Professional Documents

Culture Documents

4 Completing The Accounting Cycle Part

Uploaded by

TalionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Completing The Accounting Cycle Part

Uploaded by

TalionCopyright:

Available Formats

Appendix 4A: Reversing Entries 4-29

Appendix 4A Reversing Entries

LEARNING OBJECTIVE *5

Prepare reversing entries.

After preparing the financial statements and closing the books, it is often helpful to reverse some

of the adjusting entries before recording the regular transactions of the next period. Such entries

are reversing entries. Companies make a reversing entry at the beginning of the next ac-

counting period. Each reversing entry is the exact opposite of the adjusting entry made in the

previous period. The recording of reversing entries is an optional step in the accounting cycle.

The purpose of reversing entries is to simplify the recording of a subsequent transaction related

to an adjusting entry. For example, in Chapter 3, the payment of salaries after an adjusting entry

resulted in two debits: one to Salaries and Wages Payable and the other to Salaries and Wages

Expense. With reversing entries, the company can debit the entire subsequent payment to Salaries

and Wages Expense. The use of reversing entries does not change the amounts reported in the

financial statements. What it does is simplify the recording of subsequent transactions.

Reversing Entries Example

Companies most often use reversing entries to reverse two types of adjusting entries: accrued

revenues and accrued expenses. To illustrate the optional use of reversing entries for accrued

expenses, we will use the salaries expense transactions for Pioneer Advertising as illustrated

in Chapters 2, 3, and 4. The transaction and adjustment data are as follows.

1. October 26 (initial salary entry): Pioneer pays $4,000 of salaries and wages earned

between October 15 and October 26.

2. October 31 (adjusting entry): Salaries and wages earned between October 29 and October 31

are $1,200. The company will pay these in the November 9 payroll.

3. November 9 (subsequent salary entry): Salaries and wages paid are $4,000. Of this

amount, $1,200 applied to accrued salaries and wages payable and $2,800 was earned

between November 1 and November 9.

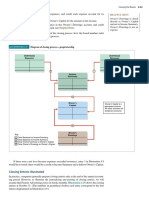

Illustration 4A.1 shows the entries with and without reversing entries.

ILLUSTRATION 4A.1 Comparative entries—without and with reversing

Without Reversing Entries With Reversing Entries

(per chapter) (per appendix)

Initial Salary Entry Initial Salary Entry

Oct. 26 Salaries and Wages Expense 4,000 Oct. 26 (Same entry)

Cash 4,000

Adjusting Entry Adjusting Entry

Oct. 31 Salaries and Wages Expense 1,200 Oct. 31 (Same entry)

Salaries and Wages Payable 1,200

Closing Entry Closing Entry

Oct. 31 Income Summary 5,200 Oct. 31 (Same entry)

Salaries and Wages Expense 5,200

Reversing Entry Reversing Entry

Nov. 1 No reversing entry is made. Nov. 1 Salaries and Wages Payable 1,200

Salaries and Wages Expense 1,200

Subsequent Salary Entry Subsequent Salary Entry

Nov. 9 Salaries and Wages Payable 1,200 Nov. 9 Salaries and Wages Expense 4,000

Salaries and Wages Expense 2,800 Cash 4,000

Cash 4,000

You might also like

- Poa Week 7 Lecture - Problem No 4.4aDocument13 pagesPoa Week 7 Lecture - Problem No 4.4aSaad Khan67% (3)

- Pretty Women Beauty Salon Financial StatementsDocument9 pagesPretty Women Beauty Salon Financial Statementsalta100% (2)

- Managerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreDocument35 pagesManagerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreRAHUL SINGHNo ratings yet

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDocument5 pagesP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesRisky Fernando67% (3)

- Static and Flexible Budget ExampleDocument12 pagesStatic and Flexible Budget ExampleAFSYARINA BT ZUNAIDI50% (2)

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDocument7 pagesP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDidan EnricoNo ratings yet

- Financial Accounting: Completing The Accounting CycleDocument82 pagesFinancial Accounting: Completing The Accounting CycleIsmadth2918388No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- ACEF APPLICATION FormDocument2 pagesACEF APPLICATION FormDaniel Mirabel100% (3)

- PPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementDocument15 pagesPPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementMohanapriya JayakumarNo ratings yet

- Completing the accounting cycleDocument1 pageCompleting the accounting cycleTalionNo ratings yet

- ACCT 2211 Assignment 2Document17 pagesACCT 2211 Assignment 2Tannaz SNo ratings yet

- In The Harvested in July. He Flexib For Below:: My Work Link ReferencesDocument8 pagesIn The Harvested in July. He Flexib For Below:: My Work Link ReferencesRizquita DhindaNo ratings yet

- Accounting W 4Document39 pagesAccounting W 4whitneykarundeng08No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- Addams&Family IncDocument16 pagesAddams&Family IncKim KoalaNo ratings yet

- Prepare financial statements and adjusting entries for Warren RoofingDocument8 pagesPrepare financial statements and adjusting entries for Warren RoofingJulian Lukman SimbolonNo ratings yet

- Assess II Act CreatingDocument15 pagesAssess II Act CreatingBrian GoNo ratings yet

- Post Closing Trial Balance AdjustmentsDocument4 pagesPost Closing Trial Balance AdjustmentsDonna Lyn BoncodinNo ratings yet

- CH 04Document6 pagesCH 04Rabie Haroun0% (1)

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Recording Business Transactions IllustratedDocument3 pagesRecording Business Transactions IllustratedCem KaradumanNo ratings yet

- Risa Khoirun Nisa Akt3j - Tugas Akuntansi Menengah 2Document1 pageRisa Khoirun Nisa Akt3j - Tugas Akuntansi Menengah 2risanisaNo ratings yet

- BHN Ajar Samone Equipment Repair Inc - TBafte Adj - FIn StatementsDocument32 pagesBHN Ajar Samone Equipment Repair Inc - TBafte Adj - FIn StatementsKevin FernandaNo ratings yet

- Accounting Information System Chapter 3Document12 pagesAccounting Information System Chapter 3NABILAH KHANSA 1911000089No ratings yet

- 16 - Accounting 4 Non-Trading ConcernsDocument17 pages16 - Accounting 4 Non-Trading ConcernsKAMAL POKHRELNo ratings yet

- Actual Revenues - Flexible Budget Revenues Revenue Variances Actual Cost - Flexible Budget Costs Spending VariancesDocument1 pageActual Revenues - Flexible Budget Revenues Revenue Variances Actual Cost - Flexible Budget Costs Spending VariancesConsumer DigitalProductNo ratings yet

- Accounting Homework AdjustmentsDocument5 pagesAccounting Homework AdjustmentsHasan NajiNo ratings yet

- Accounting Answer SheetDocument9 pagesAccounting Answer SheetHamid AliNo ratings yet

- Chapter 3 Adjusting The Accounts Chloe WuDocument10 pagesChapter 3 Adjusting The Accounts Chloe WuGebeyehu BezabehNo ratings yet

- Closing Entries, Post-Closing Trial BalanceDocument6 pagesClosing Entries, Post-Closing Trial BalanceJaye Ruanto100% (1)

- Ch 6 Problems 1-8 Adjusting EntriesDocument3 pagesCh 6 Problems 1-8 Adjusting EntriesMa Ginalyn Parreño PelaezNo ratings yet

- At 4Document4 pagesAt 4Thùy NguyễnNo ratings yet

- Instructions: Derive Adjusting Entries From Worksheet DataDocument1 pageInstructions: Derive Adjusting Entries From Worksheet DataTalionNo ratings yet

- 6 Completion of Accounting Cycle UDDocument28 pages6 Completion of Accounting Cycle UDERICK MLINGWANo ratings yet

- Journal EntryDocument9 pagesJournal Entrytrisha joy de laraNo ratings yet

- Quicky Profit and LossDocument1 pageQuicky Profit and LossBea GarciaNo ratings yet

- (A) Basic Analysis (B) Debit-Credit AnalysisDocument4 pages(A) Basic Analysis (B) Debit-Credit AnalysisAjay DesaleNo ratings yet

- Wheal Loader Pre Operating Costs Office Equipments Salary Office Rent Fuel & Lubricants Utilities Others Total InvestmentDocument16 pagesWheal Loader Pre Operating Costs Office Equipments Salary Office Rent Fuel & Lubricants Utilities Others Total InvestmentEmebet TesemaNo ratings yet

- Issued StockDocument17 pagesIssued Stockapi-16021729No ratings yet

- Presented Below Is The Trial Balance and Adjusted Trial Balance For Matsui Company On December 31Document2 pagesPresented Below Is The Trial Balance and Adjusted Trial Balance For Matsui Company On December 31Vikram Kumar100% (1)

- Accounting principles trial balanceDocument28 pagesAccounting principles trial balanceqasimtenNo ratings yet

- Chapter 3 Practice KEYDocument19 pagesChapter 3 Practice KEYmartinmuebejayiNo ratings yet

- Financial Statements (Ch1)Document8 pagesFinancial Statements (Ch1)許妤君No ratings yet

- Noel A. Bergonia's Accounting Cycle and Financial StatementsDocument15 pagesNoel A. Bergonia's Accounting Cycle and Financial StatementsClarissa Rivera VillalobosNo ratings yet

- Abc Company Unadjusted Trial Balance MARCH 31. 2014 Debit CreditDocument3 pagesAbc Company Unadjusted Trial Balance MARCH 31. 2014 Debit CreditCarmina DongcayanNo ratings yet

- Adjustment of Financial StatementDocument33 pagesAdjustment of Financial StatementAlish BaNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- CH 04Document46 pagesCH 04martinus linggoNo ratings yet

- Chapter 4Document20 pagesChapter 4chanreaksmeytepNo ratings yet

- PA1-Sesi 5 (Worksheet Dan LK)Document16 pagesPA1-Sesi 5 (Worksheet Dan LK)Qeis HabitNo ratings yet

- Chapter No 2 Financial StatementsDocument54 pagesChapter No 2 Financial StatementsFarhat Ullah KhanNo ratings yet

- The Matching Concept and the Adjusting ProcessDocument55 pagesThe Matching Concept and the Adjusting ProcessSara LoganNo ratings yet

- Class No - 10,11 & 12Document27 pagesClass No - 10,11 & 12WILD๛SHOTッ tanvirNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- January 31: Birendra Mahato Adjusting Entries and WorksheetDocument17 pagesJanuary 31: Birendra Mahato Adjusting Entries and WorksheetAjit UpretyNo ratings yet

- Chapter 8 Bsa01 LectureDocument12 pagesChapter 8 Bsa01 LectureImogen EveNo ratings yet

- CH-4: Completing The Accounting Cycle: Using A WorksheetDocument18 pagesCH-4: Completing The Accounting Cycle: Using A WorksheetMohammed Merajul IslamNo ratings yet

- Lect 4 Completing Accounting CycleDocument40 pagesLect 4 Completing Accounting Cyclejoeltan111No ratings yet

- Topic 4 - Adjusting Accounts and Preparing Financial StatementsDocument18 pagesTopic 4 - Adjusting Accounts and Preparing Financial Statementsapi-388504348100% (1)

- Principles of Accounts I Lesson Four Completing The Accounting CycleDocument9 pagesPrinciples of Accounts I Lesson Four Completing The Accounting CycleStephan Mpundu (T4 enick)No ratings yet

- Consultant Bill Format: Template#: c4127 Title: Consultant Bill Format Category: Download This Template in Excel FormatDocument2 pagesConsultant Bill Format: Template#: c4127 Title: Consultant Bill Format Category: Download This Template in Excel Formatsantoshs2002848No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Corruption Perception Index: Continuous Decline Triggers Concern TIDocument2 pagesCorruption Perception Index: Continuous Decline Triggers Concern TITalionNo ratings yet

- Planet HealthDocument12 pagesPlanet HealthTalionNo ratings yet

- Continuing Case 4-51 - Cookie Creations FinancialsDocument1 pageContinuing Case 4-51 - Cookie Creations FinancialsTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Ethics Case: © Leungchopan/ ShutterstockDocument1 pageEthics Case: © Leungchopan/ ShutterstockTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Completing the Accounting Cycle CorrectionsDocument1 pageCompleting the Accounting Cycle CorrectionsTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4-4 CHA PT E R 4 Completing the Accounting CycleDocument1 page4-4 CHA PT E R 4 Completing the Accounting CycleTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Hallmark ScamDocument3 pagesHallmark ScamMiltu TalukderNo ratings yet

- June 2017Document599 pagesJune 2017Asif sheikhNo ratings yet

- THESISDocument62 pagesTHESISBetelhem EjigsemahuNo ratings yet

- PWC Talent Mobility 2020Document36 pagesPWC Talent Mobility 2020amulya_malleshNo ratings yet

- ProdmixDocument10 pagesProdmixLuisAlfonsoFernándezMorenoNo ratings yet

- Credit Card PresentationDocument24 pagesCredit Card Presentationpradeep367380% (5)

- Unit 1: Entrepreneurship - RevisedDocument53 pagesUnit 1: Entrepreneurship - Revisedmms66No ratings yet

- Affidavit - SampleDocument3 pagesAffidavit - Sampleqandaadvisory2No ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- Bank QuestionsDocument23 pagesBank QuestionsAlthea Lyn ReyesNo ratings yet

- fINAL REPORT - ONLINE PROJECTDocument64 pagesfINAL REPORT - ONLINE PROJECTNitika Kapil Kathuria100% (4)

- Translate-BSG Quiz 1Document2 pagesTranslate-BSG Quiz 1franky mNo ratings yet

- International Trade 3rd Edition Feenstra Test BankDocument47 pagesInternational Trade 3rd Edition Feenstra Test BankMichaelRothpdytk100% (16)

- Investors Preference in Commodities MarketDocument8 pagesInvestors Preference in Commodities MarketSundar RajNo ratings yet

- Quote 023Document1 pageQuote 023Matthew LeeNo ratings yet

- FincourseDocument6 pagesFincoursebrandonxstarkNo ratings yet

- Security Market IndicesDocument9 pagesSecurity Market IndicesSyed Arham MurtazaNo ratings yet

- IIMB Vista Prodigy 2021 CaseDocument2 pagesIIMB Vista Prodigy 2021 CasedannyNo ratings yet

- Llegado-Chapter 1Document13 pagesLlegado-Chapter 1Mary LlegadoNo ratings yet

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet

- (Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Document4 pages(Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Angel Beluso DumotNo ratings yet

- Exemplu Big BathDocument16 pagesExemplu Big BathValentin BurcaNo ratings yet

- Executive Order - 11110 President John F Kennedy and The Federal ReserveDocument5 pagesExecutive Order - 11110 President John F Kennedy and The Federal Reservein1or100% (5)

- Advanced Accounting RTP N21Document39 pagesAdvanced Accounting RTP N21Harshwardhan PatilNo ratings yet

- SEIU 2021 Financial DisclosuresDocument294 pagesSEIU 2021 Financial DisclosuresLaborUnionNews.comNo ratings yet

- Manish Gupta: Presented byDocument20 pagesManish Gupta: Presented byManish GuptaNo ratings yet