Professional Documents

Culture Documents

Daily Comm ME - 3wbi8m3l PDF

Uploaded by

The red RoseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Comm ME - 3wbi8m3l PDF

Uploaded by

The red RoseCopyright:

Available Formats

Metals & Energy 24 OCT 2019

Market News

Gold Rises, Approaching $1,500 as Fed Day Nears

It's a week until Fed Day and gold rose to settle just a few dollars short of market longs’ desired perch of $1,500. The

U.S. central bank’s Oct. 29-30 policy meeting is expected to result in the third quarter-point rate cut since July. U.S.

gold futures for December delivery settled up $8.20, or 0.6%, at $1,495.70 per ounce. In post-settlement trade, it was

up $8.85, or 0.6%, at $1.496.35 by 3:20 PM ET (19:20 GMT). Spot gold, which tracks live trades in bullion, was up

$5.79, or 0.4%, at $1,493.38. Bullion is up around 16% on the year, although it has come off from its six-year highs of

above $1,550 in September. Aside from expectations for continued Fed easing, gold was also supported on

Wednesday by uncertainties over Brexit as U.K. Prime Minister Boris Johnson’s divorce plan from the EU remained in

limbo. Other global and financial troubles lent support as well. “Gold continues to find buyers at selloff times as

worries about Brexit, Turkey, China tariff talks and U.S. politics are all positive,” said George Gero, precious metals

analyst at RBC Wealth Management in New York. “And of course, we have the Fed coming, which is one of the biggest

factors of all.” According to Investing.com’s Fed Rate Monitor Tool, investors see a 93% chance of the Fed cutting rates

for the third time this year next week.

(Source: Investing)

Oil Pops on Surprise U.S. Stock Slide; Eyes Back on OPEC

A surprise dip in U.S. inventories has thrown crude oil a lifeline just as expectations for deeper output cuts by OPEC

and its allies dimmed. West Texas Intermediate, the benchmark for New York-traded crude futures, as well as

London’s Brent, the global gauge for oil, settled Wednesday’s official U.S. session in oil up more than 1% each. The

rally came after the U.S. Energy Information Administration reported a 1.7-million-barrel crude inventory drop for the

week ended Oct.18, versus analysts’ expectations for a build of 2.2 million barrels. WTI rose $1.49, or 2.7%, to settle at

$55.97 per barrel. Brent settled up $1.47, or 2.46%, at $61.17 per barrel. Oil prices were pressured prior to the release

of the EIA data, after Russian Energy Minister Alexander Novak said no formal proposals have been put forward to

change the terms of a global deal on curbing oil supplies that was agreed between OPEC and its allies. The rebound

came as investors continued to see whopping declines in inventories of fuel such as diesel and gasoline over the past

month as refiners made less of such products amid plant closures to meet new maritime fuel processing standards.

Gasoline inventories fell by 3.1 million barrels, compared with an expected drop of 2.27 million barrels. Distillate

stockpiles dropped by about 2.72 million barrels, versus forecasts for a decline of about 2.8 million barrels. Refinery

run rates picked up slightly to about 85% of capacity from the previous week’s 83%. But that was still way below

industry norm of around 90% at least. Investing.com analyst Barani Krishnan said the surprise draw in crude was also

helped by a significant drop in crude imports. Despite being the world’s largest producer of light crude, the United

States still buys significant volumes of heavy grade crude each week from Middle East and other producers. “The

reason for the draw is because imports fell by over 400,000 barrels to reach below 6 million for the first time in a

while. It probably became obvious to many that you don’t need to import as much with current refinery run rates.”

And Krishnan added, exports ticked up to almost 3.7 million barrels a day,” Krishnan added. U.S. oil production

For Internal Distribution only 1

remained at 12.6 million barrels per day. “The market’s focus, accordingly, is on

the continuous slump in distillate and gasoline inventories that are busting expectations,” Krishnan said. “And, of

course, talk of even more OPEC cuts despite Russia playing mind games as always with the market.” Retail gasoline

prices have slowly working their lower, which typically occurs in the fall. AAA's Daily Fuel Gauge Report said the U.S.

average was $2.628 a gallon, down 1.3% from Wednesday and 1% for the month. For the year, they're up nearly 16%.

(Source: Investing)

Major Global Events/Announcements

Indian Time Nation Event/Data Forecast Previous

12:30pm EUR Spanish Unemployment Rate 13.80% 14.00%

12:45pm EUR French Flash Services PMI 51.6 51.1

EUR French Flash Manufacturing PMI 50 50.1

1:00pm EUR German Flash Manufacturing PMI 42 41.7

EUR German Flash Services PMI 52 51.4

1:30pm EUR Flash Manufacturing PMI 46.1 45.7

EUR Flash Services PMI 51.9 51.6

2:00pm GBP High Street Lending 42.2K 42.6K

5:15pm EUR Monetary Policy Statement

EUR Main Refinancing Rate 0.00% 0.00%

6:00pm EUR ECB Press Conference

USD Core Durable Goods Orders m/m -0.20% 0.50%

USD Durable Goods Orders m/m -0.50% 0.20%

USD Unemployment Claims 216K 214K

6:30pm CNY CB Leading Index m/m 1.10%

EUR Belgian NBB Business Climate -6 -5.7

7:15pm USD Flash Manufacturing PMI 50.7 51.1

USD Flash Services PMI 51 50.9

7:30pm USD New Home Sales 710K 713K

8:00pm USD Natural Gas Storage 87B 104B

Tentative USD Federal Budget Balance 83.5B -200.3B

RED & BOLD - High Impact

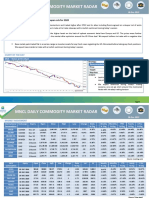

COMMEX Price Update

in US$ Units Previous Day PCP % Change

Gold T oz. 1487.5 1495.7 0.55

Silver T oz. 17.5 17.58 0.46

Crude Barrel 54.48 55.97 2.73

Copper LB 2.635 2.668 1.25

Natural Gas MMBTU 2.281 2.284 0.13

For Internal Distribution only 2

MCX Key Resistance & Support Levels for the day (in INR)

Call of the Day: Buy Crude around @ 3920 SL @ 3880 Target @ 3980

SYMBOL Supports LTP Resistances Strategy

Bullions

GOLD 05DEC2019 37906 37711 38101 38296 Buy Gold above 38120 SL-37980

38003

37808 37517 38198 38492 Tgt-38300

SILVER 05DEC2019 45098 44675 45524 45952 Silver has strong resistance

around 45600 and support

45311 around 45100, expecting range

44886 44358 45738 46382 bound trading day.

Base Metals

ALUMINIUM 31OCT2019 130.7 129.3 131.8 133.3

131.25

130.1 127.8 132.4 134.7 Strong support around 131

COPPER 31OCT2019 437.5 431.3 441.7 448.0

439.60

434.4 428.1 444.9 451.2 Sell around 440 SL-443 Tgt-435

NICKEL 31OCT2019 1191.9 1187.6 1195.3 1199.7

1193.60

1190.1 1183.3 1197.1 1204.0 Strong resistance around 1200

LEAD 31OCT2019 153.0 145.1 159.2 167.5 Buy around 155.30 SL-154.70 Tgt-

156.10

149.3 140.3 163.0 172.8 156.40

ZINC 31OCT2019 182.3 183.3 186.4 188.1 Buy around 185.20 SL-183.80 Tgt-

185.70

184.3 181.6 187.1 189.8 187

Energy

CRUDEOIL 19NOV2019 3932 3882 3964 4014 Buy around 3920 SL-3880 Tgt-

3948 3980

3909 3854 3988 4043

NATURALGAS 25OCT2019 160.3 155.3 164.1 169.3 Sell around 162.50 SL-164.50 Tgt-

162.20 157

158.1 151.6 166.4 173.2

Traders are advised to keep Disciplined STOP-LOSS. Risks can be very high without STOP-LOSS

Commodity Research Desk

DISCLAIMER: This document has been prepared by Trustline Commodities Pvt. Ltd. and is intended only for the person or entity to which it is

addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or

any other use is prohibited. Kindly note that document does not constitute an offer or solicitation for the purchase or sale of any commodity.

If you have received this in error, please contact the sender and delete the material immediately from your computer/mailbox. The

information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied

upon as such. Any comments or statements made herein do not necessarily reflect those of Trustline Commodities Pvt. Ltd.

For Internal Distribution only 3

You might also like

- RR20012020 A 3 Da 4Document3 pagesRR20012020 A 3 Da 4The red RoseNo ratings yet

- RR20012020 A 3 Da 4Document3 pagesRR20012020 A 3 Da 4The red RoseNo ratings yet

- Commodities & Currencies Weekly Outlook 20 01 20 To 24 01 20Document4 pagesCommodities & Currencies Weekly Outlook 20 01 20 To 24 01 20The red RoseNo ratings yet

- MNCL-DailyCom-23 Jan 2020 - 085020 - 13604Document9 pagesMNCL-DailyCom-23 Jan 2020 - 085020 - 13604The red RoseNo ratings yet

- 30 Min Strategy PDFDocument14 pages30 Min Strategy PDFThe red RoseNo ratings yet

- MNCL-DailyCom-06 Dec 2019 - 114912 - C659aDocument7 pagesMNCL-DailyCom-06 Dec 2019 - 114912 - C659aThe red RoseNo ratings yet

- RR1012201988 BC 9Document3 pagesRR1012201988 BC 9The red RoseNo ratings yet

- Commodity Weekly DEC 16Document8 pagesCommodity Weekly DEC 16The red RoseNo ratings yet

- Abhinaba Ingland Itihasa v.02 (KN Mohapatra, 1938) (-PP) oDocument167 pagesAbhinaba Ingland Itihasa v.02 (KN Mohapatra, 1938) (-PP) oThe red RoseNo ratings yet

- Commodity Weekly DEC 16Document8 pagesCommodity Weekly DEC 16The red RoseNo ratings yet

- MNCL Morning Equity Report 19 Dec 2019 - 082836 - E93fb PDFDocument3 pagesMNCL Morning Equity Report 19 Dec 2019 - 082836 - E93fb PDFThe red RoseNo ratings yet

- MNCL-DailyCom-19 Dec 2019 - 083000 - 967c4Document8 pagesMNCL-DailyCom-19 Dec 2019 - 083000 - 967c4The red RoseNo ratings yet

- Commodity Evening Roundup 26-11-19Document5 pagesCommodity Evening Roundup 26-11-19The red RoseNo ratings yet

- MNCL Morning Equity Report 19 Dec 2019 - 082836 - E93fb PDFDocument3 pagesMNCL Morning Equity Report 19 Dec 2019 - 082836 - E93fb PDFThe red RoseNo ratings yet

- Commodity Evening Roundup 06-12-19Document5 pagesCommodity Evening Roundup 06-12-19The red RoseNo ratings yet

- MNCL-DailyCom-16 Dec 2019 - 084008 - f7867Document8 pagesMNCL-DailyCom-16 Dec 2019 - 084008 - f7867The red RoseNo ratings yet

- Commodity Evening Roundup 26-11-19Document5 pagesCommodity Evening Roundup 26-11-19The red RoseNo ratings yet

- Daily Commodity Technical ReportDocument7 pagesDaily Commodity Technical ReportThe red RoseNo ratings yet

- NSE Nifty Index Daily Price and Range DataDocument2 pagesNSE Nifty Index Daily Price and Range DataMan ZealNo ratings yet

- Commodity Metals &energy 10-10-19Document6 pagesCommodity Metals &energy 10-10-19The red RoseNo ratings yet

- Commodity Evening Roundup 06-12-19Document5 pagesCommodity Evening Roundup 06-12-19The red RoseNo ratings yet

- 637064093203325942commodities Evening Report - 11th Oct 2019Document2 pages637064093203325942commodities Evening Report - 11th Oct 2019The red RoseNo ratings yet

- FolnviDocument5 pagesFolnviThe red RoseNo ratings yet

- Wave CalculatorDocument2 pagesWave CalculatorArun VinodNo ratings yet

- Daily Comm ME - 3wbi8m3ljmDocument3 pagesDaily Comm ME - 3wbi8m3ljmThe red RoseNo ratings yet

- Commodity DailyDocument7 pagesCommodity DailyThe red RoseNo ratings yet

- Open High Low Close Levels Camarilla PivotDocument7 pagesOpen High Low Close Levels Camarilla PivotThe red RoseNo ratings yet

- Daily Comm ME 11 Oct - ZkekjsflDocument3 pagesDaily Comm ME 11 Oct - ZkekjsflThe red RoseNo ratings yet

- Pivot Reversal: Strategy DescriptionDocument3 pagesPivot Reversal: Strategy Descriptionrahimsajed0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Top Banks in The PhilippinesDocument5 pagesTop Banks in The Philippinessummer mendozaNo ratings yet

- Chabi Joseph: World Vision, Karonga Programs, P.O. Box 549, Karonga, Malawi. PHONE: (+19) 9876543210 E-MailDocument2 pagesChabi Joseph: World Vision, Karonga Programs, P.O. Box 549, Karonga, Malawi. PHONE: (+19) 9876543210 E-Mailtajshah283No ratings yet

- Financial System QuestionsDocument25 pagesFinancial System QuestionsJ. KNo ratings yet

- ICA FormatDocument45 pagesICA Formatminushastri33No ratings yet

- Setting Up Transaction Types and Sources in Oracle ReceivablesDocument35 pagesSetting Up Transaction Types and Sources in Oracle Receivablesredro0% (1)

- KCCDocument15 pagesKCCAbhishek VohraNo ratings yet

- Sample Debit NoteDocument1 pageSample Debit Notekokocute71% (7)

- Executive ExpansionDocument19 pagesExecutive ExpansionРодион ЯценкоNo ratings yet

- Economic Systems......Document7 pagesEconomic Systems......Sanjay AcharyaNo ratings yet

- Tomorrow brings securityDocument316 pagesTomorrow brings securitySidi Yaya SyllaNo ratings yet

- Maksud Unit TrustDocument6 pagesMaksud Unit TrusthusainiNo ratings yet

- Republic Planters Bank Vs CADocument4 pagesRepublic Planters Bank Vs CAMarkJobelleMantillaNo ratings yet

- EXIMDocument18 pagesEXIMPushpak RoyNo ratings yet

- Prof. Monzer KahfDocument15 pagesProf. Monzer KahfAbdulNo ratings yet

- Audit of Cash and Cash Equivalents for Accounting StudentsDocument39 pagesAudit of Cash and Cash Equivalents for Accounting StudentsGeneral ScopiNo ratings yet

- AnnualReport 2017 PDFDocument217 pagesAnnualReport 2017 PDFMiah Mohammad Rakibul IslamNo ratings yet

- 21 - JAIIB-Final - Exam - 13.1.23 - Final - Website PDFDocument19 pages21 - JAIIB-Final - Exam - 13.1.23 - Final - Website PDFRamesh babuNo ratings yet

- Powerpoint Templates Powerpoint TemplatesDocument30 pagesPowerpoint Templates Powerpoint TemplatesParth PanchalNo ratings yet

- Vidya Guru Banking NotesDocument20 pagesVidya Guru Banking NotesGaurav ShahNo ratings yet

- INDIAN BAnk HyderabadDocument5 pagesINDIAN BAnk Hyderabadstanley JoelNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementZiyad AslamNo ratings yet

- Nympha S. Odiamar vs. Linda Odiamar Valencia DigestDocument1 pageNympha S. Odiamar vs. Linda Odiamar Valencia DigestContreras Cesar Clarence75% (4)

- Annapurna Finance R 10092018Document10 pagesAnnapurna Finance R 10092018NIBOX MEDIA CENTERNo ratings yet

- Ten Years Later Many Americans Are Calling It Conspiracy by Gary AllenDocument20 pagesTen Years Later Many Americans Are Calling It Conspiracy by Gary AllenKeith KnightNo ratings yet

- GTB StatDocument1 pageGTB StatkunlecrysNo ratings yet

- World B PDFDocument202 pagesWorld B PDFAnur WakhidNo ratings yet

- CACEIS Cross Border Distribution of UcitsDocument195 pagesCACEIS Cross Border Distribution of UcitsDerek FultonNo ratings yet

- 11i Oracle PayablesDocument101 pages11i Oracle PayablesSirish PondugulaNo ratings yet

- PMF SBLC Description 2024Document4 pagesPMF SBLC Description 2024koperasi draxis bersekutu melayuNo ratings yet

- New Microsoft Office Word DocumentDocument12 pagesNew Microsoft Office Word DocumentManish RathiNo ratings yet