Professional Documents

Culture Documents

Daily Equity Market Report - 24.01.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 24.01.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

24TH JANUARY 2022

DAILY EQUITY MARKET REPORT

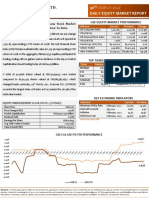

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI remained flat to Indicator Current Previous Change

GSE-Composite Index 2,789.52 2,789.52 0.00 pts

close at 2,789.52; returns 0.01% YTD

YTD (GSE-CI) 0.01% 0.01% 0.00%

The benchmark GSE Composite Index (GSE-CI) recorded no change at GSE-Financial index 2,154.03 2,154.03 0.00 pts

YTD (GSE-FSI) 0.10% 0.10% 0.00%

the first trading day of the week to close at 2,789.52 representing a YTD

Market Cap. (GH¢ MN) 64,501.06 64,501.06 0.00

return of 0.01%. The GSE Financial Stock Index (GSE-FSI) also flattened Volume Traded 298,338 134,565 121.71%

to close trading at 2,154.03 translating into a YTD return of 0.10% as there Value Traded (GH¢) 363,992.39 643,078.58 -43.40%

were no gainers or laggards for today’s trading session. TOP TRADED EQUITIES

As a result, Market Capitalization remained unchanged to close at Ticker Volume Value (GH¢)

PBC 156,700 3,134.00

GH¢64.50 billion.

MTNGH 48,819 54,189.09

GOIL 31,297 56,960.54

A total of 298,338 shares valued at GH¢363,992.39 were traded in seven EGH 27,549 209,372.40

ETI 21,508 3,011.12 57.5% value traded

(7) equities compared to 134,565 shares valued at GH¢643,078.58

which changed hands on Friday. Ecobank Ghana PLC. (EGH) recorded KEY ECONOMIC INDICATORS

the largest share of trades as it accounted for 57.5% of total value traded Indicator Current Previous

Monetary Policy Rate November 2021 14.50% 13.50%

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH) Real GDP Growth Q3 2021 6.6% 3.9%

Share Price GH¢1.11 Inflation December 2021 12.6% 12.2%

Price Change (YtD) -1.80% Reference rate December 2021 13.89% 13.46%

Market Capitalization GH¢13.64 billion Source: GSS, BOG, GBA

Dividend Yield 0.00%

Earnings Per Share GH¢0.1532 GSE-CI AND GSE-FSI YTD PERFORMANCE

Avg. Daily Volume Traded 2,015,566 0.50%

Value Traded (YtD) GH¢ 30,155,037 0.10%

0.00%

0.00% 0.01%

SBL RECOMMENDED PICKS -0.50%

-1.00%

Equity Price Outlook (Reason)

MTN GHANA GH¢ 1.11 Strong 2021 Q3 Financials -1.50%

BOPP GH¢ 6.65 Strong 2021 Q3 Financials -2.00%

CAL BANK GH¢ 0.82 Strong 2021 Q3 Financials -2.11%

-2.50%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials

SOGEGH GH¢ 1.20 Strong 2021 Q3 Financials -3.00%

FANMILK GH¢ 3.95 Positive Sentiment -3.50%

-4.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Astm D 4417Document4 pagesAstm D 4417Javier Celada0% (1)

- Concrete Mixer Truck SinotrukDocument2 pagesConcrete Mixer Truck SinotrukTiago AlvesNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.05.2022Document1 pageDaily Equity Market Report - 31.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.11.2021Document1 pageDaily Equity Market Report - 24.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.05.2022Document1 pageDaily Equity Market Report - 10.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.06.2022Document1 pageDaily Equity Market Report - 29.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.07.2022Document1 pageDaily Equity Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.11.2021Document1 pageDaily Equity Market Report - 11.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.07.2022Document1 pageDaily Equity Market Report - 19.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 23.05.2022Document1 pageDaily Equity Market Report - 23.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.06.2022Document1 pageDaily Equity Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.05.2022Document1 pageDaily Equity Market Report - 18.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.05.2022Document1 pageDaily Equity Market Report - 24.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.04.2022Document1 pageDaily Equity Market Report - 28.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 23.06.2022 2022-06-23Document1 pageDaily Equity Market Report 23.06.2022 2022-06-23Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.05.2022Document1 pageDaily Equity Market Report - 19.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.11.2021Document1 pageDaily Equity Market Report - 17.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Epoxy HRDocument5 pagesEpoxy HRMuthuKumarNo ratings yet

- Steve Jobs MarketingDocument1 pageSteve Jobs MarketingAnurag DoshiNo ratings yet

- Fruit-Gathering by Tagore, Rabindranath, 1861-1941Document46 pagesFruit-Gathering by Tagore, Rabindranath, 1861-1941Gutenberg.orgNo ratings yet

- The Three Pillars of The ASEANDocument13 pagesThe Three Pillars of The ASEANLouwell Abejo RiñoNo ratings yet

- Beef & Dairy 2016Document36 pagesBeef & Dairy 2016The Standard NewspaperNo ratings yet

- The Essential Guide To Data in The Cloud:: A Handbook For DbasDocument20 pagesThe Essential Guide To Data in The Cloud:: A Handbook For DbasInes PlantakNo ratings yet

- Parison of Dia para FerroDocument4 pagesParison of Dia para FerroMUNAZIRR FATHIMA F100% (1)

- NIJ Sawmark Analysis Manual for Criminal MutilationDocument49 pagesNIJ Sawmark Analysis Manual for Criminal MutilationAntonio jose Garrido carvajalinoNo ratings yet

- English 9Document26 pagesEnglish 9Joann Gaan YanocNo ratings yet

- Yatendra Kumar Sharma ResumeDocument3 pagesYatendra Kumar Sharma ResumeDheeraj SharmaNo ratings yet

- ANNEXURE IV Dec 2022 enDocument17 pagesANNEXURE IV Dec 2022 enadvocacyindyaNo ratings yet

- Solutions for QAT1001912Document3 pagesSolutions for QAT1001912NaveenNo ratings yet

- P150EDocument4 pagesP150EMauro L. KieferNo ratings yet

- Nature and Purpose of CommunicationDocument17 pagesNature and Purpose of CommunicationEdmond Dantès100% (4)

- 1 Time Evolution of A Coherent StateDocument7 pages1 Time Evolution of A Coherent StateHalloMannNo ratings yet

- TC-21FJ30LA: Service ManualDocument33 pagesTC-21FJ30LA: Service ManualRajo Peto alamNo ratings yet

- 7 Ways of Looking at Grammar China EditDocument20 pages7 Ways of Looking at Grammar China EditAshraf MousaNo ratings yet

- Workbook. Unit 3. Exercises 5 To 9. RESPUESTASDocument3 pagesWorkbook. Unit 3. Exercises 5 To 9. RESPUESTASRosani GeraldoNo ratings yet

- Power Fresh 16Document3 pagesPower Fresh 16M. Ardi PrediyanaNo ratings yet

- OSK Ekonomi 2016 - SoalDocument19 pagesOSK Ekonomi 2016 - SoalputeNo ratings yet

- A Grammar of Awa Pit (Cuaiquer) : An Indigenous Language of South-Western ColombiaDocument422 pagesA Grammar of Awa Pit (Cuaiquer) : An Indigenous Language of South-Western ColombiaJuan Felipe Hoyos García100% (1)

- Kak MhamadDocument1 pageKak MhamadAyub Anwar M-SalihNo ratings yet

- Nej Mo A 1311738Document7 pagesNej Mo A 1311738cindy315No ratings yet

- Chengdu Bus GroupDocument2 pagesChengdu Bus GroupMohammad LabbanNo ratings yet

- Ic T7HDocument36 pagesIc T7HCarlos GaiarinNo ratings yet

- Body Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able ToDocument19 pagesBody Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able TomahdiNo ratings yet

- Since 1977 Bonds Payable SolutionsDocument3 pagesSince 1977 Bonds Payable SolutionsNah HamzaNo ratings yet

- India: Soil Types, Problems & Conservation: Dr. SupriyaDocument25 pagesIndia: Soil Types, Problems & Conservation: Dr. SupriyaManas KaiNo ratings yet