Professional Documents

Culture Documents

Financial Analysis

Uploaded by

davewag0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

financial-analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesFinancial Analysis

Uploaded by

davewagCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Financial Analysis

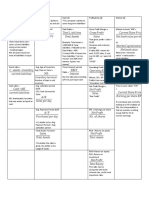

Links Between Financial Statements Solvency Ratios ROA (Dupont Chart)

Times Interest Earned = Net Income + Interest

Exp. +Tax Exp. / Interest Exp.

Shows the firm’s ability to pay the cost of

financing

Debt-to-Equity Ratio = Total Liabilities /

Shareholder's Equity

Proportion of debt for each “dollar” invested by

shareholders

Balance Sheet

SCF

Liquidity Ratios

Current Ratio = Current Assets / Current

Liabilities

Ability of the firm to cover its short term debts

Quick Ratio = Cash + cash equiv + receivables

/ Curent Liabilities

Ability of the firm to cover its immediate short

term debts

Cash Ratio = Cash + Cash Equivalents / Curent Structure of Income Statement

Liabilities Income Statement

Measures cash available to pay short term

Profit Net % of each “dollar” of

debts

Margin = Income / sales that remains as

Working capital :

Sales net income.

Margin of safety to pay current obligations

Revenue

Current assets – current liabilities

Quality Cash Flow Compares the cash

of from flows earned (real) to

FCF

Income Operating net income declared

Free Cash Flow for a project or a firm: = Activities / (accounting

= Earnings Before Interest and Taxes (EBIT) Net principles!)

x (1- tax rate) Income Return on Asset Ratios

+ Depreciation

Fixed Net Sales Shows the ability of

- Changes in working capital (without cash) Profit Margin = EBIT x (1-tax) / Net Sales

Assets Revenue / the firm to use its

- Replacement Investments (Capex) Asset Turnover = Net Sales / Average Assets

Turnover Average fixed assets to

(+ Receipt from asset sale) ROA

= Net Fixed generate revenue.

(Note: you can also get free cash flows from = Profit margin x Asset turnover

Assets

operating cash flows + investing cash flows – = EBIT x (1-tax) / Average Assets

Return Net How much income ROCE (return on capital employed) = EBIT x (1

interest (1-tax%) and adjustment for

on Income / was earned for every – tax) / Capital Employed

dividends).

Equity = Average “dollar” invested by Capital employed

Shareholde owners? = Total assets – short term liabilities OR

rs’ Equity = Long term liabilities + Equity

Financial leverage: ROE – ROA

Shows the relationship between the return on

assets (all forms of funding) and the return on

equity (only shareholder’s investment).

Should be positive (indicates that the company

creates a bigger return than the cost of

borrowing).

Financial Analysis

Return on Asset Ratios (cont)

When return on capital employed is more than the expected

return on investment => Value Creation

Investor Ratios

EPS = Net Income* /Average Number of Shares

Outstanding For The Period

Measures return on investment for shareholders.

*If there are preferred dividends, the amount is subtracted

from net income.

Price-to-earnings ratio = Current Market Price Per Share /

Earnings Per Share

Measures the relationship between the current share price

and the earnings per share. Indicates market expectations.

You might also like

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- TIFA CheatSheet MM X MLDocument10 pagesTIFA CheatSheet MM X MLCorina Ioana BurceaNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- Ratio Analysis: ROA (Profit Margin Asset Turnover)Document5 pagesRatio Analysis: ROA (Profit Margin Asset Turnover)Shahinul KabirNo ratings yet

- Accounting KpisDocument6 pagesAccounting KpisHOCININo ratings yet

- ACCCDocument6 pagesACCCAynalem KasaNo ratings yet

- SOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateDocument2 pagesSOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateRahul KapurNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalSales ExecutiveNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- Level 1 Assessment Financial Analysis ProdegreeDocument4 pagesLevel 1 Assessment Financial Analysis ProdegreePrá ChîNo ratings yet

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- 07_Fundamentals-of-Financial-Reporting_1Document8 pages07_Fundamentals-of-Financial-Reporting_1Bala VigneshNo ratings yet

- Updated FSA Ratio SheetDocument4 pagesUpdated FSA Ratio Sheetmoussa toureNo ratings yet

- Accounting RatiosDocument9 pagesAccounting RatiosRonnie Vond McRyttsson MudyiwaNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- Ratio Analysis: A Guide to Financial Statement RatiosDocument13 pagesRatio Analysis: A Guide to Financial Statement Ratiosmuralib4u5No ratings yet

- Finance Quick Reference GuideDocument16 pagesFinance Quick Reference GuideNathalia Montoya DiazNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- Chapter 3Document8 pagesChapter 3NHƯ NGUYỄN LÂM TÂMNo ratings yet

- FM Formulae SheetDocument4 pagesFM Formulae Sheetatishayjjj123No ratings yet

- Ratio Analysis DuPont AnalysisDocument7 pagesRatio Analysis DuPont Analysisshiv0308No ratings yet

- Ratios Notes and ProblemDocument6 pagesRatios Notes and ProblemAniket WaneNo ratings yet

- Financial Ratios Cheat SheetDocument1 pageFinancial Ratios Cheat SheetRichie VeeNo ratings yet

- ROE and ROA Ratios For Accounting SummaryDocument3 pagesROE and ROA Ratios For Accounting SummarymyzevelNo ratings yet

- Accounting For ManagersDocument14 pagesAccounting For ManagersHimanshu Upadhyay AIOA, NoidaNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Ratio FormulaeDocument3 pagesRatio FormulaeNandhaNo ratings yet

- Chapter 3 Financial Statment and AnalysisDocument7 pagesChapter 3 Financial Statment and AnalysisSusan ThapaNo ratings yet

- Finman Formulas ExplainedDocument11 pagesFinman Formulas ExplainedArnelli GregorioNo ratings yet

- Current RatioDocument2 pagesCurrent RatioRujean Salar AltejarNo ratings yet

- Formula Sheet - Finance - VTDocument11 pagesFormula Sheet - Finance - VTmariaajudamariaNo ratings yet

- Valuation Methods Financial RatiosDocument9 pagesValuation Methods Financial RatiosJacinta Fatima ChingNo ratings yet

- Financial Ratios ExplainedDocument2 pagesFinancial Ratios ExplainedhaleeNo ratings yet

- Ratios PDFDocument1 pageRatios PDFSayan AcharyaNo ratings yet

- Financial Ratio Formulas and Their SignificanceDocument2 pagesFinancial Ratio Formulas and Their SignificanceSierraNo ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Assets Beta, β: Acid testDocument28 pagesAssets Beta, β: Acid testAdrianaNo ratings yet

- Accounting RatiosDocument17 pagesAccounting RatiosVijayKapoorNo ratings yet

- Financial Statement and Cash Flow AnalysisDocument6 pagesFinancial Statement and Cash Flow AnalysisSandra MoussaNo ratings yet

- Financial Ratios: I. ProfitabilityDocument2 pagesFinancial Ratios: I. ProfitabilityJose Francisco TorresNo ratings yet

- ACT. 1 FINANCIAL RATIOS - EllorimoDocument3 pagesACT. 1 FINANCIAL RATIOS - EllorimoEra EllorimoNo ratings yet

- Cách Tính Ratios Của OCBDocument6 pagesCách Tính Ratios Của OCBTrình LimboNo ratings yet

- Financial Ratios at A GlanceDocument8 pagesFinancial Ratios at A Glance365 Financial AnalystNo ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- HO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Document28 pagesHO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Saud HidayatullahNo ratings yet

- Edited Formula SheetDocument2 pagesEdited Formula Sheetlinhngo.31221020350No ratings yet

- AccountingDocument2 pagesAccountingMarvin kakindaNo ratings yet

- Financial Ratios FormulaDocument4 pagesFinancial Ratios FormulaKamlesh SinghNo ratings yet

- The Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysisDocument19 pagesThe Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio Analysiskowsalya18No ratings yet

- Financial Statements As A Management ToolDocument20 pagesFinancial Statements As A Management TooldavidimolaNo ratings yet

- Ratio Analysis:: Liquidity Measurement RatiosDocument8 pagesRatio Analysis:: Liquidity Measurement RatiossammitNo ratings yet

- Financial_Analysis_Cheat_Sheet_1709070577Document2 pagesFinancial_Analysis_Cheat_Sheet_1709070577herrerofrutosNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Unit 5Document14 pagesUnit 5Shona KhuranaNo ratings yet

- Handbook of Fixed Income Money Market and Derivatives Association of India FimmdaDocument88 pagesHandbook of Fixed Income Money Market and Derivatives Association of India FimmdaPoornima Solanki100% (1)

- Assignment 1 - SWOT AnalysisDocument8 pagesAssignment 1 - SWOT AnalysisNiswarth TolaNo ratings yet

- Miner R. Form and Pattern As A Trading Tool 1991Document9 pagesMiner R. Form and Pattern As A Trading Tool 1991Om PrakashNo ratings yet

- Cayleigh Horan: Cashier/SalespersonDocument2 pagesCayleigh Horan: Cashier/Salespersonapi-581663708No ratings yet

- BED2206 VIRTUAL CATS INTERMEDIATE MICRO ECONOMICS AnnieDocument5 pagesBED2206 VIRTUAL CATS INTERMEDIATE MICRO ECONOMICS AnniecyrusNo ratings yet

- Marketing Budget Plan TemplateDocument7 pagesMarketing Budget Plan TemplateIvanNo ratings yet

- Tarjeta de Credito y DebitoDocument19 pagesTarjeta de Credito y DebitoviaraNo ratings yet

- Reliance Mutual Fund Scheme Portfolio Holdings February 2013Document280 pagesReliance Mutual Fund Scheme Portfolio Holdings February 2013luvisfact7616No ratings yet

- Product and Brand Management ConceptsDocument4 pagesProduct and Brand Management Conceptsdiasjoy67No ratings yet

- Baseline ReportDocument201 pagesBaseline ReportBrian SamanyaNo ratings yet

- Corporate GovernanceDocument16 pagesCorporate GovernancePreeti YadavNo ratings yet

- Barilla Pasta's Rise to Global Leadership Through Effective MarketingDocument5 pagesBarilla Pasta's Rise to Global Leadership Through Effective MarketingKennedy Gitonga ArithiNo ratings yet

- Government BondDocument28 pagesGovernment BondLotusNuruzzamanNo ratings yet

- Presentation On: Bata - Marketing StrategiesDocument19 pagesPresentation On: Bata - Marketing StrategiesrohanimwhtimNo ratings yet

- 219 488 1 PBDocument9 pages219 488 1 PBSurya AdhigamikaNo ratings yet

- A Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, CuttackDocument80 pagesA Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, Cuttackgopalagarwal238791% (23)

- GodrejdrhpDocument416 pagesGodrejdrhpAbhishek SinghiNo ratings yet

- Investment ProjectDocument30 pagesInvestment ProjectRaj YadavNo ratings yet

- B009 Dhruvil Shah Wealth Management WGz0kGfcZbDocument5 pagesB009 Dhruvil Shah Wealth Management WGz0kGfcZbDhruvil ShahNo ratings yet

- Direct Marketing Personal SellingDocument22 pagesDirect Marketing Personal SellingShruti bansodeNo ratings yet

- FDI Impact on Pharma IndustryDocument32 pagesFDI Impact on Pharma IndustryPrateek BhatiaNo ratings yet

- Chapter 3Document2 pagesChapter 3Ashwini PudasainiNo ratings yet

- Amazon Ads - Problem StatementDocument3 pagesAmazon Ads - Problem StatementThe ReaderNo ratings yet

- Research 1Document6 pagesResearch 1kumarsaurav.mail2965No ratings yet

- Red Yellow Emarketing Textbook - Beta 2018 PDFDocument303 pagesRed Yellow Emarketing Textbook - Beta 2018 PDFkaranNo ratings yet

- 3 Ducks Trading System PDFDocument18 pages3 Ducks Trading System PDFMj ArNo ratings yet

- Effects of Liberalization On The Indian Economy: Clearias Team December 10, 2022Document8 pagesEffects of Liberalization On The Indian Economy: Clearias Team December 10, 2022Shakti SayarNo ratings yet

- McDonald's Five Forces Analysis (Porter's Model) - Panmore InstituteDocument4 pagesMcDonald's Five Forces Analysis (Porter's Model) - Panmore InstituteBorislav FRITZ FrancuskiNo ratings yet

- PrefaceDocument98 pagesPrefaceviralNo ratings yet