Professional Documents

Culture Documents

Notes - Class 1

Notes - Class 1

Uploaded by

Majed Abou Alkhir0 ratings0% found this document useful (0 votes)

19 views1 pageOriginal Title

Notes - Class 1 .docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageNotes - Class 1

Notes - Class 1

Uploaded by

Majed Abou AlkhirCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Class 1 – September 4th

Lesson 1: Banks lend money to people that don’t need it

1) Net Working Capital;

Current Assets – Inventory – Current Liabilities

We take out inventory because it is the least liquid. Also this will all depend on the health of the

company

Liquidity

Current assets that we can sell quickly but at same time, at full value

Role of NWC and How much is enough?

Optimal Level = 0

2:1 = most companies

4-6:1 = Retail/Volatile businesses

1:1 = Utilities

As little as possible. Because we want our current assets to equal our current liabilities. The

reason for that, is that Working Capital is non-productive. The company can invest the money

somewhere else

2) Matching Principal

Accrual: legal concept obligation to record and book certain entries on the ledger even if the cash is

not received/paid. Does not represent an economic reality which makes it irrelevant for short-term

financial management. This is why we use cash statements.

You might also like

- Business Finance Notes Chapter 2Document3 pagesBusiness Finance Notes Chapter 2Clarence TongNo ratings yet

- Ratios Bas Week 9Document42 pagesRatios Bas Week 9eligamergirl101No ratings yet

- Working Capital ManagementDocument18 pagesWorking Capital ManagementSumanDasNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosNneka OkwuosaNo ratings yet

- Acfm Unit 4Document47 pagesAcfm Unit 4begumayesha7366No ratings yet

- Akanksha Project On WCMDocument112 pagesAkanksha Project On WCMAnurag MauryaNo ratings yet

- Business Finance: Senior High SchoolDocument10 pagesBusiness Finance: Senior High Schoolsheilame nudaloNo ratings yet

- Presentation ON Working CapitalDocument17 pagesPresentation ON Working Capitaltamanna13No ratings yet

- Editing Vijaya Milk DairyDocument51 pagesEditing Vijaya Milk DairyShanmuka Sreenivas100% (6)

- INTERMEDIATE ACCOUNTING 1 ReviewerDocument5 pagesINTERMEDIATE ACCOUNTING 1 Reviewercelynah.rheudeNo ratings yet

- Balance Cash HoldingsDocument34 pagesBalance Cash HoldingsSurafelNo ratings yet

- Bance Cash HoldingsDocument37 pagesBance Cash HoldingsrameNo ratings yet

- On The Basis of Concept: 1. Gross Working CapitalDocument2 pagesOn The Basis of Concept: 1. Gross Working CapitalAshish AgarwalNo ratings yet

- Rastios 20Document1 pageRastios 20testNo ratings yet

- Working Capital ManagementDocument396 pagesWorking Capital ManagementpltNo ratings yet

- Workshop 2 AccountingDocument6 pagesWorkshop 2 AccountingJulieth CaviativaNo ratings yet

- G12 Business Finance: Module 2 (Week 3-4)Document18 pagesG12 Business Finance: Module 2 (Week 3-4)Jessa GallardoNo ratings yet

- Working CapitalDocument39 pagesWorking CapitalHema LathaNo ratings yet

- Balance SheetDocument20 pagesBalance SheetJust Some Guy without a MustacheNo ratings yet

- Mas 09 - Working CapitalDocument7 pagesMas 09 - Working CapitalCarl Angelo LopezNo ratings yet

- Demo Lesson PlanDocument4 pagesDemo Lesson PlanJane Tanams100% (1)

- FM II Cha-4 ...Document19 pagesFM II Cha-4 ...yeshiwasdagnewNo ratings yet

- Justine Fin-ManDocument2 pagesJustine Fin-ManJastine CahimtongNo ratings yet

- Lesson 1 Working Capital MGTDocument6 pagesLesson 1 Working Capital MGTklipordNo ratings yet

- Chapter 30Document5 pagesChapter 30Yusuf HusseinNo ratings yet

- BF CH 5Document12 pagesBF CH 5IzHar YousafzaiNo ratings yet

- Business Finance IIDocument73 pagesBusiness Finance IIyakubu I saidNo ratings yet

- CH 7 Working CapitalDocument97 pagesCH 7 Working CapitalAnkur AggarwalNo ratings yet

- Learning Guide: Nefas Silk Poly Technic College Accounts and Budget Support Level IiiDocument36 pagesLearning Guide: Nefas Silk Poly Technic College Accounts and Budget Support Level IiiNigussie BerhanuNo ratings yet

- Woking Capital 1Document37 pagesWoking Capital 1Rohit DhamijaNo ratings yet

- FM IIChapter FourDocument17 pagesFM IIChapter FourMoti BekeleNo ratings yet

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- Week 7Document4 pagesWeek 7ZsazsaNo ratings yet

- Working Capital Unit 5Document10 pagesWorking Capital Unit 5Divyasree DsNo ratings yet

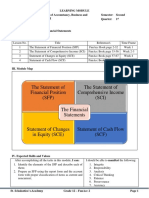

- Fundamentals of Accountancy, Business and Management 2 (Lesson 1)Document21 pagesFundamentals of Accountancy, Business and Management 2 (Lesson 1)Rojane L. Alcantara100% (1)

- WORKSHOP 2 ACCOUNTINGv2Document18 pagesWORKSHOP 2 ACCOUNTINGv2orozcodeviaalejandroNo ratings yet

- Working Capital AnlysisDocument33 pagesWorking Capital AnlysisLAXMI KANTA GIRINo ratings yet

- Chapter - 1 Working Capital Management - Introduction 1.1Document41 pagesChapter - 1 Working Capital Management - Introduction 1.1ChetanNo ratings yet

- Significance of Ratio AnalysisDocument17 pagesSignificance of Ratio AnalysisNancy DsouzaNo ratings yet

- Financial Analysis - Liquidity DecisionsDocument27 pagesFinancial Analysis - Liquidity DecisionsJoseph GuballoNo ratings yet

- WCM ProjectDocument26 pagesWCM Projectskagrawal1987No ratings yet

- 2 Financial ManagementDocument16 pages2 Financial ManagementmohamedfilfilahmedNo ratings yet

- Working Capital Management: Working Capital Current Assets Net Working Capital Current Assets Current LiabilitiesDocument14 pagesWorking Capital Management: Working Capital Current Assets Net Working Capital Current Assets Current LiabilitiesriyaneerNo ratings yet

- Working Capital NasirDocument2 pagesWorking Capital NasirNasir Mehmood AryaniNo ratings yet

- WCM PSBDocument41 pagesWCM PSBVISHAKHA BHALERAONo ratings yet

- Types of Working CapitalDocument1 pageTypes of Working CapitalGurvinder AroraNo ratings yet

- Chapter 9 10Document17 pagesChapter 9 10ainezerialc ngogupNo ratings yet

- Summer Training Report: On "Training of Employees" ATDocument56 pagesSummer Training Report: On "Training of Employees" ATGauravNo ratings yet

- Manonmaniam Sundaranar University: M.B.A. Finance - Ii YearDocument157 pagesManonmaniam Sundaranar University: M.B.A. Finance - Ii YearPravin ThoratNo ratings yet

- Yasir Working CapitalDocument2 pagesYasir Working Capitalyasir85No ratings yet

- F9FM-Session13 D08squuezDocument10 pagesF9FM-Session13 D08squuezErclanNo ratings yet

- Working Capital Imp3Document100 pagesWorking Capital Imp3SamNo ratings yet

- WC Management 2Document5 pagesWC Management 2RonakNo ratings yet

- Working Capital ManagementDocument18 pagesWorking Capital ManagementMike Dolla SignNo ratings yet

- TA LectureNote-5Document10 pagesTA LectureNote-5nguyenbachptpNo ratings yet

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- Module in Financial Management - 10Document8 pagesModule in Financial Management - 10Karla Mae GammadNo ratings yet

- Working Capital ManagementDocument57 pagesWorking Capital ManagementPrashant VanjariNo ratings yet

- Fabm 2Document5 pagesFabm 2Monica Joyce NaperiNo ratings yet

- Accounting for Non Accountants: Learn Accounting by Common SenseFrom EverandAccounting for Non Accountants: Learn Accounting by Common SenseRating: 1 out of 5 stars1/5 (1)

- Course HeroDocument23 pagesCourse HeroMajed Abou AlkhirNo ratings yet

- Notes - Class 4Document3 pagesNotes - Class 4Majed Abou AlkhirNo ratings yet

- Hello GunaDocument10 pagesHello GunaMajed Abou AlkhirNo ratings yet

- COMM 401 Course Outline Fall 2019ADocument4 pagesCOMM 401 Course Outline Fall 2019AMajed Abou AlkhirNo ratings yet

- Exhibits: Office Rental & Leashold Improvement (RMB)Document11 pagesExhibits: Office Rental & Leashold Improvement (RMB)Majed Abou AlkhirNo ratings yet

- Analysis and Estimate of The Enterprises Bankruptcy RiskDocument6 pagesAnalysis and Estimate of The Enterprises Bankruptcy RiskMajed Abou AlkhirNo ratings yet

- Cash Flow Alpa Beta GammaDocument26 pagesCash Flow Alpa Beta GammaMajed Abou AlkhirNo ratings yet