Professional Documents

Culture Documents

Weekly Capital Market Report - Week Ending 11.03.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Report - Week Ending 11.03.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

11TH MARCH 2022

WEEKLY CAPITAL MARKET REPORT

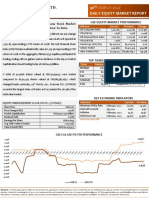

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Put Option: A put option is a contract giving the option buyer the Indicator Current Previous Change

right, but not the obligation, to sell – or sell short – a specified Week Week

amount of an underlying security at a predetermined price within a GSE-Composite Index 2,744.25 2,730.59 13.66 pts

YTD (GSE-CI) -1.62% -2.11% -23.22%

specified time frame.

GSE-Financial Stock Index 2,141.77 2,116.98 24.79 pts

YTD (GSE-FSI) -0.47% -1.62% -70.99%

ETFs: GREAT DEAL FOR INVESTORS

Market Cap. (GH¢ MN) 63,713.16 63,239.29 473.87

An exchange traded fund (ETF) is a type of security that tracks an Volume Traded 953,820 43,849,420 -97.82%

Value Traded (GH¢) 1,389,780.12 45,434,232 -96.94%

index, sector, commodity, or other asset, but which can be

purchased or sold on a stock exchange the same as a regular stock. TOP TRADED EQUITIES

New Gold ETF (GLD), an exchange traded fund sponsored by Absa Ticker Volume Value (GH¢)

Capital, offers the opportunity to invest in gold bullion. The company MTNGH 800,069 864,015.72

issues listed instruments (structured as debentures) backed by ETI 494,692 70,373.94

physical gold. Each debenture is approximately equivalent to 1/100 SIC 158,667 28,984.73

ounces of gold bullion, which is held with a secure depository on ACCESS 146,243 277,861.70 40.32%

behalf of investors. The debentures are listed on the Ghana (GSE) SOGEGH 80,360 95,932.00

and six other African stock exchanges.

GAINERS

The current share price of New Gold ETF (GLD) is GH¢108.60. GLD Ticker Close Price Open Price Change Y-t-D

this week closed at GH¢108.60 per share. The price has been stable (GH¢) (GH¢) Change

since November 2, 2021, recording a 4.2% gain over its previous ETI 0.15 0.13 15.38% 7.14%

closing price of GH¢104.25 on November 1, 2021. SIC 0.19 0.17 11.76% 137.50%

EQUITY MARKET HIGHLIGHTS: The Ghana Stock DECLINERS

Market gained 13.66 points over the week to close at Ticker Close Price Open Price Change Y-t-D

(GH¢) (GH¢) Change

2,744.25; returns -1.62% YTD. SOGEGH 1.19 1.20 -0.83% -0.83%

The benchmark GSE Composite Index (GSE-CI) at the close of the CAL 0.84 0.85 -1.18% -3.45%

week gained 13.66 points to close at 2,744.25 translating into a YTD

KEY ECONOMIC INDICATORS

return of -1.62%. The GSE Financial Stock Index (GSE-FSI) also gained Indicator Current Previous

24.79 points to close the week at 2,141.77 translating into a YTD return Monetary Policy Rate January 2022 14.50% 14.50%

Real GDP Growth Q3 2021 6.60% 3.90%

of -0.47%. Two (2) equities recorded price increases against two (2)

Inflation February 2022 15.7% 12.6%

decliners, with SIC Insurance Ltd. (SIC) recording a 137.50% YTD return Source: GSS, BOG, GBA

at close of trading for the week. GSE-CI & GSE-FSI YTD PERFORMANCE

0.50%

0.00%

Market Capitalization recorded an increase of GH¢473.87 million to 4-Jan 11-Jan 18-Jan 25-Jan 1-Feb 8-Feb 15-Feb 22-Feb 1-Mar 8-Mar

-0.50%

close the trading week at GH¢63.71 billion. -0.47%

-1.00%

A total of 1.9 million shares valued at GH¢2.1 million traded during the -1.50%

week compared to 43.8 million shares valued at GH¢45.4 million -2.00%

which traded the previous week. -2.50% -1.62%

-3.00%

Scancom PLC. (MTNGH) recorded the most trades per value over -3.50%

the week as it accounted for 40.32% of the total value traded. -4.00%

GSE-CI GSE-FSI

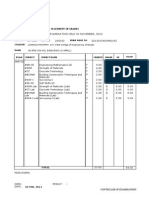

SBL RECOMMENDED PICKS EQUITY UNDER REVIEW:

SCANCOM PLC. (MTNGH)

Equity Price Opinion Market Outlook

Share Price GH¢1.08

MTN GHANA GH¢ 1.08 Strong 2021 FY Financials Higher Ask Price

Price Change (YtD) -2.70%

BOPP GH¢ 6.00 Strong 2021 FY Financials Low demand Market Cap. (GH¢) GH¢13.27 billion

CAL BANK GH¢ 0.84 Strong 2021 FY Financials Improving bids Dividend Yield 0.00%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials Bargain bids Earnings Per Share GH¢0.1633

SOGEGH GH¢ 1.19 Strong 2021 FY Financials Low demand Avg. Daily Volumes 1,593,475

FANMILK GH¢ 3.00 Positive Sentiment Profit taking Value Traded (YtD) GH¢ 91,202,739

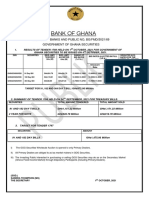

SUMMARY OF FEB. 2022 EQUITY MARKET ACTIVITIES GSE AGAINST SELECTED AFRICAN STOCK MARKETS

Indicator February February % Change Country Current Level YTD

2022 2021 2,744.25 -1.62%

(Ghana) GSE-CI

GSE-CI YTD CHANGE -2.11% 13.36% - (Botswana) BGSMDC 7,204.33 2.78%

GSE-CI 2,730.59 2,200.92 24.07 10,453.59 -12.52%

(Egypt) EGX-30

GSE-FSI YTD CHANGE -1.62% 5.08% - 159.05 -4.45%

(Kenya) NSE ASI

GSE-FSI 2,116.98 1,873.31 13.01 47,437.48 11.05%

(Nigeria) NGSE ASI

VOLUME 31.11 M 44.50 M -30.10 73,685.89 2.96%

(South Africa) JSE ASI

VALUE (GH¢) 26.43 M 35.23 M -24.97 216.15 6.86%

(WAEMU) BRVM

MKT. CAP. (GH¢M) 62,881.97 57,152.18 10.03 Source: Bloomberg

ADVANCERS & SIC, GGBL, EGL, CAL | GCB, MTNGH,

DECLINERS BOPP, ACCESS

Source: Ghana Stock Exchange, SBL Research

COMMODITIES MARKET

CURRENCY MARKET

Commodity Closing Previous YTD

Currency Closing Previous YTD

Week Week (%)

Week Week Change

(GH¢) (GH¢) %

BRENT CRUDE OIL 113.71 116.07 43.72%

DOLLAR 7.0200 7.0019 -14.44%

(US$/bbl.)

POUND 9.2215 9.2527 -11.87%

EURO 7.7352 7.6405 -11.73% GOLD 1978.64 1,961.73 8.43%

YEN 0.0605 0.0609 -13.65% (US$/oz)

YUAN 1.1103 1.1083 -14.91%

CFA FRANC 84.8021 85.8527 13.28% 2,528.14 2,434.35 3.19%

COCOA

Source: Bank of Ghana (US$/MT)

Source: Bloomberg, Bullion by Post, ICCO

JUSTIFICATIONS FOR INCLUDING STOCKS IN A PORTFOLIO ANALYSTS

Typically, stocks outperform all other investment options over a ten-year period

Godwin Kojo Odoom: Senior Research Analyst

making them a must for long term portfolio.

They are excellent vehicles for retirement. Obed Owusu Sackey: Analyst

Except for a few short periods, stocks have consistently outpaced the rate of inflation.

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Crime Scene Drawing January Incident 10501-10600Document100 pagesCrime Scene Drawing January Incident 10501-10600columbinefamilyrequest100% (2)

- Entrenamiento 3412HTDocument1,092 pagesEntrenamiento 3412HTWuagner Montoya100% (5)

- Buddhism & Tantra YogaDocument2 pagesBuddhism & Tantra Yoganelubogatu9364No ratings yet

- Oral Communication in ContextDocument31 pagesOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 29.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 20.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 20.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 20.08.2021Document2 pagesWeekly Capital Market Recap Week Ending 20.08.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 27.05.2022 2022-05-27Document2 pagesWeekly Capital Market Report Week Ending 27.05.2022 2022-05-27Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 23.06.2022 2022-06-23Document1 pageDaily Equity Market Report 23.06.2022 2022-06-23Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.03.2022Document1 pageDaily Equity Market Report - 08.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Sarcini: Caiet de PracticaDocument3 pagesSarcini: Caiet de PracticaGeorgian CristinaNo ratings yet

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Document5 pagesInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroNo ratings yet

- Nandurbar District S.E. (CGPA) Nov 2013Document336 pagesNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNo ratings yet

- LM213 First Exam Notes PDFDocument7 pagesLM213 First Exam Notes PDFNikki KatesNo ratings yet

- Alcatraz Analysis (With Explanations)Document16 pagesAlcatraz Analysis (With Explanations)Raul Dolo Quinones100% (1)

- Intro To EthicsDocument4 pagesIntro To EthicsChris Jay RamosNo ratings yet

- Skype OptionsDocument2 pagesSkype OptionsacidwillNo ratings yet

- Speaking Test FeedbackDocument12 pagesSpeaking Test FeedbackKhong TrangNo ratings yet

- Sample Financial PlanDocument38 pagesSample Financial PlanPatrick IlaoNo ratings yet

- BirdLife South Africa Checklist of Birds 2023 ExcelDocument96 pagesBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajNo ratings yet

- TestDocument56 pagesTestFajri Love PeaceNo ratings yet

- Pre T&C Checklist (3 Language) - Updated - 2022 DavidDocument1 pagePre T&C Checklist (3 Language) - Updated - 2022 Davidmuhammad farisNo ratings yet

- Final ReflectionDocument4 pagesFinal Reflectionapi-314231777No ratings yet

- Test 1Document9 pagesTest 1thu trầnNo ratings yet

- Animal Welfare in Bangladesh and The Role of Obhoyaronno CaseDocument11 pagesAnimal Welfare in Bangladesh and The Role of Obhoyaronno CaseZarin Tanjim WoyshorjoNo ratings yet

- KalamDocument8 pagesKalamRohitKumarSahuNo ratings yet

- 9francisco Gutierrez Et Al. v. Juan CarpioDocument4 pages9francisco Gutierrez Et Al. v. Juan Carpiosensya na pogi langNo ratings yet

- Engineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFDocument5 pagesEngineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFKalyani KalyaniNo ratings yet

- Q3 Grade 8 Week 4Document15 pagesQ3 Grade 8 Week 4aniejeonNo ratings yet

- CAPE Env. Science 2012 U1 P2Document9 pagesCAPE Env. Science 2012 U1 P2Christina FrancisNo ratings yet

- DLL LayoutDocument4 pagesDLL LayoutMarife GuadalupeNo ratings yet

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDocument2 pagesTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiNo ratings yet

- Michael M. Lombardo, Robert W. Eichinger - Preventing Derailmet - What To Do Before It's Too Late (Technical Report Series - No. 138g) - Center For Creative Leadership (1989)Document55 pagesMichael M. Lombardo, Robert W. Eichinger - Preventing Derailmet - What To Do Before It's Too Late (Technical Report Series - No. 138g) - Center For Creative Leadership (1989)Sosa VelazquezNo ratings yet

- Debarchana TrainingDocument45 pagesDebarchana TrainingNitin TibrewalNo ratings yet

- Contoh RPH Ts 25 Engish (Ppki)Document1 pageContoh RPH Ts 25 Engish (Ppki)muhariz78No ratings yet

- Ruahsur Vangin Basket-Ball Court Lungrem ChimDocument4 pagesRuahsur Vangin Basket-Ball Court Lungrem ChimchanmariansNo ratings yet