - Additional InformationDocument11 pagesOverpriced Jeans, Inc. - Transactions - Additional InformationKeshav TayalNo ratings yet

- Checklist of Requirements For The BacDocument3 pagesChecklist of Requirements For The BacSan Blas PaoayNo ratings yet