Professional Documents

Culture Documents

Form PDF

Uploaded by

Kanha SatyaranjanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form PDF

Uploaded by

Kanha SatyaranjanCopyright:

Available Formats

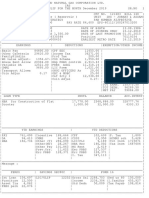

OIL AND NATURAL GAS CORPORATION LTD.

JORHAT

PAY SLIP FOR THE MONTH September 2019 SR.NO 1

______________________________________________________________________________

| NAME SATYARANJAN TRIPATHY CPF NO. 134344 BILL 006 |

| DESGN Geologist UNIT JORHAT SPECIALIST GR|

| POSITION JOR SPL GP-COORDINATION E PAN NUMBER ATZPT9066D |

| PAYSCALE 60,000 - 180,000 PAY RATE 63,660 EPS- |

|______________________________________________________________________________|

| ERC-EPS 0.00 DATE OF BIRTH 09.05.1995 |

| ERC-PRBS 10733.10 DATE OF JOINING ONGC 10.08.2017 |

| ERC-CPF 8,586.00 ERC-CSSS 1,550.00 DATE OF LAST PROMOTION 10.08.2017 |

| BANK ACCOUNT NO. 7530032456836630 Position 70048558 |

| Org. Key JORD150002919 EARLIEST RETRO DATE 10.08.2017 |

|______________________________________________________________________________|

| EARNINGS | DEDUCTIONS |EXEMPTION/OTHER INCOME|

|______________________________________________________________________________|

|Basic Pay 63660.00 |CPF EEC 8586.00 | |

|Other Cafeteria 12732.00 |Income Tax 20035.00 | |

|LFA Allowance-Ca 9549.00 |Prof Tax 208.00 | |

|Cafeteria Adj-BP 435.69-|Emplyr paid ITax 871.37-| |

|FamilyPlAdjin |CSS Scheme 1,550.00 | |

|House Rent Allow 10185.60 |Emp PRBS contrib 2,146.62 | |

|Variable DA 7894.00 |PRBS Addl 11,318.14 | |

|CMRE 8794.00 |ONGC OFFICERS As 20.00 | |

|Transport Allowa |Bachelor Accom 500.00 | |

|NE Allow 6366.00 |Misc.Rec(Liab) 600.00 | |

|Medical Reimb 26593.43 |Coin Adjus 0.26- | |

|Coin Adjus 0.21- | |----------------------|

| | |TOT EARN. 145338.13 |

| | |TOT DEDN. 44092.13 |

| | |NET PAY 101246.00 |

|______________________________________________________________________________|

| LOAN TYPE INSTL BALANCE ACC.INTRST|

|______________________________________________________________________________|

| |

| |

| |

| |

| |

| |

| |

| |

| |

|______________________________________________________________________________|

| YTD EARNINGS | YTD DEDUCTIONS |

|______________________________________________________________________________|

|PAY 381,960 |CMRE 42,337 |CPF 50,967 |P. Tax 1,248 |

|DA 42,780 |Other (T) 196,813 |CSSS 9,300 |Tot Incm 867,398 |

|HRA 61,113 |Other(NT) 10,800 |Eec PRBS 80,651 |Tax Incm 856,598 |

| |Other Pay 67,908 |Erc PRBS 63,711 | |

| |Prev.Yrs. 63,684 |I. Tax 114,772 | |

| |Erc PRBS 63,711 |ITax-HPadj 3,323 | |

| | | | |

| | | | |

| | | | |

|______________________________________________________________________________|

|Message : |

| |

|______________________________________________________________________________|

| PERKS | SAVINGS SEC80C | FORM 16 |

|______________________________________________________________________________|

|Furniture 1,594 | |Gross Sal 1570,639 |Ded us 80 150,000 |

|Bachelor 50,126 | |Income 1528,144 |I.Tax&Sur 234,981 |

| | |Std Dedn 40,000 |Tax Payab 120,209 |

| | | | |

| | | | |

|______________________________________________________________________________|

You might also like

- FormDocument2 pagesFormBhargav VekariaNo ratings yet

- Form PDFDocument1 pageForm PDFanby1No ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipHanish Meena100% (1)

- Pay Slip JunDocument1 pagePay Slip Junraj d100% (1)

- Get Payslip by Offset PDFDocument1 pageGet Payslip by Offset PDFanon_535796411100% (1)

- IBM Payslip April 2012Document1 pageIBM Payslip April 2012NARESH KESAVANNo ratings yet

- Form PDFDocument1 pageForm PDFChinmoyee SharmaNo ratings yet

- Startek Pay SlipDocument1 pageStartek Pay SlipShivam sharmaNo ratings yet

- 0039 BB 7441651750277Document1 page0039 BB 7441651750277subhaniNo ratings yet

- Payslip - 2021 03 29Document1 pagePayslip - 2021 03 29Loan LoanNo ratings yet

- Tax Invoice: This Is A Computer Generated Invoice. Signature and Stamp Are Not RequiredDocument1 pageTax Invoice: This Is A Computer Generated Invoice. Signature and Stamp Are Not Requiredsan sghNo ratings yet

- Tata Sky SampleDocument1 pageTata Sky SampleBhavani GujjariNo ratings yet

- PaySlip PDFDocument1 pagePaySlip PDFVamshi GoudNo ratings yet

- PaySlip - 09.2018Document1 pagePaySlip - 09.2018Indrajit ChitrukNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Received With Thanks ' 2,308.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 2,308.00 Through Payment Gateway Over The Internet FromKumara RagavendraNo ratings yet

- Statement of Account: State Bank of IndiaDocument9 pagesStatement of Account: State Bank of IndiaharishNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipanakinpowersNo ratings yet

- B1 48125378 PDFDocument2 pagesB1 48125378 PDFShashi0% (1)

- Fee ReceiptDocument1 pageFee ReceiptMansi PatelNo ratings yet

- Bill 10835410 ExcitelDocument1 pageBill 10835410 ExcitelAbhinav TiwariNo ratings yet

- Teamhgs 165148 Nov 2017 Payslip 165148Document1 pageTeamhgs 165148 Nov 2017 Payslip 165148Mohammad IrfanNo ratings yet

- Raju Bhai PDFDocument1 pageRaju Bhai PDFbsnlquotesNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- Apache Service BillDocument2 pagesApache Service Billgowthamkanagaraj123No ratings yet

- JUSCO Electricity BILLDocument2 pagesJUSCO Electricity BILLrajit kumarNo ratings yet

- Jindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Document1 pageJindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Tatwa NandaNo ratings yet

- Icici PruDocument1 pageIcici PruPraveen KumarNo ratings yet

- Jiio BillDocument4 pagesJiio Bill70 mm picture100% (1)

- INV1844199792Document18 pagesINV1844199792MohdDanishNo ratings yet

- FATCA CRS Curing DeclarationDocument1 pageFATCA CRS Curing DeclarationramdpcNo ratings yet

- Maharashtra State Electricity Distribution Co. LTDDocument2 pagesMaharashtra State Electricity Distribution Co. LTDMrityunjay PathakNo ratings yet

- Received With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromRavi Kiran HrNo ratings yet

- Please Note This Is A Digitally Signed Invoice.: Original For RecipientDocument1 pagePlease Note This Is A Digitally Signed Invoice.: Original For RecipientRajnish JainNo ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- Amount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30Document5 pagesAmount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30sonugautam421No ratings yet

- Airtel BillDocument8 pagesAirtel BillSaleem KhanNo ratings yet

- Sample Bank StatementDocument9 pagesSample Bank Statementemma adeoyeNo ratings yet

- Due Date Telephone Number Amount Payable: GstinDocument6 pagesDue Date Telephone Number Amount Payable: GstinsumanthsaiNo ratings yet

- Job OfferDocument4 pagesJob OfferJagjeet Singh100% (1)

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesSagar KattimaniNo ratings yet

- Hamad CVDocument3 pagesHamad CVAzhar HussainNo ratings yet

- Payslip 1 PDFDocument2 pagesPayslip 1 PDFaDivk iNo ratings yet

- Sameer Challan 21-22Document1 pageSameer Challan 21-22KATTA VENKATA KRISHNAIAHNo ratings yet

- Siti Broadband (Sep-Oct) BillDocument1 pageSiti Broadband (Sep-Oct) BillBARUN BIKASH DENo ratings yet

- Payslip SDE-6902 Jul 2023 6627469688371108306 1688020282295Document1 pagePayslip SDE-6902 Jul 2023 6627469688371108306 1688020282295Tanushree BiswasNo ratings yet

- 8.municipal Tax Receipt 2Document1 page8.municipal Tax Receipt 2Ravi ChandraNo ratings yet

- Icici Bank Gstinvoice May 2021 Xxxxxxxx2165Document1 pageIcici Bank Gstinvoice May 2021 Xxxxxxxx2165Solomon PasulaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- 3 MobileBill July AugDocument10 pages3 MobileBill July AugVinay GoyalNo ratings yet

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- BSNL Bharat FiverDocument4 pagesBSNL Bharat FiverAnshumanNo ratings yet

- Smart Privilege: Key HighlightsDocument1 pageSmart Privilege: Key HighlightsYogesh MeenaNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesKunal PatilNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- November Pay 1111ssDocument2 pagesNovember Pay 1111ssHanish MeenaNo ratings yet

- Paystub 202412Document1 pagePaystub 202412mpendulomnisi360No ratings yet

- Mahishasura-Mardini-Stotram Telugu PDF File8333Document12 pagesMahishasura-Mardini-Stotram Telugu PDF File8333Prasadd ReddyNo ratings yet

- ISO 9001 CertifiedDocument7 pagesISO 9001 Certifiedselva mechNo ratings yet

- Furniture and Household Goods Purchase SchemeDocument15 pagesFurniture and Household Goods Purchase SchemeKanha SatyaranjanNo ratings yet

- E-Ticket: Traveller Details Nnk3Xx Flight DetailsDocument1 pageE-Ticket: Traveller Details Nnk3Xx Flight DetailsKanha SatyaranjanNo ratings yet

- Geologist050717 PDFDocument2 pagesGeologist050717 PDFKanha SatyaranjanNo ratings yet

- FI CIN User Manual V1Document38 pagesFI CIN User Manual V1jagankilariNo ratings yet

- 02-06-09 Lynn Federal Court OrderDocument6 pages02-06-09 Lynn Federal Court OrdermderigoNo ratings yet

- Apple Business PlanDocument8 pagesApple Business PlanGeneve GarzonNo ratings yet

- Toll Road Financial ModelDocument190 pagesToll Road Financial ModelshamitdsNo ratings yet

- MIM BrochureDocument25 pagesMIM BrochureSaurabh BajpeyeeNo ratings yet

- Introduction To Corporate FinanceDocument4 pagesIntroduction To Corporate FinanceDarshitNo ratings yet

- EBA Public Hearing CP Draft RTS On FRTB IMADocument17 pagesEBA Public Hearing CP Draft RTS On FRTB IMADnyaneshwar PatilNo ratings yet

- P&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValueDocument66 pagesP&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValuePrabhdeep DadyalNo ratings yet

- Quiz (Dicky Irawan - C1i017051)Document3 pagesQuiz (Dicky Irawan - C1i017051)DICKY IRAWAN 1No ratings yet

- E19150V90P102700Box391418B00PUBLIC0 PDFDocument88 pagesE19150V90P102700Box391418B00PUBLIC0 PDFTirumul Rao BadeNo ratings yet

- IED 3. AR & CBQ New Economic PolicyDocument43 pagesIED 3. AR & CBQ New Economic Policysayooj tvNo ratings yet

- Employee Master File Creation FormDocument4 pagesEmployee Master File Creation Formmuhammad younasNo ratings yet

- ToaDocument80 pagesToaJuvy Dimaano100% (1)

- HSBC 1Document93 pagesHSBC 1Maneesh SharmaNo ratings yet

- PARTNERSHIP - 2nd Outline - Page 4-6Document4 pagesPARTNERSHIP - 2nd Outline - Page 4-6EsraRamosNo ratings yet

- Chapter 11 ConceptualDocument41 pagesChapter 11 ConceptualPeachy Rose TorenaNo ratings yet

- Admin1, 1102 Edt v1 303-319Document17 pagesAdmin1, 1102 Edt v1 303-319Jessica AnggiNo ratings yet

- Advance Accounting by Fischer 9e TEST BANK PDFDocument826 pagesAdvance Accounting by Fischer 9e TEST BANK PDFKersey AquinoNo ratings yet

- Lincoln University Pathway Merit Scholarship Application FormDocument4 pagesLincoln University Pathway Merit Scholarship Application FormSimonNo ratings yet

- Brand ManagementDocument46 pagesBrand ManagementPayal AroraNo ratings yet

- Chapter 4 - Post Merger ReorganisationDocument16 pagesChapter 4 - Post Merger ReorganisationAbhishek SinghNo ratings yet

- Extra Questions Solutions JK ShahDocument16 pagesExtra Questions Solutions JK ShahrrkabraNo ratings yet

- Bill HotelDocument54 pagesBill Hotelidhul bram sakti100% (1)

- ISA 510 MindMapDocument1 pageISA 510 MindMapA R AdILNo ratings yet

- A Critique of The Anglo-American Model of Corporate GovernanceDocument3 pagesA Critique of The Anglo-American Model of Corporate GovernanceSabrina MilaNo ratings yet

- Reflection Note4 1711031 MayankDocument5 pagesReflection Note4 1711031 MayankMK UNo ratings yet

- 332022Document2 pages332022samNo ratings yet

- FAQs On Entity Master 1Document13 pagesFAQs On Entity Master 1Shinil NambrathNo ratings yet

- Project ModelsDocument5 pagesProject ModelsHARSH RANJANNo ratings yet

- How To Invest Rubenstein en 45227Document6 pagesHow To Invest Rubenstein en 45227AraceliDemetrioNo ratings yet