Professional Documents

Culture Documents

28 Benefits For Senior Citizens PDF

28 Benefits For Senior Citizens PDF

Uploaded by

Ganesh S0 ratings0% found this document useful (0 votes)

10 views4 pagesOriginal Title

28+Benefits+for+senior+citizens.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pages28 Benefits For Senior Citizens PDF

28 Benefits For Senior Citizens PDF

Uploaded by

Ganesh SCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

ENEFITS FOR

SENIOR Ct IZH#NS

} >)

under Income Tax Law

Higher Basic exemption limit

Higher deduction for Medical Insurance Premium

CHC CCC MIC MMIC LOR HC Mem Ont)

and many more...

Income Tax Department

www.incometaxindia.gov.in

WHER: IS-ut ROP 60 yrs | Age >80 yrs

and <80 yrs

upto 3 lakhs 0% 0%

from 3 lakhs a Py

to 5 lakhs oie Cie

from 5 lakhs 20% 20%

to 10 lakhs

more than 30% 30%

10 lakhs

Lat a a3

Premium

From AY 2019-20, the maximum limit for

deduction u/s 80D in respect of payment made

for health insurance premium in respect of a

Senior Citizen has been increased to Rs. 50,000.

Deduction upto Rs. 50,000 is also allowed for

medical expenses incurred on the health of a

Senior Citizen provided no amount is paid for

health insurance of such person. For claiming this

deduction, it is mandatory that the health

insurance premium/medical expenses are paid

by any mode other than cash.

Higher deduction limit for interest from Banks

and Post Office

Individual taxpayers other than senior citizens

are allowed maximum deduction of Rs. 10,000

u/s 80TTA in respect of interest income from

saving bank accounts. However, from AY 2019-

20 onwards, a Senior Citizen can claim deduction

upto Rs. 50,000 u/s 8OTTB in respect of interest

income earned on not only savings bank accounts

but also on interest income earned on any bank

deposits or any deposit with post office or co-

operative banks. Further, if such interest income

earned by a senior citizen during the year is less

than Rs. 50,000, the payer bank/ post office will

not deduct any tax from such interest income.

Higher deduction limit for expenses incurred

for Medical Treatment of a specified disease or

CT atta

For general tax payers, the amount of deduction

available in respect of expenses incurred for

medical treatment of specified disease or

ailments of self or dependent relatives u/s

80DDB is Rs. 40,000. However, in case the

expenses are incurred by the tax payer in respect

of a dependent senior citizen, the entitlement has

been enhanced to Rs. 1 lakh in a year from A.Y.

2019-20 onwards.

Exemption from payment of advance tax

Every person whose estimated tax liability for the

year is Rs. 10,000 or more, is liable to pay

advance tax. However, a senior citizen need not

to pay any advance tax, provided he does not

have any income under the head “Profits and

Gains of Business or Profession”.

Benefit of Standard Deduction

From AY 2019-20, a standard deduction upto Rs.

40,000 against salary income earned during the

year has been introduced u/s 16. Accordingly, a

Senior Citizen who is in receipt of pension income

from his former employer can claim a deduction

upto Rs. 40,000/- against such salary income.

Eligibility to file Income Tax Return Manually

A Senior Citizen aged 80 years or more filing his

return of income in Form SAHAJ (ITR-1) or

SUGAM (ITR-4) and having total income of more

than Rs. 5,00,000 or having a refund claim can

file his return of income in paper mode. For such

individuals, electronic filling of ITR 1 or ITR 4 (as

the case may be ) is not mandatory. However, he

may opt for e-filing, if he chooses to do so.

Form No. 15H for Non-deduction of TDS

A senior citizen may submit form No. 15H to the

deductor for non-deduction of TDS on certain

incomes referred to in that section, if the tax on

his/her estimated total income of the concerned

year comes at nil.

Transfer of Capital asset under ‘Reverse|

Weyer hte Taw

The transfer of a residential house property by

way of a reverse mortgage as per the Reverse

Mortgage Scheme made and notified by the

Central Government for senior citizens, is not

liable to be taxed as Capital Gain (nor under any

other head of income).

DIRECTORATE OF INCOME TAX

Nov. 2018

(Public Relations, Publications & Publicity)

6th Floor, Mayur Bhawan, New Delhi

This brochure should not be construed as an exhaustive statement of the law. For details -

reference should always be made to the relevant provisions in the Acts and Rules.

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Krishna Avatar-EnglishDocument27 pagesThe Krishna Avatar-EnglishGanesh S100% (2)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- MuthiraigalDocument35 pagesMuthiraigalGanesh S100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- நாட்டு மருந்துக்கடை கு சிவராமன்Document132 pagesநாட்டு மருந்துக்கடை கு சிவராமன்Ganesh SNo ratings yet

- காமாட்சி அம்மன் விருத்தம்Document4 pagesகாமாட்சி அம்மன் விருத்தம்Ganesh S75% (4)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- BHEL Tiruchy Story PDFDocument488 pagesBHEL Tiruchy Story PDFGanesh S100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- All Slokas - Tamil PDFDocument334 pagesAll Slokas - Tamil PDFGanesh SNo ratings yet

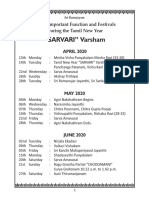

- "SARVARI" Varsham: List of Important Function and Festivals During The Tamil New YearDocument4 pages"SARVARI" Varsham: List of Important Function and Festivals During The Tamil New Yearshanthisv64No ratings yet

- Murunghe SowdhaminiOriginalPaperDocument8 pagesMurunghe SowdhaminiOriginalPaperGanesh SNo ratings yet

- திருநீற்றுப் பச்சிலையின் மருத்துவ குணங்கள்Document1 pageதிருநீற்றுப் பச்சிலையின் மருத்துவ குணங்கள்Ganesh SNo ratings yet

- முதுமை கால ரகசியங்கள் index PDFDocument18 pagesமுதுமை கால ரகசியங்கள் index PDFGanesh S100% (1)

- பாம்பு Pambu Panjangam 20 21 SaarvariDocument36 pagesபாம்பு Pambu Panjangam 20 21 SaarvariGanesh SNo ratings yet

- Sriman Naaraayaniiyam Full TeluguDocument280 pagesSriman Naaraayaniiyam Full TeluguGanesh SNo ratings yet

- Minor Game-Tamil PDFDocument134 pagesMinor Game-Tamil PDFGanesh S83% (6)

- காமாட்சி அம்மன் விருத்தம் PDFDocument4 pagesகாமாட்சி அம்மன் விருத்தம் PDFGanesh S100% (1)

- காமாட்சி அம்மன் விருத்தம் PDFDocument4 pagesகாமாட்சி அம்மன் விருத்தம் PDFGanesh SNo ratings yet

- Minor Game-Tamil PDFDocument134 pagesMinor Game-Tamil PDFGanesh S100% (1)

- Operation ReadinessDocument9 pagesOperation ReadinessGanesh SNo ratings yet

- Doctor of Philosophy (PHD)Document19 pagesDoctor of Philosophy (PHD)Ganesh SNo ratings yet