Professional Documents

Culture Documents

Jurnl Akber Sap 9

Uploaded by

Gunk Alit Part IIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jurnl Akber Sap 9

Uploaded by

Gunk Alit Part IICopyright:

Available Formats

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

Influence of Credit Risk Management Practices on

Loan Performance of Microfinance Institutions in

Baringo County

Kurui Samuel Kiplimo1*, Dr. Aquilars M. Kalio2

P.O Box 46-20105 Mogotio Kenya

kuruikiplimo@gmail.com

Abstract: The purpose of this study was to investigate the effect of credit risk management practices on loan performance in MFIs in

Baringo County. The study employed a descriptive research design and was based on a survey of MFIs in Baringo County. The target

population in this study was managers and credit officers in MFIs in Baringo County. Census sampling technique was used because all

branch managers and credit officers were directly targeted in this study. Questionnaire was used to collect data. Descriptive and

inferential statistics were used in data analysis. Descriptive statistics including percentages and frequencies while inferential statistics

used included Pearson correlation and regression analysis. The study concluded that there was a strong relationship between client

appraisals and loan performance in MFIs. The study revealed that an increase in client appraisal led to an increase in loan performance

in MFIs in Baringo County. Thus the study concludes that credit risk management practices significantly influenced loan performance

of MFIs in Baringo County. The study recommends adoption of a more stringent policy on credit risk management practices in MFIs in

Baringo County so as to improve their financial performance.

Keywords: Client Appraisal, Credit Management practices, Credit Risk Control, Loan Performance, Microfinance Institutions,

Microfinance

1. Introduction the firm may also change. Therefore MFIs must develop a

credit policy to govern their credit management operations

The concept of credit has a long history and can be traced (Pandey, 2008) and since MFIs generate their revenue

back to ancient times. However, it was not until after the from credit extended to low income individuals in the form

Second World War when it largely begun to be of interest charged on the funds granted (Kariuki, 2010)

appreciated in Europe (Kiiru, 2004). In the United States the loan repayments may be uncertain. The success of

of America (USA) banks extended credit to customers lending out credit depends on the methodology applied to

with high interest rates which sometimes discouraged evaluate and to award the credit (Ditcher, 2003) and

borrowers. Thus the concept of credit was not popular in therefore the credit decision should be based on a thorough

USA until the economic boom of 1885 when banks had evaluation of the risk conditions of the lending and the

excess liquidity and wanted to lend the excess cash characteristics of the borrower. Numerous approaches have

(Ditcher, 2003). In Africa the concept of credit was largely been developed in client appraisal process by financial

appreciated in the 1950’s when most banks started opening institutions. They range from relatively simple methods,

the credit sections to extend loans to white settlers. In such as the use of subjective or informal approaches, to

Kenya credit was initially given to the rich and big fairly complex ones, such as the use of computerized

companies and was not popular to the poor. In 1990s loans simulation models and Credit Reference Bureau (Horne,

extended to customers failed to perform well thus 2007). Many lending decisions by MFIs are frequently

necessitating the need for intervention. Mechanisms to based on their subjective feelings about the risk in relation

evaluate for the evaluation of customer’s ability to repay to expected repayment by the borrower. MFIs commonly

the loan were considered, but this didn’t work well as loan use this approach because it is both simple and

defaults continued unabated (Modoc, 1999). This has been inexpensive. However the concepts of 5C for credit

the case not only in MFIs but also in formal banking appraisal pioneered by Edward (1997) has gained currency

institutions. In microfinance institutions (MFIs) the in MFIs. These elements are character, capacity, collateral,

concept of credit management became widely appreciated capital and condition (Edward, 1997; Orua, 2009).

in the late 90s, but again this did not stop loan defaults to Microfinance deals with the lending of small amount of

this date (Modoc, 1999). capital to poor entrepreneurs in order to create a

mechanism to alleviate poverty by providing the poor and

Consequently research studies have suggested that in order destitute with resources that are available to the wealthy at

to minimize exposure to bad debt, financial institutions a small scale. According to Anyanwu (2004), MFIs

must have greater insight into customer financial strength, provide not only capital to the poor, but also combat

credit score history and changing payment patterns. The poverty at an individual level. Thus such institutions

ability to attract customers hinges on the ability to quickly should continuously provide financial services to the poor.

and easily make well-informed credit decisions and set In Africa and other developing regions, MFIs are the main

appropriate lines of credit. However, a firm’s credit policy source of funding for micro enterprises (Anyanwu, 2004).

is greatly influenced by economic conditions (Pandey, In Kenya the gap filled by MFIs has become part of the

2008). As economic conditions change, the credit policy of formal financial system and MFIs need to access capital

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2260

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

market to fund their lending portfolios, in order to allow Baringo County. This trend not only threatens the viability

them to dramatically increase the number of poor people and sustainability of the MFIs but also hinders the

they can reach. In Kenya micro financing is offered by provision of credit to the rural unbanked population and

many big and small micro financial institutions such as bridge the financing gap in the mainstream financial

Kenya Women Finance Trust (KWFT), Faulu Kenya, sector. A study on microfinance credit risk management

Rafiki, Rahisi business solutions among others. These practices and loan recovery systems is of considerable

micro financial institutions have national, regional and interest by many researchers particularly under the new

local presence in Baringo County. constitutional dispensation. This is because some MFIs

have collapsed while others are facing serious default or

Credit Risk Management and Loan Performance in low loan uptake (Migiri, 2012). However, most studies

Microfinance Institutions undertaken in the past few years have focused mainly on

credit models used by deposit taking microfinance

Loan portfolio refers to the total amount of money given institutions (DTM) and their impact on profitability

out in different loan products to different types of (Migiri, 2012). Absence of empirical studies on the role of

borrowers. This may be comprised of salary loans, group credit risk management practices on the performance of

guaranteed loans, individual loans and corporate loans. MFIs was the principal motivation behind this study which

Loan portfolio looks at the number of clients with loans sought to find out the influence of credit risk management

and the total amount in loans (Wester, 1993). Survival of practices on loan performance in microfinance institutions

most MFIs depends entirely on successful lending program in Baringo County.

that revolves on funds and loan repayments made to them

by the clients (Sindani, 2012). This requires a restrictive Objective of the Study

credit control system to be put in place so as to restrain

from unnecessary lending thus, improving on profitability To determine the effect of client appraisal on loan

of micro finance institutions (Kakuru, 2000). Credit performance of microfinance institutions in Baringo

management is the executive responsibility of determining County.

customer’s credit ratings as part of the credit control

function. Research Hypotheses

Tucker and Miles (2004) studied three data series for the H01: There is no statistically significant relationship

period between March 1999 and March 2001 and found between client appraisal and loan performance of

that self-sufficient MFIs are profitable and perform better microfinance institutions in Baringo County.

on return on equity (ROE) and return on assets (ROA). In

order to optimize their performance, MFIs are seeking to Significance of the Study

become more commercially oriented and stress more on

improving their profitability. Loan portfolio in MFIs is the The outcome of this study is expected to benefit many

most important since portfolio quality reflects the risk of parties. The microfinance sector may benefit from the

loan delinquency and determines future revenues and study because it may highlight the problems microfinance

ability to increase outreach and serve existing customers. face due to non performing loans. The results of the study

Portfolio quality is measured as portfolio at risk over 30 may also help other researchers who may be interested in

days. How best a loan portfolio is performing is looked at doing further research in the same area of study. The

in terms of profitability and rate of return on different loan findings of the study may also benefit students pursuing

products. This is a function of the number of the loans and financial management courses. The study also adds to the

the cost of administering these loans (Indjeikein, 1997). In body of knowledge in the finance discipline by bridging

Baringo County the extent of poverty is alarming. gaps in credit risk management practices. This study may

However, the need for microcredit has been noted and make several contributions to both knowledge building

several MFIs have opened branches in the area. and practice improvement in credit risk management

Consequently studies were required to establish the extent practices and financial performance.

to which credit risk management practices may influence

loan performance and minimize the risk of credit default in Scope of the Study

MFIs in the area.

The study was carried out at Baringo County and covered

Statement of the Problem a period between August and October, 2014. The study

was conducted among 7 microfinance institutions found in

The financial success of MFIs depends on the Baringo County. The area of the study was on credit risk

effectiveness of their credit management systems because management practices in MFIs in Baringo County. The

these institutions generate most of their income from area was chosen because of its proximity to the researcher

interest earned on loans extended to small and medium and accessibility of the MFIs within the study area. The

entrepreneurs. The Central Bank Annual Supervision study was conducted within the proposed budgetary plan

Report, 2010 indicates that high incidence of credit default and time frame.

has been reflected in the rising levels of non- performing

loans by MFIs in the last 10 years. This situation has

adversely impacted on loan performance and profitability

of MFIs. This situation is not different from MFIs in

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2261

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

2. Literature Review Client Appraisal and Loan Performance

Theoretical Review Client appraisal can be used to enhance loan performance.

The 5 C’s Model of Client Appraisal The first step in limiting credit risk involves screening

clients to ensure that they have the willingness and ability

Microfinance institutions may use the 5Cs model of credit to repay a loan. MFIs use the 5Cs model of credit to

management to evaluate a customer as a potential evaluate a customer as a potential borrower (Abedi, 2000).

borrower (Abedi, 2000). The 5Cs are character, capacity, The 5Cs help MFIs to increase loan performance, as they

collateral, capital and condition. Character basically is a get to know their customers better. The 5Cs need to be

tool that provides weighting values for various included in the credit scoring model. The credit scoring

characteristics of a loan applicant and the total weighted model is a classification procedure in which data collected

score of the applicant is used to estimate his credit from application forms for new or extended credit line are

worthiness (Myers, 2005). The factors that influence a used to assign credit applicants to good or bad credit risk

client can be categorized into personal, cultural, social and classes (Constantinescu, 2010). Inkumbi (2009) notes that

economic factors (Ouma, 2008). The psychological factor capital and collateral are the major stumbling blocks for

is based on a man’s inner worth rather than on his tangible entrepreneurs trying to access capital. This is especially

evidences of accomplishment. MFIs may consider this true for young entrepreneurs or entrepreneurs with no

factor by observing and learning about the individual. In money to invest as equity; or with no assets they can offer

most cases it is not considered on first application of credit as security for a loan. Any effort to improve access to

by an applicant but from the second time. finance has to address the challenges related to access to

capital and collateral. One way to guarantee the recovery

Under social factors, lifestyle is the way a person lives. of loaned money is to take some sort of collateral on a

This includes patterns of social relations such as loan. This is a straightforward way of dealing with the

membership groups, consumption and entertainment. A aspect of securing depositors funds. However, customer

lifestyle typically also reflects an individual's attitudes, evaluation has been considered appropriate in the context

values or worldview. Reference groups in most cases have of MFIs. Campsey and Brigham (1995) propounded that

indirect influence on a person’s credibility. Through group the evaluation of an individual should involve; gathering

guarantors MFIs try to identify the reference groups of of relevant information on the applicant, analyzing the

their target as they influence a client’s credibility. Personal information to determine credit worthiness and making the

factors include age, life cycle stage, occupation, income or decision to extend credit and to what tune.

economic situation, personality and self concept. Under

life cycle stage for example older families with mature Empirical Review

children are not likely to default since it’s easier to attach

collateral on their assets since they are settled unlike the Several studies have been done in regard to credit risk

unsettled young couples. The MFIs will consider the cash management on loan portfolio. Pyle (1997) in his study on

flow from the business, the timing of the repayment, and credit risk management held that financial institutions

the successful repayment of the loan. Cash flow helps the needed to meet forthcoming regulatory requirements for

MFIs to determine if the borrower has the ability to repay risk measurement and capital. However, it is a serious

the debt. The analysis of cash flow can be very technical. error to think that meeting regulatory requirements is the

It may include more than simply comparing income and sole or even the most important reason for establishing a

expenses. MFIs determine cash flow by examining sound, scientific risk management system. Managers need

existing cash flow statements and reasonable projections reliable risk measures to direct capital to activities with the

for the future. best risk/reward ratios. They need the estimate of the size

of potential losses to stay within limits imposed by readily

Collateral is any asset that customers have to pledge available liquidity, by creditors, customers and regulators.

against debt (Modoc, 1999). Collateral represents assets Mechanisms are needed to monitor positions and create

that the company pledges as alternative repayment source incentives for prudent risk taking by divisions and

of loan. Most collateral is in form of hard assets such as individuals.

real estate and office or manufacturing equipment.

Alternatively accounts receivable and inventory can be Nagarajan (2011) in his study of credit risk management

pledged as collateral. MFIs prefer collateral that has practices for microfinance institutions in Mozambique

duration closely matched to the short term loan. According found that risk management is a dynamic process that

to Wester (1993) capital is measured by the general could ideally be developed during normal times and tested

financial position of the borrower as indicated by a at the wake of risk. The study concluded that financial

financial ratio analysis, with special emphasis on tangible institutions needed to minimize risks related losses through

net worth of the borrower’s business. Thus, capital is the diligent management of portfolio and cash-flow by

money a borrower has personally invested in the business building robust institutional infrastructure with skilled

and is an indication of how much the borrower has at risk human resources and inculcating client discipline, through

should the business fail. Condition refers to the borrower’s effective coordination of stakeholders. Matu (2008) carried

sensitivity to external forces such as interest rates, inflation out a study on sustainability and profitability of

rates, business cycles as well as competitive pressures. The microfinance institutions and noted that efficiency and

conditions focus on the borrower’s vulnerability. effectiveness were the main challenges facing Kenya on

service delivery. Soke and Yusoff (2009), in their study on

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2262

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

credit risk management strategies of selected financial As presented in Table 1, 97.8% of the respondents

institutions in Malaysia found that majority of financial indicated that their MFIs had adopted credit management

institutions losses stem from outright default due to practices, whereas 2.2 % indicated that their MFIs had not.

inability of customers to meet obligations in relation to From these results it is evident that a significant number of

borrowing. This study will establish whether MFIs MFIs in Baringo County had adopted credit risk

borrowers in Baringo do meet their loan obligation or not. management practices.

Orua (2009) conducted a study on the relationship between

loan applicant appraisal and loan performance of Credit Risk Management Practices and Rate of Loan

microfinance institutions in Kenya. The study revealed that Performance

short-term debt significantly impacted MFI outreach

positively. Long term debt however showed positive The study sought to determine the extent to which credit

relationship with outreach but was not significant with risk management practices have lead to rate of loan

regard to default rates. This study is different since the performance in microfinance institutions in Baringo

focus is exclusively on short term debts. Sindani (2012) in County. The results obtained are presented in Table 2.

her study on effectiveness of credit management system on

loan performance based on empirical review established Table 2: Credit Risk Management Practices and the Rate

that credit terms formulated by microfinance institutions of Loan Performance

affected loan performance. The study recommended that Extent of Effect Frequency Percentage

both credit officers and customers should be involved in Very Great Extent 26 28.9

formulating credit terms. This study is expected to find out Great Extent 48 53.3

if this recommendation was applicable in the case of MFIs Medium Extent 15 16.7

in Baringo County. Least Extent 1 1.1

No Extent 0 0.0

Total 90 100

3. Methodology

The findings presented in Table 2 show that majority

The study employed a descriptive design because such a

(53.3%) of the respondents indicated that credit risk

design allowed simultaneous description of views,

management practices affected loan performance to a great

perceptions and beliefs of the respondents at any single

extent compared to 28.9% of the respondents who pointed

point in time (White, 2000). This technique was

out that credit risk management practices used in

considered appropriate because it enabled the researcher to

microfinance institutions in Baringo County affected loan

obtain factual information from the respondents. The target

performance to a very great extent. The results also show

population in this study was 7 managers and 88 credit

that 16.7% of the respondents indicated medium extent

officers in MFIs in Baringo County. Census technique was

whereas 1.1 % of the respondents indicated least extent.

used because all branch managers and credit officers were

This implies that credit risk management practices as used

directly targeted in this study. The researcher used the

in most MFIs in Baringo County affected loan

questionnaire in data collection. The questionnaire was

performance to a great extent.

preferred because it was efficient, cheap and easy to be

administered. Data was analyzed Descriptive statistics was

Effects of Indicators of Loan Performance in MFIs in

used to summarize the data through percentages and

Baringo County

frequencies. Tables were used to present the data for ease

of understanding and analysis. Inferential statistics such as

The study sought to ascertain the effects of different

regression and correlation analysis were used to show the

indicators of loan performance in MFIs in Baringo County.

direction and strength of association between the variables.

The respondents were asked to assess the effects of

selected indicators of loan performance in microfinance

4. Results and Discussion institutions in Baringo County. The findings obtained are

presented in Table 3.

Adoption of Credit Management Practices in MFIs in

Baringo County Table 3: Effects of Indicators of Loan Performance in

MFIs in Baringo County

The study sought to ascertain whether credit management Statement N SA A N D SD Mean SDev.

practices were adopted in MFIs in Baringo County. This

It is easy for

was done by asking the respondents to indicate whether customers to get 90 37 41 6 6 0 4.22 0.32

credit risk management practices had been adopted in their loans in your MFI

MFIs or not and the results obtained are presented in Table Your MFI incurs

1. a lot of costs in

recovering loans 90 8 29 25 22 6 3.12 0.89

Table 1: Adoption of Credit Management Practices in given to

MFIs customers

Response Frequency Percentage In cases of failure

Yes 88 97.8 to pay the loan

No 2 2.2 the MFI takes 90 35 49 3 2 1 4.50 0.46

Total 90 100 measures to

recover it

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2263

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

Loan products The findings show that 48.9% of the respondents indicated

have increased that MFIs in Baringo County used client appraisal as a

the MFI’s 90 40 38 7 4 1 4.26 0.35 credit risk management practice to a great extent while

profitability 40.0% indicated that client appraisal was used to a very

levels.

great extent. The results also show that 10% of the

The degree of

risks associated

respondents pointed out that MFIs in Baringo County used

90 8 27 18 27 10 3.00 1.03 client appraisal as a credit risk management practice to a

with loans in your

MFI is high. medium extent while only 1.1% cited least extent use of

credit risk management practices in MFIs in Baringo

From the findings, 78 of the respondents agreed that it was County. This implies that most MFIs used client appraisal

easy for customers to get loans in MFIs in Baringo County as a credit management to a great extent.

compared to 6 who disagreed. The mean response rate of

4.22 with a standard deviation of 0.32 indicates that easy Effects of Indicators of use of Client Appraisal in MFIs

accessibility of loan influenced loan performance in MFIs

in Baringo County. Concerning whether MFIs incurred a The study examined the effects of various indicators of use

lot of costs in recovering loans given to customers 37 of of client appraisal in MFIs in Baringo County. This was

the respondents agreed compared to 28 who disagreed. A done by asking the respondents whether they agreed or

mean response of 3.12 shows that the respondents slightly disagreed with the statements relating to the indicators of

agreed that MFIs incurred costs when recovering loans client appraisal in MFIs. The levels of measurements of

advanced to them. However a standard deviation of 0.89 the indicators were Strongly Disagree, Disagree, Neutral,

suggests that the respondents were varied in their Agree and Strongly Agree. The findings obtained are

responses. Similarly higher percentages were reported in presented in Table 5.

regard to whether in cases of failure to pay the loan the

MFI takes measures to recover it. For instance 84 of the Table 5: Level of Agreement on Client Appraisal in MFIs

respondents agreed that in cases of failure to pay the loan Statements N SA A N D SD Mean SDev

the MFI takes measures to recover it as compared to 3 who Client appraisal is

disagreed. This is also supported by the mean response of a good strategy for

4.50 with a standard deviation of 0.46. The findings also 90 60 28 1 1 0 4.52 0.21

credit risk

show that 78 of the respondents noted that loan products management

had increased the MFIs’ profitability levels as compared to There are

5 who disagreed and 7 who were undecided. A mean of competent

4.26 suggests that the respondents were in high agreement personnel for 90 34 47 3 3 2 4.17 0.33

with low variation in their responses as shown by a carrying out client

appraisal

standard deviation of 0.46. In regard to whether the degree

Client appraisal

of risks associated with loans in the MFI was high, 35 of

considers the

the respondents agreed that the degree of risks associated character of the 90 34 39 7 7 2 4.02 0.37

with loans in MFI was high compared to 37 who disagreed customers seeking

and 18 who were undecided. The mean response of 3.00 credit facilities

showed that the respondents were indifferent in their Aspects of

response. However, a standard deviation of 1.003 indicated collateral are

90 48 39 4 0 0 4.53 0.28

a high variation in their response. These findings seem to considered while

concur with Kibet (2008) who concluded that credit risk appraising clients

management practices played a role in enhancing loan Failure to assess

performance in financial institutions and recommended customers capacity

90 47 28 6 6 2 4.21 0.42

to repay results in

enhanced effectiveness credit risk management practices in loan defaults

promoting loan performance in the financial institutions.

From the findings, it is evident that 88 of the respondents

Extent of Use of Client Appraisal as a Credit Risk

agreed that client appraisal was a good strategy for credit

Management Practice

management as compared to 2 respondents who disagreed.

A mean response of 4.52 indicated that the respondents

The respondents were required to indicate the extent to

strongly agreed that appraisal was a good strategy for

which client appraisal had been used as a credit risk

credit management. Similarly a standard deviation of 0.21

management practice in MFIs in Baringo County. The

suggested a low variation in response. In regard to whether

findings are presented in Table 4.

there are competent personnel for carrying out client

appraisal, 81 of the respondents agreed compared to 5 who

Table 4: Extent of Use of Client Appraisal

disagreed. The results also show a mean response of 4.17

Extent of Use of Client Appraisal Frequency Percentage

with a standard deviation of 0.33 suggesting low variation

Very Great extent 36 40.0 in response. Moreover 73 respondents agreed that client

Great Extent 44 48.9 appraisal considered the character of the customers seeking

Medium Extent 9 10.0 credit facilities. This was in comparison to 10 of the

Least Extent 1 1.1 respondents who disagreed. A mean of 4.02 indicated that

No Extent 0 0.0

majority of the respondents agreed the character of the

Total 90 100

customers seeking credit facilities was considered. This is

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2264

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

also supported by a low variation in response as indicated H01: There is no statistically significant relationship

by standard deviation of 0.37. between client appraisal and loan performance of

microfinance institutions in Baringo County.

Concerning whether collateral was considered while

appraising clients 87 of the respondents agreed compared Results presented in Table 4.15 show that there is a

to 4 who were undecided. The mean response of 4.53 and positive relationship between client appraisal and loan

a standard deviation of 0.28 shows that majority of the performance (r = 0.591, p < 0.05). Hypothesis states that

respondents strongly agreed that collateral was considered client appraisal has no significant influence on loan

while appraising clients. Similarly high response rate was performance of microfinance institutions in Baringo

reported in regard to whether failure to assess customers’ County. The researcher therefore rejected the null

capacity to repay loans resulted in loan defaults as hypothesis and concluded that there is sufficient evidence

indicated by 75 of the respondents who agreed compared at 5% level of significance that client appraisal influences

to 9 who disagreed with a standard deviation of 4.21 and loan performance in microfinance institutions in Baringo

standard deviation of 0.21. It appears that most of the County. This means that client appraisal enhanced loan

respondents agreed more than they disagreed with the performance. The findings are similar to that of Maiteka

indicators of use of client appraisal in MFIs in Baringo (2010) who found that there existed a strong and positive

County. Previous studies have also found out that client relationship between client appraisal and loan performance

appraisal can be used to enhance loan performance since it in commercial banks. However, the findings are in contrast

ensures that clients have the willingness and ability to to the study findings by Liebesman (2004) who established

repay a loan. For instance Abedi (2009) found that MFIs negative relationship between client appraisal and loan

can use the 5Cs model of credit to evaluate a customer as a performance in SACCOs in Vietnam.

potential borrower in order to increase as loan

performance. The results reported in this study also agree Regression Analysis

with the findings in a study by Kamau (2011) which

reported that credit scoring model has successfully been This section presents results on the regression analysis of

used to assign credit applicants to good or bad credit risk the relationship between client appraisal, credit controls

classes. In addition, Inkumbi (2009) notes that client and collection policies and loan performance in MFIs in

appraisal can help identify whether clients have collateral Baringo County.

trying to access equity capital. Similar conclusions have

been made by Kibet (2013) who pointed out that Table 6: Model Summary

evaluation of an individual should involve gathering of Model R

R Adjusted R Std. Error of the

relevant information on the applicant and analyzing the Square Square Estimate

information to determine credit worthiness and making the 1 .837(a) .756 .781 .2867

decision to extend credit and to what tune.

Correlation Analysis Adjusted R2 is the coefficient of determination which tells

us the variation in the dependent variable due to changes in

Pearson’ correlation analysis was applied to test the the independent variable. From the findings as shown in

relationship between credit risk management practices and Table 4.16 the value of adjusted R squared was 0.781, an

loan performance (LP) in microfinance institutions in indication that there was variation of 78.1% on loan

Baringo County. The dimension of credit risk management performance of MFIs in Baringo County due to changes in

practices examined was client appraisal (CA). The client appraisal, credit risk control and collection. R is the

relationship was established through Pearson correlation correlation coefficient which shows the relationship

analysis as presented in Table 6. between the study variables. From the findings shown in

Table 6, there was a strong positive relationship between

Table 6: Pearson’s Correlation Analysis the study variables as shown by R= 0.837.

CA. Total LP. Total

Score Score Table 7: Coefficients

CA. Total Score Pearson Mode Standardize

1 Unstandardize

Correlation l d F Sig.

d Coefficients

Sig. (2 tailed) 1 Coefficients

90 Std.

Total Score N B Beta

Error

LP. Total Score Pearson 1.13 .04

0.591* 1 Constant .318 .241 .274

Correlation 1 7 9

.000

Sig. (2 tailed) Client

90 90 1.15 .03

N Appraisa .339 .265 .305

1 9

* σ=0.05 (Correlation is significant at 0.05 level (2-tailed) l

The correlation table presents the relationship client From the data in table the established regression equation

appraisal and loan performance. The hypothesis tested in was: Y = 0.318 + 0.339X1

stated below.

As shown in the regression equation above, holding client

appraisal, loan performance of MFIs would be 0.318. A

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2265

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

unit increase in client appraisal led to an increase in loan Micro finance programs, Program and Operations

performance of MFIs in Baringo County by a factor of Assessment Report No. 10, USAID, Washington, D.C.

0.339. In the computation of the coefficients the p-values [7] Horne, J. C. & Wachowicz, J. M. (2007).

were less that 0.05 an indication that client appraisal was Fundamentals of Financial Management. New Jersey:

statistically significant in influencing loan performance of Prentice Hall.

MFIs in Baringo County. [8] Indenjeinkein, M. (1997). Financial Management.

New Delhi; Vikas Publishing House.

5. Conclusion [9] Inkumbi, M. (2009). Beyond the 5Cs of Lending.

Accounting, Auditing and Accountability Journal,

From the findings, the study found that client appraisal had 16(4), 640-661

effect on loan performance of MFIs in Baringo County. [10] Kakuru, R. L. (2000). Micro credit and the Poorest of

The study revealed that a unit increase in client appraisal the Poor: Theory and Evidence from Bolivia, World

led to an increase in loan performance in MFIs in Baringo Development, 28(2), 333-346.

County indicating that there was a positive association [11] Kamau, C. G. (2013). Determinants of audit

between client appraisal and loan performance in MFIs in expectation gap: Evidence from limited companies in

Baringo County. Thus there was strong positive Nakuru Town. International Journal of Science and

relationship between client appraisal and loan performance Research (IJSR), 2(1), 480-491.

of MFIs. Hence, client appraisal significantly influenced [12] Kariuki, J. N. (2010). Effective Collection Policy.

loan performance in MFIs in Baringo County. Nairobi; KASNEB Publishers.

[13] Kibet, P. K. (2008). A survey on the role of internal

6. Recommendations audit in promoting good corporate governance in

SOEs. Unpublished MBA Project, University of

The study also recommends that there is need for MFIs to Nairobi.

enhance their client appraisal techniques so as to improve [14] Kimani, J. (2011). A study of Fraud Risk assessment

their financial performance. Through client appraisal plan for Barclays Bank of Kenya. University of

techniques, the MFIs will be able to know credit Applied Sciences.

worthiness of clients and thus reduce non-performing [15] Maiteka, S. (2010).The Influence of Risk Based Audit

loans. There is also need for MFIs to enhance their credit on Corporate Governance in Public Sector in Kenya

risk control. This may help in decreasing loan default Focusing on Selected Ministries. Unpublished MBA

levels. This may help in improving their financial Project. Moi University.

performance. [16] Matu, J. (2008). The impact of changing corporate

governance norms on economic crime. Journal of

Financial Crime 11 (4): 347-352.

7. Areas for Further Research [17] Meyers, R. L. (2005). Track Record of Financial

Institutions in Assisting the Poor in Asia ADB

The study sought to determine the effect of credit risk Institute Research Paper, No 49, Micro Capital.

management practices on the loan performance of [18] Migiri, S. (2012). Credit Analysis Technology in a

Microfinance Institutions in Baringo County. Further Changing Business Environment. Boston: CFO

research is recommended on the effect of client appraisal Publishing Corp.

on loan performance in banks in Baringo County. Further [19] Nagarajan, M. (2011). Credit risk management

research should also be done on the relationship between practices for microfinance institutions in

credit risk management practices and nonperforming loans Mozambique. Unpublished MBA Project. University

of SACCOs in Baringo County and on the reasons for loan of Maputo.

default in SACCOs in Kenya from the financial [20] Nelson, L. (2002). Solving Credit Problem.

institution’s perspective. Intermediate Financial Management, 8(2), 33-16.

[21] Orua, D. (2009). Performance Management: A

References Framework for Management Control Systems

Research, Management Accounting Research, 10(3)3-

[1] Abedi, S. (2000). Corporate Financial Management. 9.

New Jersey: Prentice Hall. [22] Ouma, B. N. (2008). Auditing and Investigations.

[2] Abedi, S. (2009). Highway to Success, Credit Owerri: Bon Publications.

Management Journal, 58(1), 17-42. [23] Pandey, I. M. (2008). Financial Management. New

[3] Achon, O. E. & Tenguh, K. (2008). The Economics of Delhi; Vikas Publishing House.

Organization: The Transaction Cost Approach. The [24] Pike, K. & Neale, D. V. (1999). Audit committee

American Journal of Sociology, 87 (3), 548-577. composition, ‘gray directors’, and interaction with

[4] Anyanwu, M. (2004). Linkage between Corporate internal auditing. Accounting Horizons, 15(2)105-18.

Governance and Firm Performance, ADB Institute, An [25] Puxty, K. (1991). Microfinance handbook: An

Unpublished MBA Project, University of Nairobi. institutional and financial perspective. Washington;

[5] Ditcher, B. (2003). Corporate Finance and The World Bank.

Investment: Decisions and Strategies. England; [26] Scheufler, B. (2002). Five Risks You Can Target with

Prentice Hall. Best Practices. Intermediate Financial Management,

[6] Edward, C. (1997). Maximizing the Outreach of 4, 35-46.

Microenterprise Finance; An Analysis of Successful

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2266

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Impact Factor (2012): 3.358

[27] Scheufler, D. M. (2002). The Market for Corporate

Control and Firm Innovation. Journal of Policy and

Planning, 6(1), 20–31.

[28] Sindani, R. (2012). An overview of fraud and money

laundering in the East Africa financial services

industry. Nairobi: Deloitte Forensic.

[29] Sollenberge, M. & Anderson, E. (1995). The New

World of Micro enterprise Finance, Hartford;

Kumarian Press.

[30] Tucker, M. & Miles, G. (2004). Loan performance of

microfinance institutions: a comparison to

performance of regional commercial Banks by

geographic regions. Journal of Microfinance/ESR

Review, 6(1), 41-54.

[31] Turyahebwa, A. (2013). Loan performance in the

Selected Microfinance Institutions in Uganda

(unpublished Masters Thesis) Kampala International

University, West campus.

[32] Wachowicz, S. (1998). Efficiency versus Risk in

Large Domestic US Banks. Managerial Finance, 30,

1-19.

[33] Wester, G. (1993). Essays on Regulation and

Supervision, International Small Business Journal,

11, 35-46.

[34] White, B. (2000). Dissertation Skills for Business and

Management Students. London; Martins the Printers

Ltd

Volume 3 Issue 10, October 2014

www.ijsr.net

Paper ID: OCT14673 2267

Licensed Under Creative Commons Attribution CC BY

You might also like

- The Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaFrom EverandThe Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaNo ratings yet

- The Effect of Loan Appraisal Process ManDocument7 pagesThe Effect of Loan Appraisal Process ManFel Salazar JapsNo ratings yet

- Credit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionDocument18 pagesCredit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionImpact JournalsNo ratings yet

- SSRN Id2704708 PDFDocument22 pagesSSRN Id2704708 PDFJessica PoligNo ratings yet

- Research Paper - Evaluating Institutional Factors Contributing To Default in Loan Repayment Within Microfinance Institutions in JamaicaDocument68 pagesResearch Paper - Evaluating Institutional Factors Contributing To Default in Loan Repayment Within Microfinance Institutions in JamaicaCecile S CameronNo ratings yet

- 13 PDFDocument10 pages13 PDFJohn Matthew CastilloNo ratings yet

- Determinants of Loan RepaymentDocument18 pagesDeterminants of Loan RepaymentmogessieNo ratings yet

- Determinants of Credit Default Risk of Microfinance InstitutionsDocument9 pagesDeterminants of Credit Default Risk of Microfinance InstitutionsgudataaNo ratings yet

- Abstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaDocument8 pagesAbstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaMrxNo ratings yet

- The Causes of Loan DefaultDocument9 pagesThe Causes of Loan DefaultLazarus AmaniNo ratings yet

- Assessment of Loan RepaymentDocument81 pagesAssessment of Loan Repaymentzachariah z. sowionNo ratings yet

- Ujas2 12902580Document9 pagesUjas2 12902580Sami JattNo ratings yet

- Impact of Borrower Characteristic On Loan Repayment in TanzaniaDocument30 pagesImpact of Borrower Characteristic On Loan Repayment in TanzaniaGift GeorgeNo ratings yet

- Determinants of Loan Repayment The CaseDocument16 pagesDeterminants of Loan Repayment The Casebisrat.redaNo ratings yet

- Credit Management Practices and Loan PerDocument33 pagesCredit Management Practices and Loan PerMichaela CatacutanNo ratings yet

- 597-Article Text-1141-1-10-20171231Document14 pages597-Article Text-1141-1-10-20171231Estevao SalvadorNo ratings yet

- Effects of Credit Appraisal Methods...Document12 pagesEffects of Credit Appraisal Methods...Nhật QuangNo ratings yet

- Ijtra 140719Document6 pagesIjtra 140719Akshay Kumar PandeyNo ratings yet

- Credit Management Strategies and Loan Performance of Selected Deposit Money Banks in Ogun State, NigeriaDocument32 pagesCredit Management Strategies and Loan Performance of Selected Deposit Money Banks in Ogun State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Determinants of Financial Performance of Microfinance Institutions in Kenya: A Case of Microfinance Institutions in Nakuru TownDocument16 pagesDeterminants of Financial Performance of Microfinance Institutions in Kenya: A Case of Microfinance Institutions in Nakuru TownTJPRC PublicationsNo ratings yet

- Published ManuscriptDocument13 pagesPublished ManuscriptmdhsohailNo ratings yet

- Credit Risk Management PDFDocument14 pagesCredit Risk Management PDFGreen India TechnologiesNo ratings yet

- Credit Risk in Microfinance Industry Evidence Fro - 2018 - Review of DevelopmenDocument11 pagesCredit Risk in Microfinance Industry Evidence Fro - 2018 - Review of DevelopmenFRANCIS YEGONo ratings yet

- Chapter Two Literature ReviewDocument17 pagesChapter Two Literature ReviewJORAMNo ratings yet

- Group Project @Document27 pagesGroup Project @Francis OgengaNo ratings yet

- ProQuest 18Document13 pagesProQuest 18Sam GregoryNo ratings yet

- 2 35 1360402468 12.credit - FullDocument20 pages2 35 1360402468 12.credit - FullbirukNo ratings yet

- Published Paper in The JournalDocument14 pagesPublished Paper in The JournalBharat Ram DhunganaNo ratings yet

- 7 Factors Affecting Loan RepaymentDocument10 pages7 Factors Affecting Loan Repaymentendeshaw yibetalNo ratings yet

- LIBERTY NYASHA MATONGO N0188812L Research ProposalDocument7 pagesLIBERTY NYASHA MATONGO N0188812L Research ProposalEdwin MudzamiriNo ratings yet

- 1 PBDocument10 pages1 PBKanbiro OrkaidoNo ratings yet

- Effects of Credit Risk Management On Loan Performance in Kenyan Commercial BanksDocument13 pagesEffects of Credit Risk Management On Loan Performance in Kenyan Commercial BanksManpreet Kaur VirkNo ratings yet

- An Examination of The Credit Management Practices of Rural Banks: A Case Study of Asokore Rural Bank Limited by Nsiah RichardDocument35 pagesAn Examination of The Credit Management Practices of Rural Banks: A Case Study of Asokore Rural Bank Limited by Nsiah RichardKaleem AhmadNo ratings yet

- Capital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaDocument11 pagesCapital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Revised Reserach JulycindyDocument53 pagesRevised Reserach JulycindyPatson simukondaNo ratings yet

- A Study On Recent Trends and Problems in Using Micro Finance Services in India-2Document11 pagesA Study On Recent Trends and Problems in Using Micro Finance Services in India-2prjpublicationsNo ratings yet

- The Impact of Credit Management On Loan Default A Case Study of Ugafode Bank, Wandegeya BranchDocument24 pagesThe Impact of Credit Management On Loan Default A Case Study of Ugafode Bank, Wandegeya BranchOOGA TITUS PATRICKNo ratings yet

- Debt Rescheduling, A Necessary Strategy in Management of Non-Performing Loans: Insights From Microfinance Institutions in Nairobi City CountyDocument19 pagesDebt Rescheduling, A Necessary Strategy in Management of Non-Performing Loans: Insights From Microfinance Institutions in Nairobi City CountyAnonymous CwJeBCAXpNo ratings yet

- Factors Influencing Loan Repayment Performance of Borrowers: Case of Microfinance InstitutionsDocument8 pagesFactors Influencing Loan Repayment Performance of Borrowers: Case of Microfinance InstitutionsGusuu GalataaNo ratings yet

- Capital Structure Financial Performance and Sustainability of Microfinance Institutions MFIs in GhanaDocument16 pagesCapital Structure Financial Performance and Sustainability of Microfinance Institutions MFIs in GhanaskambaleNo ratings yet

- Microfinance Nepal Paper Good ThingsDocument10 pagesMicrofinance Nepal Paper Good Thingspsychosoul009No ratings yet

- Factors That Influence Access To Credit For Micro, Small, and Medium - Sized Enterprises in Ruiru Sub County in Kenya by Mburu, S.MDocument10 pagesFactors That Influence Access To Credit For Micro, Small, and Medium - Sized Enterprises in Ruiru Sub County in Kenya by Mburu, S.MMburu SNo ratings yet

- Effectsof Loan Sharkingon Philippines MicroenterprisesDocument21 pagesEffectsof Loan Sharkingon Philippines MicroenterprisesChreazel RemigioNo ratings yet

- Ijmrd: A Study On Recent Trends and Problems in Using Micro Finance Services in IndiaDocument11 pagesIjmrd: A Study On Recent Trends and Problems in Using Micro Finance Services in IndiaRogil Jacob DanielNo ratings yet

- Effect of Microfinance BanksDocument12 pagesEffect of Microfinance BanksRoberto Colas SaingNo ratings yet

- The Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaDocument16 pagesThe Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaCJ De Luna100% (1)

- Micro FinanceDocument32 pagesMicro Financepsychosoul009No ratings yet

- Impact of Credit Management On Bank Performance in NigeriaDocument7 pagesImpact of Credit Management On Bank Performance in Nigeriagolden abidemNo ratings yet

- Causes and Control of Loan Default/Delinquency in Microfinance Institutions in GhanaDocument10 pagesCauses and Control of Loan Default/Delinquency in Microfinance Institutions in GhanaMotiram paudelNo ratings yet

- Capital Structure, Financial Performance, and Sustainability of Micro-Finance Institutions (Mfis) in BangladeshDocument18 pagesCapital Structure, Financial Performance, and Sustainability of Micro-Finance Institutions (Mfis) in BangladeshlalalandNo ratings yet

- Ghana SDI CalculationsDocument9 pagesGhana SDI Calculationsmmubashirm504No ratings yet

- Evaluating The Microcredit Default of MFIs of Bangladesh in Covid-19 PandemicDocument5 pagesEvaluating The Microcredit Default of MFIs of Bangladesh in Covid-19 PandemicJesmin AraNo ratings yet

- Classic Microfinance ModelDocument35 pagesClassic Microfinance ModelBasit AliNo ratings yet

- Impact of Micro Credit On The Livelihood of Borrowers Evidence From Mekelle City EthiopiaDocument8 pagesImpact of Micro Credit On The Livelihood of Borrowers Evidence From Mekelle City EthiopiaSszy Dzik Dzik SyaqiNo ratings yet

- Statistical Analysis On The Loan Repayment Efficiency and Its Impact On The BorrowersDocument22 pagesStatistical Analysis On The Loan Repayment Efficiency and Its Impact On The BorrowersChan AyeNo ratings yet

- HASSAN MOHAMED MUDEY - HD324COO559882015 FinalDocument36 pagesHASSAN MOHAMED MUDEY - HD324COO559882015 FinalmudeyNo ratings yet

- A Theory of Interactions Between MFIs and Informal LendersDocument28 pagesA Theory of Interactions Between MFIs and Informal Lendersmateo cristanchoNo ratings yet

- The Performance of Microfinance Institutions in Cameroon: Does Financial Regulation Really Matter?Document13 pagesThe Performance of Microfinance Institutions in Cameroon: Does Financial Regulation Really Matter?Ayoniseh CarolNo ratings yet

- Manuscript Final ThesisDocument60 pagesManuscript Final ThesisEya VillapuzNo ratings yet

- Loan Recovery Performance of Credit Officers in Microfinance Institutions: A Case of AssamDocument4 pagesLoan Recovery Performance of Credit Officers in Microfinance Institutions: A Case of AssamIQAC BAOSI BANIKANTA KAKATI COLLEGENo ratings yet

- 4d9b96beac51f16375946d77d43c3c06Document7 pages4d9b96beac51f16375946d77d43c3c06Gunk Alit Part IINo ratings yet

- International Journal of Research Publications Volume-10, Issue-1, August 2018Document11 pagesInternational Journal of Research Publications Volume-10, Issue-1, August 2018Gunk Alit Part IINo ratings yet

- The Quality of Sustainability Reports and Corporate Financial Performance: Evidence From Brazilian Listed CompaniesDocument9 pagesThe Quality of Sustainability Reports and Corporate Financial Performance: Evidence From Brazilian Listed CompaniesGunk Alit Part IINo ratings yet

- 4 PBDocument16 pages4 PBGunk Alit Part IINo ratings yet

- 3045 7262 1 SM PDFDocument16 pages3045 7262 1 SM PDFAdindaNo ratings yet

- MPRA Paper 38202Document33 pagesMPRA Paper 38202Gunk Alit Part IINo ratings yet

- Determinants of Access To Credit Among Rice Farmers in Biase Local Government Area of Cross River State, NigeriaDocument10 pagesDeterminants of Access To Credit Among Rice Farmers in Biase Local Government Area of Cross River State, NigeriaGunk Alit Part IINo ratings yet

- Aa1000aps 2008Document21 pagesAa1000aps 2008David BoyerNo ratings yet

- Jeremy Harmer, The Practice of English Language Teaching "Third Edition", (USA: Longman, 2001), 2Document9 pagesJeremy Harmer, The Practice of English Language Teaching "Third Edition", (USA: Longman, 2001), 2Bintang PamungkasNo ratings yet

- Module: Communication Skills/ COMS 1010 Assignment 1 1: To Be Carried Out Before ResearchDocument3 pagesModule: Communication Skills/ COMS 1010 Assignment 1 1: To Be Carried Out Before Researchrosepetals25No ratings yet

- Exploring The Role of Stakeholders in Place Branding - A Case Analysis of The 'City of Liverpool'Document19 pagesExploring The Role of Stakeholders in Place Branding - A Case Analysis of The 'City of Liverpool'Hasnain AbbasNo ratings yet

- Thesis Statement Hospitality ServicesDocument5 pagesThesis Statement Hospitality ServicesSara Parker100% (2)

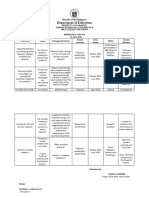

- WORKPLAN IN Project Salik Suri 2021 2022Document2 pagesWORKPLAN IN Project Salik Suri 2021 2022Maestrang DiyosaNo ratings yet

- Teachers' Cognitive Questioning Styles and Their Effects On%2 DivisionDocument111 pagesTeachers' Cognitive Questioning Styles and Their Effects On%2 DivisionAbubakar umarNo ratings yet

- Special Science 9 - Research - q1 - w1 - Slem1Document15 pagesSpecial Science 9 - Research - q1 - w1 - Slem1ديزي أماه كاباليرو بانتيلوNo ratings yet

- The Feseability of CoconutDocument2 pagesThe Feseability of CoconutNeljhan getiayonNo ratings yet

- Practical Research 2 Module 7 EditedDocument18 pagesPractical Research 2 Module 7 EditedAdell Anne Ong100% (2)

- Application Development and Emerging TechnologyDocument7 pagesApplication Development and Emerging TechnologyJoshua klyne PudaderaNo ratings yet

- Macky Chapter 1 3Document34 pagesMacky Chapter 1 3Macs MacsNo ratings yet

- Evidence-Based Software Engineering For PractitionersDocument9 pagesEvidence-Based Software Engineering For PractitionersAna Paula Lins Ferreira de VasconcelosNo ratings yet

- 1Manuscript-BSN-3y2-1A-CEDILLO-222 11111Document32 pages1Manuscript-BSN-3y2-1A-CEDILLO-222 11111SHARMAINE ANNE POLICIOSNo ratings yet

- Killing Me Softly Organizational E-Mail Monitoring Expectations' Impact On Employee and Significant Other Well-BeingDocument29 pagesKilling Me Softly Organizational E-Mail Monitoring Expectations' Impact On Employee and Significant Other Well-BeingCarlosNo ratings yet

- Loyalty Program, StoreDocument5 pagesLoyalty Program, StoreAhmed SadekNo ratings yet

- Chapter 3 &4Document98 pagesChapter 3 &4Kebede ChallaNo ratings yet

- © Associated Asia Research Foundation (AARF)Document14 pages© Associated Asia Research Foundation (AARF)Manoj KumarNo ratings yet

- Consumer Behavoiur ProjectDocument24 pagesConsumer Behavoiur ProjectKiruthikaNo ratings yet

- Framework For The Sustainable NGOs Media Strategies - Sundar K Sharma-FinalDocument20 pagesFramework For The Sustainable NGOs Media Strategies - Sundar K Sharma-FinalsundarksharmaNo ratings yet

- Grammar KeyDocument117 pagesGrammar KeyEdgar MatosNo ratings yet

- English Grade-10 Q2 LP-1-2Document7 pagesEnglish Grade-10 Q2 LP-1-2Trizh Nicole CastilloNo ratings yet

- Mobasser Monem AssigenmentDocument8 pagesMobasser Monem AssigenmentMirza ArnabNo ratings yet

- Definition of Speaking SkillDocument81 pagesDefinition of Speaking SkillMesda PitrinaNo ratings yet

- Habte HabtishDocument83 pagesHabte HabtishAsfawosen DingamaNo ratings yet

- From Mafia To Organised Crime A Comparative Analysis of Policing ModelsDocument321 pagesFrom Mafia To Organised Crime A Comparative Analysis of Policing ModelsLaura Panait100% (1)

- SchnittkeDocument245 pagesSchnittkeRazvan Cipca100% (1)

- The Contribution of Culture To Regeneration in The Uk: A Review of EvidenceDocument77 pagesThe Contribution of Culture To Regeneration in The Uk: A Review of EvidenceMaría ColladoNo ratings yet

- HRDM Thesis TitleDocument5 pagesHRDM Thesis Titleafcnczadf100% (2)

- English For Academic and Professional Purposes: First Quarter - Module 1: Reading Academic TextDocument26 pagesEnglish For Academic and Professional Purposes: First Quarter - Module 1: Reading Academic TextEmer PerezNo ratings yet

- GGGGG GGGGGDocument10 pagesGGGGG GGGGGReinan Ezekiel Sotto LlagasNo ratings yet