Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

Uploaded by

Talion0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

4 Completing the Accounting Cycle Part (33)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 page4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Practice Brief Exercises 4-33

the correct reversing entry was made on January 1, the entry on Janu- b. Salaries and Wages Payable $2,000 and Salaries and Wages

ary 8 will result in a credit to Cash $3,800 and the following debit(s): Expense $1,800.

a. Salaries and Wages Payable $1,800 and Salaries and Wages c. Salaries and Wages Expense $3,800.

Expense $2,000. d. Salaries and Wages Payable $3,800.

Solutions 9. c. The proper order of the steps in the accounting cycle is

1. b. The worksheet is a working tool of the accountant; it is not (1) journalize transactions, (2) post to ledger accounts, (3) prepare

distributed to management and other interested parties. The other unadjusted trial balance, and (4) journalize and post adjusting entries.

choices are all true statements. Therefore, choices (a), (b), and (d) are incorrect.

2. c. Net income is entered in the Dr column of the income state- 10. d. This entry causes Cash to be overstated and Supplies to be

ment and the Cr column of the balance sheet. The other choices are understated. Supplies should have been debited (increasing supplies)

incorrect because net income is entered in the (a) Cr (not Dr) column and Cash should have been credited (decreasing cash). The other

of the balance sheet, (b) Dr (not Cr) column of the income statement choices are incorrect because (a) Supplies is understated, not over-

and in the Cr (not Dr) column of the balance sheet, and (d) Dr (not stated; (b) Cash is overstated, not understated; and (c) Cash is over-

Cr) column of the income statement. stated, not understated, and Supplies is understated, not overstated.

3. c. A debit of $120,000 for Equipment would appear in the 11. b. The correcting entry is to debit Accounts Receivable $100

balance sheet column. The other choices are incorrect because and credit Service Revenue $100. The other choices are incorrect

(a) Equipment, less accumulated depreciation of $15,000, would total because (a) Service Revenue should be credited, not debited, and

$105,000 under assets on the balance sheet, not on the worksheet; Accounts Receivable should be debited, not credited; (c) Service

(b) a debit, not credit, for Depreciation Expense would appear in the Revenue should be credited for $100, and Cash should not be in-

income statement column; and (d) a credit, not debit, of $15,000 for cluded in the correcting entry as it was recorded properly; and (d)

Accumulated Depreciation—Equipment would appear in the balance Accounts Receivable should be debited for $100 and Cash should not

sheet column. be included in the correcting entry as it was recorded properly.

4. a. The Service Revenue account will have a zero balance after 12. c. Companies list current assets on balance sheet in the order

closing entries have been journalized and posted because it is a tem- of liquidity: cash, accounts receivable, inventory, and prepaid insur-

porary account. The other choices are incorrect because (b) Supplies, ance. Therefore, choices (a), (b), and (d) are incorrect.

(c) Prepaid Insurance, and (d) Accumulated Depreciation—Equip- 13. c. Long-term investments include long-term assets such as land

ment are all permanent accounts and therefore not closed in the clos- that a company is not currently using in its operating activities. The

ing process. other choices are incorrect because (a) land would be reported as

5. b. The effect of a net loss is a credit to Income Summary and property, plant, and equipment only if it is being currently used in

a debit to Owner’s Capital. The other choices are incorrect because the business; (b) land is an asset, not an expense; and (d) land has

(a) Income Summary is credited, not debited, and Owner’s Capital is physical substance and thus is a tangible property.

debited, not credited; (c) Income Summary is credited, not debited, 14. d. These are the categories usually used in a classified balance

and Owner’s Drawings is not affected; and (d) Owner’s Capital, not sheet. The other choices are incorrect because the categories (a) “long-

Owner’s Drawings, is debited. term assets” and (b) and (c) “tangible assets” are generally not used.

6. c. The correct order is (3) revenues, (1) expenses, (4) income 15. a. Current assets are listed in order of their liquidity, not (b) by

summary, and (2) drawings. Therefore, choices (a), (b), and (d) are importance, (c) by longevity, or (d) alphabetically.

incorrect.

*16. c. The use of reversing entries simplifies the recording of the

7. a. Permanent accounts appear in the post-closing trial balance. first payroll following the end of the year by eliminating the need

The other choices are incorrect because (b) temporary accounts and to make an entry to the Salaries and Wages Payable account. The

(c) income statement accounts are closed to a zero balance and are other choices are incorrect because (a) Salaries and Wages Payable

therefore not included in the post-closing trial balance. Choice (d) is is not part of the payroll entry on January 8, and the debit to Salaries

wrong as there is only one correct answer for this question. and Wages Expense should be for $3,800, not $2,000; and (b) and

8. d. Preparing a worksheet is not a required step in the accounting (d) the Salaries and Wages Expense account, not the Salaries and

cycle. The other choices are all required steps in the accounting cycle. Wages Payable account, should be debited.

Practice Brief Exercises

1. (LO 2) The ledger of Quintana Company contains the following balances: Owner’s Capital Prepare closing entries from ledger

$40,000, Owner’s Drawings $3,000, Service Revenue $65,000, Salaries and Wages Expense $39,000, balances.

and Maintenance and Repairs Expense $9,000. Prepare the closing entries at December 31.

You might also like

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- IFRS Practice: IFRS Self-Test QuestionsDocument1 pageIFRS Practice: IFRS Self-Test QuestionsTalionNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Karakteristik Uang Elektronik Dalam Sistem PembayaranDocument33 pagesKarakteristik Uang Elektronik Dalam Sistem PembayaranDicky KurniawanNo ratings yet

- Final Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Document7 pagesFinal Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Sarath SarathkumarNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryMark Kevin IIINo ratings yet

- Loan Pricing 916Document22 pagesLoan Pricing 916Gonçalo MadalenoNo ratings yet

- Pdfmergerfreecom NCFM Modules Study Material PDF Free Download DerivativescompressDocument1 pagePdfmergerfreecom NCFM Modules Study Material PDF Free Download DerivativescompressAmitabh Bachhan0% (1)

- Loan CalculatorDocument6 pagesLoan CalculatorAbegail habalNo ratings yet

- Porter's Five Forces Model ReferenceDocument3 pagesPorter's Five Forces Model ReferenceKumardeep SinghaNo ratings yet

- Cash and Cash Equivalent QuizDocument3 pagesCash and Cash Equivalent QuizApril Rose Sobrevilla DimpoNo ratings yet

- Pet Insurance: Because Pets Are Family TooDocument10 pagesPet Insurance: Because Pets Are Family ToomeeraNo ratings yet

- Memorandum HDFC Bank PDFDocument7 pagesMemorandum HDFC Bank PDFrutuja_93No ratings yet

- ScamDocument21 pagesScamPratik TiwariNo ratings yet

- FCA Approach Payment Services Electronic Money 2017Document238 pagesFCA Approach Payment Services Electronic Money 2017CrowdfundInsiderNo ratings yet

- Manufacturing Accounts - Extra Questions - A LevelDocument6 pagesManufacturing Accounts - Extra Questions - A LevelMUSTHARI KHANNo ratings yet

- PGPM 2023 Time Value Problem Set v1.2Document20 pagesPGPM 2023 Time Value Problem Set v1.2Jayanth DeshmukhNo ratings yet

- Flat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarDocument1 pageFlat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarSatvant Singh SarwaraNo ratings yet

- Bill of Supply: (Figures in:INR)Document1 pageBill of Supply: (Figures in:INR)Swati MishraNo ratings yet

- Horngrens Financial Accounting 8Th Edition Nobles Solutions Manual Full Chapter PDFDocument50 pagesHorngrens Financial Accounting 8Th Edition Nobles Solutions Manual Full Chapter PDFaddorsedmeazel1exjvs100% (10)

- Monetise Your Idle Asset To Fund Your SuccessDocument7 pagesMonetise Your Idle Asset To Fund Your Successrenugadevi_dNo ratings yet

- Co-Operative Banks Identity Through Brand Building: Presented By: Presented byDocument10 pagesCo-Operative Banks Identity Through Brand Building: Presented By: Presented byRajiv ChoudharyNo ratings yet

- Investor Perception On Investment AvenuesDocument55 pagesInvestor Perception On Investment AvenuesVenkatrao Vargani100% (1)

- Global Universal Banking: Investment PortalDocument6 pagesGlobal Universal Banking: Investment Portaledwin100% (1)

- Xii Mcqs CH - 4 Change in PSRDocument4 pagesXii Mcqs CH - 4 Change in PSRJoanna GarciaNo ratings yet

- CFI 10 Problems With SolutionsDocument4 pagesCFI 10 Problems With SolutionsPola PolzNo ratings yet

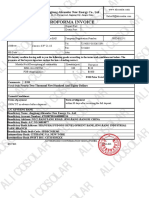

- Alicosolar Proforma Invoice For AS450WDocument1 pageAlicosolar Proforma Invoice For AS450WAngie GuerreroNo ratings yet

- Level III of CFA Program Mock Exam 1 - Solutions (PM)Document46 pagesLevel III of CFA Program Mock Exam 1 - Solutions (PM)Lê Chấn PhongNo ratings yet

- Iop HDFC LTDDocument72 pagesIop HDFC LTDSimreen HuddaNo ratings yet

- AmsaiDocument1 pageAmsaiDidi MiiraNo ratings yet

- Auditing 1Document9 pagesAuditing 1Vanessa BatallaNo ratings yet

- PCE Trial Exam 1Document55 pagesPCE Trial Exam 1Kenny Chen68% (22)