Professional Documents

Culture Documents

Methodology - The Disclosure Index VRSCORE

Uploaded by

huzaifa anwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Methodology - The Disclosure Index VRSCORE

Uploaded by

huzaifa anwarCopyright:

Available Formats

Introduction:

Voluntary disclosure of decision-useful corporate information is considered to be the first step in solving

the alleged problems of traditional financial reporting (Leadbetter, 2000). Its objectives are well defined:

closing (or narrowing) the gap between a company’s potential intrinsic market value and its current

market value (Ruhwedel and Schultze, 2002; Schultze, 2004). The benefits of voluntary disclosure are as

follows:

it deals with the shortcomings of capital-market oriented traditional financial reporting (including better

share pricing); and

It provides less volatility, less insider trading, and decreases in the cost of equity capital (COEC)

(Botosan, 1997; Leadbetter, 2000; Botosan and Plumlee, 2002; Roos et al., 2004; Andriessen, 2004;

Riegler and Kristandl, 2004).

Empirical evidence shows that COEC (cost of equity capital) is impacted by variations in disclosure levels,

but the inability of observing disclosure level and COEC is a direct hindrance to disclosure-related

research (Hail, 2002). Different approaches have included utilising proxies for COEC at first (e.g. bid-ask

spreads; see Healy and Palepu, 2001; Welker, 1995), which are directly observable, but might not relate

to COEC at all. Botosan (1997) highlighted the direct relationship between COEC and disclosure level,

followed by similar studies by Botosan and Plumlee (2002) and Hail (2002). However, lacking direct

observability poses a problem for COEC computation in particular, where factor models such as CAPM

and the three-factor model by Fama and French (1992) fail to capture risk components related to

disclosure (Botosan, 1997; for a general critique, see Black, 1993; Faff, 2004)

Methodology - the disclosure index VRSCORE

Disclosure indices have been applied in academic research since the beginning of the 1970s (see

Marston and Shrives, 1991, p. 195; for proof of their extensive use, see also Singhvi and Desai, 1971;

Buzby, 1975; Firth, 1979). The first step in developing a disclosure index lies in the methodology of

content analysis, which investigates an information carrier such as corporate (annual) reports. Content

analysis is a “research technique for making replicable and valid inferences from texts [...] to the

contexts of their use” (Krippendorff, 2004), where recent disclosure literature has clearly shown its

suitability for disclosure-related questions, especially when dealing with narratives rather than financial

statements. It becomes apparent that subjective judgement is needed in order to interpret such

information (Hail, 2002). Weighting the items in the index is another aspect; whereas early studies have

applied weighted indices (e.g. Cerf, 1961; Buzby, 1974; Buzby, 1975), later research used unweighted

indices, claiming that weights would add additional noise to the index (e.g. Cooke, 1989; Botosan, 1997;

Hail, 2002; Chow and Wong-Boren, 1987 applied both weighted and unweighted indices, arriving at the

same results). Since computing weights would infer the need to apply surveys to a target group, and

thus depending on their judgement of causality between indicator and decision-usefulness, we

computed VRSCORE as an unweighted index, eliminating a further and unnecessary biased outcome.

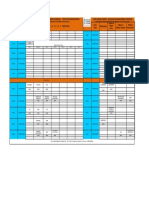

Description of VRSCORE

The purpose of VRSCORE (see Figure 1) is to measure and rank the level of corporate disclosure on an

ordinal scale according to the score achieved. The selection of items to be included stems from 28

different sources dealing with the importance of specified items or list of items to users of corporate

information. These contributions were either dealing with voluntary disclosure frameworks (e.g.

Schmalenbach Gesellschaft Work

Group on Financial Accounting, 2002; Danish Ministry of Science, Technology and Innovation, 2003a, b,

c), disclosure indices (e.g. Botosan, 1997), management and measurement systems with a reporting

option (e.g. Kaplan and Norton, 1996; Edvinsson and Malone, 1997; Sveiby, 1998; Bontis, 2003), or

selected items not represented by financial reporting standards (e.g. Aboody and Lev, 1998; Brynjolfsson

and Yang, 1999). After aggregating the suggested items, they were allocated to three main categories

following a suggestion of the Schmalenbach Gesellschaft Work Group on Financial Accounting (2002):

(1) capital-market based information relates to the financial and earnings position of a company in order

to provide investors with data for their own forecasts as well as the possibility to compare past results;

(2) Information about intellectual capital and intangibles consists of a company’s innovation capability,

intangible assets, customer assets, supplier relationships, location, human capital, investor relations,

and process capital; and

(3) Information about corporate strategy and performance consists of the value-adding activities and

measurements of a company (e.g. value-added reporting performance metrics such as DCF or EVA), and

the strategies and competitive advantages of a company (e.g. strategic advantage reporting; SWOT

analyses, competitive environment; Mu¨ller, 1998; Fischer, 2002). The master list consisted of a total of

175 items. Within each category, we selected only items that were employed by 14 or more of the 28

sources

You might also like

- Disclosure Index Approach in Accounting Research: A Review of Related IssuesDocument15 pagesDisclosure Index Approach in Accounting Research: A Review of Related IssuesMonirul Alam HossainNo ratings yet

- Disclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersFrom EverandDisclosure on sustainable development, CSR environmental disclosure and greater value recognized to the company by usersNo ratings yet

- Measuring ROI For HRD Interventions - Wang, Dou & LiDocument22 pagesMeasuring ROI For HRD Interventions - Wang, Dou & LiBoofus ShockNo ratings yet

- 10 1 1 108 7161 PDFDocument26 pages10 1 1 108 7161 PDFrestu anindityaNo ratings yet

- Bellora 2013Document45 pagesBellora 2013Teguh NarwadiNo ratings yet

- Reporting Intangible Assets: Voluntary Disclosure Practices of Top Emerging Market CompaniesDocument22 pagesReporting Intangible Assets: Voluntary Disclosure Practices of Top Emerging Market CompaniesCristina-Andreea ChiricaNo ratings yet

- Science - 5 Corporate Aggregate Disclosure Practices in JordanDocument21 pagesScience - 5 Corporate Aggregate Disclosure Practices in JordanJullyaa CyNo ratings yet

- Conceptual Analysis of Business IntelligenceDocument11 pagesConceptual Analysis of Business IntelligenceNikunj JenaNo ratings yet

- Disclosure On IntangibleDocument38 pagesDisclosure On Intangibleshyntasegitiga335No ratings yet

- Accounting, Organizations and Society. 5, No. 3, 263 - 283. 0Document21 pagesAccounting, Organizations and Society. 5, No. 3, 263 - 283. 0rarNo ratings yet

- 2002a Bpea BrynjolfssonDocument62 pages2002a Bpea Brynjolfssonmamentxu84No ratings yet

- Internationalization and Firm Performance: Meta-Analytic Review and Future Research DirectionsDocument62 pagesInternationalization and Firm Performance: Meta-Analytic Review and Future Research DirectionsAbhishek Singh100% (1)

- Assessing Disclosure Quality: A Methodological IssueDocument10 pagesAssessing Disclosure Quality: A Methodological IssueamamraNo ratings yet

- Ratio Analysis PDFDocument47 pagesRatio Analysis PDFAriunbolor BayraaNo ratings yet

- Ifrs 13 ComplianceDocument14 pagesIfrs 13 Compliancestudentul1986No ratings yet

- BUSINESS INTELLIGENCE State of The Art TDocument5 pagesBUSINESS INTELLIGENCE State of The Art TdwedqwdNo ratings yet

- Firm Characteristics and Voluntary Disclosure of Graphs in Annual Reports of Turkish Listed CompaniesDocument7 pagesFirm Characteristics and Voluntary Disclosure of Graphs in Annual Reports of Turkish Listed Companieshana1391No ratings yet

- Beaver, W.H., 2002, Perspectives On Recent Capital Market Research, Accounting Review 77 (2), 453-474Document23 pagesBeaver, W.H., 2002, Perspectives On Recent Capital Market Research, Accounting Review 77 (2), 453-474ryzqqqNo ratings yet

- 52.mutual Monitoring in Tournaments TheDocument36 pages52.mutual Monitoring in Tournaments TheBhupendra RaiNo ratings yet

- Pim Den Hertog Conceptualising PDFDocument31 pagesPim Den Hertog Conceptualising PDFvaly d.No ratings yet

- (Beaver) Perspectives On Recent Capital Market ResearchDocument23 pages(Beaver) Perspectives On Recent Capital Market ResearchWilliam Friendica MapNo ratings yet

- Business Intelligence State of The Art, Trends and Open IssuesDocument6 pagesBusiness Intelligence State of The Art, Trends and Open IssuesLuis QuitoNo ratings yet

- Pricing Strategy: A Review of 22 Years of Marketing ResearchDocument31 pagesPricing Strategy: A Review of 22 Years of Marketing ResearchAzim SachoraNo ratings yet

- Chakraborty2010-Firm SizeDocument20 pagesChakraborty2010-Firm Sizeher papoyNo ratings yet

- Convergence With IFRS - Case of IndonesiaDocument24 pagesConvergence With IFRS - Case of IndonesiaArumi LarasatiNo ratings yet

- Research Mangerial AccountingDocument62 pagesResearch Mangerial AccountinglingbbNo ratings yet

- 2b. Lassini 2015 Does Business Model Affect Accounting Choices An Empirical Analysis of European Listed CompaniesDocument32 pages2b. Lassini 2015 Does Business Model Affect Accounting Choices An Empirical Analysis of European Listed CompaniesAmanda Difa Az-zahraNo ratings yet

- The Effects of Financial Reporting and Disclosure On Corporate Investment-A ReviewDocument27 pagesThe Effects of Financial Reporting and Disclosure On Corporate Investment-A ReviewTiago Alves BarbosaNo ratings yet

- Theory Capital BudgetingDocument22 pagesTheory Capital BudgetingQuốc Duy ChungNo ratings yet

- 1 s2.0 S0959652613004654 MainDocument17 pages1 s2.0 S0959652613004654 MainshetaNo ratings yet

- Manuel Mira GodinhoDocument28 pagesManuel Mira GodinhoVictor TorrealbaNo ratings yet

- International Review of Financial AnalysisDocument18 pagesInternational Review of Financial AnalysisNouman SheikhNo ratings yet

- Concentration and Price-Cost Margins in Manufacturing IndustriesFrom EverandConcentration and Price-Cost Margins in Manufacturing IndustriesNo ratings yet

- "Business Model Change: The Case of The Major in The Phonographic Industry (1998-2008) ", Emilien MoyonDocument60 pages"Business Model Change: The Case of The Major in The Phonographic Industry (1998-2008) ", Emilien MoyonemilienmoyonNo ratings yet

- A Multidimensional Evaluation of The Effectiveness of Business Incubators: An Application of The Outranking MethodDocument17 pagesA Multidimensional Evaluation of The Effectiveness of Business Incubators: An Application of The Outranking MethodA Faroby FalatehanNo ratings yet

- IEEE Latest PapersDocument15 pagesIEEE Latest Papersramesh23380No ratings yet

- Capital - Markets - Research - in - Accounting Kotari-1-55-1-17Document17 pagesCapital - Markets - Research - in - Accounting Kotari-1-55-1-17Kun CupNo ratings yet

- Accounting Technologies and SustainabilityDocument13 pagesAccounting Technologies and Sustainabilitycharme4109No ratings yet

- Prince MKT.+Document32 pagesPrince MKT.+Jorge MuñozNo ratings yet

- Theoretical Review of The Role of Financial Ratios: Diwahar - Nadar@nmims - EduDocument22 pagesTheoretical Review of The Role of Financial Ratios: Diwahar - Nadar@nmims - EduMercy DohNo ratings yet

- Hitt - Strategic ManagementDocument7 pagesHitt - Strategic ManagementFernando R SantosNo ratings yet

- Ferreira 2015Document9 pagesFerreira 2015Shantanu DasNo ratings yet

- Changes in Performance Measurement Systems in the Banking SectorDocument24 pagesChanges in Performance Measurement Systems in the Banking Sectordimple patelNo ratings yet

- Nichols & Wahlen 2023Document29 pagesNichols & Wahlen 2023Shekhar LalaramNo ratings yet

- Business Model Innovation For Circular Economy IntDocument10 pagesBusiness Model Innovation For Circular Economy IntalaouibencherifmoNo ratings yet

- Managerial Tools and Techniques For Decision Making: CitationDocument13 pagesManagerial Tools and Techniques For Decision Making: Citationhasan najiNo ratings yet

- The Contribution of Intangibles To The Value Creation PDFDocument33 pagesThe Contribution of Intangibles To The Value Creation PDFBen TanfousNo ratings yet

- Adding New Features and Tools To Knowledge Management Models andDocument20 pagesAdding New Features and Tools To Knowledge Management Models andSheetal JasmeetNo ratings yet

- Italy Mandatory Sustainability Reporting AnalysisDocument18 pagesItaly Mandatory Sustainability Reporting Analysisanh trầnNo ratings yet

- concepto de indicadorDocument24 pagesconcepto de indicadora2020118629No ratings yet

- 2Document75 pages2stfatimah13No ratings yet

- Jurnal 1Document28 pagesJurnal 1Kim MinseokNo ratings yet

- Ahokape, Journal Manager, 1923-6523-1-CEDocument21 pagesAhokape, Journal Manager, 1923-6523-1-CEPhương ThủyNo ratings yet

- Rohm, MRQ 2018Document41 pagesRohm, MRQ 2018VietNo ratings yet

- A Conceptual Framework For Analyzing The Financial EnvironmentDocument42 pagesA Conceptual Framework For Analyzing The Financial EnvironmentNoelNo ratings yet

- Accounting AssignmentDocument8 pagesAccounting AssignmentKebebew AlemuNo ratings yet

- Zerbini, Fabrizio (2015) - CSR Initiatives As Market Signals A Review and ResearchDocument23 pagesZerbini, Fabrizio (2015) - CSR Initiatives As Market Signals A Review and ResearchridwanNo ratings yet

- Artikel Pasar Modal 1-DikonversiDocument127 pagesArtikel Pasar Modal 1-DikonversiNoviyanti AngreaniNo ratings yet

- Innovation: Definitions, History and an example fromSocial Housing in the UK: Number 1From EverandInnovation: Definitions, History and an example fromSocial Housing in the UK: Number 1No ratings yet

- Class Activity GoodMktgPracticesOrgPerformanceDocument1 pageClass Activity GoodMktgPracticesOrgPerformancehuzaifa anwarNo ratings yet

- SMM Final ReportDocument47 pagesSMM Final Reporthuzaifa anwarNo ratings yet

- AbstractDocument35 pagesAbstracthuzaifa anwarNo ratings yet

- Assignment 1 (61723)Document4 pagesAssignment 1 (61723)huzaifa anwarNo ratings yet

- Hafiz Huzaifa Anwar (61723)Document3 pagesHafiz Huzaifa Anwar (61723)huzaifa anwarNo ratings yet

- Strategic Management: The External Environment: Opportunities, Threats, Industry Competition, and Competitor AnalysisDocument40 pagesStrategic Management: The External Environment: Opportunities, Threats, Industry Competition, and Competitor Analysishuzaifa anwarNo ratings yet

- Chap 1 IbDocument3 pagesChap 1 Ibhuzaifa anwarNo ratings yet

- Adv Retailing McqsDocument3 pagesAdv Retailing Mcqshuzaifa anwarNo ratings yet

- Supply Chain Resilience, Contingencies, and Business Continuity PlansDocument8 pagesSupply Chain Resilience, Contingencies, and Business Continuity Planshuzaifa anwarNo ratings yet

- Adv. RetailDocument6 pagesAdv. Retailhuzaifa anwarNo ratings yet

- 1-Intro StrategicManagementDocument38 pages1-Intro StrategicManagementhuzaifa anwarNo ratings yet

- Corporate Level StrategyDocument18 pagesCorporate Level Strategyhuzaifa anwarNo ratings yet

- Practice Case StudiesDocument1 pagePractice Case Studieshuzaifa anwarNo ratings yet

- Basics of Supply ChainDocument38 pagesBasics of Supply Chainhuzaifa anwarNo ratings yet

- NNC Evening and Weekend Schedule FALL 2021Document1 pageNNC Evening and Weekend Schedule FALL 2021huzaifa anwarNo ratings yet

- College of Management Sciences North Campus - Morning ProgramDocument1 pageCollege of Management Sciences North Campus - Morning Programhuzaifa anwarNo ratings yet

- 2 - AssigmentDocument1 page2 - Assigmenthuzaifa anwarNo ratings yet

- Product Life Cycle & Marketing StrategyDocument23 pagesProduct Life Cycle & Marketing Strategyhuzaifa anwarNo ratings yet

- Project Report On Pizza HutDocument31 pagesProject Report On Pizza Huthuzaifa anwarNo ratings yet

- Project Report On KFCDocument60 pagesProject Report On KFCSiavash Wared75% (44)

- (Questions & Answers) : Successful SaleDocument4 pages(Questions & Answers) : Successful Salehuzaifa anwarNo ratings yet

- Business-Level Strategy: Authored By: Marta Szabo White, PH.D Georgia State UniversityDocument43 pagesBusiness-Level Strategy: Authored By: Marta Szabo White, PH.D Georgia State Universityhuzaifa anwarNo ratings yet

- Product Life Cycle & Marketing StrategyDocument23 pagesProduct Life Cycle & Marketing Strategyhuzaifa anwarNo ratings yet

- BBA Bsaf Bsav Bba/Mba Others: Days Pds TimingsDocument2 pagesBBA Bsaf Bsav Bba/Mba Others: Days Pds TimingsMark BourneNo ratings yet

- Corporate Level StrategyDocument18 pagesCorporate Level Strategyhuzaifa anwarNo ratings yet

- MID TERM MCQsDocument4 pagesMID TERM MCQshuzaifa anwarNo ratings yet

- Mid Term SubjectiveDocument1 pageMid Term Subjectivehuzaifa anwarNo ratings yet

- Midterm Exam Paper of BRW-106455 - Section BDocument4 pagesMidterm Exam Paper of BRW-106455 - Section Bhuzaifa anwarNo ratings yet

- Strategic Management: Business-Level StrategyDocument18 pagesStrategic Management: Business-Level Strategyhuzaifa anwarNo ratings yet

- 2.5 MARKS: Need To Attempt Any 5 QuestionsDocument1 page2.5 MARKS: Need To Attempt Any 5 Questionshuzaifa anwarNo ratings yet

- Jepi 03.23.22Document3 pagesJepi 03.23.22physicallen1791No ratings yet

- BoK - BPI AO - Final Customer Risk Profiling (CRP) FormatDocument3 pagesBoK - BPI AO - Final Customer Risk Profiling (CRP) FormatMuhammad Yaseen LakhaNo ratings yet

- Jasper Gifford Economics DraftDocument10 pagesJasper Gifford Economics DraftHiNo ratings yet

- Suport Curs 13Document11 pagesSuport Curs 13Sorin GabrielNo ratings yet

- Philippine Financial SystemDocument2 pagesPhilippine Financial SystemKurt Lubim Alaiza-Anggoto Meltrelez-LibertadNo ratings yet

- ACCRUALSDocument2 pagesACCRUALSLiLi LemonNo ratings yet

- Role of Governments and Nongovernmental Organizations: Chapter OverviewDocument29 pagesRole of Governments and Nongovernmental Organizations: Chapter OverviewKaete CortezNo ratings yet

- Jan 2005 Formasi Trading Inc Income StatementDocument1 pageJan 2005 Formasi Trading Inc Income StatementRictu SempakNo ratings yet

- 2008 ch1 ExsDocument21 pages2008 ch1 ExsamatulmateennoorNo ratings yet

- Business Chapter 2 BUSINESS STRUCTUREDocument7 pagesBusiness Chapter 2 BUSINESS STRUCTUREJosue MushagalusaNo ratings yet

- ASSG CargillsDocument3 pagesASSG Cargillslakmal_795738846No ratings yet

- Jadavpur University Economics Internship BrochureDocument19 pagesJadavpur University Economics Internship BrochureSuman Century RoyNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- A Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDocument255 pagesA Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDhiraj DaimaryNo ratings yet

- Republic of The PhilippinesDocument7 pagesRepublic of The Philippinesvita feliceNo ratings yet

- Calculate LTV ratio and monthly amortizationDocument4 pagesCalculate LTV ratio and monthly amortizationMichelle GozonNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- PLCR TutorialDocument2 pagesPLCR TutorialSyed Muhammad Ali SadiqNo ratings yet

- Ityukta - MECCADocument31 pagesItyukta - MECCAAditi100% (1)

- Project WalmartDocument15 pagesProject WalmartMani RatnamNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- Debt RestructuringDocument2 pagesDebt RestructuringDañella Jane Baisa0% (1)

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- 14 Sustainable TourismDocument17 pages14 Sustainable TourismIwan Firman WidiyantoNo ratings yet

- Plant HR Business Partner in Chicago IL Resume David AndreDocument2 pagesPlant HR Business Partner in Chicago IL Resume David AndreDavidAndreNo ratings yet

- Coca-Cola Hellenic 2011 Annual Report (IFRS FinancialsDocument86 pagesCoca-Cola Hellenic 2011 Annual Report (IFRS FinancialskhankhanmNo ratings yet

- Security Market IndicesDocument9 pagesSecurity Market IndicesSyed Arham MurtazaNo ratings yet

- Joint Venture Between Tata and ZaraDocument4 pagesJoint Venture Between Tata and ZaraShrishti Agarwal100% (1)

- BCG - ACC3 - 28 June 2021 - S1Document5 pagesBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Acetic Acid (Europe) 2013-10-11Document2 pagesAcetic Acid (Europe) 2013-10-11Iván NavarroNo ratings yet