Professional Documents

Culture Documents

Definition - PF Basic Wages - Supreme Court - Brief

Uploaded by

UMESH MSWCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Definition - PF Basic Wages - Supreme Court - Brief

Uploaded by

UMESH MSWCopyright:

Available Formats

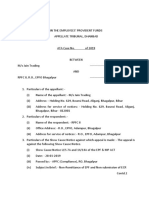

Analysis of Supreme Court Judgement on PF Basic Wages

Definition of Basic Wages

To be included Need not Include

Basic HRA

Dearness Allowance Production Incentive ( Need proper matrix for incentive scheme)

Conveyance OT ( Over Time)

Other Allowance Night Shift Allowance ( Should vary on monthly wise)

Special Allowance Attendance Allowance

LTA Washing Allowance

Fixed Allowance in the name of Tele and Food

Allowance) Canteen Allowance

Petrol Reimbursement (without bills ) Petrol Reimbursement ( need to have the proof of bills)

Retaining Allowance Bonus and Commission

Any Allowance paid as variable or only for certain category of

CCA or any other allowance paid as Fixed employees

* Any Allowances linked to an employee's productivity will not be considered as basic wages

Date of Judgement : 28th February 2019

FAQ ( Frequent Ask Questions)

1. As a HR, what will be the wise decision to compute the hassle free breakup?

Bayballs HR: Keep only Basic, HRA and Special Allowance and do not keep any

attractive allowances in the compensation structure

2. Who will impact due to this SC Judgement? Bayballs HR: Those who are drawing

below than 15,000 will be impacted, it will not hit on those who are drawing above

than 15k salary and paying contributions for 15k or above already

3. Is house rent allowance excluded what should be the quantum/ratio from total

wages? Bayballs HR : Plz do not consider above than 30% as HRA when compute the

break up, it will attract additional PF contribution if the percentage exceeds

4. Will encashment of leave also attract EPF contributions?

Bayballs HR: Bayballs HR: EL encashment Allowance is not required to consider as

Basic Wages

5. Will the above ruling have any impact upon the entitlement of gratuity and bonus to

an employee? Bayballs HR: There is no impact due to this.

6. Whether PF Authority will be implemented this retrospective effect based on

judgement? Bayballs HR : Wage limit increased from 6.5k to 15k effective from 1st

Sep 2014, hence PF authorities may be insisting to implement from this date, however

can be finalized once the discussion with central board of trustees

7. What will be the impact to International workers? Bayballs HR: This is the common questions

everywhere in different forums, SC judgement has not mentioned anything about IW, however,

international worker's PF deduction should be computed from total wages, should not be

computed from only basic wages or up to 15,000 PF cap limit

8. How HR can assist your organization in order to avoid more financial liabilities? Bayballs HR : 1.

Compute Simple breakup and do not exceed more than 4 allowances as total

2. Can exempt employee's from PF contribution liability if their total wages are above than 15k and

never possess PF account no. in his / her previous organizations, fill up Form 11 when select this

option

3. Make efforts to avail PMRPY benefits if it is first time employment and save employer's

contribution ( note that this benefit is valid only up to March 2019)

4. If your firm is small and has below than 20 employees, you can pay only 10% of employee and

employer's contribution

5. If you are working in small firm and has only 18 employees and would like to exempt from PF

liabilities when you add the head count, please engage freelancers if possible to have the sources (

tax should be deducted on every month without fail on such cases)

9. Important Pre Cautions to be taken by HR to face the PF inspections / notice due to this

judgement?

1. Prepare the forecasting contributions liabilities to be paid for the last 2 previous years if

the above included allowances have not been added in your PF wages right now

2. Keep attendance, salary register for at least 2 financial years

3. Inform Finance team to share balance sheet of 2 years immediately whenever needed

4.Download ECR remittance Challans for the last 2 years

The above synopsis prepared after spent many hours to refer judgements, journals, consulted the

concerned authorities, please write to compliance@bayballshr.com if you would like to add any points

/ suggestions / need our help

Retrospective date mentioned ( Q 6) based on apex and SC judgements and Date of PF Revision

ceiling, hence the effective / retrospective date may be differed based on central PF committee / PF

Authorities’s decision.

Analysed and Composed by

Kannan N

Bayballs HR - Labour Law

Partner

You might also like

- Complaint No. 229 Before Lokpal of India Against Malpractices in Khadi GramodyogDocument79 pagesComplaint No. 229 Before Lokpal of India Against Malpractices in Khadi GramodyogNaresh KadyanNo ratings yet

- Karnataka High Court On High Rise BuildingsDocument11 pagesKarnataka High Court On High Rise BuildingsAravindaSarvamangalaKamathNo ratings yet

- Writ Petiton AIJA Supreme CourtDocument93 pagesWrit Petiton AIJA Supreme CourtLive Law100% (1)

- Draft Model Insolvency Resolution PlanDocument7 pagesDraft Model Insolvency Resolution PlanAK100% (1)

- Petition Before National Green Tribunal For BMC's - PBR's in 62 Cantonments of IndiaDocument152 pagesPetition Before National Green Tribunal For BMC's - PBR's in 62 Cantonments of IndiaNaresh KadyanNo ratings yet

- Final Red BookDocument43 pagesFinal Red BookAjay GoudNo ratings yet

- Lalita Kumari vs. Govt. of UP and Ors. - SC On FIRsDocument91 pagesLalita Kumari vs. Govt. of UP and Ors. - SC On FIRsPrateek MishraNo ratings yet

- Concept of Insolvency and BankruptcyDocument68 pagesConcept of Insolvency and BankruptcyNavin Man Singh ShresthaNo ratings yet

- The Commissioner of Police & Ors Vs Acharya Jagdishwarananda ... On 11 March, 2004 PDFDocument21 pagesThe Commissioner of Police & Ors Vs Acharya Jagdishwarananda ... On 11 March, 2004 PDFR VigneshwarNo ratings yet

- Arrest Under GST PDFDocument9 pagesArrest Under GST PDFlakshmimenon39No ratings yet

- Andhra High Court Amaravati Land Scam Injunction OrderDocument7 pagesAndhra High Court Amaravati Land Scam Injunction OrderThe WireNo ratings yet

- E. Kumar-Suit-Recovery of Money-Attachment Before JudgmentDocument17 pagesE. Kumar-Suit-Recovery of Money-Attachment Before JudgmentChaitanya NallaniNo ratings yet

- J P Prakash S O. Puttaswamyshetty Vs Karnataka Lokayukta On 20 March, 2015Document7 pagesJ P Prakash S O. Puttaswamyshetty Vs Karnataka Lokayukta On 20 March, 2015A Common Man MahiNo ratings yet

- Letter Petition To Hon' CJIDocument24 pagesLetter Petition To Hon' CJIThe Wire100% (1)

- SC Judgement That Section 482 CRPC Petition Cannot Be Dismissed by HCs in Matrimonial Disputes Without Due Application of Mind 2018Document7 pagesSC Judgement That Section 482 CRPC Petition Cannot Be Dismissed by HCs in Matrimonial Disputes Without Due Application of Mind 2018Latest Laws TeamNo ratings yet

- Lalita Kumari Vs Government of UP & Others, 2013Document5 pagesLalita Kumari Vs Government of UP & Others, 2013Pankaj Shukla100% (1)

- Supreme Court Rules 1980 Ammended PDFDocument101 pagesSupreme Court Rules 1980 Ammended PDFAneel kumarNo ratings yet

- SLP Memo PDFDocument33 pagesSLP Memo PDFShikhar SrivastavNo ratings yet

- Ram Kishan Fauji V HR SC 2017 Forensic EtcDocument60 pagesRam Kishan Fauji V HR SC 2017 Forensic EtcwhybangadNo ratings yet

- Epf Appellate AppealDocument7 pagesEpf Appellate AppealSyed Mohammad Neyaz Hasnain100% (1)

- Allahabad HC Quashing of FIR Sec66A IT ActDocument2 pagesAllahabad HC Quashing of FIR Sec66A IT ActNewsclickNo ratings yet

- Bombay High Court OrderDocument58 pagesBombay High Court OrderThe Wire100% (4)

- Curative PetitionDocument2 pagesCurative PetitionYogesh MeenaNo ratings yet

- IP Design Search Report Sample OnlyDocument9 pagesIP Design Search Report Sample OnlyrajeshwariNo ratings yet

- 498A FIR Quashing - SC JudgementDocument28 pages498A FIR Quashing - SC JudgementMukesh Kumar SahaNo ratings yet

- GST Appeals and RevisionDocument16 pagesGST Appeals and RevisionmonikaNo ratings yet

- 7.09.17 Labour RTI Congnizance 8.08Document5 pages7.09.17 Labour RTI Congnizance 8.08Shri Gopal SoniNo ratings yet

- SC Refuses To Entertain Prashant Bhushan's PIL Alleging Abuse of Office by Justice C.K. Prasad Says The Aggrieved Can File Review or Curative PetitionDocument2 pagesSC Refuses To Entertain Prashant Bhushan's PIL Alleging Abuse of Office by Justice C.K. Prasad Says The Aggrieved Can File Review or Curative PetitionLive LawNo ratings yet

- In The Supreme Court of India Civil Appellate Jurisdiction CIVIL APPEAL NO. - OF 2019Document3 pagesIn The Supreme Court of India Civil Appellate Jurisdiction CIVIL APPEAL NO. - OF 2019Arihant JainNo ratings yet

- Y. Narasimha Rao v. Y Venkata Laxmi PDFDocument7 pagesY. Narasimha Rao v. Y Venkata Laxmi PDFVishalSinghNo ratings yet

- Legal Diary For InvestigatorsDocument2 pagesLegal Diary For InvestigatorsMahesh KumarNo ratings yet

- Case Law On - Exhibiting A Document Is An Administrative Act - It Has Nothing To Do With ProofDocument2 pagesCase Law On - Exhibiting A Document Is An Administrative Act - It Has Nothing To Do With ProofPrasadNo ratings yet

- Agartala: High Court of TripuraDocument4 pagesAgartala: High Court of TripuraLawbuzz CornerNo ratings yet

- Sep'14 ComplainDocument23 pagesSep'14 ComplainAbhishek TiwariNo ratings yet

- 1st RTI Appeal For Audit StatementDocument1 page1st RTI Appeal For Audit StatementAdv. Ibrahim DeshmukhNo ratings yet

- Guidelines On Land AllotmentDocument10 pagesGuidelines On Land AllotmentJawwad AhmadNo ratings yet

- Oppo PDFDocument41 pagesOppo PDFSatyam ThakurNo ratings yet

- Quashing DecisionsDocument127 pagesQuashing DecisionsSunil LodhaNo ratings yet

- Godwin PilDocument9 pagesGodwin PilKannanvel KannanNo ratings yet

- Appeal 7Document25 pagesAppeal 7pankaj_pandey_21No ratings yet

- Supreme Court Judgment On Sentencing Part of Criminal Justice SystemDocument10 pagesSupreme Court Judgment On Sentencing Part of Criminal Justice SystemLatest Laws Team100% (1)

- PetitionerDocument14 pagesPetitionerAmithab SankarNo ratings yet

- Format ADocument39 pagesFormat ASapan AhlawatNo ratings yet

- CBI CaseDocument15 pagesCBI CaseSanjeev KumarNo ratings yet

- Summon The Witness in MVOP-31 - 2013Document4 pagesSummon The Witness in MVOP-31 - 2013Ravi Kumar0% (1)

- PetitionDocument71 pagesPetitionhmj74761308100% (1)

- Pune Consumer Court - AWHODocument21 pagesPune Consumer Court - AWHOcnath_1No ratings yet

- InvestigationDocument105 pagesInvestigationPavan KarthikNo ratings yet

- Snapdeal PetitionDocument11 pagesSnapdeal PetitionBar & Bench100% (1)

- "Delay/Laches/Limitations": Research Project OnDocument21 pages"Delay/Laches/Limitations": Research Project Onvijaya choudharyNo ratings yet

- Uco Bank - Tulshiram Mujumale - List of Documents - Plaint To Submitted in The CourtDocument2 pagesUco Bank - Tulshiram Mujumale - List of Documents - Plaint To Submitted in The CourtAbdul Jabbar ShaikhNo ratings yet

- LT - Legal Awareness Feb-2016 CNLUDocument52 pagesLT - Legal Awareness Feb-2016 CNLUDank ShankNo ratings yet

- CLAT PetitionDocument56 pagesCLAT PetitionlegallyindiaNo ratings yet

- Landmark Judgements On Consumer Law 2008-2020Document275 pagesLandmark Judgements On Consumer Law 2008-2020mrudra819No ratings yet

- Tax Appeal Petition 01-17-2Document9 pagesTax Appeal Petition 01-17-2ashoka4425100% (1)

- Final SuitDocument6 pagesFinal SuitNeetish Kumar HandaNo ratings yet

- SR - No Nature of Case: Court Fee INDocument4 pagesSR - No Nature of Case: Court Fee INSIMAR VIJAY SINGH RAJPOOTNo ratings yet

- Definition - PF Basic Wages - Supreme Court - Brief PDFDocument2 pagesDefinition - PF Basic Wages - Supreme Court - Brief PDFRajaNo ratings yet

- Several Basic Terms Related To PayrollDocument9 pagesSeveral Basic Terms Related To PayrollAnjali PandeNo ratings yet

- CG Offer LetterDocument19 pagesCG Offer LetterPrince Kumar0% (1)

- Discussion Assessment GridDocument2 pagesDiscussion Assessment Gridapi-194946381No ratings yet

- EC - Culturally Responsive Observation ChecklistDocument2 pagesEC - Culturally Responsive Observation ChecklistLesti Kaslati SiregarNo ratings yet

- Why Is Math Important in Your LifeDocument23 pagesWhy Is Math Important in Your LifeAlliah Sta AnaNo ratings yet

- CRM Software Services IndiaDocument33 pagesCRM Software Services IndiaSales MantraNo ratings yet

- Business Presentations: Fill The Gap With A Suitable Word or Phrase. Use Textbook As A ReferenceDocument5 pagesBusiness Presentations: Fill The Gap With A Suitable Word or Phrase. Use Textbook As A ReferencealisaNo ratings yet

- Chapter 10: Management From Islamic Perspective: Self Criticism Should Be Exercised and Should Be Practiced by All atDocument4 pagesChapter 10: Management From Islamic Perspective: Self Criticism Should Be Exercised and Should Be Practiced by All atFitri Sharif67% (3)

- Lesson Exemplar in TLE-HE Using The IDEA Instructional ProcessDocument4 pagesLesson Exemplar in TLE-HE Using The IDEA Instructional ProcessRon GarrovillasNo ratings yet

- Major Schools of Thoughts Theories of Management & AdministrationDocument19 pagesMajor Schools of Thoughts Theories of Management & AdministrationSadiq NaseerNo ratings yet

- Public Policymaking Processes: Unit 5Document80 pagesPublic Policymaking Processes: Unit 5henokNo ratings yet

- Edexcel GCSE P.E. (Physical Education) Revision Guide & Workbook SampleDocument12 pagesEdexcel GCSE P.E. (Physical Education) Revision Guide & Workbook SamplePearson Schools100% (3)

- Field Trip NCPDocument14 pagesField Trip NCPchaitali shankarNo ratings yet

- School CultureDocument8 pagesSchool CultureDaniel AlcanzarinNo ratings yet

- Impotance of TrainingDocument25 pagesImpotance of TrainingDANIEL CHEKOL100% (1)

- GedaDocument2 pagesGedaशाक्य रश्क्रीनNo ratings yet

- Shivesh Raj Jaiswal (CV) PDFDocument3 pagesShivesh Raj Jaiswal (CV) PDFShivesh Raj JaiswalNo ratings yet

- RCB Dealers PHDocument3 pagesRCB Dealers PHJing AbionNo ratings yet

- Browne v. Grand Junction OrderDocument10 pagesBrowne v. Grand Junction OrderMichael_Lee_RobertsNo ratings yet

- Beko Brand Book 2017 PDFDocument75 pagesBeko Brand Book 2017 PDFYasser joudi50% (2)

- Laura U Marks, Enfoldment and Infinity - An Islamic Genealogy of New Media Art - Chapter 1Document36 pagesLaura U Marks, Enfoldment and Infinity - An Islamic Genealogy of New Media Art - Chapter 1dubregNo ratings yet

- BBB VILO CaseDocument12 pagesBBB VILO CaseYeshua Tura100% (1)

- Report Card Comments, Geography Social Studies, High School/SecondaryDocument5 pagesReport Card Comments, Geography Social Studies, High School/SecondarySchool Report Writer .com50% (2)

- Academic Question Paper Test 5Document20 pagesAcademic Question Paper Test 5usama malikNo ratings yet

- Human Resource DevelopmentDocument6 pagesHuman Resource DevelopmentPinkAlert100% (19)

- Systems Analysis & Design 7th EditionDocument45 pagesSystems Analysis & Design 7th Editionapi-24535246100% (1)

- ICF Approved Coach Training Brochure Nov 2020Document14 pagesICF Approved Coach Training Brochure Nov 2020Rajesh SaxenaNo ratings yet

- Job Description - Ops StratDocument3 pagesJob Description - Ops StratchengadNo ratings yet

- IMC Objective 1Document9 pagesIMC Objective 1Malik Muhammad AliNo ratings yet

- Bali IttineraryDocument10 pagesBali IttineraryPrimus PandumuditaNo ratings yet

- Template For Clil Unit Plan For Teyl SensesDocument31 pagesTemplate For Clil Unit Plan For Teyl SensesSonia Felipe MartínezNo ratings yet

- 2018-2019 - Seminar Workshop On Campus Journalism pp.1-4Document4 pages2018-2019 - Seminar Workshop On Campus Journalism pp.1-4NEZEL SalasNo ratings yet