Professional Documents

Culture Documents

Court upholds wharfage dues on flour mill exports

Uploaded by

Mae Clare D. BendoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Court upholds wharfage dues on flour mill exports

Uploaded by

Mae Clare D. BendoCopyright:

Available Formats

REPUBLIC FLOUR MILLS INC,.

VS

THE COMMISSIONER OF CUSTOMS & THE COURT OF TAX APPEALS

G.R. NO. 28463 May 31, 1971

DOCTRINE:

Verba Legis- when the law is clear and free of doubt, there is no room for interpretation and

construction. There could only be for application.

FACTS:

Petitioner, Republic Flour Mills, Inc., is a domestic corporation, primarily engaged in the

manufacture of wheat flour, and produces pollard (darak) and bran (ipa) in the process of

milling. From December, 1963 to July, 1964, petitioner exported pollard and/or bran abroad.

The respondent assessed the petitioner by way of wharfage dues on the said exportations in

the sum of P7,948.00, which was paid by petitioner under protest."

Petitioner contended that “products of the Philippines” found in Sec. 2802 of the Tariff &

Custom Code excludes pollard & bran on the ground that they are merely waste & not products

which is the flour produced.

ISSUE:

Whether or not “product of the Philippines” of Sec. 2802 excludes pollard & bran, thus

collection of wharfage dues was in accordance with the law.

RULING:

No. “Product of the Philippines” of Sec. 2802 does not exclude pollard & bran, thus collection of

wharfage dues is in accordance with the law.

The language of Section 2802 appears to be quite explicit: "There shall be levied, collected and

paid on all articles imported or brought into the Philippines, and on products of the Philippines

... exported from the Philippines, a charge of two pesos per gross metric ton as a fee for

wharfage ...." One category refers to what is imported. The other mentions products of the

Philippines that are exported. Even without undue scrutiny, it does appear quite obvious that as

long as the goods are produced in the country, they fall within the terms of the above section.

Petitioner appeared to have entertained such a nation. In its petition for review before

respondent Court, it categorically asserted: "Petitioner is primarily engaged in the manufacture

of flour from wheat grain. In the process of milling the wheat grain into flour, petitioner also

produces 'bran' and 'pollard' which it exports abroad." It does take a certain amount of hair-

splitting to exclude from its operation what petitioner calls "waste" resulting from the

production of flour processed from the wheat grain in petitioner's flour mills in the Philippines.

It is always timely to remember that, as stressed by Justice Moreland: "The first and

fundamental duty of courts, in our judgment, is to apply the law. Construction and

interpretation come only after it has been demonstrated that application is impossible or

inadequate without them." Petitioner ought to have been aware that deference to such a

doctrine precludes an affirmative response to its contention. The law is clear; it must be

obeyed. It is as simple, as that.

You might also like

- Angat River Irrigation System Vs Angat Worker's UnionDocument1 pageAngat River Irrigation System Vs Angat Worker's UnionColeen Navarro-RasmussenNo ratings yet

- Homeowners' Association of The Philippines, Inc. and Vicente A. Rufino v. The Municipal Board of The City of Manila Et Al. (KATRINA)Document1 pageHomeowners' Association of The Philippines, Inc. and Vicente A. Rufino v. The Municipal Board of The City of Manila Et Al. (KATRINA)Carissa CruzNo ratings yet

- GR No. L-21064 JM Tuason & Co., Inc., v. Land Tenure AdministrationDocument3 pagesGR No. L-21064 JM Tuason & Co., Inc., v. Land Tenure AdministrationJCNo ratings yet

- 10 Torres Vs YuDocument13 pages10 Torres Vs YuJamie VodNo ratings yet

- Eb Villarosa vs. Benito: SC Rules No Jurisdiction Due to Improper Service of SummonsDocument3 pagesEb Villarosa vs. Benito: SC Rules No Jurisdiction Due to Improper Service of SummonsJonathan Dela CruzNo ratings yet

- BCDA v. COA, 580 SCRA 295 (2009)Document1 pageBCDA v. COA, 580 SCRA 295 (2009)Sand FajutagNo ratings yet

- 4 - Sema Vs ComelecDocument3 pages4 - Sema Vs ComelecTew BaquialNo ratings yet

- NACOCO Not a Government EntityDocument1 pageNACOCO Not a Government EntityHenteLAWcoNo ratings yet

- Alyansa Vs ErcDocument44 pagesAlyansa Vs ErcrichardgomezNo ratings yet

- De Villa vs. Court of AppealsDocument1 pageDe Villa vs. Court of AppealsValerie Aileen AnceroNo ratings yet

- Marcos Vs ManglapusDocument8 pagesMarcos Vs ManglapusLena BeeNo ratings yet

- Ang Bagong Bayani-OFW Labor Party vs. COMELEC (Case Digest)Document1 pageAng Bagong Bayani-OFW Labor Party vs. COMELEC (Case Digest)Marionnie SabadoNo ratings yet

- Tan V Gal 43 SCRA 677, Feb29'72Document1 pageTan V Gal 43 SCRA 677, Feb29'72BudoyNo ratings yet

- Mariano vs. People, G.R. No. 224102Document10 pagesMariano vs. People, G.R. No. 224102Hendrix TilloNo ratings yet

- PHHC v. CIR Case DigestDocument3 pagesPHHC v. CIR Case DigestNocQuisaotNo ratings yet

- Arnault Vs BalagtasDocument3 pagesArnault Vs BalagtasRoberts SamNo ratings yet

- Macalintal Vs PETDocument4 pagesMacalintal Vs PETMarkNo ratings yet

- Dela Cruz Vs COA and Funa vs. Agra Case DigestsDocument3 pagesDela Cruz Vs COA and Funa vs. Agra Case DigestsGuinevere RaymundoNo ratings yet

- SC upholds constitutionality of Act regulating alien retail businessDocument2 pagesSC upholds constitutionality of Act regulating alien retail businessKrizzaShayneRamosArqueroNo ratings yet

- LTO Et Al. vs. Gutierrez (GR No. 224395, July 3, 2017)Document6 pagesLTO Et Al. vs. Gutierrez (GR No. 224395, July 3, 2017)Brye ChiNo ratings yet

- 51 GSIS v. City Assessor of IloiloDocument3 pages51 GSIS v. City Assessor of IloiloDon King MamacNo ratings yet

- Endencia V DavidDocument2 pagesEndencia V DavidMarius RodriguezNo ratings yet

- Nazareth v. Villar, G.R. No. 188635, January 29, 2013Document2 pagesNazareth v. Villar, G.R. No. 188635, January 29, 2013riii100% (1)

- Fortun v. MacapagalDocument3 pagesFortun v. MacapagalAli NamlaNo ratings yet

- 12-Jovito Salonga vs. Rolando Hermoso DigestDocument1 page12-Jovito Salonga vs. Rolando Hermoso DigestloschudentNo ratings yet

- Case Digest - Funa Vs ErmitaDocument3 pagesCase Digest - Funa Vs ErmitaHezro Inciso CaandoyNo ratings yet

- PCA v. Mathay DigestDocument1 pagePCA v. Mathay DigestLIERANo ratings yet

- US vs. Navarro PDFDocument11 pagesUS vs. Navarro PDFDave UmeranNo ratings yet

- G.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsDocument8 pagesG.R. No. 93833-September 28, 1995 - Ramirez Vs Court of AppealsKaren BandillaNo ratings yet

- G.R. No. 161434Document1 pageG.R. No. 161434REGINNS JUMILLANo ratings yet

- DeFunis V OdegaardDocument1 pageDeFunis V OdegaardRochelle AyadNo ratings yet

- StatconDocument299 pagesStatconruben diwasNo ratings yet

- Voters' rights in highly urbanized and component citiesDocument3 pagesVoters' rights in highly urbanized and component citiesJude FanilaNo ratings yet

- Supreme Court Rules on Constitutionality of Bar Exam Passing Scores ActDocument7 pagesSupreme Court Rules on Constitutionality of Bar Exam Passing Scores ActEnna Jane VillarinaNo ratings yet

- Sec. 15 Midnight AppointmentsDocument3 pagesSec. 15 Midnight AppointmentsDawn Jessa GoNo ratings yet

- Manila Jockey Club v. Games and Amusement Board 107 Phil. 151 1960 Dado Arthur Jhon A.Document1 pageManila Jockey Club v. Games and Amusement Board 107 Phil. 151 1960 Dado Arthur Jhon A.Mike TeeNo ratings yet

- Legal and Judicial Ethics (Agpalo) Chapter 8Document3 pagesLegal and Judicial Ethics (Agpalo) Chapter 8MarrielDeTorresNo ratings yet

- Philcomsat Vs SenateDocument1 pagePhilcomsat Vs SenateJebellePuracanNo ratings yet

- Francisco, Jr. vs. Nagmamalasakit Na Mga Manananggol NG Mga Manggagawang Pilipino, Inc.Document139 pagesFrancisco, Jr. vs. Nagmamalasakit Na Mga Manananggol NG Mga Manggagawang Pilipino, Inc.audreyracelaNo ratings yet

- Bulacan v. Torcino (Digest, Legal Ethics)Document2 pagesBulacan v. Torcino (Digest, Legal Ethics)Nina ConcepcionNo ratings yet

- Lopez Vs CA CaseeeeeDocument5 pagesLopez Vs CA CaseeeeeMark Kevin MartinNo ratings yet

- Supreme Court Rules on Selection of Sectoral RepresentativesDocument10 pagesSupreme Court Rules on Selection of Sectoral Representativesmcris10150% (2)

- 248 SCRA 511 Amatan Vs AujeroDocument8 pages248 SCRA 511 Amatan Vs Aujerobrecht19800% (1)

- Meyer v. Nebraska Case DigestDocument2 pagesMeyer v. Nebraska Case DigestAshreabai Kam SinarimboNo ratings yet

- Gumaua Vs ESPINODocument3 pagesGumaua Vs ESPINOYeshua TuraNo ratings yet

- Del Castillo v. PeopleDocument2 pagesDel Castillo v. PeopleWinter WoodsNo ratings yet

- Francisco v. House of Representatives, G.R. No. 160261, November 10, 2003Document2 pagesFrancisco v. House of Representatives, G.R. No. 160261, November 10, 2003Cris Angelo AndradeNo ratings yet

- Stare DecisisDocument6 pagesStare DecisisJackRio009No ratings yet

- SANLAKAS v. Executive Secretary DIGESTDocument1 pageSANLAKAS v. Executive Secretary DIGESTKim VNo ratings yet

- Teotimo Rodriguez Tio Tiam vs. RepublicDocument4 pagesTeotimo Rodriguez Tio Tiam vs. RepublicAnne Kerstine BastinenNo ratings yet

- Case Digest STATCONDocument6 pagesCase Digest STATCONLegal Division DPWH Region 6No ratings yet

- Espiritu vs. Cipriano (55 SCRA 533) Case DigestDocument1 pageEspiritu vs. Cipriano (55 SCRA 533) Case DigestCamelle Escaro100% (1)

- REPUBLIC FLOUR MILLS INC Vs Commissioner of Customs TarrayoDocument1 pageREPUBLIC FLOUR MILLS INC Vs Commissioner of Customs TarrayoMae Clare D. BendoNo ratings yet

- Republic Flour Mills V CustomsDocument4 pagesRepublic Flour Mills V CustomsJem LicanoNo ratings yet

- Republic Flour Mills V CustomsDocument3 pagesRepublic Flour Mills V CustomsJem LicanoNo ratings yet

- Republic Flour Mills Disputes Wharfage Dues on Bran and Pollard ExportsDocument4 pagesRepublic Flour Mills Disputes Wharfage Dues on Bran and Pollard ExportsDonnell ConstantinoNo ratings yet

- 17) Republic Flour Mills, Inc. Vs The Commissioner of Customs and The Court of Tax Appeals - Full TextDocument4 pages17) Republic Flour Mills, Inc. Vs The Commissioner of Customs and The Court of Tax Appeals - Full TextJane MaribojoNo ratings yet

- Part 2 CO VII. Limitation On The Power To ConstrueDocument96 pagesPart 2 CO VII. Limitation On The Power To Construemaria katherine delosendoNo ratings yet

- Full Case: Supreme CourtDocument6 pagesFull Case: Supreme CourtJoseph LawaganNo ratings yet

- Republic Flour Mill V CocDocument2 pagesRepublic Flour Mill V CocRich ReyesNo ratings yet

- Insights and Next Steps/Ways ForwardDocument2 pagesInsights and Next Steps/Ways ForwardMae Clare D. BendoNo ratings yet

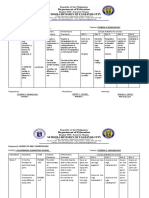

- Budget of MELC Competencies for Villahermosa Elementary SchoolDocument7 pagesBudget of MELC Competencies for Villahermosa Elementary SchoolMae Clare D. BendoNo ratings yet

- Alamode Garments v NLCR: Due process violation in employee dismissalDocument2 pagesAlamode Garments v NLCR: Due process violation in employee dismissalMae Clare D. BendoNo ratings yet

- Enclosure 1.budget of Melc CompetenciesDocument1 pageEnclosure 1.budget of Melc CompetenciesMae Clare D. BendoNo ratings yet

- Sales (De Leon)Document737 pagesSales (De Leon)Bj Carido100% (7)

- Floresca Vs PhilexDocument2 pagesFloresca Vs PhilexMae Clare D. BendoNo ratings yet

- Budget of MELC Competencies for Villahermosa Elementary SchoolDocument7 pagesBudget of MELC Competencies for Villahermosa Elementary SchoolMae Clare D. BendoNo ratings yet

- Philippine Judges Assn. v. Prado (227 SCRA 703)Document9 pagesPhilippine Judges Assn. v. Prado (227 SCRA 703)Jomarc MalicdemNo ratings yet

- Secretary of Justice Vs ComelecDocument4 pagesSecretary of Justice Vs ComelecMa Irish BethNo ratings yet

- Hagonoy-Vs-Nlrc-SingzonDocument2 pagesHagonoy-Vs-Nlrc-SingzonChristopher AdvinculaNo ratings yet

- MARY GRACE NATIVIDAD S. POE-LLAMANZARES Vs ComelecDocument2 pagesMARY GRACE NATIVIDAD S. POE-LLAMANZARES Vs ComelecMae Clare D. Bendo100% (5)

- Galman V Pamaran - SARIODocument1 pageGalman V Pamaran - SARIOChristopher AdvinculaNo ratings yet

- Three Readings Requirement for BillsDocument1 pageThree Readings Requirement for BillsMae Clare D. Bendo100% (2)

- National Power Corporation V Province of Lanao Del NorteDocument2 pagesNational Power Corporation V Province of Lanao Del NorteMae Clare D. BendoNo ratings yet

- 19A. Lloyd v. Tanner Case DigestDocument1 page19A. Lloyd v. Tanner Case DigestMae Clare D. BendoNo ratings yet

- Tanada VS AngaraDocument2 pagesTanada VS AngaraMae Clare D. BendoNo ratings yet

- Lagman v. MediaDocument7 pagesLagman v. MediaMae Clare D. BendoNo ratings yet

- 18A. David v. Macapagal ArroyoDocument1 page18A. David v. Macapagal ArroyoMae Clare D. BendoNo ratings yet

- 9A. Nograles v. People Case DigestDocument2 pages9A. Nograles v. People Case DigestMae Clare D. Bendo100% (1)

- KOR v. DMCI-PDI Stat Con DigestDocument1 pageKOR v. DMCI-PDI Stat Con DigestMae Clare D. BendoNo ratings yet

- 17A. PERCIVAL MODAY Vs COURT OF APPEALS Case DigestDocument2 pages17A. PERCIVAL MODAY Vs COURT OF APPEALS Case DigestMae Clare D. BendoNo ratings yet

- 2B. Caballes v. CA DigestedDocument1 page2B. Caballes v. CA DigestedMae Clare D. BendoNo ratings yet

- Ladlad v. ComelecDocument3 pagesLadlad v. ComelecCon PuNo ratings yet

- OSG v. Ayala Land ruling on parking feesDocument3 pagesOSG v. Ayala Land ruling on parking feesAbby PerezNo ratings yet

- CHAVEZ VS GONZALES - Case DigestsDocument7 pagesCHAVEZ VS GONZALES - Case DigestsJosine ProtasioNo ratings yet

- People v. LabtanDocument19 pagesPeople v. LabtanMae Clare D. BendoNo ratings yet

- OSG v. Ayala Land ruling on parking feesDocument3 pagesOSG v. Ayala Land ruling on parking feesAbby PerezNo ratings yet

- People v. Marra Case DigestDocument2 pagesPeople v. Marra Case DigestMae Clare D. BendoNo ratings yet

- Buck Vs BellDocument3 pagesBuck Vs BellshezeharadeyahoocomNo ratings yet

- People v. LabtanDocument19 pagesPeople v. LabtanMae Clare D. BendoNo ratings yet

- Boquiren V Del Rosario-CruzDocument2 pagesBoquiren V Del Rosario-CruzMp CasNo ratings yet

- CFD Social Media PolicyDocument3 pagesCFD Social Media PolicyJamesNo ratings yet

- Angelita Simundac-Keppel vs. Georg KeppelDocument4 pagesAngelita Simundac-Keppel vs. Georg KeppelErxha LadoNo ratings yet

- 5 Utilitarianism: Jeremy Bentham and Classical Utilitarian Theory: Utilitarianism As Quantitative HedonismDocument17 pages5 Utilitarianism: Jeremy Bentham and Classical Utilitarian Theory: Utilitarianism As Quantitative HedonismHa LoNo ratings yet

- The Stickup Kids Reflection Essay Cjs 350Document3 pagesThe Stickup Kids Reflection Essay Cjs 350api-329222613No ratings yet

- Winding Up AssignmentDocument4 pagesWinding Up AssignmentHaroonĦammadiNo ratings yet

- R. v. Pierce, 2018 NUCJ 16Document11 pagesR. v. Pierce, 2018 NUCJ 16NunatsiaqNewsNo ratings yet

- United States v. Vaughn, 4th Cir. (2007)Document6 pagesUnited States v. Vaughn, 4th Cir. (2007)Scribd Government DocsNo ratings yet

- 02 GR 198783Document4 pages02 GR 198783Mabelle ArellanoNo ratings yet

- Family Courts Cases ReferenceDocument42 pagesFamily Courts Cases ReferenceJoel A. YbañezNo ratings yet

- Law Relating To Arbitration and CociliationDocument6 pagesLaw Relating To Arbitration and CociliationAlo DuttNo ratings yet

- The Criminal Justice System in SpainDocument87 pagesThe Criminal Justice System in SpainMargarita Osborn BeltNo ratings yet

- 23 Abejaron Vs CADocument2 pages23 Abejaron Vs CAmelfabianNo ratings yet

- Romualdez Vs Civil Service CommissionDocument1 pageRomualdez Vs Civil Service CommissionFrancis Gillean OrpillaNo ratings yet

- MANSOUR Et Al v. FACTORY DIRECT OF SECAUCUS, LLCDocument20 pagesMANSOUR Et Al v. FACTORY DIRECT OF SECAUCUS, LLCTim PeacockNo ratings yet

- 3 Costi DigestDocument3 pages3 Costi DigestMonica SalvadorNo ratings yet

- Conflict of Law - CoquiaDocument111 pagesConflict of Law - CoquiaMarco Rvs100% (4)

- CompilationDocument7 pagesCompilationShiela BrownNo ratings yet

- Diño Vs JardinesDocument2 pagesDiño Vs JardinesMilesNo ratings yet

- Limkaichong v. COMELECDocument2 pagesLimkaichong v. COMELECAnsai Claudine CaluganNo ratings yet

- A.barak, "Begin and The Rule of Law", (2005) Vol.10 (3) The Right in IsraelDocument29 pagesA.barak, "Begin and The Rule of Law", (2005) Vol.10 (3) The Right in IsraelMaa ANo ratings yet

- Partition of Estate Denied Due to Lack of Filiation RecognitionDocument2 pagesPartition of Estate Denied Due to Lack of Filiation RecognitionabbyNo ratings yet

- Jurisprudence of Paternity and FiliationDocument56 pagesJurisprudence of Paternity and FiliationMary Ann Celeste LeuterioNo ratings yet

- Surrogate Parenting AgreementDocument10 pagesSurrogate Parenting Agreementsujith suryaNo ratings yet

- Lister v Hesley Hall establishes close connection testDocument3 pagesLister v Hesley Hall establishes close connection testKenneth Azagesenongo Aputara100% (1)

- Alabang Development Corporation Vs Alabang Hills VillageDocument3 pagesAlabang Development Corporation Vs Alabang Hills VillageNath AntonioNo ratings yet

- Sample Legal FormsDocument22 pagesSample Legal Formsmabzkie100% (1)

- Example Legal Notice & DemandDocument12 pagesExample Legal Notice & DemandDianaBaumgartner94% (17)

- Loria v. Muñoz, Jr.Document2 pagesLoria v. Muñoz, Jr.Derick Torres100% (10)

- Bank of Philippine Islands Tax Collection CaseDocument1 pageBank of Philippine Islands Tax Collection CaseRaquel DoqueniaNo ratings yet