Professional Documents

Culture Documents

Earnings Deductions: Eicher Motors Limited

Uploaded by

Barath BiberOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earnings Deductions: Eicher Motors Limited

Uploaded by

Barath BiberCopyright:

Available Formats

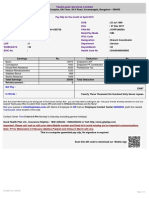

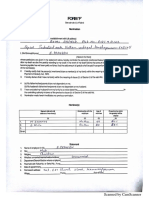

Eicher Motors Limited

96, Sector 32, Institutional Area , Gurgaon - 122001

HARYANA

Pay Slip for the month of March 2020

All amounts in INR

Emp Code : E06638 Location : Chennai

Emp Name : Praveen Elwin IFSC Code : ICIC0006037

Department : Quality Function Bank A/c No. : 603701534194 (ICICI BANK LTD)

Designation : Senior Engineer Entity : Royal Enfield

Grade : RE-S PAN : CKNPP6515N

Gender : Male PF No. :

DOB : 06 Jul 1993 DOJ : 27 May 2019 Payable Days : 31.00 PF UAN. : 101148037779

Unit : Vallam

Aadhar Card : 358939993025

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 8929.00 8929.00 0.00 8929.00 PF 1800.00

House Rent Allowance 4464.00 4464.00 0.00 4464.00 PROF. TAX 210.00

Children Edu Allow 800.00 800.00 0.00 800.00

Other Allowance 18792.00 18792.00 0.00 18792.00

Washing allowance 500.00 500.00 0.00 500.00

Reward_Recognition 2500.00 0.00 2500.00

GROSS EARNINGS 33485.00 35985.00 0.00 35985.00 GROSS DEDUCTIONS 2010.00

Net Pay : 33975.00 (THIRTY THREE THOUSAND NINE HUNDRED SEVENTY FIVE ONLY)

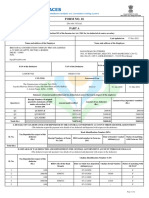

Income Tax Worksheet for the Period April 2019 - March 2020

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation( N o n - M e t r o )

Basic 90730.00 0.00 90730.00 Investments u/s 80C Rent Paid 0.00

House Rent Allowance 45360.00 0.00 45360.00 Provident Fund 18290.00 From: 27/05/2019

Children Edu Allow 8129.00 0.00 8129.00 To: 31/03/2020

Other Allowance 190950.00 0.00 190950.00 1. Actual HRA 45360.00

Washing allowance 5081.00 5081.00 0.00 2. 40% or 50% of Basic 36292.00

Reward_Recognition 2500.00 0.00 2500.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 45360.00

Gross 342750.00 5081.00 337669.00 Total Investments u/s 80C 18290.00

Tax Working U/S 80C 18290.00 T D S D e d u c t e d M o n t h l y

Standard Deduction 50000.00 T o t a l D e d U n d e r C h a p t e r V I - A18290.00 M o n t h Amount

Previous Employer Taxable Income 0.00 June-2019 0.00

Previous Employer Professional Tax 0.00 July-2019 0.00

Professional Tax 2500.00 August-2019 0.00

Under Chapter VI-A 18290.00 September-2019 0.00

Any Other Income 0.00 October-2019 0.00

Taxable Income 266879.00 November-2019 0.00

Total Tax 844.00 December-2019 0.00

Tax Rebate u/s 87a 844.00 January-2020 0.00

Surcharge 0.00 February-2020 0.00

Tax Due 0.00 March-2020 0.00

Health and Education Cess 0.00 Tax Deducted on Perq. 0.00

Net Tax 0.00 Total 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax per month 0.00

Tax on Non-Recurring Earnings 0.00 Total Any Other Income

Tax Deduction for this month 0.00

Disclaimer: This is a system generated payslip, does not require any signature.

You might also like

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- OYO Hotel and Homes Private Limited Pay Slip for August 2022Document2 pagesOYO Hotel and Homes Private Limited Pay Slip for August 2022Vivek ViviNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipHanish Meena100% (1)

- AUGUST PayslipDocument1 pageAUGUST PayslipRakesh MandalNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- D114003jul2020 PDFDocument1 pageD114003jul2020 PDFRajarshiRoyNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- Full and Final Settlement Statement of January 2021 Associate InformationDocument1 pageFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Shriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Document1 pageShriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Ronald AllenNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023Abdul Khadar Jilani ShaikNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- 24/7 Customer Private Limited PayslipDocument1 page24/7 Customer Private Limited PayslipMehraj PashaNo ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- PaySlip 6 2023...Document1 pagePaySlip 6 2023...Rahul VarmanNo ratings yet

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Upspl Pay Slip Dec 2022 EngineerDocument1 pageUpspl Pay Slip Dec 2022 EngineerpraveenNo ratings yet

- Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P MDocument1 pageQuess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P Msagar janiNo ratings yet

- June Pay Slip SureshDocument2 pagesJune Pay Slip SureshVenkat DNo ratings yet

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- Gane 1824Document1 pageGane 1824govindansanNo ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- Indusind BankDocument65 pagesIndusind BankNadeem KhanNo ratings yet

- New SlipDocument1 pageNew Slip476No ratings yet

- Pay Slip - 513901 - Apr-23Document1 pagePay Slip - 513901 - Apr-23Mohan KumarNo ratings yet

- Sal Jan18 PDFDocument1 pageSal Jan18 PDFRaghava SharmaNo ratings yet

- Sify Technologies payslip title for Vinod Kumar BoseDocument1 pageSify Technologies payslip title for Vinod Kumar BoseJOOOOONo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- Salary slip details for Afzal khanDocument1 pageSalary slip details for Afzal khanafzal khanNo ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- August 2021Document1 pageAugust 2021Zaynn17No ratings yet

- ITR FormDocument9 pagesITR FormAbdul WajidNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- PayslipDocument1 pagePayslipSk Samim AhamedNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Payslip 2018 2019 1 100000000439462 IGSLDocument1 pagePayslip 2018 2019 1 100000000439462 IGSLMandeep Ranga100% (1)

- TeamLease Services April 2019 pay slipDocument1 pageTeamLease Services April 2019 pay sliparchit chopraNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- Payslip October 2022Document1 pagePayslip October 2022Raja guptaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Payslip For MarchDocument1 pagePayslip For MarchomkassNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- PayslipsDocument4 pagesPayslipsemilyNo ratings yet

- Pay - Slip Oct. & Nov. 19Document1 pagePay - Slip Oct. & Nov. 19Atul Kumar MishraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- Kirandeep August SalaryDocument1 pageKirandeep August Salaryprince.gill07No ratings yet

- Certi Cate of Completion: Barath KICKSTART (Code Solution)Document1 pageCerti Cate of Completion: Barath KICKSTART (Code Solution)Barath BiberNo ratings yet

- Sources of Energy: Chapter - 14Document9 pagesSources of Energy: Chapter - 14milind dhamaniyaNo ratings yet

- Sources of Energy: Chapter - 14Document9 pagesSources of Energy: Chapter - 14milind dhamaniyaNo ratings yet

- Sources of Energy: Chapter - 14Document9 pagesSources of Energy: Chapter - 14milind dhamaniyaNo ratings yet

- Chemical Reactions and Equations ExplainedDocument8 pagesChemical Reactions and Equations ExplainedPremNo ratings yet

- New Employee Step - User GuideDocument21 pagesNew Employee Step - User GuideBarath BiberNo ratings yet

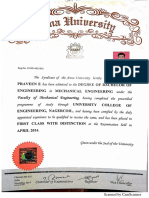

- Certificates PDFDocument1 pageCertificates PDFBarath BiberNo ratings yet

- Certificates PDFDocument1 pageCertificates PDFBarath BiberNo ratings yet

- Resume: S.No - Course Institution Year OF Passing Percentage /cgpaDocument2 pagesResume: S.No - Course Institution Year OF Passing Percentage /cgpaBarath BiberNo ratings yet

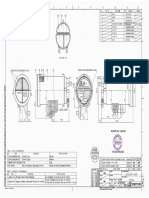

- T4200684 - A - J1D Vehicle Torque SpecificationDocument2 pagesT4200684 - A - J1D Vehicle Torque SpecificationBarath BiberNo ratings yet

- REJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFDocument5 pagesREJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFBarath BiberNo ratings yet

- Degree CertificateDocument1 pageDegree CertificateBarath BiberNo ratings yet

- REJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFDocument5 pagesREJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFBarath BiberNo ratings yet

- REJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFDocument5 pagesREJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFBarath BiberNo ratings yet

- IDENTIFIER) Please Select FLASH and Enter The Chassis No. in The Space Provided and Hit TheDocument3 pagesIDENTIFIER) Please Select FLASH and Enter The Chassis No. in The Space Provided and Hit TheBarath BiberNo ratings yet

- REJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFDocument5 pagesREJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020 PDFBarath BiberNo ratings yet

- UCE350 EMS CheckpointsDocument2 pagesUCE350 EMS CheckpointsBarath BiberNo ratings yet

- ReadmerDocument79 pagesReadmersatyajtiNo ratings yet

- Trainee Application Form (Technical Trainee) : Yes NoDocument1 pageTrainee Application Form (Technical Trainee) : Yes NoBarath BiberNo ratings yet

- INTC02179 - Va - RELEASED - J1ABCD Canister Design Review For Complete DevelopmentDocument4 pagesINTC02179 - Va - RELEASED - J1ABCD Canister Design Review For Complete DevelopmentBarath BiberNo ratings yet

- Re Part No: 1100413/BDocument1 pageRe Part No: 1100413/BBarath BiberNo ratings yet

- CDocument1 pageCBarath BiberNo ratings yet

- REJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020Document5 pagesREJ1 - Cover, Seal and Lock Plate Changes - 13MAR2020Barath BiberNo ratings yet

- Form F PDFDocument2 pagesForm F PDFBarath BiberNo ratings yet

- Idling Co % Checking Procedure For J Models - 200325Document1 pageIdling Co % Checking Procedure For J Models - 200325Barath BiberNo ratings yet

- LTI Hiring Process Details - 2021 BatchDocument16 pagesLTI Hiring Process Details - 2021 BatchAkash KumarNo ratings yet

- Scan App Review - CamScanner PDF ScannerDocument2 pagesScan App Review - CamScanner PDF ScannerBarath BiberNo ratings yet

- IDENTIFIER) Please Select FLASH and Enter The Chassis No. in The Space Provided and Hit TheDocument3 pagesIDENTIFIER) Please Select FLASH and Enter The Chassis No. in The Space Provided and Hit TheBarath BiberNo ratings yet

- INTC02179 - Va - RELEASED - J1ABCD Canister Design Review For Complete DevelopmentDocument4 pagesINTC02179 - Va - RELEASED - J1ABCD Canister Design Review For Complete DevelopmentBarath BiberNo ratings yet

- Success Gyaan Invoice - 1Document2 pagesSuccess Gyaan Invoice - 1Sanat DesaiNo ratings yet

- The Cpa Licensure Examination Syllabus Taxation Effective October 2022 ExaminationDocument4 pagesThe Cpa Licensure Examination Syllabus Taxation Effective October 2022 ExaminationMarc Anthony Max MagbalonNo ratings yet

- Jay - Kashyap@vedanta - Co.in F16Document8 pagesJay - Kashyap@vedanta - Co.in F16Jay kashyapNo ratings yet

- 06-28 Staff Report W AttachDocument125 pages06-28 Staff Report W AttachMatthew JensenNo ratings yet

- Workers Investment and Savings ProgramDocument20 pagesWorkers Investment and Savings ProgramTiMNo ratings yet

- Navasakam Grievance Application: Family DetailsDocument2 pagesNavasakam Grievance Application: Family DetailsmANOHARNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesMa. Valerie LabareñoNo ratings yet

- Tax Sa1Document15 pagesTax Sa1Kc SevillaNo ratings yet

- FABM 2 Module 8 Income TaxationDocument8 pagesFABM 2 Module 8 Income TaxationJOHN PAUL LAGAO50% (2)

- Solved Explain Whether Borrowing Constraints Increase or Decrease The Potency ofDocument1 pageSolved Explain Whether Borrowing Constraints Increase or Decrease The Potency ofM Bilal SaleemNo ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- TW2A12823900009RPOSDocument3 pagesTW2A12823900009RPOSarun poojariNo ratings yet

- Distribute A231 - BKAT3033 - Tutorial 123 - QDocument7 pagesDistribute A231 - BKAT3033 - Tutorial 123 - QallyaNo ratings yet

- S Reg PayslpDocument3 pagesS Reg Payslpjaggu_gram0% (1)

- Bcom SylDocument42 pagesBcom SylRajat BansalNo ratings yet

- Itc - Reversal EntriesDocument3 pagesItc - Reversal Entriessoumav123No ratings yet

- MGPTaxReturn 2021Document93 pagesMGPTaxReturn 2021KGW NewsNo ratings yet

- Final Test 1 Sol.Document3 pagesFinal Test 1 Sol.Akanksha UpadhyayNo ratings yet

- Taxation LawDocument7 pagesTaxation LawYsiis CCNo ratings yet

- Abc Analysis Ca Inter May 22Document4 pagesAbc Analysis Ca Inter May 22Murari AgrahariNo ratings yet

- Tax Quiz Chap 2Document1 pageTax Quiz Chap 2Kyle PegaridoNo ratings yet

- Service TaxDocument2 pagesService TaxpremsuwaatiiNo ratings yet

- Online Percentage & P&L AssignmentDocument3 pagesOnline Percentage & P&L AssignmentxeloleyNo ratings yet

- BOE Letter To Taxpayers Informing Them of Use TaxDocument1 pageBOE Letter To Taxpayers Informing Them of Use TaxDavid DuranNo ratings yet

- BIR Notice of Property Sale and VAT FilingDocument2 pagesBIR Notice of Property Sale and VAT FilingHanabishi RekkaNo ratings yet

- VAT On ImportationDocument11 pagesVAT On ImportationAmie Jane MirandaNo ratings yet

- P45 (Online) - LJDocument3 pagesP45 (Online) - LJGreat EmmanuelNo ratings yet

- Parjan Topic 1 Excel Machine Problem 1Document3 pagesParjan Topic 1 Excel Machine Problem 1Parjan, Harvey JohnNo ratings yet