Professional Documents

Culture Documents

Daily Equity Market Report - 06.06.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 06.06.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

6TH JUNE 2022

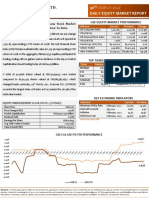

DAILY EQUITY MARKET REPORT

EQUITY MARKET HIGHLIGHTS: GSE-CI remained flat to GSE EQUITY MARKET PERFORMANCE

close at 2,550.98; returns -8.55% YTD. Indicator Current Previous Change

GSE-Composite Index 2,550.98 2,550.98 0.00 pts

On the first trading session of the week, the benchmark GSE

YTD (GSE-CI) -8.55% -8.55% 0.00%

Composite Index (GSE-CI) did not record any change closing at the GSE-Financial Stock Index 2,185.64 2,185.64 0.00 pts

same mark as it opened at 2,550.98 points representing a YTD return YTD (GSE-FSI) 1.57% 1.57% 0.00%

Market Cap. (GH¢ MN) 62,236.68 62,236.68 0.00

of -8.55%. The GSE Financial Stock Index (GSE-FSI) also maintained its

Volume Traded 317,917 56,351 464.17%

value to close trading at 2,185.64 points translating into a YTD return of Value Traded (GH¢) 280,733.23 48,321.72 480.97%

1.57%.

TOP TRADED EQUITIES

Fifteen (15) equities traded, ending with no gainer and decliner. Market

Ticker Volume Value (GH¢)

Capitalization for the day settled at GH¢62.24 billion. MTNGH 309,181 278,262.90

CPC 7,241 144.82

A total of 317,917 shares valued at GH¢280,733.23 was traded on the CAL 597 477.60

SIC 450 135.00

day. Compared with the previous GSE trading day (Friday, June 3), 99.12%

UNIL 165 971.85

SSSS a 464.17% improvement in volume traded and

today's data shows

481.97% improvement in trade turnover. Scancom PLC. (MTNGH)

accounted for 99% of the total value traded as well as 97% of volumes. KEY ECONOMIC INDICATORS

Indicator Current Previous

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH) Monetary Policy Rate May 2022 19.00% 17.00%

Share Price GH¢0.90 Real GDP Growth December 2021 5.4% 0.4%

Price Change (YtD) -18.92% Inflation April 2022 23.6% 19.4%

Market Capitalization GH¢11,061.43 million Reference rate April 2022 16.58% 14.18%

Dividend Yield 12.778% Source: GSS, BOG, GBA

Earnings Per Share GH¢0.2303

Avg. Daily Volume Traded 3,939,120

Value Traded (YtD) GH¢967,737,436

GSE-CI & GSE-FSI YTD PERFORMANCE

4.00% 1.57%

2.00%

0.00%

4-Jan 11-Jan 18-Jan 25-Jan 1-Feb 8-Feb 15-Feb 22-Feb 1-Mar 8-Mar 15-Mar 22-Mar 29-Mar 5-Apr 12-Apr 19-Apr 26-Apr 3-May 10-May 17-May 24-May 31-May

-2.00%

-4.00%

-6.00% -8.55%

-8.00%

-10.00% GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.06.2022Document1 pageDaily Equity Market Report - 29.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.03.2022Document1 pageDaily Equity Market Report - 02.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 16.06.2022Document1 pageDaily Equity Market Report - 16.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.07.2022Document1 pageDaily Equity Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.05.2022Document1 pageDaily Equity Market Report - 31.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.07.2022Document1 pageDaily Equity Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.06.2022Document1 pageDaily Equity Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.07.2022Document1 pageDaily Equity Market Report - 19.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.07.2022Document1 pageDaily Equity Market Report - 07.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.06.2022Document1 pageDaily Equity Market Report - 15.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.05.2022Document1 pageDaily Equity Market Report - 19.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.08.2022Document1 pageDaily Equity Market Report - 15.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2022Document1 pageDaily Equity Market Report - 07.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 23.06.2022 2022-06-23Document1 pageDaily Equity Market Report 23.06.2022 2022-06-23Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.05.2022Document1 pageDaily Equity Market Report - 24.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.04.2022Document1 pageDaily Equity Market Report - 28.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.08.2022Document1 pageDaily Equity Market Report - 11.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.08.2022Document1 pageDaily Equity Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.05.2022Document1 pageDaily Equity Market Report - 25.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.09.2022Document1 pageDaily Equity Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.08.2022Document1 pageDaily Equity Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- FAR1 Solution ManualDocument4 pagesFAR1 Solution ManualChristian OliverosNo ratings yet

- Business Combination Comprehensive ExamDocument4 pagesBusiness Combination Comprehensive ExamRose VeeNo ratings yet

- A Beginner's Guide To The Stock Market - Everything You Need To Start Making Money Today by Matthew KratterDocument82 pagesA Beginner's Guide To The Stock Market - Everything You Need To Start Making Money Today by Matthew KratterSuhel Faraz100% (2)

- Homework Notes Unit 1 MBA 615Document10 pagesHomework Notes Unit 1 MBA 615Kevin NyasogoNo ratings yet

- Venture CapitalDocument10 pagesVenture CapitalsadathnooriNo ratings yet

- Lloyds TSB Bank PLC: Report and Accounts 2008Document109 pagesLloyds TSB Bank PLC: Report and Accounts 2008saxobobNo ratings yet

- Financial Report 2009Document120 pagesFinancial Report 2009hongwenliNo ratings yet

- FinancialStatement 2019Document298 pagesFinancialStatement 2019Tonga ProjectNo ratings yet

- Fund Flow Statement AnalysisDocument25 pagesFund Flow Statement AnalysisGovindNo ratings yet

- Corporate Finance Ross 10th Edition Test BankDocument15 pagesCorporate Finance Ross 10th Edition Test Bankotoscopyforklesslx8v100% (29)

- Jubilant Pharmova 07 06 2021 IciciDocument6 pagesJubilant Pharmova 07 06 2021 IciciBhagwat RautelaNo ratings yet

- SSRN Id3850494Document34 pagesSSRN Id3850494Aniket nalawadeNo ratings yet

- The Trading PlanDocument10 pagesThe Trading PlanDennys FreireNo ratings yet

- Internship Report on Stock Holding Corporation of IndiaDocument32 pagesInternship Report on Stock Holding Corporation of IndiaJenifer Chrisla TNo ratings yet

- Corporate Bond Pricing GuideDocument5 pagesCorporate Bond Pricing Guideshua2000No ratings yet

- Mercial PaperDocument39 pagesMercial PaperArjun Khunt100% (1)

- CIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022Document4 pagesCIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022ryedah musyairaNo ratings yet

- Forex Pip Calculation & P/LDocument2 pagesForex Pip Calculation & P/LBogdan LupuNo ratings yet

- ACP103 Task 1Document3 pagesACP103 Task 1Joshuji LaneNo ratings yet

- Form PDF 633072411111022Document43 pagesForm PDF 633072411111022LaxusNo ratings yet

- Revaluation of Property, Plant and Equipment ExplainedDocument1 pageRevaluation of Property, Plant and Equipment ExplainedAia SmithNo ratings yet

- Fundamental Analysis and Relative Valuation Multiples Pg80Document411 pagesFundamental Analysis and Relative Valuation Multiples Pg80krisNo ratings yet

- Will Your Factor Deliver - An Examination of Factor Robustness and Implementation Costs - Noah Beck Jason Hsu Vitali Kalesnik Helge KostkaDocument25 pagesWill Your Factor Deliver - An Examination of Factor Robustness and Implementation Costs - Noah Beck Jason Hsu Vitali Kalesnik Helge KostkaJuan Manuel VeronNo ratings yet

- Accounting Icom Part 2Document2 pagesAccounting Icom Part 2Ayman ChishtyNo ratings yet

- Portfolio Diversification Enigma CaseDocument3 pagesPortfolio Diversification Enigma CaserahulNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisRam KrishnaNo ratings yet

- Finance Applications and Theory 4th Edition Cornett Solutions ManualDocument69 pagesFinance Applications and Theory 4th Edition Cornett Solutions Manuala36775880550% (2)

- The Search For Entrepreneurial CapitalDocument5 pagesThe Search For Entrepreneurial CapitalAngelie Anillo100% (1)

- Project Report On Buy Back of Shares FinalDocument18 pagesProject Report On Buy Back of Shares FinalDivyaModaniNo ratings yet

- Chapter 4 Parity Conditions in InternatiDocument21 pagesChapter 4 Parity Conditions in InternatiShavi KhanNo ratings yet