Professional Documents

Culture Documents

Weekly Capital Market Report - Week Ending 30.09.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Report - Week Ending 30.09.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

30TH SEPTEMBER, 2022

WEEKLY CAPITAL MARKET REPORT

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Flat: Flat, in the securities market, is a price that is neither rising nor Indicator Current Previous Change

declining. Within the context of securities, it refers to markets that do Week Week

not provide much opportunity for profits. Traders can make profits by GSE-Composite Index 2,460.12 2,488.21 -28.09

trading individual stocks rather than indices in such markets. When the YTD (GSE-CI) -11.80% -10.80% 9.26%

stock market has made little to no movement over a period of time, it is GSE-Financial Stock Index 2,070.10 2,055.64 14.46

said to be a flat market. Individual stocks can also be flat. For example, YTD (GSE-FSI) -3.80% -4.47% -14.99%

a stock that has been trading around the same price over a period. Market Cap. (GH¢ MN) 63,985.81 64,279.00 -293.19

Volume Traded 32,024,328 953,819 3257.48%

ETFs: GREAT DEAL FOR INVESTORS

Value Traded (GH¢) 30,794,565.98 1,460,375.70 2008.67%

An exchange-traded fund (ETF) is a type of security that tracks an index,

sector, commodity, or other assets, but which can be purchased or sold TOP TRADED EQUITIES

on a stock exchange the same as a regular stock. Ticker Volume Value (GH¢)

New Gold ETF (GLD), an exchange-traded fund sponsored by Absa MTNGH 30,626,188 26,953,687.51

Capital, offers the opportunity to invest in gold bullion. GCB 668,287 2,673,129.40

sssssS listed instruments (structured as debentures) SOGEGH 622,734 622,734.00

The company issues

EGH 25,834 172,184.42

backed by physical gold. Each debenture is approximately equivalent to

SIC 19,237 6,335.71 87.53%

1/100 ounces of gold bullion, which is held with a secure depository on

behalf of investors. The debentures are listed on the Ghana Stock KEY ECONOMIC INDICATORS

Exchange (GSE) and six other African stock exchanges. Indicator Current Previous

The current share price of New Gold ETF (GLD) is GH¢166.50. Monetary Policy Rate August 2022 22.00% 19.00%

Real GDP Growth March 2022 3.30% 5.40%

EQUITY MARKET HIGHLIGHTS: The Ghana Stock Market Inflation August 2022 33.90% 31.70%

drops 28.09 points over the week to close at 2,460.12; Source: GSS, BOG, GBA

returns -11.80% YTD.

GAINERS AND DECLINERS

Market activity for the week dropped 28.09 points to close at 2,460.12 Ticker Close Price Open Price Price Y-t-D

points translating into a YTD return of -11.80%. The GSE Financial Stock (GH¢) (GH¢) Change Change

GCB 4.00 3.70 0.30 -23.66%

Index (GSE-FSI) on the other hand gained 14.46 points to close at 2,070.10

SS EGH 6.64 6.60 0.04 -12.63%

points translating into a YTD return of -3.80%. ACCESS 4.01 4.00 0.01 27.30%

GOIL 1.77 1.79 -0.02 -2.75%

Twenty-Four (24) equities traded over the week, ending with three (3)

MTNGH 0.88 0.91 -0.03 -20.72%

gainers and decliners each. GCB, EGH and ACCESS were the gainers as SCB 20.16 20.24 -0.08 -0.69%

they gained GH¢0.30, GH¢0.04 and, GH¢0.01 to close trading at GH¢4.00,

GH¢6.64 and, GH¢4.01 respectively. GOIL, MTNGH, and SCB were the

decliners as they lost GH¢0.02, GH¢0.03, and GH¢0.08 to close trading at

GSE-CI & GSE-FSI YTD PERFORMANCE

GH¢1.77, GH¢0.88, and GH¢20.16 respectively. As a result, Market 5.00% -3.80%

Capitalization decreased by GH¢293.19 million to close the trading week

SS 0.00%

at GH¢63.99 billion. 5-Jan 5-Feb 5-Mar 5-Apr 5-May 5-Jun 5-Jul 5-Aug 5-Sep

-5.00%

A total of 32,024,328 shares valued at GH¢30,794,565.98 were traded

S -10.00%

during the week. Compared with the previous trading week, this week’s

data shows a 3257.48% increase in volume traded and a 2008.67% -15.00%

increase in trade turnover. Scancom PLC. (MTNGH) accounted for

-20.00% -11.80%

87.53% of the total value traded and recorded the most volumes traded. GSE-CI GSE-FSI

SBL RECOMMENDED PICKS EQUITY UNDER REVIEW:

NewGold. (GLD)

Equity Price Opinion Market Outlook

Share Price GH¢166.50

MTN GHANA GH¢ 0.88 Strong 2022 Q2 Financials Higher Ask Price

Price Change (YtD) 53.31%

BOPP GH¢ 6.48 Strong 2022 Q2 Financials Low offers

Market Cap. (GH¢) GH¢66.60 million

CAL BANK GH¢ 0.80 Strong 2022 Q2 Financials Available offers

Dividend Yield -

ECOBANK GH¢ 6.64 Strong 2022 Q2 Financials Bargain bids

Earnings Per Share -

SOGEGH GH¢ 1.00 Strong 2022 Q1 Financials Low demand Avg. Daily Volumes 942

FANMILK GH¢ 3.00 Positive Sentiment Low demand Value Traded (YtD) GH¢66,109,870.60

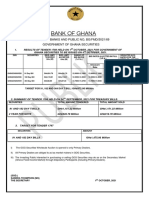

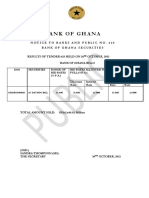

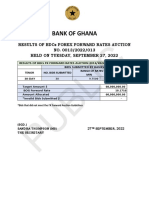

SUMMARY OF AUGUST 2022 EQUITY MARKET ACTIVITIES GSE AGAINST SELECTED AFRICAN STOCK MARKETS

Indicator August August % Change Country Current Level YTD

2022 2021

2,460.21 -11.80%

(Ghana) GSE-CI

GSE-CI YTD CHANGE -10.05% 41.66% -

(Botswana) BGSMDC 7,401.77 3.10%

GSE-CI 2,508.99 2,750.37 -8.78%

(Egypt) EGX-30 9,827.46 12.13%

GSE-FSI YTD CHANGE -3.34% 8.21% -

(Kenya) NSE ASI 128.41 -4.21%

GSE-FSI 2,079.94 1,929.19 7.81%

(Nigeria) NGSE ASI 49,024.16 -6.11%

VOLUME 77.25 M 20.67 M 273.81%

(South Africa) JSE ASI 63,726.37 -2.09%

VALUE (GH¢) 114.17 M 27.49 M 315.37%

(WAEMU) BRVM 205.32 -0.95%

MKT. CAP. (GH¢M) 64,445.45 62,904.96 15.69%

Source: Bloomberg

ADVANCERS & ACCESS, GLD, BOPP, SOGEGH, CAL,

DECLINERS TOTAL | GCB, UNIL, ETI, SIC, EGH

Source: Ghana Stock

S Exchange, SBL Research

COMMODITIES MARKET

CURRENCY MARKET

Commodity Closing Previous YTD

Currency Closing Previous YTD

Week Week (%)

Week Week Change

(GH¢) (GH¢) %

BRENT CRUDE OIL 88.00 85.82 11.22%

DOLLAR 9.6048 9.5414 -37.47%

(US$/bbl.)

POUND 10.7017 10.4150 -24.06%

EURO 9.4147 9.2721 -27.47% GOLD 1,665.14 1,645.63 -8.75%

YEN 0.0664 0.0667 -21.39% (US$/oz)

YUAN 1.3497 1.3385 -30.00%

CFA FRANC 69.6737 70.7453 37.88% 2,214.19 2,204.12 -9.63%

COCOA

Source: Bank of Ghana (US$/MT)

Source: Bloomberg, Bullion by Post, ICCO

JUSTIFICATIONS FOR INCLUDING STOCKS IN A PORTFOLIO ANALYSTS

Typically, stocks outperform all other investment options over a ten-year period

Godwin Kojo Odoom: Senior Research Analyst

making them a must for long term portfolio.

They are excellent vehicles for retirement. Obed Owusu Sackey: Analyst

Except for a few short periods, stocks have consistently outpaced the rate of inflation. Wisdom Asigbetse: Analyst

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.08.2022Document1 pageDaily Equity Market Report - 30.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.09.2022Document1 pageDaily Equity Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2022Document1 pageDaily Equity Market Report - 07.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.09.2022Document1 pageDaily Equity Market Report - 14.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.08.2022Document1 pageDaily Equity Market Report - 15.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.08.2022Document1 pageDaily Equity Market Report - 09.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Toxic Trading - SaluzziDocument5 pagesToxic Trading - SaluzziZerohedge100% (6)

- The 5 Most Dangerous Times To Trade: Kathy LienDocument2 pagesThe 5 Most Dangerous Times To Trade: Kathy Liensink or swimNo ratings yet

- Impact of Insider Trading On Open Market Share Repurchase: A Study in Indian ContextDocument22 pagesImpact of Insider Trading On Open Market Share Repurchase: A Study in Indian ContextRamesh Chandra DasNo ratings yet

- Project Report On Angel Broking Limited New DelhiDocument26 pagesProject Report On Angel Broking Limited New DelhiMukesh Kumar Yadav88% (8)

- Beginners Guide For Investment in The Stock Market PDFDocument2 pagesBeginners Guide For Investment in The Stock Market PDFFinnotes orgNo ratings yet

- G Dividend PolicyDocument7 pagesG Dividend PolicySweeti JaiswalNo ratings yet

- T 000000Document4 pagesT 000000Marin DraganovNo ratings yet

- Treasury Operations - Front Office, Back OfficeDocument28 pagesTreasury Operations - Front Office, Back Officeshrikant shinde80% (20)

- Corporations: Organization and Capital Stock Transactions: Weygandt - Kieso - KimmelDocument54 pagesCorporations: Organization and Capital Stock Transactions: Weygandt - Kieso - Kimmelkey aidanNo ratings yet

- Sonnemann Camerer Fox Langer 2013 - Behavioral FinanceDocument6 pagesSonnemann Camerer Fox Langer 2013 - Behavioral FinancevalleNo ratings yet

- Analysis of Investment Options Mba ProjectDocument59 pagesAnalysis of Investment Options Mba Projectbalki12383% (12)

- Cohn, Engelmann, Fehr, Marechal - Evidence For Countercyclical Risk AversionDocument33 pagesCohn, Engelmann, Fehr, Marechal - Evidence For Countercyclical Risk AversionVeronica TrabacchinNo ratings yet

- Chapter 5Document33 pagesChapter 5Abdelnasir HaiderNo ratings yet

- Case Digest Missing CasesDocument9 pagesCase Digest Missing CasesXhome ZomNo ratings yet

- Case ZerodhaDocument7 pagesCase ZerodhaMihir JichkarNo ratings yet

- A Study On Stock and Investment Decision Using Fundamental and Technical AnalysisDocument12 pagesA Study On Stock and Investment Decision Using Fundamental and Technical AnalysispavithragowthamnsNo ratings yet

- Logical Hierarchy - The Core of Erik WeathersDocument233 pagesLogical Hierarchy - The Core of Erik WeathersGreg Glaser100% (6)

- 315 STRGDocument4 pages315 STRGchetanvyas@No ratings yet

- Annual Return: Form No. Mgt-7Document20 pagesAnnual Return: Form No. Mgt-7Esha ChaudharyNo ratings yet

- Problems On Dividend PolicyDocument3 pagesProblems On Dividend Policymanjunathajnaik67% (15)

- Pre-Test 8Document3 pagesPre-Test 8BLACKPINKLisaRoseJisooJennieNo ratings yet

- Financial Markets: Capital vs. Money Markets - InvestopediaDocument4 pagesFinancial Markets: Capital vs. Money Markets - InvestopediaIshan100% (1)

- Letter of Offer WiproDocument52 pagesLetter of Offer WiproSauvik BhattacharyaNo ratings yet

- Practice Exam Questions On Stock ValuationDocument6 pagesPractice Exam Questions On Stock ValuationKazelinne Añonuevo100% (3)

- Answer: 1 Price After Split Price Before Split Old Share New Share 2 Total Share Total Stock Before Split Stock Split P6-1Document7 pagesAnswer: 1 Price After Split Price Before Split Old Share New Share 2 Total Share Total Stock Before Split Stock Split P6-1Kristo Febrian Suwena -No ratings yet

- Happiest Minds Technologies Limited Draft Red Herring Prospectus June 10 2020 - 20200615170724Document437 pagesHappiest Minds Technologies Limited Draft Red Herring Prospectus June 10 2020 - 20200615170724SubscriptionNo ratings yet

- Competitive Adv PeriodDocument20 pagesCompetitive Adv Periodad9292100% (1)

- Corporate FinanceDocument24 pagesCorporate FinancePranav TipleNo ratings yet

- SNA 16 Sesi 1 ADocument409 pagesSNA 16 Sesi 1 AReynold Gustaf D'BradahNo ratings yet

- Intermediate Accounting CH 14 HWDocument5 pagesIntermediate Accounting CH 14 HWBreanna WolfordNo ratings yet