Professional Documents

Culture Documents

UBA Ghana 2021 Q3 Financial Statements

Uploaded by

Fuaad DodooCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBA Ghana 2021 Q3 Financial Statements

Uploaded by

Fuaad DodooCopyright:

Available Formats

United Bank for Africa (Ghana) Ltd.

Unaudited Condensed Financial Statements for the Nine Months Ended 30 September 2021

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME FOR THE NINE MONTHS ENDED 30 UNAUDITED STATEMENT OF FINANCIAL POSITION AS AT 30 SEPTEMBER 2021

SEPTEMBER 2021

(All amounts are expressed in thousands of Ghana cedis unless otherwise stated)

(All amounts are expressed in thousands of Ghana cedis unless otherwise stated)

Sept 2021 Sept 2020

Sept 2021 Sept 2020 Assets

Cash and bank balances 870,526 768,552

Interest income 362,999 413,762

Investment securities:

Interest expense (120,872) (180,454) - At amortised cost 2,506,937 1,261,195

- At fair value through other comprehensive income 259,607 492,841

Net interest income 242,127 233,308

Loans and advances to customers 1,004,949 1,077,009

Fees and commission income 53,653 42,596 Other assets 239,494 65,991

Fees and commission expense (11,759) (8,363) Property and equipment 64,212 46,894

Intangible assets 1,683 113

Net fees and commission income 41,894 34,233

Income tax asset 271 3,659

Net trading and revaluation income 36,606 36,727 Deferred tax asset 3,340 -

Other operating income 910 1,343 Total assets 4,951,019 3,716,254

Liabilities

Net trading and other income 37,516 38,070

Deposits from customers 3,668,279 2,571,831

Operating income 321,537 305,611 Deposits from banks 88,380 82,237

Allowance for credit losses on financial assets (69,114) (12,557) Other liabilities 106,819 88,321

Deferred tax liability - 872

Employee benefit expenses (46,913) (45,579)

Total liabilities 3,863,478 2,743,261

Depreciation and amortisation (8,774) (8,511) Equity

Other operating expenses (36,451) (42,812) Stated capital 400,000 400,000

Income surplus 378,904 299,016

Profit before income tax 160,285 196,152

Fair value reserve (39) 4,594

Income tax expense (63,607) (56,439) Credit risk reserve 7,120 8,381

Profit for the period 96,678 139,713 Statutory reserve 301,556 261,002

Total equity 1,087,541 972,993

Other comprehensive income

Total liabilities and equity 4,951,019 3,716,254

Items that will be reclassified to the income statement:

Net change in fair value during the year (net of tax) (885) 3,316 UNAUDITED STATEMENT OF CHANGES IN EQUITY FOR THE NINE MONTHS ENDED 30 SEPTEMBER 2021

Total comprehensive income for the period 95,793 143,029 (All amounts are expressed in thousands of Ghana cedis unless otherwise stated)

Basic and diluted earnings per share (Ghana cedis) 0.01 0.02 For the nine months ended 30 September 2021

Income Statutory Credit risk Fair value

Stated capital Total

surplus reserve reserve reserve

UNAUDITED STATEMENT OF CASHFLOWS FOR THE NINE MONTHS ENDED 30 SEPTEMBER 2021 At 31 December 2020 400,000 289,346 301,556 - 846 991,748

(All amounts are expressed in thousands of Ghana cedis unless otherwise stated) Profit for the period - 96,678 - - - 96,678

Net change in fair value

- - - - (885) (885)

during the year (net of tax)

Sept 2021 Sept 2020

Total comprehensive

Cash flows from operating activities - 96,678 - - (885) 95,793

income for the period

Profit before income tax 160,285 196,152 Transfer between reserves - (7,120 ) - 7,120 - -

Adjustments for: At 30 September 2021 400,000 378,904 301,556 7,120 (39) 1,087,541

Depreciation and amortisation 8,774 8,511 For the nine months ended 30 September 2020

Allowance for credit losses on financial assets 66,995 12,557 Stated capital Income Statutory Credit risk Fair value Total

Gain on disposal of property and equipment - (62) surplus reserve reserve reserve

Allowance for credit loss on contingent liabilities 2,119 100 At 31 December 2019 400,000 159,303 261,002 8,381 1,278 829,964

Profit for the period - 139,713 - - - 139,713

Finance cost on lease liabilities 975 -

Net change in fair value

Net interest income (242,127) (233,308) - - - - 3,316 3,316

during the year (net of tax)

(2,979) (16,050) Total comprehensive

- 139,713 - - 3,316 143,029

Change in operating assets and liabilities income for the period

Change in mandatory reserve deposits (88,151) (23,303) Transfer between reserves - - - - - -

Change in loans and advances to customers 34,393 (127,701) At 30 September 2020 400,000 299,016 261,002 8,381 4,594 972,993

Change in other assets (150,332) (33,683)

Change in placements with banks - (62,222) NOTES TO THE UNAUDITED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED 30 SEPTEMBER 2021

Change in deposits from banks 15,936 (1,156,127) 1. Reporting Entity

Change in deposits from customers 881,515 233,031 United Bank for Africa (Ghana) Limited (“the Bank”) is a limited liability company and is incorporated and domiciled in Ghana. The

registered office is Heritage Towers, Ambassadorial Enclave, Accra. The Bank operates under the Banks and Specialised Deposit-Taking

Change in other liabilities 10,435 (7,017) Institutions Act, 2016 (Act 930).

Interest received 362,999 413,762 The Bank is a subsidiary of United Bank for Africa Plc of Nigeria and provides retail, corporate banking and investment banking services.

2. Basis of Preparation and Significant Accounting Policies

Interest paid (120,872) (180,454)

The condensed financial statements have been prepared in accordance with IAS 34 (Interim Financial Reporting) as issued by the Inter-

Income tax paid (54,126) (54,580) national Accounting Standards Board (IASB). Additional information required under the Companies Act, 2019 (Act 992) and the Banks

and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) have been included where appropriate.

Net cash used in operating activities 888,818 (1,014,344)

The accounting policies adopted in the preparation of these condensed financial statements are consistent with those applied in the

Cash flows from investing activities preparation of the Bank’s annual financial statements for the year ended 31 December 2020, The Bank has not early adopted any stan-

dard, interpretation or amendment that has been issued but is not yet effective.

Purchase of investment securities (3,488,286) (1,986,536) These financial statements are presented in Ghana Cedi which is the Bank’s functional currency.

Proceeds from sale/redemption of investment securities 2,494,506 3,186,760 3. Quantitative Disclosures

Purchase of property and equipment (5,497) (5,874) Sept 2021 Sept 2020

Capital adequacy ratio 23.38% 21.97%

Proceeds from sale of property and equipment 43 63

Common equity tier 1 ratio 21.38% 19.97%

Purchase of intangible assets (1,177) (19)

Leverage ratio 14.33% 15.30%

Net cash from investing activities (1,000,411) 1,194,394 Liquidity ratio 87.99% 54.96%

Cash flows from financing activities Non-performing loans ratio 40.41% 41.80%

Proceeds from borrowings - - 4. Qualitative Disclosures

The Bank’s activities expose it to a variety of risks such as credit risk, liquidity risk, operational risks and market risks.

Repayment of borrowings - -

The Board of Directors has overall responsibility for the establishment and oversight of the Bank’s risk management framework. The

Payments of principal on lease liabilities (3,784) - Board has established a Risk Management Committee in support of their risk oversight objectives and responsibilities. There is also a

Risk Management Department which has responsibility for the implementation of the Bank’s risk control principles, frameworks and

Net cash used in financing activities (3,784) - processes across the entire risk spectrum.

Net increase/decrease in cash and cash equivalents (115,377) 180,050 The Bank’s risk management policies are established to identify and analyse the risks faced by the Bank, to set appropriate risk limits and

controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes

Cash and cash equivalents at 1 January 779,309 351,270 in market conditions, products and services offered. The Bank, through its training and management standards and procedures, aims to

develop a disciplined and constructive control environment, in which all employees understand their roles and obligations.

Cash and cash equivalents at 30 September 663,932 531,320 5. Defaults in prudential requirements and accompanying sanctions

Cash and cash equivalents for the purpose of statement of Sept 2021 Sept 2020

cashflow comprises: Default in statutory liquidity Nil 1

Cash and balances with Bank of Ghana 533,886 306,603 Sanctions (GHS’000) - 53

Less mandatory deposit reserve (366,828) (257,183) Default in prudential requirement (times) Nil Nil

Sanctions (GHS’000) - -

167,058 49,420

Due from other banks 336,639 399,726

Short term treasury bills 160,235 82,174

Kweku Awotwi Olalekan Balogun

Cash and cash equivalents at 30 September 663,932 531,320

Board Chairman MD/CEO

www.ubagroup.com Email: cfcghana@ubagroup.com Africa’s global bank

You might also like

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- Bajaj Finserv Ltd. (India) : SourceDocument5 pagesBajaj Finserv Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- Income Statement and Balance Sheet (LV & Parda)Document30 pagesIncome Statement and Balance Sheet (LV & Parda)Pallavi KalraNo ratings yet

- FBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Document1 pageFBNBank Ghana Limited 3rd Quarter Financial Statement (2021)Fuaad DodooNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDocument60 pagesPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiNo ratings yet

- 2021 Full Year FinancialsDocument2 pages2021 Full Year FinancialsFuaad DodooNo ratings yet

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNo ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocument6 pagesHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKNo ratings yet

- Ultratech Cement Ltd. (India) : SourceDocument6 pagesUltratech Cement Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Spreadsheet 9M21Document14 pagesSpreadsheet 9M21Salah HusseinNo ratings yet

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Vitrox q42011Document10 pagesVitrox q42011Dennis AngNo ratings yet

- Prime Bank 1st ICB AMCL Mutual Fund Half Yearly ReportDocument1 pagePrime Bank 1st ICB AMCL Mutual Fund Half Yearly ReportAbrar FaisalNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Asian PaintsDocument6 pagesAsian PaintsDivyagarapatiNo ratings yet

- Asian Paints Ltd. (India) : SourceDocument6 pagesAsian Paints Ltd. (India) : SourceDivyagarapatiNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- Annual Report 2019 Financial Statements and Notes PDFDocument124 pagesAnnual Report 2019 Financial Statements and Notes PDFArti AtkaleNo ratings yet

- Samorita Hospital(Last 6 Month Financial Report)Document11 pagesSamorita Hospital(Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Wipro Ltd. (India) : SourceDocument6 pagesWipro Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Supplementary Accounting Statement ECPLDocument15 pagesSupplementary Accounting Statement ECPLdeepNo ratings yet

- Cervecería Nacional - FinanzasDocument39 pagesCervecería Nacional - FinanzasLuismy VacacelaNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Equity Group Holdings PLC Condensed Financial Statements For The Period Ended 31 ST December 2020Document1 pageEquity Group Holdings PLC Condensed Financial Statements For The Period Ended 31 ST December 2020MajugoNo ratings yet

- mc21 - 090716 - MCB LTD - Financial Statements - tcm55-52628Document7 pagesmc21 - 090716 - MCB LTD - Financial Statements - tcm55-52628Jessnah GraceNo ratings yet

- Financial Statements For The Financial Year 2022Document6 pagesFinancial Statements For The Financial Year 2022Clyton MusipaNo ratings yet

- UPL Ltd. (India) : SourceDocument6 pagesUPL Ltd. (India) : SourceDivyagarapatiNo ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- RCOM 4thconsoliated 09-10Document3 pagesRCOM 4thconsoliated 09-10Goutam YenupuriNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Zenith Bank 2020Document2 pagesZenith Bank 2020Fuaad DodooNo ratings yet

- Condensed Interim Financial Information For The Three Months Ended March 31Document15 pagesCondensed Interim Financial Information For The Three Months Ended March 31AJWAD AIRFNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Arab Sudanese Bank Financial Statements 2018Document30 pagesArab Sudanese Bank Financial Statements 2018Shadow PrinceNo ratings yet

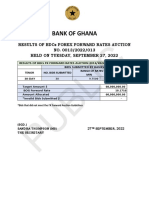

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

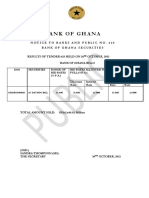

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

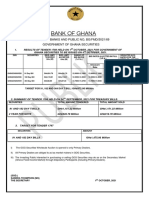

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Problem Set 6Document9 pagesProblem Set 6Jade BilisNo ratings yet

- C+ F P N F+PDocument6 pagesC+ F P N F+PIfka HassanNo ratings yet

- Acc Xi See QP With BP, MsDocument43 pagesAcc Xi See QP With BP, MsSiddhi GuptaNo ratings yet

- Stress Testing Guidelines for BanksDocument21 pagesStress Testing Guidelines for BankskrishmasethiNo ratings yet

- A Visual Guide To The ETF UniverseDocument4 pagesA Visual Guide To The ETF UniverseNomad LifeNo ratings yet

- EC5500 - Topics Only - SortedDocument6 pagesEC5500 - Topics Only - SortedBhawna ChaurasiaNo ratings yet

- CASE STUDY Long-Term Financial PlanningDocument2 pagesCASE STUDY Long-Term Financial PlanningsNo ratings yet

- Candlestick Cheat Sheet - RGB-FINALDocument16 pagesCandlestick Cheat Sheet - RGB-FINALlowtarhkNo ratings yet

- Porshe AssignmentDocument7 pagesPorshe Assignmentsyed kamal67% (3)

- ACP - Quiz-On-Cash-Flow - For-PostingDocument3 pagesACP - Quiz-On-Cash-Flow - For-PostingJunel PlanosNo ratings yet

- DRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDDocument275 pagesDRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDNihal YnNo ratings yet

- Tugas Manajemen KeuanganDocument3 pagesTugas Manajemen KeuanganmunawarchalilNo ratings yet

- Project Report On Buy Back of Shares FinalDocument18 pagesProject Report On Buy Back of Shares FinalDivyaModaniNo ratings yet

- MasteringMetastockManual PDFDocument84 pagesMasteringMetastockManual PDFvkumaran100% (1)

- Latihan - Aset Tidak Berwujud-JAWABDocument7 pagesLatihan - Aset Tidak Berwujud-JAWABAndreas HottoNo ratings yet

- Finmar FormulaDocument2 pagesFinmar FormulaCPAs AccountNo ratings yet

- Far.118 Sharholders-EquityDocument8 pagesFar.118 Sharholders-EquityMaeNo ratings yet

- Singapore: Takeover GuideDocument27 pagesSingapore: Takeover GuideNitin GuptaNo ratings yet

- Midterm - Quiz - AEC6Document4 pagesMidterm - Quiz - AEC6aprilNo ratings yet

- Market AnomaliesDocument8 pagesMarket AnomaliesUsman KashifNo ratings yet

- Corporate Bond Pricing GuideDocument5 pagesCorporate Bond Pricing Guideshua2000No ratings yet

- M'sian Resources Corp Berhad: Construction and Property Development Activities Gather Momentum in 1QFY12/10 - 19/5/2010Document4 pagesM'sian Resources Corp Berhad: Construction and Property Development Activities Gather Momentum in 1QFY12/10 - 19/5/2010Rhb InvestNo ratings yet

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- Analisis KelayakanDocument11 pagesAnalisis KelayakanRizkyana KyaNo ratings yet

- C1G020025 - Kusuma Dewa Yudhistira PDFDocument2 pagesC1G020025 - Kusuma Dewa Yudhistira PDFKusuma Dewa YudhistiraNo ratings yet

- 14239Document89 pages14239maxeytm_839061685No ratings yet

- Unclaimed 1st Interim Dividend 2009 10 PDFDocument44 pagesUnclaimed 1st Interim Dividend 2009 10 PDFArvind R PissayNo ratings yet

- Darya Varia Annual Report PDFDocument93 pagesDarya Varia Annual Report PDFNovi Amalyana SariNo ratings yet

- Ambit Capital Financial Shenanigans Detection Methods - JUNE 2017 - V3Document27 pagesAmbit Capital Financial Shenanigans Detection Methods - JUNE 2017 - V3me_girish_deshpande100% (1)

- Candlestick Cheat SheetDocument1 pageCandlestick Cheat SheetSmile Ever60% (5)