Professional Documents

Culture Documents

Weekly Capital Market Report - Week Ending 08.04.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Report - Week Ending 08.04.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

8TH APRIL 2022

WEEKLY CAPITAL MARKET REPORT

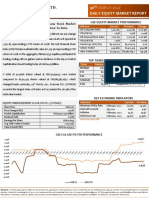

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Index Fund: An index fund is a type of mutual fund or exchange- Indicator Current Previous Change

Week Week

traded fund (ETF) with a portfolio constructed to match or track the

GSE-Composite Index 2,693.65 2,742.85 -49.2 pts

components of a financial market index. An index mutual fund is YTD (GSE-CI) -3.43% -1.67% 105.39%

said to provide broad market exposure, low operating expenses, GSE-Financial Stock Index 2,214.18 2,174.96 39.22 pts

and low portfolio turnover. YTD (GSE-FSI) 2.90% 1.07% 171.03%

Market Cap. (GH¢ MN) 64,011.45 64,029.79 -18.34

ETFs: GREAT DEAL FOR INVESTORS Volume Traded 3,677,274 83,028,224 -95.57%

Value Traded (GH¢) 3,635,914 88,889,722.4 -95.91%

An exchange traded fund (ETF) is a type of security that tracks an

index, sector, commodity, or other asset, but which can be TOP TRADED EQUITIES

purchased or sold on a stock exchange the same as a regular stock. Ticker Volume Value (GH¢)

New Gold ETF (GLD), an exchange traded fund sponsored by Absa MTNGH 2,126,759 2,127,010.80

Capital, offers the opportunity to invest in gold bullion. CAL 790,177 679,983.16

ETI 200,373 39,826.26

The company issues listed instruments (structured as debentures)

POP 200,129 132,085.14 58.50%

backed by physical gold. Each debenture is approximately SIC 120,290 28,783.60

equivalent to 1/100 ounces of gold bullion, which is held with a secure

depository on behalf of investors. The debentures are listed on the KEY ECONOMIC INDICATORS

Ghana (GSE) and six other African stock exchanges. Indicator Current Previous

Monetary Policy Rate February 2022 17.00% 14.50%

The current share price of New Gold ETF (GLD) is GH¢158.60. Real GDP Growth Q3 2021 6.60% 3.90%

Inflation February 2022 15.7% 12.6%

Source: GSS, BOG, GBA

EQUITY MARKET HIGHLIGHTS: The Ghana Stock GAINERS & DECLINERS

Market lost 49.20 points over the week to close at Ticker Close Price Open Price Price Y-t-D

2,693.65; returns -3.43% YTD. (GH¢) (GH¢) Change Change

ETI 0.20 0.17 0.03 17.65%

Market activity for the week lost 49.20 points to close at 2,693.65 SIC 0.24 0.22 0.02 9.09%

translating into a YTD return of -3.43%. The GSE Financial Stock Index SOGEGH 1.20 1.19 0.01 0.84%

POP 0.66 0.65 0.01 1.54%

(GSE-FSI) on the other hand increased by 39.22 points to close the TOTAL 4.99 5.02 -0.03 -0.60%

week at 2,214.18 translating into a YTD return of 2.90%. In the GCB 5.12 5.16 -0.04 -0.78%

MTNGH 1.00 1.06 -0.06 -5.66%

aggregate, twenty-four (24) equities participated in trading, ending

GSE-CI & GSE-FSI YTD PERFORMANCE

with four (4) gainers and three (3) decliners.

4.00% 2.90%

Market Capitalization subsequently decreased by GH¢18.34 million to 3.00%

2.00%

close the trading week at GH¢64.01 billion.

1.00%

A total of 3.68 million shares valued at GH¢3.64 million traded during 0.00%

the week compared to 83.03 million shares valued at GH¢88.89 -1.00%

million which traded the previous week. Scancom PLC. (MTNGH) -2.00%

S

recorded the most trades per value over the week as it accounted for -3.00%

58.50% of the total value traded. -4.00%

-5.00% -3.43%

GSE-CI GSE-FSI

SBL RECOMMENDED PICKS EQUITY UNDER REVIEW:

SCANCOM PLC. (MTNGH)

Equity Price Opinion Market Outlook

Share Price GH¢1.06

MTN GHANA GH¢ 1.06 Strong 2021 FY Financials Higher Ask Price

Price Change (YtD) -4.50%

BOPP GH¢ 6.00 Strong 2021 FY Financials Low offers Market Cap. (GH¢) GH¢13.03 billion

CAL BANK GH¢ 0.85 Strong 2021 FY Financials Improving bids Dividend Yield 0.00%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials Bargain bids Earnings Per Share GH¢0.1633

SOGEGH GH¢ 1.19 Strong 2021 FY Financials Low demand Avg. Daily Volumes 2,045,090

FANMILK GH¢ 3.00 Positive Sentiment Low demand Value Traded (YtD) GH¢265,418,622

SUMMARY OF FEB. 2022 EQUITY MARKET ACTIVITIES GSE AGAINST SELECTED AFRICAN STOCK MARKETS

Indicator February February % Change Country Current Level YTD

2022 2021 2,693.65 -3.43%

(Ghana) GSE-CI

GSE-CI YTD CHANGE -2.11% 13.36% - (Botswana) BGSMDC 7,231.27 3.16%

GSE-CI 2,730.59 2,200.92 24.07 11,101.94 -7.09%

(Egypt) EGX-30

GSE-FSI YTD CHANGE -1.62% 5.08% - 157.28 -5.51%

(Kenya) NSE ASI

GSE-FSI 2,116.98 1,873.31 13.01 46,631.46 9.17%

(Nigeria) NGSE ASI

VOLUME 31.11 M 44.50 M -30.10 74,776.13 4.48%

(South Africa) JSE ASI

VALUE (GH¢) 26.43 M 35.23 M -24.97 217.92 7.73%

(WAEMU) BRVM

MKT. CAP. (GH¢M) 62,881.97 57,152.18 10.03 Source: Bloomberg

ADVANCERS & SIC, GGBL, EGL, CAL | GCB, MTNGH,

DECLINERS BOPP, ACCESS

Source: Ghana Stock Exchange, SBL Research

COMMODITIES MARKET

CURRENCY MARKET

Commodity Closing Previous YTD

Currency Closing Previous YTD

Week Week (%)

Week Week Change

(GH¢) (GH¢) %

BRENT CRUDE OIL 101.27 104.92 28.00%

DOLLAR 7.1120 7.1120 -15.55%

(US$/bbl.)

POUND 9.2663 9.3217 -12.29%

EURO 7.7338 7.8515 -11.71% GOLD 1,940.49 1,921.33 6.34%

YEN 0.0572 0.0580 -8.74% (US$/oz)

YUAN 2.1163 1.1175 -55.36%

CFA FRANC 84.8175 83.5455 13.26% 2,472.24 2,513.46 0.90%

COCOA

Source: Bank of Ghana (US$/MT)

Source: Bloomberg, Bullion by Post, ICCO

JUSTIFICATIONS FOR INCLUDING STOCKS IN A PORTFOLIO ANALYSTS

Typically, stocks outperform all other investment options over a ten-year period

Godwin Kojo Odoom: Senior Research Analyst

making them a must for long term portfolio.

They are excellent vehicles for retirement. Obed Owusu Sackey: Analyst

Except for a few short periods, stocks have consistently outpaced the rate of inflation.

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Valuation Methods and Shareholder Value CreationFrom EverandValuation Methods and Shareholder Value CreationRating: 4.5 out of 5 stars4.5/5 (3)

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 29.04.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 16-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 16-04-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

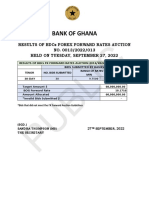

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- Current Liabilities Management SOLUTIONSDocument9 pagesCurrent Liabilities Management SOLUTIONSJack Herer100% (1)

- Migrations: Financial ServicesDocument31 pagesMigrations: Financial ServicesSachin PoojaryNo ratings yet

- ONYXX Investment Unlocking The Future Scott TwyfordDocument2 pagesONYXX Investment Unlocking The Future Scott Twyfordscott3952No ratings yet

- Chapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsDocument10 pagesChapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsIna NaaNo ratings yet

- AQR Alternative Thinking 1Q12Document8 pagesAQR Alternative Thinking 1Q12Zen TraderNo ratings yet

- The Debt Collection PolicyDocument3 pagesThe Debt Collection PolicyGulshan KumarNo ratings yet

- Closure - Form Ver 1.1-201802221526458136617Document1 pageClosure - Form Ver 1.1-201802221526458136617Anshuman SinghNo ratings yet

- Manappuram Finance LTD AshikaDocument6 pagesManappuram Finance LTD Ashikachatuuuu123No ratings yet

- Finance in Dental CareDocument42 pagesFinance in Dental CarePuspa AdhikariNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Assets Reconstruction CompanyDocument8 pagesAssets Reconstruction CompanyKartik VariyaNo ratings yet

- Policy Amendment FormDocument8 pagesPolicy Amendment FormN V Sumanth VallabhaneniNo ratings yet

- Solution 4-5-6Document4 pagesSolution 4-5-6ShafiqUr RehmanNo ratings yet

- Chap03 1Document39 pagesChap03 1Hà NguyễnNo ratings yet

- Lista Tranzactii: DL Simon Rares-Andrei RO09BRDE270SV26380332700 RON Alina-Ramona SimonDocument5 pagesLista Tranzactii: DL Simon Rares-Andrei RO09BRDE270SV26380332700 RON Alina-Ramona SimonRamona SimonNo ratings yet

- e-StatementBRImo 716901009766537 Oct2023 20231019 110239Document1 pagee-StatementBRImo 716901009766537 Oct2023 20231019 110239yenimaisya9No ratings yet

- Acceptance of Surrender Value PDFDocument1 pageAcceptance of Surrender Value PDFAshish JainNo ratings yet

- Base Dividend PolicyDocument77 pagesBase Dividend PolicySantosh ChhetriNo ratings yet

- Credit Card DetailsDocument2 pagesCredit Card DetailsAhm Victor83% (6)

- Mapping Between GUI and Fiori in FICODocument11 pagesMapping Between GUI and Fiori in FICOKushagra purohitNo ratings yet

- Chapter 6Document49 pagesChapter 6Nguyen Vu Thuc Uyen (K17 QN)No ratings yet

- Voucher Form For NGODocument1 pageVoucher Form For NGOjoy elizondoNo ratings yet

- Form CDocument2 pagesForm Cnimoakalanka100% (1)

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Be Happy Make HappyDocument30 pagesBe Happy Make Happybhawana kcNo ratings yet

- Capital Structure Decisions NIDocument34 pagesCapital Structure Decisions NIHari chandanaNo ratings yet

- 20.00 Points: AwardDocument5 pages20.00 Points: AwardMikulas HarvankaNo ratings yet

- Practice Questions A1Document11 pagesPractice Questions A1rishalNo ratings yet

- Thesis On UcpDocument325 pagesThesis On UcpJhoo AngelNo ratings yet