Professional Documents

Culture Documents

Chapter 4 Reviewer For 1st Years

Uploaded by

Airene BaesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Reviewer For 1st Years

Uploaded by

Airene BaesCopyright:

Available Formats

OPERATING AND FINANCIAL LEVERAGE

Cost Volume Profit (CVP) Analysis is a powerful tool and vital in many business decisions because it helps managers

understand the relationships among cost, volume & profit and focus on how profits are affected by

• Selling prices

• Sales volume

• Unit variable costs

• Total fixed costs

• Mix of products sold

Contribution Margin per unit

● Excess of unit selling price over unit variable costs and the amount each unit sold contributes toward

Covering fixed costs and

Providing operating profits

CM per unit = Unit selling price – unit variable costs

Contribution Margin ratio

● Percentage of contribution margin to total sales

● Affected by a given peso change in total sales

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏

CM Ratio = 𝑺𝒂𝒍𝒆𝒔

CVP Analysis for Breakeven Planning

● Break-even point – total revenues and total expenses are equal

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

Break-even point (units) = 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝒑𝒆𝒓 𝒖𝒏𝒊𝒕

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

Break-even point (pesos) = 𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝑪𝒐𝒔𝒕𝒔

𝟏−

𝑺𝒂𝒍𝒆𝒔

● Break-even sales

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

Multi-products firms (combined units) = 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝑨𝒗𝒆𝒓𝒂𝒈𝒆 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏

𝑼𝒏𝒊𝒕 𝑪𝑴 𝒙 𝑵𝒐. 𝒐𝒇 𝒖𝒏𝒊𝒕𝒔 𝒑𝒆𝒓 𝒎𝒊𝒙+𝑼𝒏𝒊𝒕 𝑪𝑴 𝒙 𝑵𝒐. 𝒐𝒇 𝒖𝒏𝒊𝒕𝒔 𝒑𝒆𝒓 𝒎𝒊𝒙

Weighted Contribution Margin per unit =

𝑻𝒐𝒕𝒂𝒍 𝒏𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝒖𝒏𝒊𝒕𝒔 𝒑𝒆𝒓 𝑺𝒂𝒍𝒆𝒔 𝑴𝒊𝒙

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

Multi-products firm (combined pesos) = 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝑪𝑴 𝑹𝒂𝒕𝒊𝒐

𝑻𝒐𝒕𝒂𝒍 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝑪𝑴 (𝑷)

Weighted CM Ratio =

𝑻𝒐𝒕𝒂𝒍 𝑾𝒆𝒊𝒈𝒉𝒕𝒆𝒅 𝑺𝒂𝒍𝒆𝒔 (𝑷)

CVP Analysis for Revenue and Cost Planning

-determines the level of sales needed to achieve a desired level of profit

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔+𝑫𝒆𝒔𝒊𝒓𝒆𝒅 𝑷𝒓𝒐𝒇𝒊𝒕

Sales (units) =

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝒑𝒆𝒓 𝑼𝒏𝒊𝒕

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔+𝑫𝒆𝒔𝒊𝒓𝒆𝒅 𝑷𝒓𝒐𝒇𝒊𝒕

Sales (P) =

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑹𝒂𝒕𝒊𝒐

Assumptions & Limitations of CVP Analysis

1. Valid for a limited range of values - the “relevant” and a limited period of time

2. Variable or Fixed

3. Revenue

4. Constant product mix

5. Changes in volume

6. No significant changes in inventories

7. Operation leverage questions

8. Deterministic and appropriate data can be found

Sensitivity Analysis of CVP Result

Examine sensitivity of profits to change in sales.

Margin Of Safety

Indicates the amount by which sales could decrease before loses are incurred

Potential effect the risk that sales will fall short of planned levels

𝑴𝒂𝒓𝒈𝒊𝒏 𝒐𝒇 𝑺𝒂𝒇𝒆𝒕𝒚

Ratio= 𝑨𝒄𝒕𝒖𝒂𝒍 𝒐𝒓 𝑷𝒍𝒂𝒏𝒏𝒆𝒅 𝑺𝒂𝒍𝒆𝒔

Units= Actual or Budgeted Unit Sales – Breakeven Unit Sales

Operating Leverage

Degree of Operating Leverage (DOL)

● A measure, at a given level of sales, of how a percentage change in sales volume will affect profits

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏

DOL =

𝑵𝒆𝒕 𝑶𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝑰𝒏𝒄𝒐𝒎𝒆

Degree of Operating Leverage (DOL) Alternative Approach

● Percentage change in operating income that occurs as a result of a percentage change in units sold

𝑷𝒆𝒓𝒄𝒆𝒏𝒕 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝑶𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝑰𝒏𝒄𝒐𝒎𝒆

DOL = 𝑷𝒆𝒓𝒄𝒆𝒏𝒕 𝒄𝒉𝒂𝒏𝒈𝒆 𝒊𝒏 𝒖𝒏𝒊𝒕 𝒗𝒐𝒍𝒖𝒎𝒆

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1000 Guide To Global Grants enDocument40 pages1000 Guide To Global Grants enRjendra LamsalNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Auditing Graded QuestionsDocument370 pagesAuditing Graded QuestionsVeron GovenderNo ratings yet

- Bookkeeping NC Iii - Module 1Document15 pagesBookkeeping NC Iii - Module 1Abigail AndradeNo ratings yet

- Mathematics in The Modern WorldDocument3 pagesMathematics in The Modern WorldAirene Baes100% (7)

- Management Accounting UpdatedDocument6 pagesManagement Accounting UpdatedJackie Sheila Ronquillo Castillo100% (1)

- Housing Society Matters Issue 3Document12 pagesHousing Society Matters Issue 3PrasadNo ratings yet

- Module 2 Values EducationDocument5 pagesModule 2 Values EducationJabonJohnKenneth100% (1)

- 1 Introduction To Food SafetyDocument24 pages1 Introduction To Food SafetyAirene Baes100% (3)

- Chapter 1Document14 pagesChapter 1Airene Baes100% (1)

- Appellant Rebuttal Document PDFDocument26 pagesAppellant Rebuttal Document PDFsaul campbellNo ratings yet

- Love and Sexual IssuesDocument16 pagesLove and Sexual IssuesAirene BaesNo ratings yet

- SCHEDDocument1 pageSCHEDAirene BaesNo ratings yet

- Good CitizenshipDocument27 pagesGood CitizenshipAirene BaesNo ratings yet

- SCHEDDocument1 pageSCHEDAirene BaesNo ratings yet

- Love and Sexual IssuesDocument16 pagesLove and Sexual IssuesAirene BaesNo ratings yet

- Chapter 6Document30 pagesChapter 6Airene BaesNo ratings yet

- Environmental Law in The PhilippinesDocument1 pageEnvironmental Law in The PhilippinesAirene BaesNo ratings yet

- Understanding The Self: (GNED8)Document14 pagesUnderstanding The Self: (GNED8)Airene BaesNo ratings yet

- GNED O3 Handout 2 PDFDocument1 pageGNED O3 Handout 2 PDFAirene BaesNo ratings yet

- GNED O3 Handout 2 PDFDocument1 pageGNED O3 Handout 2 PDFAirene BaesNo ratings yet

- Randall BlantonDocument2 pagesRandall Blantonrandblan12No ratings yet

- Fibria Celulose S.ADocument158 pagesFibria Celulose S.AFibriaRINo ratings yet

- SUSHMA AJIT SHELAR Resume 1Document2 pagesSUSHMA AJIT SHELAR Resume 1S perfect ServicesNo ratings yet

- Diana Faye Caduada ResumeDocument3 pagesDiana Faye Caduada ResumeDiana Faye CaduadaNo ratings yet

- Organizing For Advertising and Promotion The Role of Ad AgenciesDocument20 pagesOrganizing For Advertising and Promotion The Role of Ad AgenciesMichelle EaktavewutNo ratings yet

- FinQuiz - Smart Summary - Study Session 7 - Reading 24Document3 pagesFinQuiz - Smart Summary - Study Session 7 - Reading 24RafaelNo ratings yet

- MCQ in bts-MISDocument21 pagesMCQ in bts-MISsushilNo ratings yet

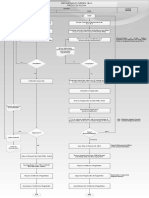

- DO 18-A REVISED Flow ChartDocument1 pageDO 18-A REVISED Flow ChartPaulineNo ratings yet

- CTFAIA Hari Ke 5 Materi 2 - Waheed KhanDocument31 pagesCTFAIA Hari Ke 5 Materi 2 - Waheed Khanoyonglisa12No ratings yet

- Chapter 16 AEBHDocument43 pagesChapter 16 AEBHAyu FricilyaNo ratings yet

- 1 SMDocument28 pages1 SMine ylsNo ratings yet

- IAP Draft Instruction 2 MarchDocument37 pagesIAP Draft Instruction 2 MarchsandipgargNo ratings yet

- Engagement Letter-Q Express PVT LTD Pakistan-2018Document6 pagesEngagement Letter-Q Express PVT LTD Pakistan-2018ALi ChNo ratings yet

- Steel Authority of India Limited (SAIL) : Project Topic-Training and Development of RDCIS (SAIL), RanchiDocument52 pagesSteel Authority of India Limited (SAIL) : Project Topic-Training and Development of RDCIS (SAIL), RanchimatchisNo ratings yet

- স্পেশাল_পিডিএফ_একাউন্টিংDocument11 pagesস্পেশাল_পিডিএফ_একাউন্টিংMuhammad Rakib HossenNo ratings yet

- Engy Osman Ibrahim Moneeb: Career ObjectivesDocument5 pagesEngy Osman Ibrahim Moneeb: Career ObjectivesEngy MoneebNo ratings yet

- Charles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsDocument21 pagesCharles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsAnnisa AdriannaNo ratings yet

- ASSIGNMENT 404 - Audit of InventoriesDocument3 pagesASSIGNMENT 404 - Audit of InventoriesWam OwnNo ratings yet

- ACCA Practice F1 QsDocument34 pagesACCA Practice F1 QsSiham SajjadNo ratings yet

- Comparing InvestmentsDocument59 pagesComparing InvestmentsKondeti Harsha VardhanNo ratings yet

- Punjab Food Authority Act 2011Document15 pagesPunjab Food Authority Act 2011WaqarAhmedButt100% (1)

- Auditing and Assurance Services Louwers 4th Edition Solutions ManualDocument26 pagesAuditing and Assurance Services Louwers 4th Edition Solutions ManualRichardThomasrfizy100% (26)

- Annex 3 Auditing Guide Audit Report TemplateDocument11 pagesAnnex 3 Auditing Guide Audit Report TemplateAlejandroNo ratings yet

- NonConformities 02Document3 pagesNonConformities 02sheerazaliNo ratings yet

- Transcription Prepared By: Corina BasubasDocument2 pagesTranscription Prepared By: Corina BasubasZimm BasubasNo ratings yet