Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

Uploaded by

TalionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

Available Formats

4-48 CH A PT E R 4 Completing the Accounting Cycle

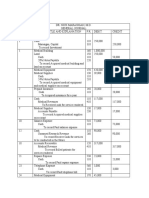

Warren Roofing

Worksheet

For the Month Ended March 31, 2020

Trial Balance

Account Titles Dr. Cr.

Cash 4,500

Accounts Receivable 3,200

Supplies 2,000

Equipment 11,000

Accumulated Depreciation—Equipment 1,250

Accounts Payable 2,500

Unearned Service Revenue 550

Owner’s Capital 12,900

Owner’s Drawings 1,100

Service Revenue 6,300

Salaries and Wages Expense 1,300

Miscellaneous Expense 400

23,500 23,500

Other data:

1. A physical count reveals only $480 of roofing supplies on hand.

2. Depreciation for March is $250.

3. Unearned revenue amounted to $260 at March 31.

4. Accrued salaries are $700.

Instructions

a. Adjusted trial balance a. Enter the trial balance on a worksheet and complete the worksheet.

$24,450 b. Prepare an income statement and owner’s equity statement for the month of March and a classified bal-

b. Net income $2,420 ance sheet at March 31. T. Warren made an additional investment in the business of $10,000 in March.

Total assets $17,680 c. Journalize the adjusting entries from the adjustments columns of the worksheet.

d. Journalize the closing entries from the financial statement columns of the worksheet.

Complete worksheet; prepare finan- P4.2A (LO 1, 2, 4) Financial Statement The adjusted trial balance columns of the worksheet for

cial statements, closing entries, and Nguyen Company, owned by C. Nguyen, are as follows.

post-closing trial balance.

Nguyen Company

GLS Worksheet

For the Year Ended December 31, 2020

Adjusted

Account Trial Balance

No. Account Titles Dr. Cr.

101 Cash 5,300

112 Accounts Receivable 10,800

126 Supplies 1,500

130 Prepaid Insurance 2,000

157 Equipment 27,000

158 Accumulated Depreciation—Equipment 5,600

200 Notes Payable 15,000

201 Accounts Payable 6,100

212 Salaries and Wages Payable 3,600

230 Interest Payable 600

301 Owner’s Capital 13,000

306 Owner’s Drawings 7,600

400 Service Revenue 61,000

610 Advertising Expense 9,000

631 Supplies Expense 4,000

711 Depreciation Expense 5,600

722 Insurance Expense 3,500

726 Salaries and Wages Expense 28,000

905 Interest Expense 600

Totals 104,900 104,900

You might also like

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Jose Calves Realty Year-End Adjustments and Financial StatementsDocument2 pagesJose Calves Realty Year-End Adjustments and Financial StatementsMariecris BatasNo ratings yet

- Module 4 - Problem 5Document1 pageModule 4 - Problem 5Lycksele RodulfaNo ratings yet

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Adjusted Trial BalanceDocument2 pagesAdjusted Trial BalanceJerrica Rama100% (1)

- Guabna Aldyn Bookkeeping TransactionsDocument40 pagesGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- Problem 5-1 PDFDocument1 pageProblem 5-1 PDFJaira AsuncionNo ratings yet

- ANALYZING BUSINESS TRANSACTIONSDocument3 pagesANALYZING BUSINESS TRANSACTIONSPhaelyn YambaoNo ratings yet

- Cash Flow AssignmentDocument39 pagesCash Flow AssignmentMUHAMMAD HASSANNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Holy Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Document3 pagesHoly Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Haries Vi Traboc Micolob100% (1)

- Accounting adjustments impact financial statementsDocument6 pagesAccounting adjustments impact financial statementsLoey ParkNo ratings yet

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Book Answers BalanceDocument9 pagesBook Answers BalanceIza Valdez100% (1)

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Financial Preparation For Entrepreneurial VenturesDocument37 pagesFinancial Preparation For Entrepreneurial VenturesCzarina MichNo ratings yet

- Santos ChaDocument18 pagesSantos ChaSANTOS, CHARISH ANNNo ratings yet

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- Neo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleDocument17 pagesNeo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleGina Calling Danao100% (1)

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDocument2 pagesRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNo ratings yet

- CFAS Notes Chapter 2 ObjectivesDocument5 pagesCFAS Notes Chapter 2 ObjectivesKhey KheyNo ratings yet

- Adjusting Entries Discussion and SolutionDocument6 pagesAdjusting Entries Discussion and SolutionGarp BarrocaNo ratings yet

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1Mary Joy CabilNo ratings yet

- Prepare Merchandising AdjustmentsDocument2 pagesPrepare Merchandising AdjustmentsDesirre TransonaNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Question: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingDocument2 pagesQuestion: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingKen SannNo ratings yet

- ACCTGDocument2 pagesACCTGGrace Anne AlaptoNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- ANSWER KEY Adjustments Quiz 2Document6 pagesANSWER KEY Adjustments Quiz 2Christine Mae BurgosNo ratings yet

- Perpetual BowmanDocument19 pagesPerpetual BowmanEric AntonioNo ratings yet

- 03 - Partnership DissolutionDocument38 pages03 - Partnership DissolutionDonise Ronadel SantosNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document8 pagesFinancial Accounting and Reporting: Exercise 1Lenneth Mones0% (1)

- General Leger Cleaning Business FinancialsDocument3 pagesGeneral Leger Cleaning Business FinancialsAriel Palay100% (1)

- Complete Cycle Servicing Graded ActivityDocument13 pagesComplete Cycle Servicing Graded ActivityZPadsNo ratings yet

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- Adjusting Entries Prob 3 4Document4 pagesAdjusting Entries Prob 3 4Jasmine ActaNo ratings yet

- Bhebu Lero TransactionDocument5 pagesBhebu Lero TransactionLeo Marbeda FeigenbaumNo ratings yet

- Accounting Assignment 3Document2 pagesAccounting Assignment 3aira mikaela ruazolNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationJules AguilarNo ratings yet

- Maximizing Income from Two Part-Time Jobs with Simplex MethodDocument21 pagesMaximizing Income from Two Part-Time Jobs with Simplex MethodJohn Rovic GamanaNo ratings yet

- CLBS Financial Statement 1Document6 pagesCLBS Financial Statement 1Peter Cranzo MeisterNo ratings yet

- CH 10 - Special and Combo Journals and Voucher SysDocument41 pagesCH 10 - Special and Combo Journals and Voucher SysJem Bobiles100% (1)

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- 6 Adjusting Entry For Depreciation ExpenseDocument3 pages6 Adjusting Entry For Depreciation Expenseapi-299265916No ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Wawa Trading EditedDocument22 pagesWawa Trading EditedAngela Dane JavierNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Brief History of Accounting Profession in The PhilippinesDocument3 pagesBrief History of Accounting Profession in The PhilippinesWest AfricaNo ratings yet

- PAS 12 INCOME TAXES Cont With ProbsDocument8 pagesPAS 12 INCOME TAXES Cont With ProbsFabrienne Kate Eugenio LiberatoNo ratings yet

- INTGR TAX 005 Compensation IncomeDocument5 pagesINTGR TAX 005 Compensation IncomeZatsumono YamamotoNo ratings yet

- Teresita Buenaflor Shoes Financial Statement AnalysisDocument25 pagesTeresita Buenaflor Shoes Financial Statement AnalysisMary Ingrid Arellano RabulanNo ratings yet

- CfasDocument32 pagesCfasLouiseNo ratings yet

- AssignmentDocument16 pagesAssignmentSABORDO, MA. KRISTINA COLEENNo ratings yet

- 2 Abm Fabm2 12 W2 3 Melc 4 1Document9 pages2 Abm Fabm2 12 W2 3 Melc 4 1Rializa Caro BlanzaNo ratings yet

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceGraciella Marie SorrenoNo ratings yet

- Effects of Transactions for Zabeth Rosales Freight ServicesDocument1 pageEffects of Transactions for Zabeth Rosales Freight ServicesHessiel Mae Jumalon Garcines100% (1)

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Continuing Case 4-51 - Cookie Creations FinancialsDocument1 pageContinuing Case 4-51 - Cookie Creations FinancialsTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Ethics Case: © Leungchopan/ ShutterstockDocument1 pageEthics Case: © Leungchopan/ ShutterstockTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Completing the Accounting Cycle CorrectionsDocument1 pageCompleting the Accounting Cycle CorrectionsTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4-4 CHA PT E R 4 Completing the Accounting CycleDocument1 page4-4 CHA PT E R 4 Completing the Accounting CycleTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- TOPIC 2 - Supply Chain Performance-Achieving Strategic FitDocument53 pagesTOPIC 2 - Supply Chain Performance-Achieving Strategic FitAdolf AcquayeNo ratings yet

- Segmentation & Positioning Analysis (Frooti)Document11 pagesSegmentation & Positioning Analysis (Frooti)debrizz50% (2)

- Victoria Chemicals Part 2Document2 pagesVictoria Chemicals Part 2cesarvirata100% (3)

- Tarea 1 - Ficha Bibliográfica-Hanai KishimotoDocument8 pagesTarea 1 - Ficha Bibliográfica-Hanai KishimotoHanai KishimotoNo ratings yet

- Accounting and Finance Carriculum New (2021)Document172 pagesAccounting and Finance Carriculum New (2021)Abdi Mucee Tube67% (3)

- Accounting 2301 Final Exam ReviewDocument38 pagesAccounting 2301 Final Exam ReviewVusal GahramanovNo ratings yet

- Operating Segment Reporting Key Financial DataDocument19 pagesOperating Segment Reporting Key Financial DataRainNo ratings yet

- Sales Manager Skills ResumeDocument8 pagesSales Manager Skills Resumeafjwftijfbwmen100% (2)

- Sees Candy SchroederDocument15 pagesSees Candy SchroederAAOI2No ratings yet

- Sales Promotion Tools in Financial InstitutionsDocument5 pagesSales Promotion Tools in Financial InstitutionsEditor IJTSRDNo ratings yet

- Dockers Creating A Sub Brand PDFDocument31 pagesDockers Creating A Sub Brand PDFanny alfiantiNo ratings yet

- CEO or Head of Sales & MarketingDocument3 pagesCEO or Head of Sales & Marketingapi-78902079No ratings yet

- Adamodar MkttimingDocument56 pagesAdamodar MkttimingMardiko NumbraNo ratings yet

- Apple's Internal Environment AnalysisDocument5 pagesApple's Internal Environment AnalysisVinabie PunoNo ratings yet

- Break Even Analysis and Decision Making TechniquesDocument15 pagesBreak Even Analysis and Decision Making TechniquesVimal KanthNo ratings yet

- Covisage Case OptionsDocument8 pagesCovisage Case OptionsDivyansh SinghNo ratings yet

- Prima Plastics Initiating Coverage IDBI CapitalDocument12 pagesPrima Plastics Initiating Coverage IDBI CapitalAkhil ParekhNo ratings yet

- CSEC Introductory Math TestDocument3 pagesCSEC Introductory Math TestDKzNo ratings yet

- Commerce XII ISC Sample PaperDocument3 pagesCommerce XII ISC Sample PaperAkshay PandeyNo ratings yet

- Tugas Auditing II - TGL 30 Jan 2021Document2 pagesTugas Auditing II - TGL 30 Jan 2021Fara DinaNo ratings yet

- TitanDocument15 pagesTitanMayur SomaniNo ratings yet

- 6 Piercy Fourth EdDocument28 pages6 Piercy Fourth EdChandolu LeenaamulyaNo ratings yet

- Group 8 Restaurateur (SCM)Document22 pagesGroup 8 Restaurateur (SCM)Bea RamosNo ratings yet

- Subledger Accounting Program ReportDocument67 pagesSubledger Accounting Program Reportsyed kareemappsNo ratings yet

- Chapter14 - Capital Struture in Perfect MarketsDocument15 pagesChapter14 - Capital Struture in Perfect MarketsAntonio Jose DuarteNo ratings yet

- Financial Statements and Ratio AnalysisDocument42 pagesFinancial Statements and Ratio AnalysisMd. Rezwan Hossain Sakib 1711977630No ratings yet

- Channels of DistributionDocument6 pagesChannels of DistributionLakshmi KrishnaswamyNo ratings yet

- Master Budget for Burger BusinessDocument6 pagesMaster Budget for Burger BusinessAsrafia Mim 1813026630No ratings yet

- Y3 - Module 8 - Evaluate The Business1Document7 pagesY3 - Module 8 - Evaluate The Business1Maria Lyn Victoria AbriolNo ratings yet

- APICS CSCP Exam Questions and AnswersDocument14 pagesAPICS CSCP Exam Questions and AnswersAnil MishraNo ratings yet