Professional Documents

Culture Documents

Jagan Mohan Absli Payslip April

Uploaded by

Surya GodasuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jagan Mohan Absli Payslip April

Uploaded by

Surya GodasuCopyright:

Available Formats

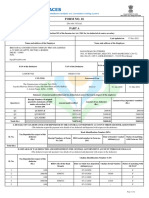

Aditya Birla Sun Life Insurance Company Limited

One India bulls Center, Tower 1, 16th Floor, Jupiter Mill Compound, 841,

Senapati Bapat Marg, Elphinstone Road, Mumbai - 400013

Pay Slip for the month of April 2022

All amounts are in INR

EmpIoyee Code : 567907 Location : Hyderabad

Emp Nam e : Godasu Jagan Mohan I FSC Code : HDFC0009168

Department : HDFC Bank Relationship Bank A/c No : 50100309131475 (HDFC BANK LTD)

Gen der : M Cost Center : Ad itya Birla Sun Life Insurance Company

DOB : 30 Apr 1996 Limited

DOJ : 02 Aug 2021 PAN : BUGPG5329B

PayabIe Days : 30.00 PF No.

LWP : 0.00 PF UAN. : UANNOTAVBL

Arrear Day(s) : 9.00

Earnings Deductions

Description | Rate | MonthIy | Arrear | Total Description Amount

BASIC SALARY 12708.00 12708.00 2964.00 15672.00 PF 2966.0 0

HOUSE RENT ALLOW 6770.00 6770.00 1482.00 8252.00 PROF. TAX 991.0 0

SPECIAL ALLOWANCE 11629.00 11629.00 2892.00 14521.00

EDUCATION ALLOWANCE 616.0 0 616.00 58.00 674.00

STATUTORY ADVANCE BONUS 1816.00 1816.00 406.00 2222.00

GROSS EARNINGS | 33539.00 | 33539.00 | 7802.00 | 41341.00 ) GROSS DEDUCTIONS 3957.00

Net Pay : 37384.00 (THIRTY SEVEN THOUSAND THREE HUNDRED EIGHTY FOUR

ONLY)

Income Tax Worksheet for the Period April 2021- March 2022

“You have opted for Old Tax Regme

D es c ri ptio n G ross ExempI Taxa b Ie Deduction Under Chapter VI-A )) Taxable HRA C alculat ion {No n - M etro)

BAS IC SALARY 152500.00 0.00 152500.00 Investments uis 80C Rent Paid 0.0 0

HOUSE RENT ALLOW 81250.00 0.0 0 81250.00 Provident Fund 35600.00 From: 23/05/2022

SPECIAL ALLOWANCE 139558.00 0.0 0 139558.00 To: 31/03/2023

EDUCATION ALLOWANCE 7400.00 0.0 0 7400.00 1. Actual HRA 81250 .00

STATUTORY ADVANCE BONU 21800.00 0.00 21800.00 2. 40% or 50% of Basic 4 2018.00

3. Rent - 10% Basic 0.00

Least of above is exem pt 0.0 0

Taxa ble HRA 81250.00

Gr os s 402508.00 0.00 402508.00 Tot a I I n vestm ents uis 80 C 35600 .00

U/S 80C 35600.00

Tax Worki ng

Standard Deduction 00000.00 Tot aI Ded Und er C h apter VI-A 35600.00 TDS Ded ucted M o nt h I y

Mo n I h Amou nt

Previous Employer Taxable Income 0.00

Previous Employer Professional Tax O June-2022 0.0 0

Professional Tax 2000 Tax Deducted on Perq. 0. 0 0

Under Chapter VI-A 35600.00 T oI a I 0.0 0

Any Other Income 0.00

Taxable Income 250008 .00

Total Tax 0 .00

Tax Rebate u/s 87a 0 .00

Surcharge 0 .00

Tax Due 0 .00

Health and Education Cess 0 .00

Net Tax 0 .00

Tax Deducted (Previous Employer) 0 .00

Tax Deducted on Perq. 0 .00

Tax Deducted on Any Other Income. 0 .00

Tax Deducted Till Date 0 .00

Tax to be Deducted 0 .00

Tax per month 0 .00

Tax on Non-Recurring Earnings 0 .00 Tot aI An y Other Income

Tax Deduct i on fo r th i s month 0.00

Disclaimer: This is a system generated payslip, does not require any signature.

You might also like

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedBarath BiberNo ratings yet

- 2412 Payslip JunDocument1 page2412 Payslip JunAnonymous 68rvpJvvNo ratings yet

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- 24/7 Customer Private Limited PayslipDocument1 page24/7 Customer Private Limited PayslipMehraj PashaNo ratings yet

- Pay Slip - 513901 - Apr-23Document1 pagePay Slip - 513901 - Apr-23Mohan KumarNo ratings yet

- October 2022: Employee Details Payment & Leave Details Location DetailsDocument1 pageOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiNo ratings yet

- Square Yards Consulting Private Limited: Payslip For The Month of April 2023Document1 pageSquare Yards Consulting Private Limited: Payslip For The Month of April 2023Neelesh PandeyNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- TarunDocument1 pageTarunUbed QureshiNo ratings yet

- India Payslip January 2023 PDFDocument1 pageIndia Payslip January 2023 PDFN RamPrasadNo ratings yet

- Full and Final Settlement Statement of January 2021 Associate InformationDocument1 pageFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Salary Slip January 2023Document1 pageSalary Slip January 2023SYAHRIL 25071991No ratings yet

- Upspl Pay Slip Dec 2022 EngineerDocument1 pageUpspl Pay Slip Dec 2022 EngineerpraveenNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- 127961300-Aug Payslip PDFDocument1 page127961300-Aug Payslip PDFAjay Chowdary Ajay ChowdaryNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- SalaryReport 0404701 201802Document61 pagesSalaryReport 0404701 201802Abhay SinghNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- India Payslip January 2022Document1 pageIndia Payslip January 2022Mir KazimNo ratings yet

- Salary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)Document1 pageSalary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)ROHIT RANJAN33% (3)

- Pay Slip Title Under 40 CharactersDocument1 pagePay Slip Title Under 40 CharactersMickey CreationNo ratings yet

- CG FEB 2023 46280987 PayslipDocument1 pageCG FEB 2023 46280987 PayslipHR DucallNo ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- Payslip 11 2022Document1 pagePayslip 11 2022Md SharidNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- PaySlip 6 2023...Document1 pagePaySlip 6 2023...Rahul VarmanNo ratings yet

- ITR FormDocument9 pagesITR FormAbdul WajidNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- PaySlip AUG 2019Document1 pagePaySlip AUG 2019Amit SharmaNo ratings yet

- Civil Core Salary SlipsDocument6 pagesCivil Core Salary SlipsDhanush DMNo ratings yet

- EazeWorkPaySlip86723 Salslip 1017Document1 pageEazeWorkPaySlip86723 Salslip 1017Dhiraj LokhandeNo ratings yet

- Payslip February 2023Document2 pagesPayslip February 2023Abdul Khadar Jilani ShaikNo ratings yet

- AIRTELDocument2 pagesAIRTELKolkata Jyote MotorsNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- PaySlip1 DecDocument1 pagePaySlip1 Decjesten jadeNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of July 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of July 2018srini reddyNo ratings yet

- Salary Slip Report SpecimenDocument1 pageSalary Slip Report SpecimenMuhammad Zeeshan HaiderNo ratings yet

- Jagmeet Singh StatementDocument6 pagesJagmeet Singh StatementBALKAR SINGHNo ratings yet

- वेतन पर्ची - Payslip - May - मई,2021Document2 pagesवेतन पर्ची - Payslip - May - मई,2021Sanjay SanNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Aditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Document1 pageAditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Praneeth Sasanka TadepalliNo ratings yet

- View Duplicate Invoice - AppleDocument3 pagesView Duplicate Invoice - AppleEduardo Gamez0% (1)

- 10 Plus Purchase Not in TallyDocument14 pages10 Plus Purchase Not in TallyAAKARNo ratings yet

- Book in VoiceDocument1 pageBook in VoiceSanjeet RaizadaNo ratings yet

- Chapter 8 Exclusions From Gross IncomeDocument4 pagesChapter 8 Exclusions From Gross IncomeMary Jane PabroaNo ratings yet

- Invoice 20190845103512 CBN45047100819Document1 pageInvoice 20190845103512 CBN45047100819yudhamomoichyNo ratings yet

- O2 - Telefónica UK Limited PDFDocument1 pageO2 - Telefónica UK Limited PDFAgre Junior Noël0% (1)

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- Decision: Republic of Philippines Court of Tax Appeals Quezon CityDocument23 pagesDecision: Republic of Philippines Court of Tax Appeals Quezon CityRebecca S. OfalsaNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of Supplyvansh kediaNo ratings yet

- SalarySlip 1 - 2023Document1 pageSalarySlip 1 - 2023Rizham IbniNo ratings yet

- Harry Franklin Itinerary Qatar Airways Flight TicketDocument1 pageHarry Franklin Itinerary Qatar Airways Flight TicketPeter GrayNo ratings yet

- Proforma Invoice JHW1907069Document1 pageProforma Invoice JHW1907069Hakim BenabbouNo ratings yet

- Syllabus B Com Sem-4 CE203D Computer Applications ECommerceDocument3 pagesSyllabus B Com Sem-4 CE203D Computer Applications ECommerceDNo ratings yet

- Essential reading list and instructions for live UPSC classDocument12 pagesEssential reading list and instructions for live UPSC classJana KvNo ratings yet

- India Banknotes - India Paper Money Catalog, Indian Currency and Money HistoryDocument14 pagesIndia Banknotes - India Paper Money Catalog, Indian Currency and Money HistoryMurhidul Arfin100% (1)

- Baran-Final Exam TaxDocument3 pagesBaran-Final Exam TaxAlona JeanNo ratings yet

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- CTA rules waivers invalidDocument10 pagesCTA rules waivers invalidsherleen damianNo ratings yet

- Sources of Government RevenueDocument28 pagesSources of Government RevenueVamshi SainiNo ratings yet

- Ebill 100081672407Document7 pagesEbill 100081672407Awie daudNo ratings yet

- Sample I MCQs On Negotiable Instruments ActDocument2 pagesSample I MCQs On Negotiable Instruments ActLokesh RathiNo ratings yet

- Account Number: 554644786 PIN CODE: 289217: Tax InvoiceDocument3 pagesAccount Number: 554644786 PIN CODE: 289217: Tax InvoiceANDREW STRUGNELLNo ratings yet

- Tax2 Dy Recit QsDocument9 pagesTax2 Dy Recit QsNoypi TayooNo ratings yet

- Kra PinDocument1 pageKra Pinmike kiroreNo ratings yet

- Subcontracting ProcessDocument5 pagesSubcontracting ProcessRenu BhasinNo ratings yet

- Nokia 6.1 Plus (Black, 64 GB) Refurbished - Good: Grand Total 6299.00Document2 pagesNokia 6.1 Plus (Black, 64 GB) Refurbished - Good: Grand Total 6299.00Swapnil Gade007No ratings yet

- Topic 1 Introduction To TaxationDocument28 pagesTopic 1 Introduction To TaxationZebedee Taltal0% (1)

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1Pruthiv RajNo ratings yet

- Accounting Cycle - Comprehensive ProblemDocument29 pagesAccounting Cycle - Comprehensive ProblemTooba HashmiNo ratings yet

- SRPL 2300255Document2 pagesSRPL 2300255radhe panelNo ratings yet