Professional Documents

Culture Documents

Weekly Capital Market Recap Week Ending 15.10.2021

Uploaded by

Fuaad DodooCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Recap Week Ending 15.10.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

15TH OCTOBER 2021

WEEKLY CAPITAL MARKET REPORT

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Price-to-Book Ratio (P/B): P/B ratio compares a company's market Indicator Current Previous Change

value to its book value. The market value of a company is its share price Week Week

multiplied by the number of outstanding shares. The book value is the GSE-Composite Index 2,847.90 2,868.71 -20.81 pts

net assets of a company. In other words, if a company liquidated all of its YTD (GSE-CI) 46.68% 47.75% -2.24%

assets and paid off all its debt, the value remaining would be the book GSE-Financial Stock Index 2,070.00 2,052.31 17.69 pts

YTD (GSE-FSI) 16.11% 15.12% 6.55%

value. The P/B ratio reflects the value that market participants attach to

Market Cap. (GH¢ MN) 64,097.65 64,315.43 -217.78

a company's equity relative to the book value of its equity.

Volume Traded 5,237,565 2,069,466 153.09%

Value Traded (GH¢) 7,456,774.42 3,911,407.05 90.64%

EQUITY MARKET HIGHLIGHTS: GSE Composite Index

TOP TRADED EQUITIES

slips in the week by 20.81 points; returns 46.68% YTD.

Ticker Volume Value (GH¢)

The Ghana Stock market dropped by 20.81 points in the week under MTNGH 4,442,533 5,348,116.59

review as the benchmark GSE Composite Index (GSE-CI) closed the week CAL 225,446 168,233.26

FML 156,910 784,550.00

at 2,847.90 translating into a YTD return of 46.68%. The GSE Financial

GOIL 143,538 244,014.60

Stock Index (GSE-FSI) however recorded an impressive week as it gained GCB 87,811 471,553.33 71.7% of value traded

for 5 straight days, adding 17.69 points to close at 2,070.00 translating

into a YTD return of 16.11%. GAINERS & DECLINERS

Ticker Close Price Open Price Change Y-t-D Change

There were 4 gainers against 5 decliners causing Market Capitalization to (GH¢) (GH¢)

RBGH 0.52 0.43 20.93% 30.00%

decrease by GH¢217.78 million to close trading at GH¢64.09.

BOPP 4.00 3.45 15.94% 100.00%

A total of 5.24 million shares valued at GH¢7.46 million traded, EGL 2.50 2.30 8.70% 78.57%

TOTAL 5.00 4.65 7.53% 76.68%

representing a significant increase of 153.09% and 90.64% respectively

GCB 5.37 5.38 -0.19% 32.59%

compared to the previous week. Eighteen (18) stocks traded in the week CAL 0.76 0.77 -1.30% 10.14%

as MTNGH accounted for 71.7% of the total value traded. FML 5.00 5.08 -1.57% 362.96%

MTNGH 1.20 1.23 -2.44% 87.50%

SOGEGH 1.20 1.25 -4.00% 87.50%

EQUITY UNDER REVIEW: FAN MILK PLC. (FML)

Share Price GH¢5.00

Price Change (YtD) 362.96% SUMMARY OF SEP. 2021 EQUITY MARKET ACTIVITIES

Market Cap. (GH¢) GH¢581.04 million EQUITIES

Dividend Yield 0.00% Indicator Jan.-Sep. Jan.-Sep. % Change

Earnings Per Share GH¢0.1188 2021 2020

Avg. Daily Trade Volumes 7,693 GSE-CI YtD CHANGE 47.06% -17.75%

Value Traded (YtD) GH¢4,820,002.00 VOLUME 400.60 M 403.91 M -0.82

VALUE (GH¢) 411.10 M 295.19 M 39.26

SUMMARY OF SEP. 2021 GFIM ACTIVITIES GSE-CI 2,855.29 1,855.56 53.88

GHANA FIXED INCOME MARKET MKT. CAP. (GH¢M) 64,170.83 53,153.76 20.73

YEAR Jan.-Sep. 2021 Jan.-Sep. 2020 Change ADVANCERS FML, SOGEGH, ETI, BOPP, EGL,

TOTAL, SCB, GGBL, GOIL, EGH, GLD,

VOLUME 155,045,312,018 74,735,752,576 107.45%

UNIL, SCB Pref, CAL

VALUE (GH¢) 161,161,532,485.79 76,257,565,446.18 111.33% DECLINERS GCB, RBGH

Source: Ghana Stock Exchange Source: Ghana Stock Exchange

INDEX YTD PERFORMANCE

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

23-Jul

23-Sep

20-Jan

22-Mar

19-Apr

23-Jun

12-Jan

27-Aug

3-Mar

22-Apr

25-May

15-Jun

28-Jun

6-Jan

25-Jan

23-Feb

2-Jun

18-Jun

17-Mar

25-Mar

30-Mar

17-May

15-Jan

15-Feb

26-Feb

2-Aug

16-Aug

19-Aug

6-Oct

11-Oct

14-Oct

6-Apr

9-Apr

14-Apr

27-Apr

30-Apr

28-May

28-Jan

2-Feb

18-Feb

7-Jun

10-Jun

6-Jul

9-Jul

6-Sep

9-Sep

20-May

14-Jul

14-Sep

17-Sep

DATE

5-Feb

10-Feb

9-Mar

12-Mar

6-May

11-May

19-Jul

28-Jul

6-Aug

11-Aug

24-Aug

28-Sep

1-Oct

1-Jul

1-Sep

GSE-CI GSE-FSI

TREASURY RATES YIELD (11th Oct. – 15th Oct. 2021)

25.00

GOG Treasuries 11th– 15th 04th – 08th Change

Oct. 2021 Oct. 2021 (%)

20.20

20.00 19.00 19.25 19.75 19.75 91-Day T-Bill 12.45% 12.47% -0.027%

18.30 18.10

17.50 182-Day T-Bill 13.14% 13.15% -0.008%

16.27

364-Day T-Bill 16.27% 16.21% 0.053%

15.00

13.14

3-Year Bond 19.00% 17.70% 1.300%

12.45

BOG Offer 969.00 1,475.00

10.00

(GH¢ MN)

Dealers Tender 1,966.21 993.39

(GH¢ MN)

5.00 Amount Raised 1,960.21 993.39

(GH¢ MN)

Source: Bank of Ghana

0.00

91-Day 182-Day 364-Day 2-Year 3-Year 5-Year 6-Year 7-Year 10-Year 15-Year 20-Year

CURRENCY MARKET

FIXED INCOME MARKET HIGHLIGHTS

Interbank Average Rates

At last week’s auction, a total of GH¢867.55 million was raised in 91-Day bills, Currency Closing Previous Y-t-D

Week Week Change

GH¢63.99 million in 182-Day bills, GH¢71.71 million in 364-Day bills and GH¢956.96

(GH¢) (GH¢) %

million in 3-Year Bond compared to GH¢827.17 million in 91-Day bills, GH¢166.22 DOLLAR 5.8822 5.8688 -2.07%

million in 182-Day bills and GH¢97.30 million in 364-Day bills at the previous week’s POUND 8.0919 8.0089 -2.69%

EURO 6.8231 6.7938 3.54%

auction.

YEN 0.0515 0.0524 8.54%

YUAN 0.9141 0.9109 -3.47%

91-Day bill yield fell by 0.027% to close at 12.45%, 182-Day bills fell by 0.008% to

CFA FRANC 96.1377 96.5530 -3.47%

13.14%, 364-Day bills went up to 16.27% and 3 Year Bond was at 19%. Source: Bank of Ghana

The target for the next auction is GH¢1,083.00 million in 91-Day bills, 182-Day bills

and 364-Day bills.

KEY ECONOMIC INDICATORS

Indicator Current Previous ANALYSTS

Monetary Policy Rate September 2021 13.50% 13.50%

Godwin Kojo Odoom: Senior Research Analyst

Real GDP Growth Q2 2021 3.90% 3.10%

Inflation September 2021 10.60% 9.70% Edna Awurama Fosua: Analyst

Reference rate October 2021 13.46% 13.51%

Source: GSS, BOG, GBA Nelson Cudjoe Kuagbedzi: Analyst

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report-28.10.2021Document1 pageDaily Equity Market Report-28.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 20.08.2021Document2 pagesWeekly Capital Market Recap Week Ending 20.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.06.2022Document1 pageDaily Equity Market Report - 29.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.10.2021Document1 pageDaily Equity Market Report - 07.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.11.2021Document1 pageDaily Equity Market Report - 24.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.05.2022Document1 pageDaily Equity Market Report - 10.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.11.2021Document1 pageDaily Equity Market Report - 17.11.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.05.2022Document1 pageDaily Equity Market Report - 18.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.07.2022Document1 pageDaily Equity Market Report - 19.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.09.2021 2021-09-29Document1 pageDaily Equity Market Report 29.09.2021 2021-09-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.06.2022Document1 pageDaily Equity Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.04.2022Document1 pageDaily Equity Market Report - 28.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 23.06.2022 2022-06-23Document1 pageDaily Equity Market Report 23.06.2022 2022-06-23Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

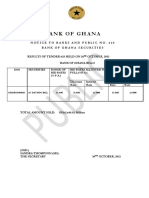

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

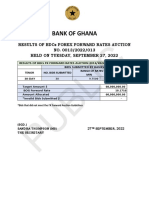

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Coca Cola Balance Sheet Horizontal Analysis Balan - HorizonDocument2 pagesCoca Cola Balance Sheet Horizontal Analysis Balan - Horizonalisheikh12No ratings yet

- 2013 Annual Report enDocument206 pages2013 Annual Report enspachecofdzNo ratings yet

- Cost of Capital and Leverage (MAS3)Document2 pagesCost of Capital and Leverage (MAS3)Andrea FernandoNo ratings yet

- Merchant Banking PDFDocument4 pagesMerchant Banking PDFAbhiNo ratings yet

- Bascic of Financial ManagementDocument17 pagesBascic of Financial ManagementHazlina HusseinNo ratings yet

- HDFC Mutual FundDocument88 pagesHDFC Mutual Fundmiksharma50% (2)

- Investing in Stock Markets SyllabusDocument2 pagesInvesting in Stock Markets SyllabusNandini ChughNo ratings yet

- FINA 4221 Corporate Finance Problem Set 1Document2 pagesFINA 4221 Corporate Finance Problem Set 1mahirahmed510% (1)

- Adcorp 2Document10 pagesAdcorp 2rtchuidjangnanaNo ratings yet

- Chapter 07 - Intercompany Inventory TransactionsDocument38 pagesChapter 07 - Intercompany Inventory Transactions_casals100% (8)

- Upwork FinancialDocument19 pagesUpwork FinancialVvb SatyanarayanaNo ratings yet

- Homework Assignment 1 PDFDocument2 pagesHomework Assignment 1 PDFDavid RoblesNo ratings yet

- Akuntansi Sanata DharmaDocument3 pagesAkuntansi Sanata DharmaDominica ViolitaNo ratings yet

- IHM 3 Notes NewDocument10 pagesIHM 3 Notes NewSadik ShaikhNo ratings yet

- Sales, Expenses and Cash Flow AnalysisDocument6 pagesSales, Expenses and Cash Flow AnalysisRUPIKA R GNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- Limited Liability CompaniesDocument4 pagesLimited Liability CompaniesPham Ngoc MaiNo ratings yet

- Total Return Futures On Cac 40 PresentationDocument17 pagesTotal Return Futures On Cac 40 Presentationouattara dabilaNo ratings yet

- OKE - SchwabDocument5 pagesOKE - SchwabJeff SturgeonNo ratings yet

- Accounting Fundamantals 2Document13 pagesAccounting Fundamantals 2Viren BansalNo ratings yet

- Isha Jain Eship AssignmentDocument8 pagesIsha Jain Eship AssignmentIsha JainNo ratings yet

- What Are Financial StatementsDocument4 pagesWhat Are Financial StatementsJustin Era ApeloNo ratings yet

- Chapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosDocument36 pagesChapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosceojiNo ratings yet

- Computation For Formation of PartnershipDocument10 pagesComputation For Formation of PartnershipErille Julianne (Rielianne)No ratings yet

- SM Garrison MGR Acc 13e Ch16Document49 pagesSM Garrison MGR Acc 13e Ch16YuliArdiansyahNo ratings yet

- AdvAcc1 - Assignment #1 (Busi Com Pfrs 3)Document2 pagesAdvAcc1 - Assignment #1 (Busi Com Pfrs 3)Kyla de SilvaNo ratings yet

- Feltham 1995Document44 pagesFeltham 1995vickyzaoNo ratings yet