Professional Documents

Culture Documents

Financial Ratio Formulas and Their Significance

Uploaded by

Sierra0 ratings0% found this document useful (0 votes)

85 views2 pagesOriginal Title

Financial Ratio Cheat Sheet WAIIC

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

85 views2 pagesFinancial Ratio Formulas and Their Significance

Uploaded by

SierraCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

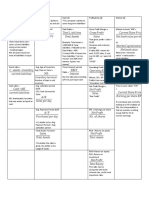

Financial Ratio Formula Criteria Source

Gross Profit Margin Gross Profit Bonus: >40%

÷ Sales Revenue

Net Profit Margin PATMI (Profit After Tax & Minority Interest) Bonus: >10%

÷ Sales Revenue

Operating Margin EBIT (Earning Before Interest & Tax) Bonus: >15%

÷ Sales Revenue

Market Cap(italization) Share Price Mega Cap: >US$200B

x Large Cap: US$10B-US$200B

Total Shares Outstanding Mid-Cap: US$1B-US$10B

Small Cap: US$300M-US$1B

Micro Cap: US$50M-US$300M

Nano Cap: <US$50M

EPS Net Profit after Tax Direct relationship to stock price.

(Earning Per Share) ÷ Total Shares Outstanding Income Statement

PE Ratio Current Share Price <10: Under-priced

(Price-to-Earning Ratio) ÷ EPS 10-20: Fairly-priced

>20: Over-priced

Dividend Yield (%) Gross Dividend Per Share x 100% Compare to other cash generating

÷ Share Price investments (e.g. FD & bonds).

PB Share Price <0.5: Company losing money

(Price-to-Book Ratio) ÷ Book Value Per Share

Where Book Value Per Share =

(Total Asset - Intangible Assets – Total

Liabilities)

÷

No. of Shares

Current Ratio Current Assets Bonus: >1

÷ Current Liabilities

Debt-to-Equity Ratio Total Liabilities Bonus: <1

Balance Sheet

÷ Total Equity

Working Capital Inventory Increase at a slower rate than

+ Account Receivables Sales Revenue.

– Accounts Payable

Financial Ratio Formula Criteria Source

Cash Conversion Working Capital x 365 Decreasing or constant.

÷ Sales Revenue

ROE Net Profit after Tax Bonus: >15% 1. Balance Sheet

(Return on Equity) ÷ Total Equity 2. Income Statement

ROIC (%) EBIT (1-Tax Rate) x 100% Bonus: >15%

(Return on Invested Capital) ÷ (Equity + Total Debt – Cash & Equivalents)

Net Cash from Operation - Increasing consistently.

Free Cash Flow Net Cash from Operation Must be positive. Cash Flow Statement

- CAPEX

You might also like

- Financial Ratios FormulaDocument4 pagesFinancial Ratios FormulaKamlesh SinghNo ratings yet

- 02 BIWS Projections Quick ReferenceDocument3 pages02 BIWS Projections Quick ReferencecarminatNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Notes You Say More Than You ThinkDocument4 pagesNotes You Say More Than You ThinkVijay Sharma100% (3)

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Leverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. TypesDocument17 pagesLeverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. Typessameer0725No ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalSales ExecutiveNo ratings yet

- Leverage AnalysisDocument29 pagesLeverage AnalysisFALAK OBERAINo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- ACCA F7 December 2015 NotesDocument280 pagesACCA F7 December 2015 NotesopentuitionID100% (3)

- Accounting Principles and Standards: For Financial AnalystsDocument91 pagesAccounting Principles and Standards: For Financial AnalystsRamona VoinescuNo ratings yet

- BUSINESS COMBINATION-lesson 1Document10 pagesBUSINESS COMBINATION-lesson 1Rhea Mae CarantoNo ratings yet

- 2020 - PFRS For SEs NotesDocument16 pages2020 - PFRS For SEs NotesRodelLaborNo ratings yet

- DINAGTUAN Rhonalyn Installment LiquidationDocument20 pagesDINAGTUAN Rhonalyn Installment LiquidationRhad EstoqueNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- CH 15Document45 pagesCH 15Mohamed AdelNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- TIFA CheatSheet MM X MLDocument10 pagesTIFA CheatSheet MM X MLCorina Ioana BurceaNo ratings yet

- Finman Formulas ExplainedDocument11 pagesFinman Formulas ExplainedArnelli GregorioNo ratings yet

- Ratios Notes and ProblemDocument6 pagesRatios Notes and ProblemAniket WaneNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Ratio Analysis: ROA (Profit Margin Asset Turnover)Document5 pagesRatio Analysis: ROA (Profit Margin Asset Turnover)Shahinul KabirNo ratings yet

- Ratio FormulaeDocument3 pagesRatio FormulaeNandhaNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- Business Management RatiosDocument6 pagesBusiness Management RatiosBrittney KotzeNo ratings yet

- Ch15 Capital Structure and Leverage-1Document44 pagesCh15 Capital Structure and Leverage-1Fizza AwanNo ratings yet

- Merger Lbo ValuationDocument6 pagesMerger Lbo ValuationPaulMorvannicNo ratings yet

- EVADocument34 pagesEVAMuhammad GulzarNo ratings yet

- Capital Structure 1Document12 pagesCapital Structure 1Ismiyar CahyaniNo ratings yet

- Updated FSA Ratio SheetDocument4 pagesUpdated FSA Ratio Sheetmoussa toureNo ratings yet

- FM Formulae SheetDocument4 pagesFM Formulae Sheetatishayjjj123No ratings yet

- FSA - 2022 - Formula - Sheet - For Business AnalysisDocument1 pageFSA - 2022 - Formula - Sheet - For Business Analysisphan BaonganNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- Financial Statements xAYwDocument21 pagesFinancial Statements xAYwKinNo ratings yet

- Valuation techniques using free, capital and equity cash flowsDocument2 pagesValuation techniques using free, capital and equity cash flows...ADITYA… JAINNo ratings yet

- Financial Ratios Cheat SheetDocument1 pageFinancial Ratios Cheat SheetRichie VeeNo ratings yet

- Financial Ratios ExplainedDocument2 pagesFinancial Ratios ExplainedhaleeNo ratings yet

- Accounting For ManagersDocument14 pagesAccounting For ManagersHimanshu Upadhyay AIOA, NoidaNo ratings yet

- Finman Formulas Prelims 3Document3 pagesFinman Formulas Prelims 3eiaNo ratings yet

- Capital StructureDocument14 pagesCapital StructureIsmiyar CahyaniNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- CB Chapter 15 AnswerDocument5 pagesCB Chapter 15 AnswerSim Pei YingNo ratings yet

- How To Value Stocks - P - E or EV - EBIT - Kelvestor PDFDocument4 pagesHow To Value Stocks - P - E or EV - EBIT - Kelvestor PDFPook Kei JinNo ratings yet

- 0.80 Points: AwardDocument25 pages0.80 Points: AwardhirevNo ratings yet

- Edited Formula SheetDocument2 pagesEdited Formula Sheetlinhngo.31221020350No ratings yet

- Foundations of Business: Financial Ratios & Ratio AnalysisDocument16 pagesFoundations of Business: Financial Ratios & Ratio Analysisabhinay_saliNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Date of Valuation: Default AssumptionsDocument53 pagesDate of Valuation: Default AssumptionsVsjnsnakihbNo ratings yet

- Bholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Document9 pagesBholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Chirag MalhotraNo ratings yet

- D. Ratio AnalysisDocument6 pagesD. Ratio AnalysisMohit JainNo ratings yet

- 9 Mas Capital Budgeting Sessions 3 4Document14 pages9 Mas Capital Budgeting Sessions 3 4seya dummyNo ratings yet

- FcffsimpleginzuDocument62 pagesFcffsimpleginzuJosé Manuel EstebanNo ratings yet

- Foundations of Business: Financial Ratios & Ratio AnalysisDocument16 pagesFoundations of Business: Financial Ratios & Ratio AnalysisPriyabrataTaraiNo ratings yet

- Financial Ratio AnalysisDocument42 pagesFinancial Ratio AnalysisFaheemullah HaddadNo ratings yet

- 07_Fundamentals-of-Financial-Reporting_1Document8 pages07_Fundamentals-of-Financial-Reporting_1Bala VigneshNo ratings yet

- Financial Statement Analysis (Ch.2)Document14 pagesFinancial Statement Analysis (Ch.2)TianyiNo ratings yet

- Ratio Analysis: A Guide to Financial Statement RatiosDocument13 pagesRatio Analysis: A Guide to Financial Statement Ratiosmuralib4u5No ratings yet

- Ratio Analysis Formula GuideDocument2 pagesRatio Analysis Formula GuideMuhammed KhalidNo ratings yet

- Financial Statement Analysis: 17-5 The Dividend Yield Is TheDocument51 pagesFinancial Statement Analysis: 17-5 The Dividend Yield Is TheMafi De LeonNo ratings yet

- Fin 531 Exam 1Document19 pagesFin 531 Exam 1Gaurav SonkeshariyaNo ratings yet

- Interpretation of Financial Statements: Ratio Analysis and ReportingDocument9 pagesInterpretation of Financial Statements: Ratio Analysis and ReportingSania SaeedNo ratings yet

- 06 Financial Planning Part ADocument38 pages06 Financial Planning Part Agopika.7mNo ratings yet

- Ratio Analysis Part 1Document27 pagesRatio Analysis Part 1RAVI KUMARNo ratings yet

- Book Trade Elder 2012 - 07 - 194ADocument5 pagesBook Trade Elder 2012 - 07 - 194ASierraNo ratings yet

- Matriks Valuasi Saham 22 Juni 2020 PDFDocument2 pagesMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerNo ratings yet

- Equity Research Methodology 010512 PDFDocument8 pagesEquity Research Methodology 010512 PDFSierraNo ratings yet

- Micro Cap Magic Formula Newsletter Sep 2012Document15 pagesMicro Cap Magic Formula Newsletter Sep 2012SierraNo ratings yet

- TL-WR840N V1 UgDocument105 pagesTL-WR840N V1 UgrajinbacaNo ratings yet

- Retail sales index trends across major Indonesian citiesDocument7 pagesRetail sales index trends across major Indonesian citiesSierraNo ratings yet

- Accounting For Amalgamation - C.W.Document6 pagesAccounting For Amalgamation - C.W.Krish SharmaNo ratings yet

- 9706 s06 QP 2Document16 pages9706 s06 QP 2roukaiya_peerkhanNo ratings yet

- Cambridge IGCSE™: Accounting 0452/22 March 2020Document14 pagesCambridge IGCSE™: Accounting 0452/22 March 2020FarrukhsgNo ratings yet

- Chapt 31mergersDocument8 pagesChapt 31mergersNageshwar SinghNo ratings yet

- Fundamentals of Capital BudgetingDocument54 pagesFundamentals of Capital BudgetingLee ChiaNo ratings yet

- WRD 27e - IE PPT - Ch03 - ADADocument60 pagesWRD 27e - IE PPT - Ch03 - ADAYuchen WangNo ratings yet

- EFM2e, CH 03, SlidesDocument36 pagesEFM2e, CH 03, SlidesEricLiangtoNo ratings yet

- Chapter 28 Financial AnalysisDocument4 pagesChapter 28 Financial AnalysisSaranyieh RamasamyNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Partnerships: Liquidation: Mcgraw-Hill/IrwinDocument67 pagesPartnerships: Liquidation: Mcgraw-Hill/IrwinSamah Refa'tNo ratings yet

- Mock Prelim - Intermediate AcctDocument9 pagesMock Prelim - Intermediate AcctNikki LabialNo ratings yet

- PPE PPT - Ch10Document81 pagesPPE PPT - Ch10ssreya80No ratings yet

- Assessing Indigenous Ghanaian Banks' Performance, Credit Risk, Liquidity and Basel ComplianceDocument104 pagesAssessing Indigenous Ghanaian Banks' Performance, Credit Risk, Liquidity and Basel ComplianceNana Yaw MarfoNo ratings yet

- Team Project 2: Chapter 8: Investment Decision Rules Fundamentals of Capital BudgetingDocument61 pagesTeam Project 2: Chapter 8: Investment Decision Rules Fundamentals of Capital BudgetingБекФорд ЗакNo ratings yet

- Understanding Depreciation Methods and ConceptsDocument30 pagesUnderstanding Depreciation Methods and ConceptsVimalKumar100% (1)

- AP - InvestmentDocument7 pagesAP - InvestmentGrace Patricia TeopeNo ratings yet

- Central Statistical Agency: Report On Small Scale Manufacturing Industries SurveyDocument55 pagesCentral Statistical Agency: Report On Small Scale Manufacturing Industries SurveySintayehu AshenafiNo ratings yet

- ACC Chapter 8 QuestionsDocument12 pagesACC Chapter 8 Questionsmasud.mily06No ratings yet

- Welcome To The 11 Accountancy Webinar: by CA. (DR.) G. S. Grewal Sunday, 21 June, 2020Document58 pagesWelcome To The 11 Accountancy Webinar: by CA. (DR.) G. S. Grewal Sunday, 21 June, 2020kai georgeNo ratings yet

- Mock Exam QuestionsDocument21 pagesMock Exam QuestionsDixie CheeloNo ratings yet

- Barclay Corp cash flow statement and explanationDocument4 pagesBarclay Corp cash flow statement and explanationTRANG NGUYỄN THỊ HÀNo ratings yet

- Applied Auditing Audit of Intangibles: Problem No. 1Document2 pagesApplied Auditing Audit of Intangibles: Problem No. 1danix929No ratings yet

- Partnership Capital Accounting FundamentalsDocument5 pagesPartnership Capital Accounting FundamentalsAlleah Mae Del RosarioNo ratings yet