Professional Documents

Culture Documents

Costing Past Papet Question Chapter 9

Uploaded by

Kadeem “LeoLee” LeonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing Past Papet Question Chapter 9

Uploaded by

Kadeem “LeoLee” LeonCopyright:

Available Formats

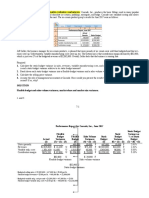

SMJ Bakeries produces and sells health breads in mixed packages.

The firm uses variable

costing for internal management purposes and absorption costing for external purposes. At the

end of each year, financial statements must be converted from variable to absorption costing to

satisfy external requirements.

At the end of 2016, it was anticipated that sales would increase by 50% from the 2016 levels for

2017due to the change in healthy eating. Production was expected to be increased to meet this

expected demand. The increase in production gave rise to a favorable materials price variance as

a result of bulk discounts.

The following data relates to the years 2016and 2017:

2016 2017

Selling price per package $30 $30

Sales (packages) 30,000 45,000

Beginning inventory 2,000 12,000

Production 40,000 50,000

Ending Inventory 12,000 ?

Direct material price variance $4,000F $8,000F

Other variable production variances $7,500U $12,000U

Standard variable cost per case for 2016 and 2017

Direct material $ 3.50

Labor 12.00

Overhead 1.00

Variable selling and admin 6.00

Annual fixed cost for 2016 and 2017 actual and budgeted were:

Production $160,000

Selling and administration 80,000

The fixed overhead rate under absorption costing is based on a practical capacity of 40,000 units

per year. All variances and under or overapplied overhead are written off to cost of goods sold.

Required

a) Prepare Income Statements for the year 2017 using (i) Absorption, (ii)Variable costing

and (iii) Throughput costing. (18 Marks)

b) Reconcile the Absorption costing and Variable costing incomes. (2 Marks)

c) Calculate the break-even point under Absorption costing. (2 Marks)

d) How can Absorption costing be used to by managers to support their dysfunctional

behavior? (3 Marks)

You might also like

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportFrom Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportNo ratings yet

- UTS AKMEN - IRA MS - 01012622226026 - 52B FinalDocument7 pagesUTS AKMEN - IRA MS - 01012622226026 - 52B FinalIra M. SariNo ratings yet

- 2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyFrom Everand2017 International Comparison Program for Asia and the Pacific: Purchasing Power Parities and Real Expenditures—Results and MethodologyNo ratings yet

- Cost 1 PDFDocument13 pagesCost 1 PDFShubham jindalNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- SCM J.k.shah Free Revision Classes For May 2019Document155 pagesSCM J.k.shah Free Revision Classes For May 2019Anuj AgrawalNo ratings yet

- Constructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyFrom EverandConstructing Purchasing Power Parities Using a Reduced Information Approach: A Research StudyNo ratings yet

- 9-34,37,48 HorngrenDocument1 page9-34,37,48 HorngrenyolandafitrionitaNo ratings yet

- Asian Development Bank Sustainability Report 2018: Investing for an Asia and the Pacific Free of PovertyFrom EverandAsian Development Bank Sustainability Report 2018: Investing for an Asia and the Pacific Free of PovertyNo ratings yet

- Ma 2Document3 pagesMa 2123 123No ratings yet

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- Bep ProblemsDocument5 pagesBep ProblemsvamsibuNo ratings yet

- 3420 - Midterm Review QuestionsDocument11 pages3420 - Midterm Review QuestionsANKIT SHARMANo ratings yet

- Latihan Segmented Reporting Absorption Costing Vs Variable CostingDocument3 pagesLatihan Segmented Reporting Absorption Costing Vs Variable CostingPrisilia AudilaNo ratings yet

- Baims-1618315565 202 PDFDocument3 pagesBaims-1618315565 202 PDFShahadNo ratings yet

- Absorption and Variable Costing Reviewer EphDocument4 pagesAbsorption and Variable Costing Reviewer Ephephraim100% (1)

- Midterm - Ch. 10, 11Document14 pagesMidterm - Ch. 10, 11Cameron BelangerNo ratings yet

- MAS-Midterm Exam Name: - ScoreDocument15 pagesMAS-Midterm Exam Name: - ScoreRengeline LucasNo ratings yet

- SolutionDocument14 pagesSolutionRishiaendra Cool100% (1)

- Exercise Inventory CostingDocument2 pagesExercise Inventory CostingRatriNo ratings yet

- Accounting Project Segment 4Document3 pagesAccounting Project Segment 4Zach James LebreiroNo ratings yet

- Tutorial 5 - CHAPTER 9 - QDocument13 pagesTutorial 5 - CHAPTER 9 - QThuỳ PhạmNo ratings yet

- C 4 C 00 D 37Document12 pagesC 4 C 00 D 37alyaa rabbaniNo ratings yet

- Exam Revision QuestionsDocument5 pagesExam Revision Questionsfreddy kwakwalaNo ratings yet

- MARGINAL COSTIN1 Auto SavedDocument6 pagesMARGINAL COSTIN1 Auto SavedVedant RaneNo ratings yet

- Man Acct Exam 2018S1 PDBTADocument6 pagesMan Acct Exam 2018S1 PDBTAkwameNo ratings yet

- Adv Cost Assignment 2023Document6 pagesAdv Cost Assignment 2023GETAHUN ASSEFA ALEMUNo ratings yet

- Examples FMA - 5Document10 pagesExamples FMA - 5DaddyNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Tutorial 5 - Marginal and Absorption Costing QuestionsDocument3 pagesTutorial 5 - Marginal and Absorption Costing QuestionsAnonymous 9GgsGYEf100% (1)

- ch10 2Document5 pagesch10 2ghsoub777No ratings yet

- Study Guide For MGR Exam 2 PDFDocument10 pagesStudy Guide For MGR Exam 2 PDFRandyNo ratings yet

- Solved Problems-Chapter 6 PDFDocument11 pagesSolved Problems-Chapter 6 PDFRoqaia AlwanNo ratings yet

- Uts Akmen (Fix)Document10 pagesUts Akmen (Fix)Oppa Massimo MorattiNo ratings yet

- Cost Ass 3Document1 pageCost Ass 3Adugna MegenasaNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- CH 06Document7 pagesCH 06Gus JooNo ratings yet

- Intercompany Sales - Inventories ProblemsDocument13 pagesIntercompany Sales - Inventories ProblemsMhelka Tiodianco100% (2)

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Horngrens Accounting The Managerial Chapters 12Th Edition Miller Nobles Test Bank Full Chapter PDFDocument78 pagesHorngrens Accounting The Managerial Chapters 12Th Edition Miller Nobles Test Bank Full Chapter PDFgiaocleopatra192y100% (9)

- Finan Decision Making II Probs On Decision AnalysisDocument10 pagesFinan Decision Making II Probs On Decision Analysisrathanreddy2002No ratings yet

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- Executive Summary: A. The North American Dermatology Division's 2017 EVADocument2 pagesExecutive Summary: A. The North American Dermatology Division's 2017 EVAAtul Anand bj21135No ratings yet

- Indicate How Much Depreciation Expense Should Be Recorded Each Year For This Equipment by Completing The TableDocument4 pagesIndicate How Much Depreciation Expense Should Be Recorded Each Year For This Equipment by Completing The TableLara Lewis AchillesNo ratings yet

- Gls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Document12 pagesGls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Archana0% (1)

- Paper - 3: Cost Accounting and Financial Management: © The Institute of Chartered Accountants of IndiaDocument26 pagesPaper - 3: Cost Accounting and Financial Management: © The Institute of Chartered Accountants of Indiaharshrathore17579No ratings yet

- Addtional Exercises - 6Document18 pagesAddtional Exercises - 6Gega XachidENo ratings yet

- Latihan CVPDocument2 pagesLatihan CVPAchmad RidwanNo ratings yet

- Shree Krishna Ban Program Code: MBA Enrollment No: 018IUKL-HCMMBA1080Document7 pagesShree Krishna Ban Program Code: MBA Enrollment No: 018IUKL-HCMMBA1080bhuvanNo ratings yet

- Variable Costing-A Tool For ManagementDocument32 pagesVariable Costing-A Tool For ManagementSederiku KabaruzaNo ratings yet

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- MA Session 13Document7 pagesMA Session 13Anirban SadhuNo ratings yet

- Chap 11 - Decision Making and Relevant Information (1) PrintDocument28 pagesChap 11 - Decision Making and Relevant Information (1) PrintranjithaNo ratings yet

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocument9 pagesFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- MANAGEMENT ACCOUNTING PAPER 2.2 May 2019Document21 pagesMANAGEMENT ACCOUNTING PAPER 2.2 May 2019Nana DespiteNo ratings yet

- Marginal Costing SumsDocument3 pagesMarginal Costing SumsMedhaNo ratings yet

- Act 202 Midterm Fall 2020 MathsDocument2 pagesAct 202 Midterm Fall 2020 MathsMahiNo ratings yet

- AUDP ROB REV-Correction of Errors Wit Ans KeyDocument12 pagesAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (242)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The Aqua Group Guide to Procurement, Tendering and Contract AdministrationFrom EverandThe Aqua Group Guide to Procurement, Tendering and Contract AdministrationMark HackettRating: 4 out of 5 stars4/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Real Life: Construction Management Guide from A-ZFrom EverandReal Life: Construction Management Guide from A-ZRating: 4.5 out of 5 stars4.5/5 (4)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Post Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&AFrom EverandPost Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&ANo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Principles of Welding: Processes, Physics, Chemistry, and MetallurgyFrom EverandPrinciples of Welding: Processes, Physics, Chemistry, and MetallurgyRating: 4 out of 5 stars4/5 (1)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesFrom EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesNo ratings yet