Professional Documents

Culture Documents

Share Price Movement

Uploaded by

sakshi gulati0 ratings0% found this document useful (0 votes)

9 views1 pageShare prices of public sector banks soared after the government announced a Rs 2.11 lakh crore recapitalization plan for public sector banks. The PNB share price gained 46% since the announcement as the infusion of capital is expected to boost credit growth and the economy by strengthening banks' balance sheets and addressing non-performing loans. While other public sector bank stocks pared some gains, PNB share price continued climbing 5.6% higher as it was considered one of the most capital-starved top public sector banks.

Original Description:

iapm

Original Title

IAPM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentShare prices of public sector banks soared after the government announced a Rs 2.11 lakh crore recapitalization plan for public sector banks. The PNB share price gained 46% since the announcement as the infusion of capital is expected to boost credit growth and the economy by strengthening banks' balance sheets and addressing non-performing loans. While other public sector bank stocks pared some gains, PNB share price continued climbing 5.6% higher as it was considered one of the most capital-starved top public sector banks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageShare Price Movement

Uploaded by

sakshi gulatiShare prices of public sector banks soared after the government announced a Rs 2.11 lakh crore recapitalization plan for public sector banks. The PNB share price gained 46% since the announcement as the infusion of capital is expected to boost credit growth and the economy by strengthening banks' balance sheets and addressing non-performing loans. While other public sector bank stocks pared some gains, PNB share price continued climbing 5.6% higher as it was considered one of the most capital-starved top public sector banks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Share price movement

NSE PSU Bank index soared 24% intraday, led by gains

in SBI, PNB, Bank of Baroda, Bank of India and Union Bank,

among others, while NSE Private Bank index is up 35%.

Benchmark indices Sensex and Nifty jumped 20-21% in the

same period.

PNB has gained 46 per cent since October 24, when the

recapitalisation plan was rolled out by the government.

Even as stocks of other public sector banks (PSBs) pared

some gains on Thursday, PNB was an exception with an up move of

5.6 per cent.

Reasons for the surge

The government announcement was a much-needed

stimulus package, which could shore up the sluggish credit

growth at public sector undertaking (PSU) banks and help

kick-start the economy.

Analysts said the top-up plan was long-awaited for

PSU banks that have been reeling under a pile of non-

performing loans (NPLs), which was blocking their growth

plans.

The decision to recapitalise PSBs (public sector banks) with Rs 2.11 lakh crore was expected

to address the bank balance sheet problem and push growth forward.

PNB being a capital-starved bank among the top-rung PSBs, the government’s plan to infuse

money was a positive.

You might also like

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaNo ratings yet

- Recapitalisation of PSU BanksDocument4 pagesRecapitalisation of PSU BanksRamnik Singh KohliNo ratings yet

- Penilaian Kualitas Kinerja Keuangan Perusahaan PerDocument16 pagesPenilaian Kualitas Kinerja Keuangan Perusahaan PerCABE GEMINGNo ratings yet

- Daily News Analysis Privatisation of Banks Print ManuallyDocument3 pagesDaily News Analysis Privatisation of Banks Print ManuallyadkgNo ratings yet

- 0RBIBULLETIN2D1CE48Document200 pages0RBIBULLETIN2D1CE48sp78gxmfkrNo ratings yet

- RBIs Expansionary Monetary PolicyDocument2 pagesRBIs Expansionary Monetary PolicyVandana SharmaNo ratings yet

- Bispap122 JDocument9 pagesBispap122 JHashmita MistriNo ratings yet

- Impact of RBI's Monetary Policy Announcements On Government Bond Yields: Evidence From The PandemicDocument31 pagesImpact of RBI's Monetary Policy Announcements On Government Bond Yields: Evidence From The Pandemicpritam neogiNo ratings yet

- Privatisation of Banks: Why in NewsDocument3 pagesPrivatisation of Banks: Why in NewsAbhay RajNo ratings yet

- Impact of Demonetization On Banking Sector: Submitted To: DR Bipasha MeityDocument15 pagesImpact of Demonetization On Banking Sector: Submitted To: DR Bipasha MeityHari PriyaNo ratings yet

- Perspective On The Monetary Policy' by Rajani Sinha, Chief Economist & National Director - Research, Knight Frank IndiaDocument3 pagesPerspective On The Monetary Policy' by Rajani Sinha, Chief Economist & National Director - Research, Knight Frank IndiaNaveen BhaiNo ratings yet

- Calibrated Normalisation: Monetary PolicyDocument4 pagesCalibrated Normalisation: Monetary Policyvikash singhNo ratings yet

- Review of Monetary Policy Statement H2'24 by EBLSLDocument7 pagesReview of Monetary Policy Statement H2'24 by EBLSLAnika Nawar ChowdhuryNo ratings yet

- An Inter Temporal AnalysisDocument8 pagesAn Inter Temporal AnalysisTarun KhandelwalNo ratings yet

- The Banking Conundrum: Non-Performing Assets and Neo-Liberal ReformDocument9 pagesThe Banking Conundrum: Non-Performing Assets and Neo-Liberal ReformAyush gargNo ratings yet

- RBI Allows Recast of Home, Personal & Small Business Loans: TNN - May 6, 2021, 04.17 AM ISTDocument2 pagesRBI Allows Recast of Home, Personal & Small Business Loans: TNN - May 6, 2021, 04.17 AM ISTAbhijeet SinghNo ratings yet

- Development of Non Bank Financial Institutions To Strengthen The Financial System of BangladeshDocument22 pagesDevelopment of Non Bank Financial Institutions To Strengthen The Financial System of BangladeshFazle-Rabbi AnnoorNo ratings yet

- FMI Updates 2021 MainsDocument13 pagesFMI Updates 2021 MainsGarima LohiaNo ratings yet

- DCBBDDocument21 pagesDCBBDFahimKhanDeepNo ratings yet

- Final Submitted To FID - NFIS B v2Document60 pagesFinal Submitted To FID - NFIS B v2Yasmine AbdelbaryNo ratings yet

- Banking Law AssignmentDocument10 pagesBanking Law AssignmentAkshsNo ratings yet

- Feb 1Document5 pagesFeb 1Pavan SuhaneyNo ratings yet

- Indias Public-Sector Banking Crisis Whither The Withering BanksDocument24 pagesIndias Public-Sector Banking Crisis Whither The Withering BankspraveenmohantyNo ratings yet

- Editorial Consolidation (July) 2023Document62 pagesEditorial Consolidation (July) 2023Hello HiiNo ratings yet

- Indias Public-Sector Banking Crisis Whither The Withering BanksDocument24 pagesIndias Public-Sector Banking Crisis Whither The Withering BanksSrajal JainNo ratings yet

- ResearchDocument PDFDocument6 pagesResearchDocument PDFJayant BodheNo ratings yet

- Merger of PsbsDocument3 pagesMerger of PsbsSanjay SolankiNo ratings yet

- Indian Banking Sector Credit Growth Has Grown at A Healthy PaceDocument1 pageIndian Banking Sector Credit Growth Has Grown at A Healthy PaceAkshay GonewarNo ratings yet

- Commercial Bank Management: Assignment-2Document4 pagesCommercial Bank Management: Assignment-2Prash SNo ratings yet

- RBI Dec Monetary PolicyDocument3 pagesRBI Dec Monetary PolicyKalpesh AgrawalNo ratings yet

- RBI Mid QTR Policy Review 16122010Document3 pagesRBI Mid QTR Policy Review 16122010tamirisaarNo ratings yet

- Privatization of BanksDocument2 pagesPrivatization of BanksMRS.NAMRATA KISHNANI BSSSNo ratings yet

- Sip Report On SbiDocument46 pagesSip Report On SbiRashmi RanjanNo ratings yet

- Lessons From NPA Crisis PDFDocument6 pagesLessons From NPA Crisis PDFANKUR PUROHITNo ratings yet

- Mutual Fund Review: Equity MarketDocument11 pagesMutual Fund Review: Equity MarketNadim ReghiwaleNo ratings yet

- News Analysis (05 Mar, 2022)Document22 pagesNews Analysis (05 Mar, 2022)Vivaswan DeekshitNo ratings yet

- ICICIdirect MonthlyMFReportDocument12 pagesICICIdirect MonthlyMFReportSagar KulkarniNo ratings yet

- Challenges For India in Financial SectorDocument2 pagesChallenges For India in Financial SectorShivaditya VermanNo ratings yet

- Beyond Pakistans 2021 22 Budget The Economy and GrowthDocument8 pagesBeyond Pakistans 2021 22 Budget The Economy and GrowthFurqan AhmedNo ratings yet

- Introduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksDocument6 pagesIntroduction To Indian Financial System: The Union Budget 2021 Has Announced The Privatisation of Two Public Sector BanksVidushi TandonNo ratings yet

- Literature Review On Npa in SbiDocument4 pagesLiterature Review On Npa in Sbirpmvtcrif100% (1)

- The Financial Sector in Papua New Guinea - A Good Case of ReformDocument22 pagesThe Financial Sector in Papua New Guinea - A Good Case of ReformZebedee TaltalNo ratings yet

- Chapter 5Document24 pagesChapter 5asifanisNo ratings yet

- Y V Reddy: Banking Sector Reforms in India - An OverviewDocument7 pagesY V Reddy: Banking Sector Reforms in India - An OverviewTanimaa MehraNo ratings yet

- Caa Week 1 November, 2019.inddDocument6 pagesCaa Week 1 November, 2019.inddPraveen P. S. TomarNo ratings yet

- Classroom 0 BANKINGDocument19 pagesClassroom 0 BANKINGSimbaBabduNo ratings yet

- Reforms in Financial SectorDocument15 pagesReforms in Financial SectorRikaNo ratings yet

- Performance of Nbfcs A Pre and Post Covi A084d920Document11 pagesPerformance of Nbfcs A Pre and Post Covi A084d920SeetanNo ratings yet

- Vol 45Document101 pagesVol 45Darshan ThummarNo ratings yet

- Table of ContentDocument9 pagesTable of ContentNitin YadavNo ratings yet

- Republic of Indonesia Presentation Book - June 2023Document136 pagesRepublic of Indonesia Presentation Book - June 2023Rachel HosannaNo ratings yet

- Chaitanya Godavari Grameena Bank - Economic Value AddDocument3 pagesChaitanya Godavari Grameena Bank - Economic Value AddPhaniee Kumar VicharapuNo ratings yet

- Finvest Pulse April 2022Document7 pagesFinvest Pulse April 2022Shivani SharmaNo ratings yet

- Finmar Chapter 12Document30 pagesFinmar Chapter 12Lee TeukNo ratings yet

- Assignment4Document2 pagesAssignment4Laiba EjazNo ratings yet

- BSP Org Primer PDFDocument39 pagesBSP Org Primer PDFTheresa PaladinNo ratings yet

- Republic of Indonesia Presentation Book - April 2023Document120 pagesRepublic of Indonesia Presentation Book - April 2023mnbvcxzqwerNo ratings yet

- Monetary & Fiscal PolicyDocument10 pagesMonetary & Fiscal PolicyManavazhaganNo ratings yet

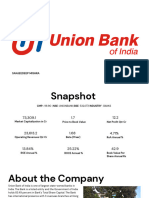

- Union BankDocument30 pagesUnion BankSanjeedeep Mishra , 315No ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Monmouth Case QuestionsDocument1 pageMonmouth Case Questionssakshi gulatiNo ratings yet

- Krispy NaturalDocument16 pagesKrispy Naturalsakshi gulatiNo ratings yet

- Gail India Ltd. ReportDocument8 pagesGail India Ltd. Reportsakshi gulatiNo ratings yet

- Presented By: Baishali Sarmah Sakshi Gulati Sachin BainslaDocument10 pagesPresented By: Baishali Sarmah Sakshi Gulati Sachin Bainslasakshi gulatiNo ratings yet

- Dr. Kavita Sasidharan Kulkarni, Supervisor, School of BusinessDocument2 pagesDr. Kavita Sasidharan Kulkarni, Supervisor, School of Businesssakshi gulatiNo ratings yet

- SVKM'S Narsee Monjee Institute of Management Studies HyderabadDocument7 pagesSVKM'S Narsee Monjee Institute of Management Studies Hyderabadsakshi gulatiNo ratings yet