Professional Documents

Culture Documents

Daily Equity Market Report - 10.03.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 10.03.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

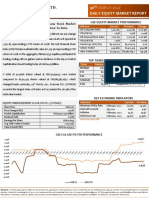

10TH MARCH 2022

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI inched up further, Indicator Current Previous Change

gains 6.59 points to close at 2,744.74 to return -1.60% YTD. GSE-Composite Index 2,744.74 2,738.15 6.59 pts

YTD (GSE-CI) -1.60% -1.84% -13.04%

The benchmark GSE Composite Index (GSE-CI) gained 6.59 points to GSE-Financial Stock Index 2,142.67 2,130.70 11.97 pts

close at 2,744.74 on the day representing a YTD return of -1.60%. The YTD (GSE-FSI) -0.43% -0.98% -56.12%

Market Cap. (GHMN) 63,718.29 63,483.88 234.41

GSE Financial Stock Index (GSE-FSI) also improved its level as it gained

Volume Traded 364,808 541,830 -32.67%

11.97 points to close trading at 2,142.67 translating into a YTD return of Value Traded (GH¢) 413,676.90 313,986.49 31.75%

-0.43%. In the aggregate, thirteen (13) equities participated in trading,

ending with only one gainer, namely Ecobank Transnational Inc. (ETI) TOP TRADED EQUITIES

Ticker Volume Value (GH¢)

with GH¢0.01 gain to close at GH¢0.15 representing a YTD gain of 7.14%,

ETI 111,706 16,755.90

and also one decliner, namely CAL Bank PLC. (CAL) losing GH¢0.01 to SIC 80,000 14,400.00

close at GH¢0.84 representing a YTD loss of -3.45% as this pushed CAL 60,271 50,627.64

MTNGH 54,854 59,242.32

Market Capitalization to GH¢63.72 billion.

EGL 29,720 98,076.00 26.32%

A total of 364,808 shares valued at GH¢413,676.90 were traded KEY ECONOMIC INDICATORS

Indicator Current Previous

compared to 541,830 shares valued at GH¢313,986.49 which changed Monetary Policy Rate January 2022 14.50% 14.50%

hands yesterday, 9th March, 2022. Ecobank Transnational Inc. (ETI) Real GDP Growth Q3 2021 6.6% 3.9%

Inflation February 2022 15.7% 13.9%

traded the most volumes while Standard Chartered Bank Ghana PLC.

Reference rate February 2022 14.01% 13.90%

(SCB) accounted for 26.32% of the total value traded. Source: GSS, BOG, GBA

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH) GAINER & DECLINER

Scancom

Share PricePLC. (MTNGH) at close of market traded the most,

GH¢1.08 Ticker Close Price Open Price Change YTD

Price Change (GH¢) (GH¢) Change

accounting for(YtD)

90.23% of the total value traded. -2.7%

Market Capitalization GH¢13,273.71 million ETI 0.15 0.14 7.14% 7.14%

Dividend Yield 0.00% CAL 0.84 0.85 -1.18% -3.45%

Earnings Per Share GH¢0.1633

Avg. Daily Volume Traded 1,602,113

Value Traded (YtD) GH¢90,503,483

GSE-CI & GSE-FSI YTD PERFORMANCE

1.00%

-0.43%

0.00%

24-Jan

4-Jan

20-Jan

28-Jan

15-Feb

21-Feb

23-Feb

1-Mar

3-Mar

8-Jan

22-Jan

26-Jan

6-Jan

1-Feb

3-Feb

27-Feb

10-Jan

14-Jan

18-Jan

7-Feb

9-Feb

25-Feb

7-Mar

9-Mar

11-Feb

12-Jan

16-Jan

30-Jan

5-Mar

5-Feb

13-Feb

17-Feb

19-Feb

-1.00%

-2.00%

-1.60%

-3.00%

-4.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Assignment 19 - Written Assignment - The Great Depression PDFDocument1 pageAssignment 19 - Written Assignment - The Great Depression PDFPedro Alvarez SabinNo ratings yet

- Ai Hidayati Amminy BT Ahmad AmminyDocument6 pagesAi Hidayati Amminy BT Ahmad AmminyhidayatiamminyNo ratings yet

- Chapter 21 Intangible AssetsDocument27 pagesChapter 21 Intangible Assetsshelou_domantayNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.03.2022Document1 pageDaily Equity Market Report - 15.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.07.2022Document1 pageDaily Equity Market Report - 07.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.02.2022Document1 pageDaily Equity Market Report - 16.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.05.2022Document1 pageDaily Equity Market Report - 10.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 23.05.2022Document1 pageDaily Equity Market Report - 23.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.05.2022Document1 pageDaily Equity Market Report - 19.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.05.2022Document1 pageDaily Equity Market Report - 31.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.06.2022Document1 pageDaily Equity Market Report - 29.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.05.2022Document1 pageDaily Equity Market Report - 24.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2021Document1 pageDaily Equity Market Report - 01.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.05.2022Document1 pageDaily Equity Market Report - 18.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.03.2022Document1 pageDaily Equity Market Report - 22.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.09.2021Document1 pageDaily Equity Market Report - 09.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2021Document1 pageDaily Equity Market Report - 24.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 23.08.2022Document1 pageDaily Equity Market Report - 23.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- 161 15 PAS 28 Investment in AssociateDocument2 pages161 15 PAS 28 Investment in AssociateRegina Gregoria SalasNo ratings yet

- Inter Corporate Loans, Investments, Gaurantees and SecuritiesDocument29 pagesInter Corporate Loans, Investments, Gaurantees and SecuritiesManik Singh KapoorNo ratings yet

- Exide Life Sampoorna Jeevan1599746534637 PDFDocument7 pagesExide Life Sampoorna Jeevan1599746534637 PDFDarshan HN100% (1)

- Internal Control Internal Audit Internal Checks by Good PDFDocument8 pagesInternal Control Internal Audit Internal Checks by Good PDFpnditdeepak786No ratings yet

- BCom TableDocument10 pagesBCom TablesimsonNo ratings yet

- SEAT Ibiza Range BrochureDocument25 pagesSEAT Ibiza Range BrochureJason SmithNo ratings yet

- AnDocument5 pagesAnPritesh ChaudhariNo ratings yet

- Industry Spectra Volume 1 Series 1Document82 pagesIndustry Spectra Volume 1 Series 1Vinay KhandelwalNo ratings yet

- Seminar - PPT - FinalDocument26 pagesSeminar - PPT - FinalMythili MuthappaNo ratings yet

- Jino Jose M CVDocument3 pagesJino Jose M CVJo JiNo ratings yet

- Unclaimed Benefits NorthwestDocument45 pagesUnclaimed Benefits NorthwestBenny MoingotliNo ratings yet

- Defining Fiscal FederalismDocument9 pagesDefining Fiscal FederalismAbdullahKadirNo ratings yet

- ADB - Masato MiyachiDocument40 pagesADB - Masato MiyachiAsian Development BankNo ratings yet

- CV Cale J Dunlap Us3Document1 pageCV Cale J Dunlap Us3api-312690447No ratings yet

- Central Industries PLC: (Company Reg - No. PQ 121)Document10 pagesCentral Industries PLC: (Company Reg - No. PQ 121)wasantha12No ratings yet

- A.Income Statement: Pre-Operation Year 1Document5 pagesA.Income Statement: Pre-Operation Year 1Benjie MariNo ratings yet

- Monetary Policy and Central Bank SyllabusDocument5 pagesMonetary Policy and Central Bank Syllabusjose aureo camacamNo ratings yet

- Mint Delhi 03-04-2024Document18 pagesMint Delhi 03-04-2024shashankstsNo ratings yet

- Advanced Accounting Full Notes 11022021 RLDocument335 pagesAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- Citibank CaseDocument6 pagesCitibank CaseLalatendu Das0% (1)

- Swedbank: A Corporate PresentationDocument32 pagesSwedbank: A Corporate PresentationmeluojuNo ratings yet

- SKC Consulting Private LimitedDocument29 pagesSKC Consulting Private LimitedChetan DabasNo ratings yet

- 10.6 Compound Interest PDFDocument7 pages10.6 Compound Interest PDFMarijoy MarquezNo ratings yet

- Diploma in Cambodia Tax Pilot Exam AnswersDocument13 pagesDiploma in Cambodia Tax Pilot Exam AnswersVannak2015No ratings yet

- Chapter 8 In-Class Problems SOLUTIONSDocument4 pagesChapter 8 In-Class Problems SOLUTIONSAbdullah alhamaadNo ratings yet

- Chapter 14Document18 pagesChapter 14RenNo ratings yet

- Education and Qualifications: Address: Mobile: EmailDocument2 pagesEducation and Qualifications: Address: Mobile: Emailahmad faidNo ratings yet