Professional Documents

Culture Documents

November Pay Slip

Uploaded by

Hanish Meena100%(1)100% found this document useful (1 vote)

136 views2 pagesPayslip

Original Title

NOVEMBER PAY SLIP

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPayslip

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

136 views2 pagesNovember Pay Slip

Uploaded by

Hanish MeenaPayslip

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

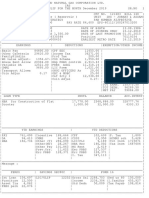

INDIAN OIL CORPORATION LTD.

INDIAN OIL BHAWAN JAIPUR-302204

PAY SLIP FOR THE MONTH November 2022 SR.NO 641

______________________________________________________________________________

| NAME MALKESH MEENA CPF NO. 133672 BILL 001 |

| DESGN Assistant Executive engineer UNIT JAIPUR EXPLORATION |

| POSITION GRADUATE TRAINEE PAN NUMBER ERRPF9166F |

| PAYSCALE 60,000 - 180,000 PAY RATE 66,700 EPS- |

|______________________________________________________________________________|

| ERC-EPS 0.00 DATE OF BIRTH 22.03.1995 |

| ERC-PRBS 9,882.74 DATE OF JOINING ONGC 27.12.2021 |

| ERC-CPF 7,906.00 ERC-CSSS 1,550.00 DATE OF LAST PROMOTION 27.12.2021 |

| BANK ACCOUNT NO. SBA-006601553066 Position 70085802 |

| Org. Key OVLD150005534 EARLIEST RETRO DATE 27.12.2021 |

|______________________________________________________________________________|

| EARNINGS | DEDUCTIONS |EXEMPTION/OTHER INCOME|

|______________________________________________________________________________|

|Basic Pay 63472.58 |CPF EEC 7906.00 |PM Rel Fund 2,152 |

|Perk Adj IN |Income Tax 10202.00 | |

|FamilyPlAdjin |CSS Scheme 1,550.00 | |

|House Rent Allow 16008.00 |Emp PRBS contrib 1,976.55 | |

|Variable DA 2412.34 |PRBS Addl 10,289.22 | |

|Arr.Misc. Non.Ta 1000.00-|RelFund IT.Expt 2,152.00 | |

|Misc Pay/ Rec: N 520.00-|Arr.Rec.Breifcas 5,000.00-| |

|Coin Adjus 0.42- |Coin Adjus 0.27- | |

|Misc. Pay / Rec: 23345.00 | | |

| | | |

| | | |

| | |----------------------|

| | |TOT EARN. 103717.50 |

| | |TOT DEDN. 29075.50 |

| | |NET PAY 74642.00 |

|______________________________________________________________________________|

| LOAN TYPE INSTL BALANCE ACC.INTRST|

|______________________________________________________________________________|

| |

| |

| |

| |

| |

| |

| |

| |

| |

|______________________________________________________________________________|

| YTD EARNINGS | YTD DEDUCTIONS |

|______________________________________________________________________________|

|PAY 330,272 |Other (T) 128,345 |CPF 41,066 |Tot Incm 665,039 |

|DA 11,952 |Other(NT) 2,320 |CSSS 7,750 |Tax Incm 662,719 |

|HRA 80,040 |Other Pay 61,735 |Eec PRBS 61,712 | |

| |Prev.Yrs. 50,373 |Erc PRBS 51,333 | |

| |Erc PRBS 51,333 |I. Tax 59,259 | |

| | | | |

| | | | |

| | | | |

| | | | |

|______________________________________________________________________________|

|Message : |

| |

|______________________________________________________________________________|

| PERKS | SAVINGS SEC80C | FORM 16 |

|______________________________________________________________________________|

| | |Gross Sal 1235,969 |Ded us 80 152,152 |

| | |Income 1195,970 |I.Tax&Sur 130,672 |

| | |Std Dedn 40,000 |Tax Payab 71,413 |

| | | | |

| | | | |

|______________________________________________________________________________|

You might also like

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- FormDocument2 pagesFormBhargav VekariaNo ratings yet

- Form PDFDocument1 pageForm PDFanby1No ratings yet

- 001I7D7441643896296Document1 page001I7D7441643896296Shamantha ManiNo ratings yet

- Form PDFDocument1 pageForm PDFChinmoyee SharmaNo ratings yet

- Apr 21Document1 pageApr 21pavan kumarNo ratings yet

- Payslip 5 2021Document1 pagePayslip 5 2021Mehraj PashaNo ratings yet

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023Abdul Khadar Jilani ShaikNo ratings yet

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- Payslip February 2023Document2 pagesPayslip February 2023Abdul Khadar Jilani ShaikNo ratings yet

- Pay Slip - 513901 - Apr-23Document1 pagePay Slip - 513901 - Apr-23Mohan KumarNo ratings yet

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedBarath BiberNo ratings yet

- PaySlip PDFDocument1 pagePaySlip PDFVamshi GoudNo ratings yet

- SalarySlip ICCS NovDocument1 pageSalarySlip ICCS NovAkash GuptaNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- 0039 BB 7441651750277Document1 page0039 BB 7441651750277subhaniNo ratings yet

- Full and Final Settlement Statement of January 2021 Associate InformationDocument1 pageFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNo ratings yet

- Salary SlipDocument1 pageSalary SlipSYAHRIL 25071991No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- PaySlip 221213111459P PDFDocument1 pagePaySlip 221213111459P PDFpraveenNo ratings yet

- Payslip 11 2022Document1 pagePayslip 11 2022Md SharidNo ratings yet

- Apollo Tyres Ltd. Payslip For The Month of AUGUST 2017Document1 pageApollo Tyres Ltd. Payslip For The Month of AUGUST 2017Praveen MalavaeNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- 2412 Payslip JunDocument1 page2412 Payslip JunAnonymous 68rvpJvvNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- Chola 31148 2019 7 Payslip PDFDocument1 pageChola 31148 2019 7 Payslip PDFDass Prakash100% (1)

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountTinisharmaNo ratings yet

- PDF 628846520240522Document1 pagePDF 628846520240522Narayana Rao GanapathyNo ratings yet

- Transmission Corporation of Andhra Pradesh LimitedDocument1 pageTransmission Corporation of Andhra Pradesh LimitedpavanNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- India Payslip January 2023 PDFDocument1 pageIndia Payslip January 2023 PDFN RamPrasadNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviNo ratings yet

- PDF - 933662320220722.pdf ITR 22-23Document1 pagePDF - 933662320220722.pdf ITR 22-23smpNo ratings yet

- PDF 733373380270723Document1 pagePDF 733373380270723uthaman.palaniappanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAEN TRACKNo ratings yet

- Square Yards Consulting Private Limited: Payslip For The Month of April 2023Document1 pageSquare Yards Consulting Private Limited: Payslip For The Month of April 2023Neelesh PandeyNo ratings yet

- Get Payslip by Offset PDFDocument1 pageGet Payslip by Offset PDFanon_535796411100% (1)

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- Aswini Salary Slip FebDocument1 pageAswini Salary Slip FebAvnish MisraNo ratings yet

- Salary Slip July 2023 - UnlockedDocument1 pageSalary Slip July 2023 - UnlockedPardeep AttriNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- PaySlip1 DecDocument1 pagePaySlip1 Decjesten jadeNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- PayslipDocument1 pagePayslipSharathPundamalliNo ratings yet

- 1600 SalarySlip December 2020Document1 page1600 SalarySlip December 2020Mickey CreationNo ratings yet

- Pay Slip - 604316 - Nov-22Document1 pagePay Slip - 604316 - Nov-22ArchanaNo ratings yet

- Part B PDFDocument3 pagesPart B PDFDebesh KuanrNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- November Pay 1111ssDocument2 pagesNovember Pay 1111ssHanish MeenaNo ratings yet

- Act Apprentice Notification 2022-23Document11 pagesAct Apprentice Notification 2022-23Akshay HageNo ratings yet

- November Pay 1111ssDocument2 pagesNovember Pay 1111ssHanish MeenaNo ratings yet

- Forester Physical221222Document5 pagesForester Physical221222Hanish MeenaNo ratings yet

- Salary BrochureDocument4 pagesSalary BrochureHanish MeenaNo ratings yet

- Chapter 3Document14 pagesChapter 3phan hàNo ratings yet

- Analysis of The Economic Survey 2022-23Document39 pagesAnalysis of The Economic Survey 2022-23Umair NeoronNo ratings yet

- Letter Request For Cash Advance 2020Document2 pagesLetter Request For Cash Advance 2020toni annNo ratings yet

- Macroeconomics ExamDocument16 pagesMacroeconomics ExamCarlo SantosNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- Astm E1757 01Document2 pagesAstm E1757 01Ankit MaharshiNo ratings yet

- Masteral Thesis Proposal ProgramDocument5 pagesMasteral Thesis Proposal ProgramAN NUR EMPALNo ratings yet

- Urbanization and Urban Growth - Poverty LinkagesDocument3 pagesUrbanization and Urban Growth - Poverty LinkagesRitik GuptaNo ratings yet

- Module II - RURAL MARKETING ENVIRONMENTDocument11 pagesModule II - RURAL MARKETING ENVIRONMENTIndrajitNo ratings yet

- En Custom Form 22Document1 pageEn Custom Form 22Tamil Arasu100% (1)

- RECEIPT UTILITIES 20210312 Elektrik EapDocument1 pageRECEIPT UTILITIES 20210312 Elektrik EapTahap TeknikNo ratings yet

- Valuation Lucky CementDocument2 pagesValuation Lucky CementAhsan KhanNo ratings yet

- 01 Introduction To MacroeconomicsDocument8 pages01 Introduction To MacroeconomicsRaunak RayNo ratings yet

- 61365annualreport Icai 2019 20 EnglishDocument124 pages61365annualreport Icai 2019 20 EnglishSãñ DëëpNo ratings yet

- Edelweiss Balanced Advantage Fund - Presentation Feb 2021 - 11022021 - 060534 - PMDocument22 pagesEdelweiss Balanced Advantage Fund - Presentation Feb 2021 - 11022021 - 060534 - PMMythili BalakrishnanNo ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- ReillyBrown IAPM 11e PPT Ch02Document72 pagesReillyBrown IAPM 11e PPT Ch02rocky wongNo ratings yet

- Demystifying The ICT Questionnaire 1 2Document3 pagesDemystifying The ICT Questionnaire 1 2Thar RharNo ratings yet

- Chapter 4 Time Value of Money (Part 2b) 2020Document36 pagesChapter 4 Time Value of Money (Part 2b) 2020Nur HazwaniNo ratings yet

- Performance of The ASEAN Iron and Steel Industry in 2015 and Outlook - 2016Document35 pagesPerformance of The ASEAN Iron and Steel Industry in 2015 and Outlook - 2016imetallurgyNo ratings yet

- Indifference Curves Between Goods Bads & Neuters PDFDocument10 pagesIndifference Curves Between Goods Bads & Neuters PDFHarshvardhan Kothari100% (1)

- E-Ticket PassengerDocument4 pagesE-Ticket PassengerXPCENo ratings yet

- July Allegheny County Employee Executive ActionsDocument71 pagesJuly Allegheny County Employee Executive ActionsAllegheny JOB WatchNo ratings yet

- Tma Members List South Circle 2022-2023Document15 pagesTma Members List South Circle 2022-2023acube.printerNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Invoice Zoom YKB 2022Document2 pagesInvoice Zoom YKB 2022Dian ElgaNo ratings yet

- Ecuador's Ministry of Tourism's Seeks Foreign Investment in The Galapagos IslandsDocument4 pagesEcuador's Ministry of Tourism's Seeks Foreign Investment in The Galapagos IslandsSalvaGalapagosNo ratings yet

- Income Tax Set Off and Carry Forward AY21-22Document7 pagesIncome Tax Set Off and Carry Forward AY21-22sreyans banthiaNo ratings yet

- National Income Basic Numericals Economics 12Document2 pagesNational Income Basic Numericals Economics 12Ratnakar MishraNo ratings yet

- Pakistan Development Review - V61i4 PDFDocument158 pagesPakistan Development Review - V61i4 PDFBushra AhmedNo ratings yet