Professional Documents

Culture Documents

Tax 1 - GP

Uploaded by

Jayson ChanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 1 - GP

Uploaded by

Jayson ChanCopyright:

Available Formats

p

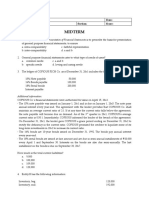

TAXATION REVIEW

General Principles

1. This is the inherent power by which the sovereign, through its law-making body, raises income

from the public to defray the necessary expenses of government.

a. Tax c. Taxation

b. Taxes d. National Internal Revenue Code

2. What branch of the government has the power to enact national tax legislations?

a. Congress c. House of representative

b. Senate d. Legislative department

3. What is the nature of the right of the national government to enact tax laws?

a. Inherent c. Constitutional grant

b. Delegated d. Co-ordinate with other branches of government

4. What is the nature of the right of local government units to enact tax laws?

a. Inherent c. Constitutional grant

b. Delegated d. Co-ordinate with other branches of government

5. Refer to the following statements:

S1: The national government may create tax laws even in the absence of constitutional grant of

power to tax.

S2: The power to tax is granted by the Constitution.

S3: Tax laws are superior to the Constitution.

Which is correct.

a. Only statement 3 is incorrect. c. Statements 2 and 3 are incorrect

b. Statements 1 and 2 are correct. d. Only statement 1 is incorrect

6. Which tax is collected through the BIR?

a. Real property tax c. Documentary stamp tax

b. Real estate transfer tax d. Local business tax

7. Which is paid to the local treasury?

a. Business tax c. Professional tax

b. Excise tax d. Value added tax

8. The place of taxation is commonly determined by the following, except

a. Residence c. Nationality

b. Source d. Domicile

Admission year 2019 – 2020 K.T. Tegio 1

9. The Constitution provides that the power to tax shall be “progressive” in nature. Which of the

following taxes best exemplify this Constitutional provision?

a. Corporate income tax c. Individual income tax

b. Final income tax d. Business taxes

10. Taxation is so unlimited in force and searching in extent that courts scarcely venture to declare

that it is subject to any restrictions, except those that such rests in the discretion of the authority

which exercises it. This jurisprudential pronouncement means that taxation is

a. Comprehensive c. Plenary

b. Unlimited d. Supreme

11. Income of individuals earned in the Philippines are subject to tax while income from foreign

countries are exempt from taxes, as a rule. This means that taxation is

a. Legislative c. Territorial

b. For public purpose d. Extra-territorial

12. In Ilo-ilo, et. al. v. Smart Communications, Inc. G.R. N O. 167260, February 27, 2009, the Court

ruled that the power to tax is not provided for in the law, statute or Constitution; it co-exists

with the state. This means that the power to tax is

a. Inherent c. Superior that the Constitution

b. Constitutional d. Superior than other national laws

13. The power to create tax laws cannot be delegated, as a rule. The following are the exceptions,

except

a. To local governments

b. When allowed by the Constitution

c. For merely administrative implementation

d. Delegation to the vice-president for fixing tariff rates

14. May the government tax itself?

a. Yes, the rule is taxation, exemptions are the exceptions.

b. No, the rule for government is exemption, taxation is the exception.

c. Yes, the power to tax is so unlimited and searching in its nature. It may tax everything it

deems proper to tax.

d. No, the government can not be held liable to pay for tax.

15. What is the strongest among the inherent powers of the government?

a. Taxation c. Eminent domain

b. Police power d. Imminent domain

16. What is the most pervasive among the inherent powers of the government?

c. Taxation c. Eminent domain

d. Police power d. Imminent domain

17. The power to tax is not the power to destroy. The power of taxation should be exercised with

caution to minimize injury to the proprietary rights of a taxpayer.

a. Marshall Dictum c. Pactum commissorium

b. Holmes Dictum d. Solution indebiti

Admission year 2019 – 2020 K.T. Tegio 2

18. Congress passed a sin tax law that increased the tax rates on cigarettes by 1,000%. The

law was thought to be sufficient to drive many cigarette companies out of business, and

was questioned in court by a cigarette company that would go out of business because it

would not be able to pay the increased tax.

The cigarette company is __________

a. Wrong because taxes are the lifeblood of the government

b. Wrong because the law recognizes that the power to tax is the power to destroy

c. Correct because no government can deprive a person of his livelihood

d. Correct because congress, in this case, exceeded its power to tax

19. The president of the Republic of the Philippines imposed tariffs on imported rice. This action aims

to use taxation

a. As revenue measure c. To encourage economic growth

b. For promotion of general welfare d. For protectionism

20. The giving of 20% discount to qualified senior citizens and allowing as tax deductions those

discounts exemplifies the use of

a. Police power and taxation c. Taxation only

b. Eminent domain and taxation d. Police power only

21. Regular withholding of taxes, electronic filing and payment system are examples of which

principle of sound tax system

a. Fiscal adequacy c. Theoretical justice

b. Administrative feasibility d. Lifeblood doctrine

22. The national government may levy properties of taxpayers for payment of delinquent taxes. This

fiscal policy may affect which principle of tax system

a. Fiscal adequacy c. Theoretical justice

b. Administrative feasibility d. Lifeblood doctrine

23. XYZ Corporation manufactures glass panels and is almost at the point of insolvency. It has no

more cash and all it has are unsold glass panels. It received an assessment from the BIR for

deficiency income taxes. It wants to pay but due to lack of cash, it seeks permission to pay in

kind with glass panels. Should the BIR grant the requested permission?

a. It should grant permission to make payment convenient to taxpayers.

b. It should not grant permission because a tax is generally a pecuniary burden.

c. It should grant permission; otherwise, XYZ Corporation would not be able to pay.

d. It should not grant permission because the government does not have the storage facilities

for glass panels.

24. A tax law which violates the canons of sound tax systems are considered

a. Valid c. Voidable

b. Rescissible d. Void

Admission year 2019 – 2020 K.T. Tegio 3

25. The BIR wants to collect taxes from the members of an ancient tribe in the deep mountains of

Samar Island, however, the latter refused to pay on the basis that the government failed to

provide on its duty to protect and provide social benefits, like infrastructures and other

governmental programs. What legal argument can the bureau use as a theory or basis for taxing

them?

a. Jurisdiction over subject & objects

b. Benefits-Protection Theory

c. Lifeblood doctrine

d. Necessity Theory

26. Frank Chavez, as taxpayer, and Realty Owners Association of the Philippines, Inc. (ROAP), alleged

that E.O.73 providing for the collection of real property taxes as provided for under Section 21 of

P.D.464 (Real Property Tax Code) is unconstitutional because it accelerated the application of

the general revision of assessments to January 1, 1987 thereby increasing real property taxes by

100% to 400% on improvements, and up to 100% on land which would necessarily lead to

confiscation of property. What defense could be raised by the BIR as against the contention of

the Chavez and ROAP?

a. Fiscal adequacy c. Theoretical justice

b. Administrative feasibility d. Jurisdiction

27. The local government of Palo enacted an ordinance taxing all transfers of real estates within the

municipality. The heirs of Mr. X asked the court to declare such ordinance as invalid invoking

double taxation. The contended that such law will re-subject their inherited real properties,

already taxed with estate tax, to another type of tax. Is their contention meritorious?

a. Yes, double taxation is prohibited as the same violates due process of the Constitution.

b. No, double taxation is not prohibited.

c. Yes, there is direct double taxation as the same subject property is subjected to same

purpose paid by the same taxpayer during the same taxable year.

d. No, there was no double taxation as the tax is collected by different government authority.

28. Bank A deposit money with Bank B which earns interest that is subjected to the 20% final

withholding tax. At the same time, Bank A is subjected to the 5% gross receipts tax on its interest

income on loan transactions to customers. Which statement below INCORRECTLY describes the

transaction?

a. There is double taxation because two taxes – income tax and gross receipts tax are imposed

on the interest incomes described above and double taxation is prohibited under the 1987

Constitution;

b. There is no double taxation because the first tax is income tax, while the second tax is

business tax;

c. There is no double taxation because the income tax is on the interest income of Bank A on

its deposits with Bank B (passive income), while the gross receipts tax is on the interest

income received by Bank A from loans to its debtor-customers (active income);

d. Income tax on interest income of deposits of Bank A is a direct tax, while GRT on interest

income on loan transaction is and tax.

Admission year 2019 – 2020 K.T. Tegio 4

29. Mr. Alas sells shoes in Makati through a retail store. He pays the VAT on his gross sales to the BIR

and the municipal license tax based on the same gross sales to the City of Makati. He comes to

you for advice because he thinks he is being subjected to double taxation. What advice will you

give him?

a. Yes, there is double taxation and it is oppressive.

b. The City of Makati does not have this power.

c. Yes, there is double taxation and this is illegal m the Philippines.

d. Double taxation is allowed where one tax is imposed by the national government and the

other by the local government.

30. What makes direct double taxation unconstitutional?

a. It violates equal protection clause c. It violates due process clause

b. It violates progressiveness rule d. It violates the Regalian Doctrine

31. The municipality of San Isidro passed an ordinance imposing a tax on installation managers.

At that time, there was only one installation manager in the municipality; thus, only he

would be liable for the tax. Is the law constitutional?

a. It is unconstitutional because it clearly discriminates against this person.

b. It is unconstitutional for lack of legal basis.

c. It is constitutional as it applies to all persons in that class.

d. It is constitutional because the power to tax is the power to destroy.

32. Payment of business taxes on goods sold, payment of income tax based on income earned from

such sales, and payment of dividend taxes for distributing such income to members constitutes

a. Direct double taxation c. Triple taxation

b. Indirect double taxation d. Double taxation

33. These are legal means of tax payment, except

a. Exemption c. Transformation

b. Shifting d. Evasion

34. CIC entered into an alleged simulated sale of a 16-storey commercial building. CIC authorized

Benigno Toda, Jr., its President to sell the Cibeles Building and the two parcels of land on which

the building stands. Toda purportedly sold the property at a loss for P100 million to Altonaga,

who, in turn, sold the same property on the same day to Royal Match Inc. (RMI) for P200 million

evidenced by Deeds of Absolute Sale notarized on the same day by the same notary public. For

the sale of the property to RMI, Altonaga paid capital gains tax in the amount of P10 million.

The BIR sent an assessed deficiency income tax arising from the sale alleging that CIC evaded the

payment of higher corporate income tax of 30% with regard to the resulting gain. What scheme

was perpetuated by Toda?

a. Evasion c. Shifting

b. Avoidance d. Capitalization

35. This form of escape from payment of taxes requires legislation

a. Exemption c. Transformation

b. Shifting d. Capitalization

Admission year 2019 – 2020 K.T. Tegio 5

36. VAT is originally assessed against the seller who is required to pay the said tax, but the

payment is actually shifted or passed on to the buyer. Who, then, bares the incidence of

taxation?

a. Seller c. Government

b. Buyer d. Either a or b

37. Refer to the following statements:

S1: Tax statues are construed strictly against the government.

S2: Exemptions are strictly construed against the taxpayers.

S3: Tax exemptions are construed liberally in favor of government political subdivision or

instrumentality.

S4: Tax refunds are in the nature of tax exemptions and are to be construed strictissimi juris

against the taxpayer.

Which is incorrect?

a. S1 and S2 are correct. c. S2 is correct

b. S4 is correct. d. S3 is incorrect.

38. These are rules or orders having force of law issued by the executive branch of the government

to ensure uniform application of the tax law.

a. Revenue regulations c. BIR rulings

b. Revenue memorandum circulars d. Tax laws

39. Rulings are official response of the Bureau to queries of taxpayers for clarifications and

interpretation of tax laws.

a. Revenue regulations c. BIR rulings

b. Revenue memorandum circulars d. Tax laws

40. What is the nature of our NIRL?

a. Civil c. Political

b. Penal d. Remedial

41. It is the imposition of a tax upon another tax.

a. Tax pyramiding c. Double jeopardy

b. Double taxation d. Duplicate taxation

42. The litmus test for this kind of limit of taxation is that taxes should be used for something which

is the duty of the State to provide.

a. Public purpose c. Territoriality

b. Exemption of the government d. International comity

43. All appropriation, revenue or tariff bills, bills authorizing increase of the public debt, bills of local

application, and private bills, shall originate exclusively in the House of Representatives, but the

Senate may propose or concur with amendments.

a. Territoriality limit c. International comity limit

b. Non-delegability limit d. Public purpose limit

Admission year 2019 – 2020 K.T. Tegio 6

44. The factor which determines the source of income for personal services is the place where

a. Services were actually rendered c. Contract is perfected

b. Payment is made d. Debtor resides

45. Failure to notify taxpayers regarding tax assessments violates principle of

a. Due process c. Non-impairment clause

b. Equal protection clause d. Either a or b

46. Non-payment of which type of tax does not result in imprisonment?

a. Income tax c. Basic poll tax

b. Poll tax d. Additional poll tax

47. This principle is one of the attributes or characteristics of tax. Money collected from taxation

shall not be paid to any religious dignitary EXCEPT when:

a. The religious dignitary is assigned to the Philippine Army

b. It is paid by a local government unit

c. The payment is passed in audit by the COA

d. It is part of a lawmaker’s pork barrel

48. Refer to the following statements:

S1: The president has the exclusive power to fix within specified limits, tariff rates, import or

export quotas, tonnage and wharfage dues and other duties or imposts.

S2: The house of representatives has the sole power to enact national tax laws.

S3: The sanggunian has the exclusive power to enact local tax legislations.

Which is correct.

a. S1 and S2 are correct c. S2 is incorrect

b. S2 and S3 are correct d. All are correct

49. A local government agency collects fees from use of its facilities. These proceeds are used to pay

the costs of regulating the covered activities of such agency and for constructions of public

infrastructures. The fees collected results from?

a. Police power c. Eminent domain

b. Taxation d. Either a or b

50. Which of these inherent powers is exercised exclusively by the legislative department?

a. Police power c. Eminent domain

b. Taxation d. All inherent powers

--- Altius ---

Admission year 2019 – 2020 K.T. Tegio 7

You might also like

- Principles of Taxation2Document8 pagesPrinciples of Taxation2Daniel DialinoNo ratings yet

- TaxationreviewDocument11 pagesTaxationreviewmarvin barlisoNo ratings yet

- Chapter 12: The Strategy of International Business: True / False QuestionsDocument40 pagesChapter 12: The Strategy of International Business: True / False QuestionsQuốc PhúNo ratings yet

- International Business: by Charles W.L. HillDocument30 pagesInternational Business: by Charles W.L. HillApanar OoNo ratings yet

- CH 12Document36 pagesCH 12Ella LopezNo ratings yet

- Topic 3: Introduction To Transaction ProcessingDocument45 pagesTopic 3: Introduction To Transaction ProcessingTeo ShengNo ratings yet

- Operation Costing Review QuestionsDocument2 pagesOperation Costing Review QuestionsAndriaNo ratings yet

- Taxes, Tax Laws, and Tax AdministrationDocument8 pagesTaxes, Tax Laws, and Tax AdministrationAilene MendozaNo ratings yet

- Chapter 4 FinaccDocument4 pagesChapter 4 Finaccv lNo ratings yet

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonNo ratings yet

- Calculating Income Tax for COVID CompanyDocument2 pagesCalculating Income Tax for COVID CompanyRico, Jalaica B.No ratings yet

- Midterm Mockboard ACCOUNTING 601-Integrated Course in TaxationDocument12 pagesMidterm Mockboard ACCOUNTING 601-Integrated Course in TaxationhyasNo ratings yet

- Notes Receivable DiscountingDocument33 pagesNotes Receivable DiscountingKristia AnagapNo ratings yet

- Chapter 21 - Debt Restructuring, Corporate Reorganizations, and LiquidationsDocument41 pagesChapter 21 - Debt Restructuring, Corporate Reorganizations, and LiquidationsDieter LudwigNo ratings yet

- AFAR-02 (Partnership Dissolution & Liquidation)Document15 pagesAFAR-02 (Partnership Dissolution & Liquidation)Jennelyn CapenditNo ratings yet

- Cost Accounting Study FlashcardsDocument7 pagesCost Accounting Study FlashcardsWilliam SusetyoNo ratings yet

- 68125672575bdf96fc857f403531f1c9-copyDocument9 pages68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- Chapter Solutions I3Document15 pagesChapter Solutions I3Clyde RamosNo ratings yet

- Audit of PPE Comprehensive QuizzerDocument9 pagesAudit of PPE Comprehensive QuizzerAlice WuNo ratings yet

- PAS1 Answer KeyDocument4 pagesPAS1 Answer KeyGalilee Dawn JullezaNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Module 11 Current Liabilities Provisions and ContingenciesDocument14 pagesModule 11 Current Liabilities Provisions and ContingenciesZyril RamosNo ratings yet

- AP04 05 Audit of IntangiblesDocument8 pagesAP04 05 Audit of IntangibleseildeeNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Aje 1bsa Abm1Document7 pagesAje 1bsa Abm1Ej UlangNo ratings yet

- CPA REVIEW SCHOOL FINANCIAL ACCOUNTING TOPICSDocument6 pagesCPA REVIEW SCHOOL FINANCIAL ACCOUNTING TOPICSAljur SalamedaNo ratings yet

- TAX 1 2020 SolMan Chapters 1 To 4Document13 pagesTAX 1 2020 SolMan Chapters 1 To 4KRISTEL JOYCENo ratings yet

- Module 6 Income Taxes For Corporations - Part 1Document12 pagesModule 6 Income Taxes For Corporations - Part 1Maricar DimayugaNo ratings yet

- Which Is Subject To FINAL TAXDocument1 pageWhich Is Subject To FINAL TAXbutterfly kisses0217No ratings yet

- LIKE A JOKE THAT SEEMS TRUE (Wabe)Document12 pagesLIKE A JOKE THAT SEEMS TRUE (Wabe)Gwynne WabeNo ratings yet

- Chapter 8Document37 pagesChapter 8Ailene QuintoNo ratings yet

- Intermacc Inventories and Bio Assets Prelec WaDocument1 pageIntermacc Inventories and Bio Assets Prelec WaClarice Awa-aoNo ratings yet

- Topacio Rizza C. Activity 6-1Document12 pagesTopacio Rizza C. Activity 6-1santosashleymay7No ratings yet

- Maximizing Income from Two Part-Time Jobs with Simplex MethodDocument21 pagesMaximizing Income from Two Part-Time Jobs with Simplex MethodJohn Rovic GamanaNo ratings yet

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Cfas Quiz Pas 19Document5 pagesCfas Quiz Pas 19Michaella NudoNo ratings yet

- Understanding ERP and IoT SystemsDocument8 pagesUnderstanding ERP and IoT SystemsCatherine LaguitaoNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Philippine Income Tax Exemptions and Personal DeductionsDocument5 pagesPhilippine Income Tax Exemptions and Personal DeductionsQueen ValleNo ratings yet

- Inacc3 BalucanDocument8 pagesInacc3 BalucanLuigi Enderez BalucanNo ratings yet

- Income Taxation Preliminary Examination Income Tax On Individuals Multiple ChoicesDocument3 pagesIncome Taxation Preliminary Examination Income Tax On Individuals Multiple ChoicesJoel RagosNo ratings yet

- Chapter 14 Test BankDocument45 pagesChapter 14 Test Bankngan phanNo ratings yet

- Activity in Just in Time Acctg. With Answer KeyDocument3 pagesActivity in Just in Time Acctg. With Answer KeyLucy HeartfiliaNo ratings yet

- Questions: Buy This Full Document at Http://test-Bank - UsDocument35 pagesQuestions: Buy This Full Document at Http://test-Bank - UsSami KhanNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- Intermediate Accounting IDocument35 pagesIntermediate Accounting ICrystal AlcantaraNo ratings yet

- Jhazreel Mae Biasura 2 BCH 10Document2 pagesJhazreel Mae Biasura 2 BCH 10Jhazreel BiasuraNo ratings yet

- 12 Capital Budgeting v2Document3 pages12 Capital Budgeting v2kris mNo ratings yet

- TAXATION PRINCIPLES QUIZDocument8 pagesTAXATION PRINCIPLES QUIZalcazar rtuNo ratings yet

- Intermediate Accounting 3 - January 24, 2023, F2F DiscussionDocument8 pagesIntermediate Accounting 3 - January 24, 2023, F2F DiscussionZhaira Kim CantosNo ratings yet

- Prelim Exam: Name: Date: Professor: Section: ScoreDocument13 pagesPrelim Exam: Name: Date: Professor: Section: ScoreJoyce LunaNo ratings yet

- Governance, Risk and Internal ControlsDocument6 pagesGovernance, Risk and Internal ControlsA cNo ratings yet

- Ais Chapter 1Document3 pagesAis Chapter 1Alfred LopezNo ratings yet

- Chapter 1 Standard Costs and Operating PerformanceDocument5 pagesChapter 1 Standard Costs and Operating PerformanceSteffany RoqueNo ratings yet

- Naranjo Company Designs Industrial Prototypes For Outside Companies Budgeted OverheadDocument1 pageNaranjo Company Designs Industrial Prototypes For Outside Companies Budgeted OverheadAmit PandeyNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- Rea ModelDocument9 pagesRea ModelRiska GirlcancerNo ratings yet

- Compilation of QuizzesDocument37 pagesCompilation of QuizzesHazel MoradaNo ratings yet

- Take HOme Quiz 1Document6 pagesTake HOme Quiz 1Jessa HerreraNo ratings yet

- 1 Fundamental Principles of TaxationDocument13 pages1 Fundamental Principles of TaxationAlted AluraNo ratings yet

- BIR Clarification On Senior Citizens DiscountDocument13 pagesBIR Clarification On Senior Citizens DiscountPaolo Antonio EscalonaNo ratings yet

- James 2 PDFDocument8 pagesJames 2 PDFJayson ChanNo ratings yet

- Case Digest - AtpDocument8 pagesCase Digest - AtpJayson ChanNo ratings yet

- 2813-Article Text-9190-1-10-20190730 PDFDocument9 pages2813-Article Text-9190-1-10-20190730 PDFJayson ChanNo ratings yet

- TAX - Special Economic Zone Act & Omnibus Investments Code: Cpa Review CenterDocument9 pagesTAX - Special Economic Zone Act & Omnibus Investments Code: Cpa Review CenterJayson Chan100% (1)

- Accounting Standards and Financial Reporting FrameworkDocument14 pagesAccounting Standards and Financial Reporting FrameworkJayson ChanNo ratings yet

- Draft PDFDocument4 pagesDraft PDFJayson ChanNo ratings yet

- Public Attorneys Not Allowed To Handle Ejectment CasesDocument2 pagesPublic Attorneys Not Allowed To Handle Ejectment Casesyurets929No ratings yet

- Sources of LawDocument6 pagesSources of LawTanya TandonNo ratings yet

- Press Release Re 2nd Diaspora EngagementDocument1 pagePress Release Re 2nd Diaspora EngagementMandyNo ratings yet

- Course Code: 19BMC205A Course Title: Banking and Financial InstitutionsDocument13 pagesCourse Code: 19BMC205A Course Title: Banking and Financial InstitutionsVarun AVNo ratings yet

- PISA Test Focus Standardized TestingDocument4 pagesPISA Test Focus Standardized TestingVũ Thanh Giang NguyễnNo ratings yet

- Turkey's Economic and Political Issues SymposiumDocument455 pagesTurkey's Economic and Political Issues SymposiumKoray YAZICINo ratings yet

- Lesson 2 Philippine Politics and Government POLITICAL IDEOLOGYDocument35 pagesLesson 2 Philippine Politics and Government POLITICAL IDEOLOGYBrynn EnriquezNo ratings yet

- CA2 Module 8Document6 pagesCA2 Module 8Ne MeNo ratings yet

- Holder & Holder in Due CourseDocument6 pagesHolder & Holder in Due Coursekareena23100% (1)

- Wrongful Restraint and Wrongful ConfinementDocument2 pagesWrongful Restraint and Wrongful ConfinementshreyaNo ratings yet

- Digest Mirando Vs WellingtonDocument2 pagesDigest Mirando Vs WellingtonUsman EdresNo ratings yet

- Uniform Bonding CodeDocument15 pagesUniform Bonding CodeJohn Kronnick100% (15)

- Perkins Vs Dizon Facts: RulingDocument2 pagesPerkins Vs Dizon Facts: RulingCharizz DominguezNo ratings yet

- Machiavelli's Contributions to Management ThoughtDocument14 pagesMachiavelli's Contributions to Management ThoughtAlifa ZasqyaNo ratings yet

- G.R. No. 192530, March 07, 2018 - Tee Ling Kiat, Petitioner, vs. Ayala Corporation, Respondent.Document2 pagesG.R. No. 192530, March 07, 2018 - Tee Ling Kiat, Petitioner, vs. Ayala Corporation, Respondent.Francis Coronel Jr.100% (1)

- Keynesian TheoryDocument2 pagesKeynesian TheoryJoy DegobatonNo ratings yet

- Lecture 5 New York ConventionDocument4 pagesLecture 5 New York ConventionAli AmmadNo ratings yet

- Punjab Commission For Regularization of Irregular Housing Schemes Ordinance 2021 PDFDocument8 pagesPunjab Commission For Regularization of Irregular Housing Schemes Ordinance 2021 PDFShazia RaniNo ratings yet

- Dagudag vs Paderanga RulingDocument1 pageDagudag vs Paderanga RulingJaja GkNo ratings yet

- Judiciary's Role in Promoting ADR through Policy Decisions and Case ManagementDocument13 pagesJudiciary's Role in Promoting ADR through Policy Decisions and Case ManagementashwaniNo ratings yet

- Homestead Act 1975Document4 pagesHomestead Act 1975puzzle7444No ratings yet

- Oppression Types. Racial OppressionDocument8 pagesOppression Types. Racial OppressionEldana ElikbaevaNo ratings yet

- Religious rituals at Hall of JusticeDocument5 pagesReligious rituals at Hall of JusticeKara SolidumNo ratings yet

- G.R. No. 141471Document8 pagesG.R. No. 141471ghoudzNo ratings yet

- Ethics DigestDocument14 pagesEthics DigestJeffreyReyesNo ratings yet

- Transformational LeadershipDocument14 pagesTransformational Leadershipapi-354563570100% (1)

- Vawc Template Tpo Ppo For LegformsDocument5 pagesVawc Template Tpo Ppo For LegformsAgatha Faye Castillejo100% (3)

- Cebu Oxygen vs. Bercilles (Contract)Document1 pageCebu Oxygen vs. Bercilles (Contract)Bam Bathan100% (1)

- What Is A Good Acrostic Poem For Government?Document2 pagesWhat Is A Good Acrostic Poem For Government?Jake CastañedaNo ratings yet

- 17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFDocument3 pages17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFAleezah Gertrude RaymundoNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)