Professional Documents

Culture Documents

Digi Malay Co Sofp

Uploaded by

Cherry BlasoomCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digi Malay Co Sofp

Uploaded by

Cherry BlasoomCopyright:

Available Formats

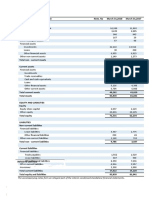

Annual Report 2018 87

Statements of financial position

As at 31 December 2018

Group Company

Note 2018 2017 2018 2017

Strategic Review

RM’000 RM’000 RM’000 RM’000

Non-current assets

Property, plant and equipment 11 2,881,172 2,908,968 - -

Intangible assets 12 981,683 937,100 - -

Investments in subsidiaries 14 - - 772,751 772,751

Other investment 15 78 163 - -

Trade and other receivables 17 140,762 101,163 - -

Contract costs 13 71,130 - - -

Performance Review

Contract assets 5 40,900 - - -

Derivative financial assets 18 569 355 - -

4,116,294 3,947,749 772,751 772,751

Current assets

Inventories 16 61,135 59,138 - -

Trade and other receivables 17 1,460,709 1,216,988 4 4

Contract assets 5 134,800 - - -

Tax recoverable - 34,693 - -

Sustainability

Cash and short-term deposits 19 433,118 575,045 776 897

2,089,762 1,885,864 780 901

Total assets 6,206,056 5,833,613 773,531 773,652

Non-current liabilities

Loans and borrowings 20 2,512,683 2,691,438 - -

Deferred tax liabilities 21 276,063 297,523 - -

Other liabilities 22 48,964 44,077 - -

Governance

2,837,710 3,033,038 - -

Current liabilities

Trade and other payables 23 2,144,070 1,928,256 1,071 965

Contract liabilities 5 315,386 - - -

Derivative financial liabilities 18 301 1,447 - -

Other liabilities 22 5,373 339,257 - -

Loans and borrowings 20 181,371 12,881 - -

Tax payable 48,657 16 21 16

Financials

2,695,158 2,281,857 1,092 981

Total liabilities 5,532,868 5,314,895 1,092 981

Equity

Share capital 24 769,655 769,655 769,655 769,655

(Accumulated losses)/retained earnings 26 (96,467) (250,937) 2,784 3,016

Additional Information

Total equity 673,188 518,718 772,439 772,671

Total equity and liabilities 6,206,056 5,833,613 773,531 773,652

The accompanying accounting policies and explanatory information form an integral part of the financial statements. The Group and the Company

have adopted MFRS 15 and MFRS 9 on 1 January 2018. Under the transition methods elected, cumulative impacts arising from the adoption of

the new standards were adjusted to the accumulated losses of the Group as at 1 January 2018. Accordingly, comparatives have not been restated.

You might also like

- Way Finders Brands Limited: Balance Sheet As at 31 March 2017Document2 pagesWay Finders Brands Limited: Balance Sheet As at 31 March 2017Shoaib ShaikhNo ratings yet

- Shell PLC Annual Report and Accounts 2021: AssetsDocument1 pageShell PLC Annual Report and Accounts 2021: AssetsSonia CrystalNo ratings yet

- Royal Dutch Shell PLC Annual Report and Form 20-F 2018: Consolidated Balance SheetDocument1 pageRoyal Dutch Shell PLC Annual Report and Form 20-F 2018: Consolidated Balance SheetSonia CrystalNo ratings yet

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDocument60 pagesPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiNo ratings yet

- Standalone Balance SheetDocument1 pageStandalone Balance SheetPrerna ChavanNo ratings yet

- Balance Sheet VW Ar18Document1 pageBalance Sheet VW Ar18Sneha SinghNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Bharti Airtel Limited Standalone Financial Statements 2018-19Document2 pagesBharti Airtel Limited Standalone Financial Statements 2018-19Ankit ViraNo ratings yet

- 4q19 Cimb Group Financial StatementsDocument70 pages4q19 Cimb Group Financial StatementsShaheer AliNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- RTH Financial Statements Interim 2020 - FinalDocument15 pagesRTH Financial Statements Interim 2020 - FinalPali GallNo ratings yet

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNo ratings yet

- SOFP HartaDocument1 pageSOFP Hartaワンピ ースNo ratings yet

- IMperial Mines 2018.Q2 FSDocument30 pagesIMperial Mines 2018.Q2 FSKevin GullufsenNo ratings yet

- Operating Segments Comprehensive ProblemDocument2 pagesOperating Segments Comprehensive ProblemJazehl Joy ValdezNo ratings yet

- Pakistan Refinery Limited (Annual Report 2008)Document84 pagesPakistan Refinery Limited (Annual Report 2008)Monis Ali100% (1)

- 15 Balance Sheet - 2Document1 page15 Balance Sheet - 2amer_mrd87No ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- E.9 Estimated Balance Sheets (RS.) : Assets Non-Current AssetsDocument6 pagesE.9 Estimated Balance Sheets (RS.) : Assets Non-Current AssetsMelanie D'SouzaNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Bitfarms Q4 2021 FS FinalDocument46 pagesBitfarms Q4 2021 FS FinalAlexandru IonescuNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Telkom - FS TW I 2023 Eng - RilisDocument113 pagesTelkom - FS TW I 2023 Eng - RilisSyafrizal ThaherNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- FS Untr 2022Document162 pagesFS Untr 2022Yanto LieNo ratings yet

- NIVS. 2009 SAIC Filing TranslatedDocument3 pagesNIVS. 2009 SAIC Filing Translatedwensley2001No ratings yet

- Dec 22 Management ConsolidatedDocument23 pagesDec 22 Management ConsolidatedKhalid KhanNo ratings yet

- A04 T86uxmwsyll4x6ve.1Document44 pagesA04 T86uxmwsyll4x6ve.1citybizlist11No ratings yet

- ABC Limited Annual Report Group MembersDocument30 pagesABC Limited Annual Report Group MembersHira ParachaNo ratings yet

- 2016 Nestle ExtratedDocument7 pages2016 Nestle ExtratednesanNo ratings yet

- Wipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY23Document35 pagesWipro Limited Interim Condensed Consolidated Financial Statements for Q1 FY23Midhun ManoharNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- CompleteDocument17 pagesCompletesanket patilNo ratings yet

- FS Untr 0322 PDFDocument143 pagesFS Untr 0322 PDFMuchlis AbadiNo ratings yet

- First Women Bank Limited Q3 2018 Financial ResultsDocument19 pagesFirst Women Bank Limited Q3 2018 Financial Resultssheeraz ali khuhroNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- Signed FS Inocycle Technology Group TBK 2018 PDFDocument74 pagesSigned FS Inocycle Technology Group TBK 2018 PDFmichele hazelNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Document307 pagesAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNo ratings yet

- Ar-18 8Document5 pagesAr-18 8jawad anwarNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- Financial-Statements 22 FADocument4 pagesFinancial-Statements 22 FAkhushinagar9009No ratings yet

- Enterprise GroupDocument8 pagesEnterprise GroupFuaad DodooNo ratings yet

- Cash Flow Questions RucuDocument5 pagesCash Flow Questions RucuWalton Jr Kobe TZNo ratings yet

- 2020 6 Months Financial Statements Usd ImzaliDocument57 pages2020 6 Months Financial Statements Usd Imzalihero111983No ratings yet

- Credo Bank 2018 - EngDocument51 pagesCredo Bank 2018 - EngAzerNo ratings yet

- Zynga 2019 Annual Report - Excerpts - FinalDocument7 pagesZynga 2019 Annual Report - Excerpts - FinalAlexa WilcoxNo ratings yet

- Sorry Company Financial Analysis Warns of BankruptcyDocument5 pagesSorry Company Financial Analysis Warns of BankruptcyRevatee HurilNo ratings yet

- FS ACST 30 September 2022Document81 pagesFS ACST 30 September 2022Yoffy AchmadNo ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- HONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTDocument8 pagesHONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTTheng RogerNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- Annual Report CV WLY 2019Document81 pagesAnnual Report CV WLY 2019Narra AndikaNo ratings yet

- FS-Q4 2020-2021 (Bod) - SofpDocument1 pageFS-Q4 2020-2021 (Bod) - SofpAsif MahmudNo ratings yet

- Interim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Document23 pagesInterim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Сергей АнуфриевNo ratings yet

- Afaa InsuranceDocument9 pagesAfaa InsuranceARAIB TAJINo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- 2017 Year End FinancialsDocument37 pages2017 Year End FinancialsFryan GreenhousegasNo ratings yet

- Summary Government AccountingDocument2 pagesSummary Government AccountingCherry BlasoomNo ratings yet

- Scholarships 2020 PDFDocument5 pagesScholarships 2020 PDFCherry BlasoomNo ratings yet

- Soal Chapter 5Document5 pagesSoal Chapter 5Cherry BlasoomNo ratings yet

- 1 PBDocument16 pages1 PBapi-356772067No ratings yet

- Chapter 3 Investment Information and Securities TransactionsDocument1 pageChapter 3 Investment Information and Securities TransactionsCherry BlasoomNo ratings yet

- Government Acconting AssignmentDocument3 pagesGovernment Acconting AssignmentCherry BlasoomNo ratings yet

- New Public Management Concept SummaryDocument4 pagesNew Public Management Concept SummaryCherry BlasoomNo ratings yet

- Scholarships 2020 PDFDocument5 pagesScholarships 2020 PDFCherry BlasoomNo ratings yet

- Soal Chapter 4Document4 pagesSoal Chapter 4Cherry BlasoomNo ratings yet

- Summary Chapter 4 - Vega Agnitya E P - 17312053Document4 pagesSummary Chapter 4 - Vega Agnitya E P - 17312053Cherry BlasoomNo ratings yet

- SMCB PDFDocument3 pagesSMCB PDFCherry BlasoomNo ratings yet

- Mis Vega Bi and Ci (17312053)Document25 pagesMis Vega Bi and Ci (17312053)Cherry BlasoomNo ratings yet

- AUDITING II GROUP ASSIGNMENT Case 3.1 A Day in The Life of Brent DorseyDocument2 pagesAUDITING II GROUP ASSIGNMENT Case 3.1 A Day in The Life of Brent DorseyCherry Blasoom100% (1)

- No 1-5Document3 pagesNo 1-5Cherry BlasoomNo ratings yet

- Metopel Ch1Document15 pagesMetopel Ch1Cherry BlasoomNo ratings yet

- The Sale and Purchasing Transaction IjarahDocument12 pagesThe Sale and Purchasing Transaction IjarahCherry BlasoomNo ratings yet

- (Disajikan Dalam Ribuan Rupiah, Kecuali Dinyatakan Lain) : Other CurrentDocument4 pages(Disajikan Dalam Ribuan Rupiah, Kecuali Dinyatakan Lain) : Other CurrentCherry BlasoomNo ratings yet

- Public Sector AccDocument20 pagesPublic Sector AccCherry BlasoomNo ratings yet

- Quiz Solutions Acc TheoryDocument8 pagesQuiz Solutions Acc TheoryCherry BlasoomNo ratings yet

- Annual Report: PT Intikeramik Alamasri Industri TBKDocument4 pagesAnnual Report: PT Intikeramik Alamasri Industri TBKCherry BlasoomNo ratings yet

- PsaDocument11 pagesPsaCherry BlasoomNo ratings yet

- Ikai Financial StatementDocument3 pagesIkai Financial StatementCherry BlasoomNo ratings yet

- Performance Measurement Using Financial and Non-Financial IndicatorsDocument24 pagesPerformance Measurement Using Financial and Non-Financial IndicatorsCherry BlasoomNo ratings yet

- Fiqih Muamalah - Istishna PDFDocument18 pagesFiqih Muamalah - Istishna PDFCherry Blasoom100% (1)

- Chapter 4 - Financial Forecasting, Planning, and BudgetingDocument44 pagesChapter 4 - Financial Forecasting, Planning, and BudgetingAbdur RahimNo ratings yet

- Paper Public Sector AccDocument10 pagesPaper Public Sector AccCherry BlasoomNo ratings yet

- Definition of Accounting TheoryDocument4 pagesDefinition of Accounting TheoryCherry BlasoomNo ratings yet

- Accounting Theory AnswerDocument3 pagesAccounting Theory AnswerCherry BlasoomNo ratings yet

- Paper Public Sector AccDocument10 pagesPaper Public Sector AccCherry BlasoomNo ratings yet

- Internal and External ConsistencyDocument35 pagesInternal and External ConsistencyAakriti ChNo ratings yet

- CCP Certification Study GuideDocument19 pagesCCP Certification Study GuideSAMAR QASIMNo ratings yet

- RECENT DEVELOPMENTS IN STANDARD CONSTRUCTION AND ENGINEERING CONTRACTSDocument2 pagesRECENT DEVELOPMENTS IN STANDARD CONSTRUCTION AND ENGINEERING CONTRACTSn0035085No ratings yet

- Tele BankingDocument24 pagesTele BankingManjula Ashok100% (1)

- Quiz Tutor IFA Week 5-6Document13 pagesQuiz Tutor IFA Week 5-6Ersha NatachiaNo ratings yet

- Verification of Model Transformations: A Case Study With BPELDocument17 pagesVerification of Model Transformations: A Case Study With BPELFatih ÖzulucanNo ratings yet

- Partnership AccountingDocument8 pagesPartnership Accountingferdinand kan pennNo ratings yet

- Success Stories of Selected Frontrow Members.Document6 pagesSuccess Stories of Selected Frontrow Members.Jonna Riza BasayaNo ratings yet

- Maryland Open Meetings Act Manual CompleteDocument97 pagesMaryland Open Meetings Act Manual CompleteCraig O'DonnellNo ratings yet

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- Service StrategyDocument15 pagesService Strategyvikash_gahlotNo ratings yet

- Kone Kds50: Command and Signaliz Ation SystemDocument4 pagesKone Kds50: Command and Signaliz Ation SystemAbdelmuneimNo ratings yet

- HLL's Project Shakti Empowers Rural Women Through Marketing FMCGDocument27 pagesHLL's Project Shakti Empowers Rural Women Through Marketing FMCGShamoeel Khan100% (1)

- H&M SCM Model ExplainedDocument1 pageH&M SCM Model Explainedagga1111No ratings yet

- More Than A School A Way of Life: 2020 Fee ScheduleDocument1 pageMore Than A School A Way of Life: 2020 Fee ScheduleRoss SaundersNo ratings yet

- Chapter 5Document67 pagesChapter 5saad107No ratings yet

- FDI Confidence Index Insights for International Business ManagersDocument3 pagesFDI Confidence Index Insights for International Business ManagersJacie TupasNo ratings yet

- Facility LocationDocument56 pagesFacility Locationanon-930959100% (7)

- Business Writing EssentialsDocument30 pagesBusiness Writing EssentialsAzizah Abdul AzizNo ratings yet

- Audit TheoryDocument80 pagesAudit TheoryMarriz Bustaliño TanNo ratings yet

- Training Syllabus 2 Days Makers InstituteDocument4 pagesTraining Syllabus 2 Days Makers InstitutePriyo SudarsonoNo ratings yet

- Sanlu Case StudyDocument10 pagesSanlu Case StudyJasvin BhasinNo ratings yet

- Davangere University: Institute of Management StudiesDocument5 pagesDavangere University: Institute of Management StudiesVenki GajaNo ratings yet

- Calicut University B.Com Sixth Semester Income Tax Law Question BankDocument16 pagesCalicut University B.Com Sixth Semester Income Tax Law Question BankAbdul Salim NNo ratings yet

- Shity PaperDocument2 pagesShity PaperCarina MerceaNo ratings yet

- Hong Leong Bank Performance A ReviewDocument16 pagesHong Leong Bank Performance A ReviewMohd Helmi100% (2)

- 00 032C09Document28 pages00 032C09hillyoungNo ratings yet

- Balance SheetDocument1 pageBalance Sheetdhuvad.2004No ratings yet

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerNo ratings yet

- TechnotronicsDocument1 pageTechnotronicsviral patelNo ratings yet