Professional Documents

Culture Documents

Jra Phils Vs Internal Revenue

Uploaded by

Johan Francisco0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

jra phils vs internal revenue.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesJra Phils Vs Internal Revenue

Uploaded by

Johan FranciscoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

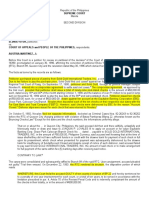

G.R. NO.

177127 October 11, 2010

J.R.A. PHILIPPINES, INC., Petitioner,

vs.

COMMISSIONER OF INTERNAL REVENUE, Respondent.

DECISION

DEL CASTILLO, J.:

Stare decisis et non quieta movere.

Courts are bound by prior decisions. Thus, once a case has been decided one way, courts have

no choice but to resolve subsequent cases involving the same issue in the same manner.1 We

ruled then, as we rule now, that failure to print the word "zero-rated" in the invoices/receipts is

fatal to a claim for credit/refund of input value-added tax (VAT) on zero-rated sales.

This Petition for Review on Certiorari under Rule 45 of the Rules of Court seeks to set aside the

January 15, 2007 Decision2 and the March 16, 2007

Resolution3 of the Court of Tax Appeals (CTA) En Banc.

Factual Antecedents

Petitioner J.R.A. Philippines, Inc., a domestic corporation, is engaged in the manufacture and

wholesale export of jackets, pants, trousers, overalls, shirts, polo shirts, ladies’ wear, dresses and

other wearing apparel.4 It is registered with the Bureau of Internal Revenue (BIR) as a VAT

taxpayer5 and as an Ecozone Export Enterprise with the Philippine Economic Zone Authority

(PEZA).6

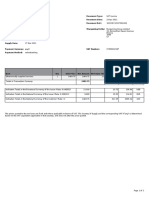

On separate dates, petitioner filed with the Revenue District Office (RDO) No. 54 of the BIR,

Trece Martires City, applications for tax credit/refund of unutilized input VAT on its zero-rated

sales for the taxable quarters of 2000 in the total amount of ₱8,228,276.34, broken down as

follows:

1st quarter ₱ 2,369,060.97

2nd quarter 2,528,126.02

3rd quarter 1,918,015.38

4th quarter 1,413,073.977

The claim for credit/refund, however, remained unacted by the respondent. Hence, petitioner

was constrained to file a petition before the CTA.

Proceedings before the Second Division of the Court of Tax Appeals

On April 16, 2002, petitioner filed a Petition for Review8 with the CTA for the refund/credit of the

same input VAT which was docketed as CTA Case No.

6454 and raffled to the Second Division of the CTA.

In his Answer,9 respondent interposed the following special and affirmative defenses, to wit:

4. Petitioner’s alleged claim for refund is subject to administrative routinary

investigation/examination by the Bureau;

5. Being allegedly registered with the Philippine Economic Zone Authority as an export

enterprise, petitioner’s business is not subject to VAT pursuant to Section 24 of R.A. No. 7916 in

relation to Section 109 (q) of the Tax Code. Hence, it is not entitled to tax credit of input taxes

pursuant to Section 4.103-1 of Revenue Regulations No. 7-95;

6. The amount of ₱8,228,276.34 being claimed by petitioner as alleged unutilized VAT input

taxes for the year 2000 was not properly documented;

7. In an action for refund, the burden of proof is on the taxpayer to establish its right to refund,

and failure to [do so] is fatal to the claim for refund/ credit;

8. Petitioner must show that it has complied with the provisions of Section 204 (c) and 229 of the

Tax Code on the prescriptive period for claiming tax refund/credit;

9. Claims for refund are construed strictly against the claimant for the same partake the nature

of exemption from taxation.10

After trial, the Second Division of the CTA rendered a Decision11 denying petitioner’s claim for

refund/credit of input VAT attributable to its zero-rated sales due to the failure of petitioner to

indicate its Taxpayer’s Identification Number-VAT (TIN-V) and the word "zero-rated" on its

invoices.12 Thus, the fallo reads:

WHEREFORE, premises considered, the instant petition is hereby DENIED DUE COURSE, and,

accordingly, DISMISSED for lack of merit.

SO ORDERED.13

Aggrieved by the Decision, petitioner filed a Motion for Reconsideration14 to which respondent

filed an Opposition.15 Petitioner, in turn, tendered a Reply.16

The Second Division of the CTA, however, stood firm on its Decision and denied petitioner’s

Motion for lack of merit in a Resolution17 dated October 5, 2005. This prompted petitioner to

elevate the matter to the CTA En Banc.18

Ruling of the CTA En Banc

On January 15, 2007, the CTA En Banc denied the petition, reiterating that failure to comply with

invoicing requirements results in the denial of a claim for refund.19 Hence, it disposed of the

petition as follows:

WHEREFORE, the petition for review is DENIED for lack of merit. ACCORDINGLY, the Decision

dated June 30, 2005 and Resolution dated October 5, 2005 of Second Division of the Court of Tax

Appeals in C.T.A Case No. 6454 are hereby AFFIRMED.

SO ORDERED.20

Presiding Justice Ernesto D. Acosta (Presiding Justice Acosta) concurred with the findings of the

majority that there was failure on the part of petitioner to comply with the invoicing

requirements;21 he dissented, however, to the outright denial of petitioner’s claim since there

are other pieces of evidence proving petitioner’s transactions and VAT status.22

Petitioner sought reconsideration23 of the Decision but the CTA En Banc

denied the same in a Resolution24 dated March 16, 2007. Presiding Justice Acosta maintained his

dissent.

Issue

Hence, the instant Petition with the solitary issue of whether the failure to print the word "zero-

rated" on the invoices/receipts is fatal to a claim for credit/ refund of input VAT on zero-rated

sales.

Petitioner’s Arguments

Petitioner submits that:

THE COURT OF TAX APPEALS ERRED BY DECIDING QUESTIONS OF SUBSTANCE IN A MANNER

THAT IS NOT IN ACCORD WITH LAW AND JURISPRUDENCE, IN THAT:

A. THE INVOICING REQUIREMENTS UNDER THE 1997 TAX CODE DO NOT REQUIRE THAT

INVOICES AND/OR RECEIPTS ISSUED BY A VAT-REGISTERED TAXPAYER, SUCH AS THE PETITIONER,

SHOULD BE IMPRINTED WITH THE WORD "ZERO-RATED."

B. THE INVOICING REQUIREMENTS PRESCRIBED BY THE 1997 TAX CODE AND THE REQUIREMENT

THAT THE WORDS "ZERO-RATED" BE IMPRINTED ON THE SALES INVOICES/OFFICIAL RECEIPTS

UNDER REVENUE REGULATIONS NO. 7-95 ARE NOT EVIDENTIARY RULES AND THE ABSENCE

THEREOF IS NOT FATAL TO A TAXPAYER’S CLAIM FOR REFUND.

C. RESPONDENT’S REGULATIONS ARE INVALID BECAUSE THEY DO NOT IMPLEMENT THE 1997

TAX CODE BUT INSTEAD, [EXCEED] THE LIMITATIONS OF THE LAW.

D. PETITIONER PRESENTED SUBSTANTIAL EVIDENCE THAT UNEQUIVOCALLY PROVED

PETITIONER’S ZERO-RATED TRANSACTIONS FOR THE YEAR 2000.

E. NO PREJUDICE CAN RESULT TO THE GOVERNMENT BY REASON OF THE FAILURE OF

PETITIONER TO IMPRINT THE WORD "ZERO-RATED" ON ITS INVOICES. PETITIONER’S CLIENTS FOR

ITS ZERO-RATED TRANSACTIONS CANNOT UNDULY BENEFIT FROM ITS "OMISSION"

CONSIDERING THAT THEY ARE NON-RESIDENT FOREIGN CORPORATIONS [that] ARE NOT

COVERED BY THE PHILIPPINE VAT SYSTEM.

F. IN CIVIL CASE[S], SUCH AS CLAIMS FOR REFUND, STRICT COMPLIANCE WITH TECHNICAL RULES

OF EVIDENCE IS NOT REQUIRED. MOREOVER, A MERE PREPONDERANCE OF EVIDENCE WILL

SUFFICE TO JUSTIFY THE GRANT OF A CLAIM.25

Respondent’s Arguments

Emphasizing that tax refunds are in the nature of tax exemptions which are strictly construed

against the claimant, respondent seeks the affirmance of the assailed Decision and Resolution of

the CTA En Banc. 26 He insists that the denial of petitioner’s claim for tax credit/refund is justified

because it failed to comply with the invoicing requirements under Section 4.108-127 of Revenue

Regulations No. 7-95.

Our Ruling

The petition is bereft of merit.

The absence of the word "zero-rated" on the invoices/receipts is fatal to a claim for

credit/refund of input VAT

The question of whether the absence of the word "zero-rated" on the invoices/receipts is fatal to

a claim for credit/refund of input VAT is not novel. This has been squarely resolved in Panasonic

Communications Imaging Corporation of the Philippines (formerly Matsushita Business Machine

Corporation of the Philippines) v. Commissioner of Internal Revenue.28 In that case, we sustained

the denial of petitioner’s claim for tax credit/refund for non-compliance with Section 4.108-1 of

Revenue Regulations No. 7-95, which requires the word "zero rated" to be printed on the

invoices/receipts covering zero-rated sales. We explained that:

Zero-rated transactions generally refer to the export sale of goods and services. The tax rate in

this case is set at zero. When applied to the tax base or the selling price of the goods or services

sold, such zero rate results in no tax chargeable against the foreign buyer or customer. But,

although the seller in such transactions charges no output tax, he can claim a refund of the VAT

that his suppliers charged him. The seller thus enjoys automatic zero rating, which allows him to

recover the input taxes he paid relating to the export sales, making him internationally

competitive.

For the effective zero rating of such transactions, however, the taxpayer has to be VAT-

registered and must comply with invoicing requirements. x x x

xxxx

Petitioner Panasonic points out, however, that in requiring the printing on its sales invoices of

the word "zero-rated," the Secretary of Finance unduly expanded, amended, and modified by a

mere regulation (Section 4.108-1 of RR 7-95) the letter and spirit of Sections 113 and 237 of the

1997 NIRC, prior to their amendment by R.A. 9337. Panasonic argues that the 1997 NIRC, which

applied to its payments – specifically Sections 113 and 237 – required the VAT-registered

taxpayer’s receipts or invoices to indicate only the following information:

(1) A statement that the seller is a VAT-registered person, followed by his taxpayer’s

identification number (TIN);

(2) The total amount which the purchaser [paid] or is obligated to pay to the seller with the

indication that such amount includes the value-added tax;

(3) The date of transaction, quantity, unit cost and description of the goods or properties or

nature of the service; and

(4) The name, business style, if any, address and taxpayer's identification number (TIN) of the

purchaser, customer or client.

Petitioner Panasonic points out that Sections 113 and 237 did not require the inclusion of the

word "zero-rated" for zero-rated sales covered by its receipts or invoices. The BIR incorporated

this requirement only after the enactment of R.A. 9337 on November 1, 2005, a law that did not

yet exist at the time it issued its invoices.

But when petitioner Panasonic made the export sales subject of this case, i.e., from April 1998 to

March 1999, the rule that applied was Section 4.108-1 of RR 7-95, otherwise known as the

Consolidated Value-Added Tax Regulations, which the Secretary of Finance issued on December

9, 1995 and [which] took effect on January 1, 1996.1avvphil It already required the printing of

the word "zero-rated" on the invoices covering zero-rated sales. When R.A. 9337 amended the

1997 NIRC on November 1, 2005, it made this particular revenue regulation a part of the tax

code. This conversion from regulation to law did not diminish the binding force of such

regulation with respect to acts committed prior to the enactment of that law.

Section 4.108-1 of RR 7-95 proceeds from the rule-making authority granted to the Secretary of

Finance under Section 245 of the 1977 NIRC (Presidential Decree 1158) for the efficient

enforcement of the tax code and of course its amendments. The requirement is reasonable and

is in accord with the efficient collection of VAT from the covered sales of goods and services. As

aptly explained by the CTA’s First Division, the appearance of the word "zero-rated" on the face

of invoices covering zero-rated sales prevents buyers from falsely claiming input VAT from their

purchases when no VAT was actually paid. If, absent such word, a successful claim for input VAT

is made, the government would be refunding money it did not collect.

Further, the printing of the word "zero-rated" on the invoice helps segregate sales that are

subject to 10% (now 12%) VAT from those sales that are zero-rated. Unable to submit the proper

invoices, petitioner Panasonic has been unable to substantiate its claim for refund.29

Consistent with the foregoing jurisprudence, petitioner’s claim for credit/ refund of input VAT for

the taxable quarters of 2000 must be denied. Failure to print the word "zero-rated" on the

invoices/receipts is fatal to a claim for credit/ refund of input VAT on zero-rated sales.

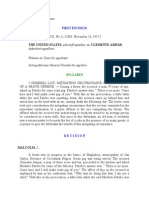

WHEREFORE, the petition is hereby DENIED. The assailed Decision dated January 15, 2007 and

the Resolution dated March 16, 2007 of the Court of Tax Appeals En Banc are hereby AFFIRMED.

SO ORDERED.

MARIANO C. DEL CASTILLO

Associate Justice

WE CONCUR:

RENATO C. CORONA

You might also like

- TAXATION LAW Survival Kit by 4CDocument75 pagesTAXATION LAW Survival Kit by 4CMara Corteza San Pedro100% (2)

- 3113 4 Zero Rated TransactionsDocument5 pages3113 4 Zero Rated TransactionsConic DurangparangNo ratings yet

- PUNDAODAYA vs. COMELEC G.R. No. 179313 September 17, 2009Document1 pagePUNDAODAYA vs. COMELEC G.R. No. 179313 September 17, 2009Nej AdonayNo ratings yet

- Cortes vs. Court of Appeals 494 SCRA 570 July 12 2006Document15 pagesCortes vs. Court of Appeals 494 SCRA 570 July 12 2006John Rey CodillaNo ratings yet

- Churchill Vs Rafferty PDFDocument18 pagesChurchill Vs Rafferty PDFPam Miraflor100% (1)

- Calica Book 1 AufDocument139 pagesCalica Book 1 AufJohan FranciscoNo ratings yet

- 06 Ret. Judge Alpajora v. Atty. CalayanDocument13 pages06 Ret. Judge Alpajora v. Atty. CalayanPaolo Enrino PascualNo ratings yet

- 50 Pilapil vs. Ibay-Somera 174 SCRA 653Document1 page50 Pilapil vs. Ibay-Somera 174 SCRA 653G-one PaisonesNo ratings yet

- Estipona, Jr. v. Hon. Lobrigo, G.R. No. 226679, August 15, 2017Document2 pagesEstipona, Jr. v. Hon. Lobrigo, G.R. No. 226679, August 15, 2017mae ann rodolfoNo ratings yet

- Hermosisima vs. Court of AppealsDocument8 pagesHermosisima vs. Court of AppealsTherese ElleNo ratings yet

- Bunag Jr. Vs CA 211 Scra 440Document9 pagesBunag Jr. Vs CA 211 Scra 440Mitch LimNo ratings yet

- Tilar Versus TilarDocument8 pagesTilar Versus TilarRoberto SingianNo ratings yet

- Your Electricity Bill at A Glance: Total Due 149.63Document2 pagesYour Electricity Bill at A Glance: Total Due 149.63Юлия ПNo ratings yet

- Quiambao V OsorioDocument3 pagesQuiambao V OsorioDNAANo ratings yet

- People vs. Reyes, G.R. No. 74226-27, July 27, 1989 (Prescription)Document3 pagesPeople vs. Reyes, G.R. No. 74226-27, July 27, 1989 (Prescription)Jin AghamNo ratings yet

- Locsin II v. Mekeni, G.R. 192105, Dec. 9, 2013 FactsDocument1 pageLocsin II v. Mekeni, G.R. 192105, Dec. 9, 2013 FactsV CruzNo ratings yet

- Statement FINV05490132-2011D 15016473 20201225 4201445Document1 pageStatement FINV05490132-2011D 15016473 20201225 4201445Isha PopNo ratings yet

- Cojuangco Vs Republic 686 Scra 472-13Document1 pageCojuangco Vs Republic 686 Scra 472-13suizyyyNo ratings yet

- Jra Phils Vs CirDocument5 pagesJra Phils Vs Cirdianne rebutarNo ratings yet

- Republic of The Philippines, Petitioner, vs. Chule Y. LIM, RespondentDocument5 pagesRepublic of The Philippines, Petitioner, vs. Chule Y. LIM, RespondentRogelio Rubellano IIINo ratings yet

- Lupo Atienza v. Judge Brilliantes PDFDocument6 pagesLupo Atienza v. Judge Brilliantes PDFchescasenNo ratings yet

- Impact of GST On Gold Purchase - Devika UnniDocument55 pagesImpact of GST On Gold Purchase - Devika UnniAthul G100% (1)

- PBCom v. Go, 642 SCRA 693, G.R. No. 175514 February 14, 2011Document4 pagesPBCom v. Go, 642 SCRA 693, G.R. No. 175514 February 14, 2011Caleb Josh PacanaNo ratings yet

- Manila Memorial Park Vs Sec. of DSWDDocument4 pagesManila Memorial Park Vs Sec. of DSWDChola CastilloNo ratings yet

- Case Digest - Santiago V COMELEC GR 127325Document1 pageCase Digest - Santiago V COMELEC GR 127325Isco AgubaNo ratings yet

- LINA CALILAP-ASMERON, Petitioner vs. Development Bank of The Philippines, RespondentsDocument3 pagesLINA CALILAP-ASMERON, Petitioner vs. Development Bank of The Philippines, RespondentsDee SalvatierraNo ratings yet

- Kilosbayan V ErmitaDocument16 pagesKilosbayan V Ermitaalexis_beaNo ratings yet

- Pimentel v. Pimentel, G.R. No. 172060, September 13, 2010 PDFDocument6 pagesPimentel v. Pimentel, G.R. No. 172060, September 13, 2010 PDFJohzzyluck R. MaghuyopNo ratings yet

- Sps. Custodio vs. CaDocument2 pagesSps. Custodio vs. CaNAT CYRUS B. ASUFRANo ratings yet

- People Vs GuhitingDocument3 pagesPeople Vs Guhitingcrisey1100% (1)

- Manuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Document50 pagesManuel Luis C. Gonzales vs. GJH Land, Inc., Gr. No. 202664, November 10, 2015Jerry SerapionNo ratings yet

- People Vs Ignacio PDFDocument6 pagesPeople Vs Ignacio PDFVeen Galicinao FernandezNo ratings yet

- Pesca vs. Pesca, G.R. No. 136921. April 17, 2001 DIGESTDocument1 pagePesca vs. Pesca, G.R. No. 136921. April 17, 2001 DIGESTMonaliza LiztsNo ratings yet

- B45 Marvex Commercial Co. Inc. v. Petra Hawpia and Co., GR L-19297, 22 December 1966, en Banc, Castro (J) - CARINANDocument2 pagesB45 Marvex Commercial Co. Inc. v. Petra Hawpia and Co., GR L-19297, 22 December 1966, en Banc, Castro (J) - CARINANloschudentNo ratings yet

- Daluruya vs. OlivaDocument4 pagesDaluruya vs. OlivaJa RuNo ratings yet

- Pedro Abad Santos, W. H. Booram, Solicitor-General Harvey,: 150 Philippine Reports AnnotatedDocument6 pagesPedro Abad Santos, W. H. Booram, Solicitor-General Harvey,: 150 Philippine Reports AnnotatedReyna RemultaNo ratings yet

- MAGUAN V COURT OF APPEALSDocument2 pagesMAGUAN V COURT OF APPEALSCedricNo ratings yet

- People v. Bindoy 56 PHIL 15Document3 pagesPeople v. Bindoy 56 PHIL 15AnonymousNo ratings yet

- Lawhpil Quimvel vs. People G.R. No. 214497 PDFDocument25 pagesLawhpil Quimvel vs. People G.R. No. 214497 PDFrols villanezaNo ratings yet

- Delgado Vs HRETDocument7 pagesDelgado Vs HRETBrylle DeeiahNo ratings yet

- G.R. No. 128096 Lacson PDFDocument10 pagesG.R. No. 128096 Lacson PDFShariNo ratings yet

- Diong Bi Chu V Ca PDFDocument3 pagesDiong Bi Chu V Ca PDFTrishalyVienBaslotNo ratings yet

- Bolos V BolosDocument5 pagesBolos V BolosKasey Shaun YapNo ratings yet

- PERSONS (De Roy vs. Court of Appeals 157 SCRA 757)Document1 pagePERSONS (De Roy vs. Court of Appeals 157 SCRA 757)Joseph TheThirdNo ratings yet

- Appellant, vs. Shell Company of The Philippine Islands, LTD., Defendant-Appellee, Yek Hua TradingDocument2 pagesAppellant, vs. Shell Company of The Philippine Islands, LTD., Defendant-Appellee, Yek Hua TradingKevin Patrick Magalona DegayoNo ratings yet

- Locgov HW 03.2 - City of Bacolod vs. Phuture VisionsDocument2 pagesLocgov HW 03.2 - City of Bacolod vs. Phuture VisionsMarlene TongsonNo ratings yet

- Yu Oh v. CADocument7 pagesYu Oh v. CAAgapito DuqueNo ratings yet

- Pena v. AparicioDocument3 pagesPena v. AparicioJohn Patrick GarciaNo ratings yet

- Campugan vs. Tolentino, JR., 752 SCRA 254, March 11, 2015Document14 pagesCampugan vs. Tolentino, JR., 752 SCRA 254, March 11, 2015Jane BandojaNo ratings yet

- 7 People V TemporadaDocument152 pages7 People V TemporadaFrench TemplonuevoNo ratings yet

- Etepha V DIRECTOR OF PATENTSDocument1 pageEtepha V DIRECTOR OF PATENTSsweet dudeNo ratings yet

- People Vs FormigonesDocument6 pagesPeople Vs Formigonesnigel alinsugNo ratings yet

- Alcantara V Alcantara DigestDocument1 pageAlcantara V Alcantara DigestRez BasilaNo ratings yet

- Albino Co Vs - Court of Appeals G. R. No. 100776Document9 pagesAlbino Co Vs - Court of Appeals G. R. No. 100776cooley14No ratings yet

- Chavez Vs JBC en Banc G.R. No. 202242 April 16, 2013Document29 pagesChavez Vs JBC en Banc G.R. No. 202242 April 16, 2013herbs22225847No ratings yet

- Valderama vs. MacaldeDocument19 pagesValderama vs. MacaldeAje EmpaniaNo ratings yet

- UNITED STATES Vs AmparDocument3 pagesUNITED STATES Vs Amparautumn moonNo ratings yet

- CASE No. 20 VICTORIAS MILLING COMPANY INC Vs SOCIAL SECURITY COMMISSIONDocument10 pagesCASE No. 20 VICTORIAS MILLING COMPANY INC Vs SOCIAL SECURITY COMMISSIONCarmelo Jay LatorreNo ratings yet

- Those Whose Fathers Are Citizens of The PhilippinesDocument20 pagesThose Whose Fathers Are Citizens of The PhilippinesRA BautistaNo ratings yet

- Benjamin Gomez Vs Enrico Palomar Et AlDocument1 pageBenjamin Gomez Vs Enrico Palomar Et Alljalotjot100% (2)

- Endencia VsDocument2 pagesEndencia VsHao Wei WeiNo ratings yet

- SC Affirms Subdivisions Can Regulate Entry Into Roads Even If They Were Donated To Local GovernmentDocument2 pagesSC Affirms Subdivisions Can Regulate Entry Into Roads Even If They Were Donated To Local GovernmentMelvin PernezNo ratings yet

- United States of America V CeballosDocument1 pageUnited States of America V CeballosAbigael SeverinoNo ratings yet

- Yapyucu V Sandiganbayan G.R. Nos. 120744-46Document34 pagesYapyucu V Sandiganbayan G.R. Nos. 120744-46Apay GrajoNo ratings yet

- 04 Garcia-Quiazon vs. Belen, 702 SCRA 707, G.R. No. 189121 July 31, 2013Document14 pages04 Garcia-Quiazon vs. Belen, 702 SCRA 707, G.R. No. 189121 July 31, 2013Jaypoll DiazNo ratings yet

- J.R.A. PHILIPPINES V CIAG.R. No. 177127Document6 pagesJ.R.A. PHILIPPINES V CIAG.R. No. 177127Apr CelestialNo ratings yet

- J.R.A. Phils. Inc. vs. Commissioner of Internal RevenueDocument4 pagesJ.R.A. Phils. Inc. vs. Commissioner of Internal RevenueDarl YabutNo ratings yet

- Blaquera Vs Alcala DFDocument8 pagesBlaquera Vs Alcala DFJohan FranciscoNo ratings yet

- The Office Had Already Prepared MemoDocument5 pagesThe Office Had Already Prepared MemoJohan FranciscoNo ratings yet

- Saligang Batas NG Pilipinas Konstitusyon NG Pilipinas Constitución de La República de FilipinasDocument28 pagesSaligang Batas NG Pilipinas Konstitusyon NG Pilipinas Constitución de La República de FilipinasJohan FranciscoNo ratings yet

- Civil LawDocument8 pagesCivil LawJohan FranciscoNo ratings yet

- Arturo Flores v. Spouses LindoG.R. No. 183984, 13 April 2011Document8 pagesArturo Flores v. Spouses LindoG.R. No. 183984, 13 April 2011Johan FranciscoNo ratings yet

- IBP v. Zamora, G.R. No. 141284, August 15, 2000Document33 pagesIBP v. Zamora, G.R. No. 141284, August 15, 2000Johan FranciscoNo ratings yet

- Taxation (Malaysia) : Specimen Exam Applicable From December 2015Document22 pagesTaxation (Malaysia) : Specimen Exam Applicable From December 2015cytan828No ratings yet

- Lion Brewery Ceylon Annual Report 2019 20Document128 pagesLion Brewery Ceylon Annual Report 2019 20Venkatesh RYNo ratings yet

- Acc 1102Document19 pagesAcc 1102Bonatan S. MuzzammilNo ratings yet

- Si146204 SMCCDocument4 pagesSi146204 SMCCAJ PerezNo ratings yet

- Economics Adda 247Document48 pagesEconomics Adda 247WHO AM INo ratings yet

- Satyam BillDocument1 pageSatyam BilldevinderNo ratings yet

- VAT 12 Fort Bonifacio Dev. Corp. Vs CIRDocument2 pagesVAT 12 Fort Bonifacio Dev. Corp. Vs CIRMarivic EspiaNo ratings yet

- Document TypeDocument1 pageDocument TypeAdam ŽákNo ratings yet

- Apprise New Features in Version 7.5Document18 pagesApprise New Features in Version 7.5Yangyiren YangNo ratings yet

- Yagpo Application FormDocument2 pagesYagpo Application FormJoel Rotich80% (5)

- Morales Taxation Topic 9 Value Added TaxDocument31 pagesMorales Taxation Topic 9 Value Added TaxMary Joice Delos santosNo ratings yet

- Related Revenue Issuances For VATDocument4 pagesRelated Revenue Issuances For VATKenneth DavidNo ratings yet

- Module 1 - VAT ExemptionsDocument15 pagesModule 1 - VAT ExemptionsCrazy DaveNo ratings yet

- Tax Reform For Acceleration and Inclusion Act - Wikipedia PDFDocument66 pagesTax Reform For Acceleration and Inclusion Act - Wikipedia PDFKaitlyn RayterNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)m.p.enterprisesNo ratings yet

- 7th STD Social 3rd Term Book Back Questions With Answers in English PDFDocument32 pages7th STD Social 3rd Term Book Back Questions With Answers in English PDFAlvin ANo ratings yet

- Tax AufbestDocument584 pagesTax AufbestJohn Patrick GarciaNo ratings yet

- Ikea PPP MacroDocument56 pagesIkea PPP MacroSaira BanuNo ratings yet

- Zimbabwe November 2013Document24 pagesZimbabwe November 2013Tendai ZamangweNo ratings yet

- WRX YY2 PDWQ HDPW 4 NEx 3 Ig JR DT 8 KM 4 o Cewq QDocument5 pagesWRX YY2 PDWQ HDPW 4 NEx 3 Ig JR DT 8 KM 4 o Cewq QHamzah FaatehNo ratings yet

- Methodology: Method OverviewDocument42 pagesMethodology: Method OverviewNtr-Global TradingNo ratings yet

- Maersk - CTA Case No. 8934 - 2017Document30 pagesMaersk - CTA Case No. 8934 - 2017Angeline AncloteNo ratings yet

- Commercial Invoice: 2101 East St. Elmo Road, Ste 275 Austin, TX 78744 Phone: 512-326-3244 Fax: 512-326-3299Document1 pageCommercial Invoice: 2101 East St. Elmo Road, Ste 275 Austin, TX 78744 Phone: 512-326-3244 Fax: 512-326-3299Muhammad Shahzad AkramNo ratings yet

- Tax Determination in Sales and Distribution - SAP ONE Support LaunchpadDocument1 pageTax Determination in Sales and Distribution - SAP ONE Support LaunchpadGuest GuestNo ratings yet