Professional Documents

Culture Documents

Compute The Taxable Income

Uploaded by

Mark Joseph OlinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compute The Taxable Income

Uploaded by

Mark Joseph OlinoCopyright:

Available Formats

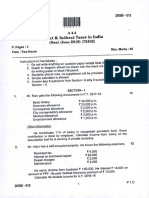

An individual reported the following items for the years 2018 and 2019.

2018 2019

Ordinary income P 14,000 P 180,000

Capital transactions:

Long term capital gains 20,000 104,000

Short term capital loss 36,000

Long term capital loss 40,000

Compute the taxable income.

A corporation reported the following items for the years 2018 and 2019.

2018 2019

Ordinary income P 300,000 P 400,000

Capital transactions:

Long term capital gains 80,000 120,000

Long term capital loss 100,000 80,000

Compute the taxable income.

X reported the following income and losses for the years 1 and 2:

Year 1 Year 2

Ordinary taxable income P 60,000 P 180,000

Short-term capital loss 400,000

Long-term capital gains 600,000

Long-term capital loss 100,000

Short-term capital gain 200,000

If X is an individual taxpayer, the year 2 total net income is?

If X is a corporation, the year 2 total net income is?

You might also like

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- 0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFDocument9 pages0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFIan RanilopaNo ratings yet

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Midterm Quiz in ACCTG2215Document17 pagesMidterm Quiz in ACCTG2215guess who100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- MCQ Working Capital Management CPAR 1 84Document18 pagesMCQ Working Capital Management CPAR 1 84PiaElemos85% (13)

- QUIZ 1: Interim Financial ReportingDocument13 pagesQUIZ 1: Interim Financial ReportingJusteen BalcortaNo ratings yet

- Calculate Income Tax for Individual TaxpayersDocument4 pagesCalculate Income Tax for Individual TaxpayersKenneth Pimentel100% (1)

- Cash Flow Statement for Passaic CompanyDocument7 pagesCash Flow Statement for Passaic CompanyShane TabunggaoNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- TAX DEDUCTIONS GUIDEDocument4 pagesTAX DEDUCTIONS GUIDEAnonymous LC5kFdtcNo ratings yet

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- Income Tax ProblemsDocument6 pagesIncome Tax Problemskristian eldric BondocNo ratings yet

- Minalas Corp 2016 Tax AuditDocument11 pagesMinalas Corp 2016 Tax AuditEmerson Peralta0% (2)

- Relevant Costing CPARDocument13 pagesRelevant Costing CPARxxxxxxxxx100% (2)

- MS Corporation financial data analysis 2018-2019Document2 pagesMS Corporation financial data analysis 2018-2019Princess Edelyn CastorNo ratings yet

- Summary Cash Flow - Taxation Paid, Dividends Paid and Interest PaidDocument8 pagesSummary Cash Flow - Taxation Paid, Dividends Paid and Interest PaidLesego BaneleNo ratings yet

- Inbound 1400148020110951276Document3 pagesInbound 1400148020110951276MarielleNo ratings yet

- 4.2 Assignment - Principles To Accounting Period and MethodsDocument7 pages4.2 Assignment - Principles To Accounting Period and MethodsRoselyn LumbaoNo ratings yet

- Bad Debt Recovery Tax CalculationDocument1 pageBad Debt Recovery Tax Calculationstephanie filoteoNo ratings yet

- Mle02 Far 1 Answer KeyDocument9 pagesMle02 Far 1 Answer KeyCarNo ratings yet

- Batman's 2018 Business Tax ComputationDocument1 pageBatman's 2018 Business Tax ComputationHazel Malveda GamillaNo ratings yet

- St. Anthony's College Business Final Exam ReviewDocument9 pagesSt. Anthony's College Business Final Exam ReviewHazel Seguerra BicadaNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Practical Accounting 1 - Cash Flow Statement ReviewDocument6 pagesPractical Accounting 1 - Cash Flow Statement ReviewVeron Briones0% (1)

- Afar 2 Quizzes AcgsbdjxjcudhdhDocument27 pagesAfar 2 Quizzes Acgsbdjxjcudhdhrandomlungs121223No ratings yet

- Bookkeeping for Partnership Profits and LossesDocument3 pagesBookkeeping for Partnership Profits and LossesHoney MuliNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Calculate net income from financial statement changesDocument2 pagesCalculate net income from financial statement changesSean ThyrdeeNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Calculate Income Tax Expense and Deferred TaxDocument10 pagesCalculate Income Tax Expense and Deferred Taxlana del reyNo ratings yet

- Financial Management FundamentalsDocument7 pagesFinancial Management FundamentalsMoira C. VilogNo ratings yet

- Individual AssignmentDocument5 pagesIndividual AssignmentMuhammad Faiyam Shafiq 1911819630No ratings yet

- Module 9 and 10Document9 pagesModule 9 and 10French Jame RianoNo ratings yet

- Domestic Corporation Dividend Withholding TaxDocument4 pagesDomestic Corporation Dividend Withholding TaxLFGS FinalsNo ratings yet

- Based On Heads of IncomeDocument3 pagesBased On Heads of Incomeatul.maurya0290No ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- Pre Finals Manacc 1Document8 pagesPre Finals Manacc 1Gesselle Acebedo0% (1)

- Revenue recognition installment salesDocument3 pagesRevenue recognition installment salesReyn Saplad PeralesNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- Solved The Statement of Cash Flows For The Year Ended DecemberDocument1 pageSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaNo ratings yet

- Audit adjustments uncover financial reporting errorsDocument9 pagesAudit adjustments uncover financial reporting errorsAldrin ZolinaNo ratings yet

- Entity A and Entity B Invested P1Document3 pagesEntity A and Entity B Invested P1elsana philipNo ratings yet

- Understanding accounting closure activitiesDocument6 pagesUnderstanding accounting closure activitiesJamaica DavidNo ratings yet

- Direct IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Document3 pagesDirect IndirectTaxesinIndia October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A E31C0FB4Mubin Shaikh NooruNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- Midterm ExaminationDocument6 pagesMidterm ExaminationJamie Rose Aragones100% (1)

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Angela MartiresNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- Philippine corporate income tax problems and solutionsDocument2 pagesPhilippine corporate income tax problems and solutionsRandy Manzano100% (1)

- CPAR PreweekDocument20 pagesCPAR Preweekrochielanciola100% (1)

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Dealings in PropertiesDocument6 pagesDealings in PropertieserespemaychisagangNo ratings yet

- Board Exam QuestionnaireDocument13 pagesBoard Exam QuestionnaireGemm Panol0% (1)

- Quiz MTDocument6 pagesQuiz MTClara MacallingNo ratings yet

- Central Plain University income tax calculationDocument3 pagesCentral Plain University income tax calculationLFGS Finals0% (1)

- 0.1 Branches of PhilosophyDocument9 pages0.1 Branches of PhilosophylukmnaNo ratings yet

- KahbwnshDocument2 pagesKahbwnshMark Joseph OlinoNo ratings yet

- YfrhhhDocument3 pagesYfrhhhMark Joseph OlinoNo ratings yet

- HahahhwDocument1 pageHahahhwMark Joseph OlinoNo ratings yet

- Vat QuizDocument2 pagesVat QuizMark Joseph OlinoNo ratings yet

- 22nd RMYC Schedule of Activities 1Document3 pages22nd RMYC Schedule of Activities 1Angelica YapanNo ratings yet

- CP E14Document5 pagesCP E14Mark Joseph OlinoNo ratings yet

- YycfyfDocument1 pageYycfyfMark Joseph OlinoNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Financial Projections GymDocument4 pagesFinancial Projections GymMark Joseph OlinoNo ratings yet

- Acquisition of Stocks and Business CombinationsDocument2 pagesAcquisition of Stocks and Business CombinationsMark Joseph OlinoNo ratings yet

- CharDocument5 pagesCharMark Joseph OlinoNo ratings yet

- YycfyfDocument1 pageYycfyfMark Joseph OlinoNo ratings yet

- Booking Agreement: - WITNESSETHDocument5 pagesBooking Agreement: - WITNESSETHMark Joseph OlinoNo ratings yet

- CharDocument5 pagesCharMark Joseph OlinoNo ratings yet

- Socio-Economic FeasibilityDocument8 pagesSocio-Economic Feasibilityツwιlarт ८૦No ratings yet

- Black Letter LawDocument1 pageBlack Letter LawMark Joseph Olino0% (1)

- How The Economic Machine WorksDocument7 pagesHow The Economic Machine WorksMark Joseph OlinoNo ratings yet

- Sison Vs AnchetaDocument3 pagesSison Vs AnchetaMario BagesbesNo ratings yet

- NotesDocument1 pageNotesMark Joseph OlinoNo ratings yet

- Schedule 1 Depreciation Expense - Machineries and EquipmentDocument4 pagesSchedule 1 Depreciation Expense - Machineries and EquipmentMark Joseph OlinoNo ratings yet

- Summary of Report (MacroEcon)Document2 pagesSummary of Report (MacroEcon)Mark Joseph OlinoNo ratings yet

- Sison Vs AnchetaDocument3 pagesSison Vs AnchetaMario BagesbesNo ratings yet

- Compre2 ReviewerDocument6 pagesCompre2 ReviewerMark Joseph OlinoNo ratings yet

- Law On SalesDocument19 pagesLaw On SalesPearl Alicando CaadanNo ratings yet