Professional Documents

Culture Documents

Accounting Cycle in Service Company

Uploaded by

Gusti Ayu0 ratings0% found this document useful (0 votes)

116 views2 pages...

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document...

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

116 views2 pagesAccounting Cycle in Service Company

Uploaded by

Gusti Ayu...

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Name : Gusti Ayu Putu Agustini (16651015)

Class : 6B – Managerial Accounting

Accounting Cycle In Service Company

The company accounting cycle is a series of various stages carried out systematically

with the aim of processing various proofs of financial transactions to produce a financial

statement or accounting information on a company or organization in a given period. In

general, the accounting cycle is always understood from the transaction to the preparation of

financial statements and proceed with the balance closed with the closing journal or arrive at

the inverting journal.

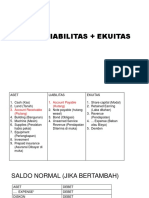

In accounting science, the accounting cycle can be broadly divided into two types,

namely the service company accounting cycle and the trading company accounting cycle, but

the stages are not much different. The difference is only in the process of business activities

and products produced, the products produced by service companies are intangible products

that can be directly felt by benefits such as car services, salons and consultants. while the

trading company of the products produced has forms such as food, drinks and equipment. So

the proof of trading company transactions is more varied and the journals used are not only

general journals but also special journals.

In a service company is a company that sells and provides services to meet consumer

needs with the aim of earning profits. In other words, service companies sell goods that are

intangible and products that are produced are not standard or varied.

In addition, in making financial reports on service companies there are eight stages

known as the accounting cycle. The first stage is collecting financial data that is valid,

accurate and accountable. Then record it in a general journal. After that, move the data from a

large general journal. The second stage is to create a trial balance to assess the process of

recording data from a general journal to a ledger (posting) and if the debit and credit are

balanced, it means there are no errors in inputting data. The third stage is the preparation of

adjusting journals that are made when the transaction takes place that affects the company

account.

The fourth stage is the preparation of the balance sheet that refers to the trial balance

and adjusting journal. The fifth stage is making financial statements on the basis of the work

sheet that has been done, the financial statements consist of income statements, balance

sheets and reports of changes in capital. The sixth stage is to make a closing journal, on the

estimated accounts in the capital change report and the income statement that is in the service

company will be closed. These accounts include expenses, profit and loss and prive.

The seventh stage is the reversing journal stage, the reversal stage of some accounts

that have been closed to return the balance. Estimated accounts that are usually reversed are

payments that are prepaid and have not matured and the last stage or eighth stage, namely

making a final or initial balance sheet (after closing), called the final or initial balance sheet

because as the final balance sheet is produced at the end of the period will be used as the

initial balance sheet in the accounting cycle of the following period.

So, there are eight stages in the service company's accounting cycle starting from

transaction analysis to creating the final or initial balance sheet (after closing). The

accounting cycle is needed as a guideline for accountants when they want to make financial

statements. An accountant must know and understand about a series of accounting cycles

because if only one stage is not understood and missed, the results of the financial statements

will not be in accordance with the company's expectations and the standards set out in the

PSAK.

You might also like

- Inter Psak 25Document28 pagesInter Psak 25vincent alvinNo ratings yet

- Faktor yang Mempengaruhi Audit Delay pada Perusahaan Consumer GoodDocument17 pagesFaktor yang Mempengaruhi Audit Delay pada Perusahaan Consumer GoodandrianyuniNo ratings yet

- Identifying and Journalizing Transactions: Learning OutcomesDocument51 pagesIdentifying and Journalizing Transactions: Learning OutcomesTip Tap100% (1)

- Soal Myob PT DinamikaDocument5 pagesSoal Myob PT DinamikaRaden Andini AnggreaniNo ratings yet

- Beams11 ppt04Document49 pagesBeams11 ppt04Rika RieksNo ratings yet

- Week 3 - Chap 2-Collaboration, Interpersonal Communication and Business Etiquette Bovee - Ebc12 - Inppt - 02Document37 pagesWeek 3 - Chap 2-Collaboration, Interpersonal Communication and Business Etiquette Bovee - Ebc12 - Inppt - 02qwertyuiopNo ratings yet

- Analisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyDocument11 pagesAnalisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyFrans KristianNo ratings yet

- Chapter 2 - Understanding StrategiesDocument31 pagesChapter 2 - Understanding StrategiesSarah Laras WitaNo ratings yet

- Teori AkunDocument12 pagesTeori AkunErditama GeryNo ratings yet

- Beams11 Ppt10 EDITDocument46 pagesBeams11 Ppt10 EDITAgoeng Susanto BrajewoNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument29 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.No ratings yet

- Beams10e - Ch08 Changes in Ownership InterestDocument42 pagesBeams10e - Ch08 Changes in Ownership InterestBayoe AjipNo ratings yet

- Kieso - Inter - Ch20 - IfRS (Pensions)Document47 pagesKieso - Inter - Ch20 - IfRS (Pensions)hidaNo ratings yet

- Laporan Keuangan Ace Hardware 2018 PDFDocument82 pagesLaporan Keuangan Ace Hardware 2018 PDFBang BegsNo ratings yet

- Case Study 1 v.3 PDFDocument21 pagesCase Study 1 v.3 PDFAce DesabilleNo ratings yet

- Advanced Acct PP CH08Document42 pagesAdvanced Acct PP CH08Jose TNo ratings yet

- Foreword: Financial Auditing 1 - 9 Edition - 1Document37 pagesForeword: Financial Auditing 1 - 9 Edition - 1meyyNo ratings yet

- Isa 300Document5 pagesIsa 300sabeen ansariNo ratings yet

- Reengineering Business Process To Improve Responsiveness: Accounting For TimeDocument17 pagesReengineering Business Process To Improve Responsiveness: Accounting For TimediahNo ratings yet

- Concise SEO-Optimized Title for a Document on Social and Cultural NormsDocument70 pagesConcise SEO-Optimized Title for a Document on Social and Cultural Normsmillie MutiaNo ratings yet

- Astra International: IndonesiaDocument7 pagesAstra International: Indonesiaalvin maulana.pNo ratings yet

- ALTO ALTO Annual ReportDocument120 pagesALTO ALTO Annual Reportputhreerhy100% (3)

- Case 15-5 Xerox Corporation RecommendationsDocument6 pagesCase 15-5 Xerox Corporation RecommendationsgabrielyangNo ratings yet

- Chapter 14Document19 pagesChapter 14Anonymous Yo03tioNo ratings yet

- Materi Bahasa Inggris BisnisDocument5 pagesMateri Bahasa Inggris BisnisIrma WatiNo ratings yet

- Chapter 3 - Behavior in OrganizationsDocument20 pagesChapter 3 - Behavior in OrganizationsSarah Laras Wita100% (2)

- 2017 Annual Report - PT Graha Layar Prima TBK PDFDocument220 pages2017 Annual Report - PT Graha Layar Prima TBK PDFKevin D'ShōnenNo ratings yet

- Record To Report (R2R) Best Practices: Report (R2R) Process Is Used To Collect, Organize, and Analyze Your Company'sDocument11 pagesRecord To Report (R2R) Best Practices: Report (R2R) Process Is Used To Collect, Organize, and Analyze Your Company'sManna MahadiNo ratings yet

- Case Study - Starbucks TeamworkDocument3 pagesCase Study - Starbucks TeamworkMateusz JuszczykowskiNo ratings yet

- EB Hall Sw11 ITAudit3 WMDocument657 pagesEB Hall Sw11 ITAudit3 WMRheaMaeBranzuelaNo ratings yet

- Case 6.2Document5 pagesCase 6.2Azhar KanedyNo ratings yet

- Hansen AISE IM Ch08Document54 pagesHansen AISE IM Ch08AimanNo ratings yet

- TUTORIAL SOLUTIONS (Week 4A)Document8 pagesTUTORIAL SOLUTIONS (Week 4A)Peter100% (1)

- Soal Siklus AkuntansiDocument10 pagesSoal Siklus AkuntansiAlfin Dwi SaptaNo ratings yet

- Agrs Annual Report 2016Document163 pagesAgrs Annual Report 2016Dzulfaqor Tanzil ArifinNo ratings yet

- Beams11 Ppt07 Obligasi NewDocument28 pagesBeams11 Ppt07 Obligasi Newarfian0% (1)

- Chapter 13: Foreign Currency Financial Statements: Advanced AccountingDocument42 pagesChapter 13: Foreign Currency Financial Statements: Advanced AccountingMad JayaNo ratings yet

- Arens14e ch07 PPTDocument43 pagesArens14e ch07 PPTNindya Harum SolichaNo ratings yet

- Akuntansi Keuangan 2: Pertemuan 1Document72 pagesAkuntansi Keuangan 2: Pertemuan 1Monita nababanNo ratings yet

- Reporting Standards Impact Company AssetsDocument8 pagesReporting Standards Impact Company AssetsAqsa ButtNo ratings yet

- Chapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingDocument52 pagesChapter 12: Derivatives and Foreign Currency Transactions: Advanced AccountingindahmuliasariNo ratings yet

- ADHI - Annual Report - 2017 PDFDocument222 pagesADHI - Annual Report - 2017 PDFYulia FitriNo ratings yet

- Arens Solution Manual Chapter 3Document37 pagesArens Solution Manual Chapter 3Rizal Pandu NugrohoNo ratings yet

- Overall Audit Plan and Audit Program: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/BeasleyDocument36 pagesOverall Audit Plan and Audit Program: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/BeasleydindaadaniNo ratings yet

- (PDF) Jawaban Kasus Bab 9Document26 pages(PDF) Jawaban Kasus Bab 9Shinning Nunaa45No ratings yet

- Chapter 1-Solution To ProblemsDocument7 pagesChapter 1-Solution To ProblemsawaisjinnahNo ratings yet

- MAGP Annual Report 2017Document86 pagesMAGP Annual Report 2017cindytantrianiNo ratings yet

- Budgeting and Ethics Delma Company Manufactures A Variety ofDocument1 pageBudgeting and Ethics Delma Company Manufactures A Variety oftrilocksp SinghNo ratings yet

- Persamaan Dasar AkuntansiDocument10 pagesPersamaan Dasar Akuntansiapelina teresia100% (1)

- Tugas Kelompok - Corporate Financial Management.Document4 pagesTugas Kelompok - Corporate Financial Management.AgusSetiawanNo ratings yet

- Ch8 000Document83 pagesCh8 000khawarsherNo ratings yet

- PT Sepatu Bata Financial Analysis and 2008 Financial CrisisDocument6 pagesPT Sepatu Bata Financial Analysis and 2008 Financial CrisisOlim BariziNo ratings yet

- CH 03 Financial Statements ExercisesDocument39 pagesCH 03 Financial Statements ExercisesJocelyneKarolinaArriagaRangel100% (1)

- Perbandingan PSAK DGN IFRS Menurut DeloitteDocument0 pagesPerbandingan PSAK DGN IFRS Menurut Deloittete_menNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument30 pagesAudit of The Capital Acquisition and Repayment CycleLouis ValentinoNo ratings yet

- Kolom Inventory CardDocument1 pageKolom Inventory CardargarinirizqiayuNo ratings yet

- UTS SPM - Salman Hafidz Iriansyah - 120620170003Document13 pagesUTS SPM - Salman Hafidz Iriansyah - 120620170003Rizal AlfianNo ratings yet

- BSDE Annual Report 2018Document38 pagesBSDE Annual Report 2018Furqon MuhammadNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleAmitNo ratings yet

- Far - Nica TomitaDocument3 pagesFar - Nica TomitaMikayNo ratings yet

- Module 1 Engineering EconomicsDocument34 pagesModule 1 Engineering EconomicsSINGIAN, Alcein D.No ratings yet

- Joint Venture Between Tata and ZaraDocument4 pagesJoint Venture Between Tata and ZaraShrishti Agarwal100% (1)

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- Consumer Awareness ProjectDocument3 pagesConsumer Awareness ProjectBincy CherianNo ratings yet

- Reaction Paper ADIDASDocument2 pagesReaction Paper ADIDASShin WalkerNo ratings yet

- Financial Literacy SACCO ManualDocument38 pagesFinancial Literacy SACCO ManualMukalele RogersNo ratings yet

- British Steel Interactive Stock Range GuideDocument86 pagesBritish Steel Interactive Stock Range GuideLee Hing WahNo ratings yet

- Understanding Rwanda Agribusiness and Manufacturing SeDocument258 pagesUnderstanding Rwanda Agribusiness and Manufacturing Seooty.pradeepNo ratings yet

- Tourism Policy of Malta 2007-2011: Francis Zammit Dimech Minister For Tourism and CultureDocument11 pagesTourism Policy of Malta 2007-2011: Francis Zammit Dimech Minister For Tourism and Cultureნინი მახარაძეNo ratings yet

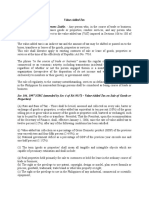

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- The Billabong CaseDocument14 pagesThe Billabong CaseRati Sinha100% (1)

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet

- Dsr April 2024Document10 pagesDsr April 2024vapatel767No ratings yet

- Jwi 530 Assignment 4Document3 pagesJwi 530 Assignment 4gadisika0% (1)

- Case Studies For Acc2Document2 pagesCase Studies For Acc2jtNo ratings yet

- 3 AlibabaDocument24 pages3 AlibabaADAM LOW0% (1)

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- Exercises - Topic 3 (Impairment) (Eng)Document7 pagesExercises - Topic 3 (Impairment) (Eng)Thảo PhạmNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Barcelona PDFDocument165 pagesBarcelona PDFHector Alberto Garcia LopezNo ratings yet

- ProspectusDocument2 pagesProspectusJuliana Mae FradesNo ratings yet

- "Study of Different Loans Provided by SBI Bank": Project Report ONDocument55 pages"Study of Different Loans Provided by SBI Bank": Project Report ONAnonymous g7uPednINo ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

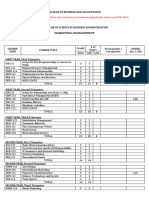

- The Graduates of Bachelor of Science in Criminology of Collegio de Amore SY 2010 To 2018 A Tracer StudyDocument11 pagesThe Graduates of Bachelor of Science in Criminology of Collegio de Amore SY 2010 To 2018 A Tracer Studyjetlee estacionNo ratings yet

- Strategy - RBI Grade - B - Officer-2016 by RBI Topper Manojkumar EDocument23 pagesStrategy - RBI Grade - B - Officer-2016 by RBI Topper Manojkumar EAbhijit Konwar100% (1)

- MOSP Final Project - ITC - Group7 - SectionCDocument29 pagesMOSP Final Project - ITC - Group7 - SectionCArjun JainNo ratings yet

- CBMEC 1 - Assignment 3Document4 pagesCBMEC 1 - Assignment 3Tibay, Genevive Angel Anne A.No ratings yet

- Accounting For Income Taxes: About This Chapter!Document9 pagesAccounting For Income Taxes: About This Chapter!sabithpaulNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet