Professional Documents

Culture Documents

Taxflash 2010-13

Uploaded by

mblitar2Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxflash 2010-13

Uploaded by

mblitar2Copyright:

Available Formats

Tax Indonesia

TaxFlash

December 2010, no.13

An

In This Issue

VAT on Banking

Services – How

far does it go?

VAT treatment of

Financial Lease

and Sale and

Leaseback

Confirmation on

the VAT

Cancellation

Notes

VAT on Banking Services – How far does it go?

Article 4A of the New Value Added Tax (VAT) Law No.42/2009 (“Law No.42/2009”) mandated certain services as not

subject to VAT and among them are financial services. Under Law No. 42/2009 and its Elucidation, the definition of

financial services is quite detailed but it does not cover the whole range of banking services. There are several banking

services which had been left in uncertainty with regard to the VAT treatment.

In response to queries from the banking sector, the Director General of Tax (DGT) issued Circular Letter No.SE-

121/PJ/2010 dated 29 November 2010. In the Circular, the DGT concludes that non VAT-able financial services performed

by general banks have the following main characteristics:

a. the financial service is a financing, which obtains income in the form of interest, or

b. if it is not a financing, the financial service should be directly rendered to the bank’s customers.

The Circular and its attachments provide a detailed list of the VAT-able and the non VAT-able financial services. The

services are listed down below and compared with banking services according to the Banking Law No.7/1992 as amended

by Banking Law No.10/1998.

PwC Indonesia No. 13/2010

TaxFlash Page 1

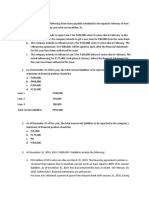

Banking Law No.10/1998 Circular Letter No.SE-121/PJ/2010

Non VAT-able VAT-able

Banking activities

banking activities banking activities

(Paragraph 4) (Paragraph 5)

(Article 6)

collect funds from public in the collect funds from public in the

form of deposits, comprising form of deposits, comprising

demand deposits, time deposits, demand deposits, time deposits,

a certificate of deposits, savings a certificate of deposits, savings

and/or other equivalent forms of and/or other equivalent forms of

deposits deposits

provide credits

b b provide credits

issuing notes

c f issuing notes

buy, sell and guarantee on own

buy, sell and guarantee for and

risk or for and as instructed by guarantee on own risk:

as instructed by customers:

customers: 1) bill of exchange, including

1) bill of exchange, including

1) bill of exchange, including bank’s acceptance which

bank’s acceptance which

bank’s acceptance which maturity are not longer than

maturity are not longer than

maturity are not longer than common practice in the

common practice in the

common practice in the trade papers referred to;

trade papers referred to;

trade papers referred to; 2) promissory notes and other

2) promissory notes and other

2) promissory notes and other commercial papers, the

commercial papers, the

commercial papers, the maturity of which are not

maturity of which are not

maturity of which are not more than the common

more than the common

more than the common practice in the trade papers

d g f practice in the trade papers

practice in the trade papers referred to;

referred to;

referred to; 3) treasury bills and

3) treasury bills and

3) treasury bills and government guarantees;

government guarantees;

government guarantees; 4) certificate of Bank of

4) certificate of Bank of

4) certificate of Bank of Indonesia (SBI);

Indonesia (SBI);

Indonesia (SBI); 5) bonds;

5) bonds;

5) bonds; 6) commercial papers with

6) commercial papers with

6) commercial papers with maturity within a year;

maturity within a year;

maturity within a year; 7) other security instruments

7) other security instruments

7) other security instruments with maturity within a year

with maturity within a year

with maturity within a year

fund transfer either on own

behalf or for the interest of non- fund transfer for the interest of

e a

customers non-customers

placing funds in, borrowing

placing funds in, borrowing funds

funds from, or lending funds to

from, or lending funds to other

other banks, whether by letter,

banks, whether by letter,

f telecommunications device, or c

telecommunications device, or by

by sight draft, cheque, or other

sight draft, cheque, or other

means

means

receive payment of claim for

receive payment of claim for

securities and perform

securities and perform

g calculation with or among third c

calculation with or among third

parties

parties

providing a place to store providing a place to store

h d

valuable goods and securities valuable goods and securities

PwC Indonesia No. 13/2010

TaxFlash Page 2

Banking Law No.10/1998 Circular Letter No.SE-121/PJ/2010

Non VAT-able VAT-able

Banking activities

banking activities banking activities

(Article 6) (Paragraph 4) (Paragraph 5)

conducting deposit activities for

conducting deposit activities for

the interest of other parties

i e the interest of other parties

under certain contracts

under certain contracts

fund placement from a customer fund placement from a customer

to another customer in the form to another customer in the form

j b

of securities not listed in the of securities not listed in the

stock exchange stock exchange

conducting activities in

conducting activities in factoring conducting activities in trustee

k factoring, credit cards, and d e

and credit cards services

trustee services

providing financing and/or providing financing and/or

conducting other activities based conducting other activities based

l on Syariah Principles, in e on Syariah Principles, in

accordance with the regulations accordance with the regulations

stipulated by Bank Indonesia stipulated by Bank Indonesia

perform other activities perform other activities perform other activities

commonly done by the bank as commonly done by the bank as commonly done by the bank as

m long as they do not contradict h long as they do not contradict the g long as they do not contradict

the Banking Law and prevailing Banking Law and prevailing the Banking Law and prevailing

regulations regulations regulations

The attachments to the Circular also provide examples of banking products/services for each group listed above.

Other than the above list, foreclosed assets which are then sold by the bank are also subject to 10%VAT. The technical

regulatory basis of this treatment is not mentioned in the Circular.

Although this Circular is quite comprehensive, it still leaves some issues to be clarified, amongst others:

As banking products are continuously developing, how would banking practitioners assess the VAT implications of

new products not included in the Circular?

One of the main characteristics of non VAT-able financial service is the service is directly rendered to customers;

however, we noted that in the examples mentioned in the Circular that certain banking income e.g., from transactions

of bank drafts, traveler’s checks, telex, and swift, are subject to VAT. Is it true then that those services are not directly

rendered to customers?

In practice, it will be challenging to identify services rendered to customers and to non-customers. Clearer definitions

of “customers” and “non-customers” in day-to-day banking operation are needed.

The Circular was issued to confirm the implementation of the Law No. 42/2009, specifically on financial services

issues. Since the Law No. 42/2009 has been effective since 1 April 2010, does it mean that banks delivering services

subject to VAT according to the above Circular will be imposed administrative penalties for not issuing VAT invoices

( 2% of Tax Imposition Base) and for late issue of VAT invoices (2% per month) starting from 1April 2010 ? What is the

impact to the customers for late VAT invoice issued more than three months since the related service delivery, would

the VAT be creditable?

PwC Indonesia No. 13/2010

TaxFlash Page 3

VAT treatment of Financial Lease and Sale and Leaseback

As defined in Law No. 42/2009, leasing with option right (financial lease) is classified as a non VAT-able service, whereas

leasing without option right (operating lease) is subject to 10% VAT. The DGT recently released a guideline on VAT

treatment of the above leasing activities in the form of Circular Letter No. SE-129/PJ/2010 (“SE-129”) dated and effective

as of 29 November 2010.

In 1994, the Indonesian Tax Office already issued a comprehensive guideline on VAT and Income Tax treatments of

leasing transactions i.e., SE-10/PJ.42/1994 (“SE-10”). However, this Circular was revoked by SE-129, which is not as

comprehensive as SE-10 and only addresses the VAT treatment.

The most significant change brought by SE-129 is the confirmation that sale and leaseback of capital goods in financial

lease scheme is not subject to VAT.

It is now confirmed that in the financial lease of capital goods, the lessor is not required to register for VAT purposes (to be

a PKP/VAT-able Entrepreneur) considering the following reasons:

a. the taxable (capital) goods are from supplier and considered directly delivered by supplier to lessee;

b. lessor is only rendering a financing service which is not subject to VAT; and

c. the delivery of taxable goods from lessee to lessor in substance are for collateral purposes.

Consequently, the lessor is not required to issue VAT invoice for financial lease. Previously, the party who delivers/sells the

goods has to fill out the buyer’s identity in the VAT invoice with the identity of the lessor q.q.(qualitate qua) the lessee.

Now, the VAT invoice is directly issued to the lessee and the lessor’s identity does not need to be mentioned again.

The new Circular does not clearly address VAT impact for early termination of a financial lease.

Confirmation on the VAT Cancellation Notes

The DGT has recently released Circular Letter No.SE-131/PJ/2010, which is a confirmation of the treatment on the VAT

Notes for Returned Goods and Cancellation of Services. This Circular is an implementing regulation of the MoF

Regulation No.65/PMK.03/2010.

The DGT confirmed that the VAT cancellation note cannot be used as a base for deduction to the seller’s Output VAT if the

VAT invoice previously issued on the delivery of relevant goods/service did not mention the buyer’s identity. Thus, to fulfill

the validity criteria, the buyer’s identity is necessary to be put in the VAT invoice as the requirement of VAT deduction if

any return of goods or cancellation of services occurs.

PwC Indonesia No. 13/2010

TaxFlash Page 4

Your PwC Indonesia contacts

Ali Mardi Hendra Lie Nazly Siregar

ali.mardi@id.pwc.com hendra.lie@id.pwc.com nazly.siregar@id.pwc.com

Ali Widodo Irene Atmawijaya Paul Raman

ali.widodo@id.pwc.com irene.atmawijaya@id.pwc.com paul.raman@id.pwc.com

Anthony J. Anderson Ita Budhi Parluhutan Simbolon

anthony.j.anderson@id.pwc.com ita.budhi@id.pwc.com parluhutan.simbolon@id.pwc.com

Anton Manik Jim McMillan Ray Headifen

anton.a.manik@id.pwc.com jim.f.mcmillan@id.pwc.com ray.headifen@id.pwc.com

Antonius Sanyojaya Laksmi Djuwita Suyanti Halim

antonius.sanyojaya@id.pwc.com laksmi.djuwita@id.pwc.com suyanti.halim@id.pwc.com

Ay-Tjhing Phan Mardianto Tim Watson

ay.tjhing.phan@id.pwc.com mardianto.mardianto@id.pwc.com tim.robert.watson@id.pwc.com

Engeline Siagian Margie Margaret Triadi Mukti

engeline.siagian@id.pwc.com margie.margaret@id.pwc.com triadi.mukti@id.pwc.com

www.pwc.com/id DISCLAIMER: This publication has been prepared for general guidance on matters

of interest only, and does not constitute professional advice. You should not act upon

the information contained in this publication without obtaining specific professional

If you would like to be removed from this mailing list, please reply and write advice. No representation or warranty (express or implied) is given as to the accuracy

UNSUBSCRIBE in the subject line, or send an email to or completeness of the information contained in this publication, and, to the extent

maria.purwaningsih@id.pwc.com. permitted by law, KAP Tanudiredja, Wibisana & Rekan, PT Prima Wahana Caraka, or

PT PricewaterhouseCoopers FAS, its members, employees and agents do not accept

© 2010 PT Prima Wahana Caraka. All rights reserved. In this document, “PwC” refers or assume any liability, responsibility or duty of care for any consequences of you or

to PT Prima Wahana Caraka, which is a member firm of PricewaterhouseCoopers anyone else acting, or refraining to act, in reliance on the information contained in

International Limited, each member firm of which is a separate legal entity. this publication or for any decision based on it.

PwC Indonesia No. 13/2010

TaxFlash Page 5

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Accounting For Financial Instruments: AS-30, AS-31, AS-32Document36 pagesAccounting For Financial Instruments: AS-30, AS-31, AS-32ratikarumitNo ratings yet

- BLAW 2 - UNIT 1 - LESSON 1 - Negotiable Instruments in GeneralDocument3 pagesBLAW 2 - UNIT 1 - LESSON 1 - Negotiable Instruments in GeneralboldtespaybNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- 12 Letter of CreditDocument16 pages12 Letter of Creditحسيب مرتضي96% (25)

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- What Is ForfaitingDocument10 pagesWhat Is ForfaitingmanjarimandalNo ratings yet

- External Commercial BorrowingsDocument37 pagesExternal Commercial BorrowingsTrisha Agarwala100% (1)

- FEMADocument41 pagesFEMApuneet.sharma1493No ratings yet

- Resa Tax 1 Final Preboard May 2018Document11 pagesResa Tax 1 Final Preboard May 2018Joyce CagayatNo ratings yet

- Types of SecuritiesDocument17 pagesTypes of SecuritiesSouvik DebnathNo ratings yet

- ARCir.04 2nov20Document3 pagesARCir.04 2nov20Puneet WadhwaniNo ratings yet

- Banking OperationsDocument22 pagesBanking OperationsRana AkkasNo ratings yet

- International Trade FinanceDocument19 pagesInternational Trade FinanceEknath BirariNo ratings yet

- Đề Cương Môn IPDocument14 pagesĐề Cương Môn IPhoangdieulinh2211No ratings yet

- BFIA (Mortgage Finance Regulations)Document24 pagesBFIA (Mortgage Finance Regulations)KELVIN A JOHNNo ratings yet

- Islamic Economy: ObjectivesDocument6 pagesIslamic Economy: ObjectivesIntiser RockteemNo ratings yet

- International Financial Management: Dr.P.K. GuptaDocument17 pagesInternational Financial Management: Dr.P.K. Guptaashu khetanNo ratings yet

- Banking Laws & Operations: (Statutory Body Under An Act of Parliament)Document16 pagesBanking Laws & Operations: (Statutory Body Under An Act of Parliament)Vinu DNo ratings yet

- Issue of DebenturesDocument28 pagesIssue of DebenturesFalguni Mathews100% (1)

- Financial Institutions and ServicesDocument17 pagesFinancial Institutions and Servicesanand.av8rNo ratings yet

- Negotiable Instruments Law 2003Document17 pagesNegotiable Instruments Law 2003Aejay Villaruz BariasNo ratings yet

- Loan-Agreement Citi MortgagesDocument80 pagesLoan-Agreement Citi Mortgagesmrinal lalNo ratings yet

- Commercial BillsDocument17 pagesCommercial BillsanshuldceNo ratings yet

- Bonds PayableDocument52 pagesBonds PayableJohn Charles Andaya100% (2)

- Bank Guarantees: Your Protection Against Non-Performance and Non-PaymentDocument37 pagesBank Guarantees: Your Protection Against Non-Performance and Non-PaymentDuyên Trần Thị QuỳnhNo ratings yet

- Capital MarketDocument2 pagesCapital MarkettymphNo ratings yet

- Concept Map - Banks & OFIDocument2 pagesConcept Map - Banks & OFISherilyn BunagNo ratings yet

- Law of Banking and Negotiable InstrumentsDocument35 pagesLaw of Banking and Negotiable InstrumentsM A MUBEEN 172919831047No ratings yet

- CACS1 Updates Version 2.3Document2 pagesCACS1 Updates Version 2.3trishitalalaNo ratings yet

- Mortgage Loan AgreementDocument80 pagesMortgage Loan AgreementRohit WankhedeNo ratings yet

- Introduction To Negotiable Instruments Law: Intended Learning OutcomesDocument6 pagesIntroduction To Negotiable Instruments Law: Intended Learning OutcomesRikki Joy C MagcuhaNo ratings yet

- Negotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentDocument12 pagesNegotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentAshrafNo ratings yet

- Acc 6.1 Boe & PNDocument31 pagesAcc 6.1 Boe & PNJpNo ratings yet

- Governing Law: - The Negotiable Instruments Law (ACT No. 2031)Document7 pagesGoverning Law: - The Negotiable Instruments Law (ACT No. 2031)Leilani WeeNo ratings yet

- Uses of Bank Funds: 1. Non - Profitable Uses 2. Profitable UsesDocument15 pagesUses of Bank Funds: 1. Non - Profitable Uses 2. Profitable UsesBatool AbbasNo ratings yet

- Bank Lending - A Look at The Standard Provisions of A Facility Agreement and General Considerations Corporate LoansDocument47 pagesBank Lending - A Look at The Standard Provisions of A Facility Agreement and General Considerations Corporate Loanssrinath.koten1962No ratings yet

- Banking & FinanceDocument23 pagesBanking & FinanceHamza Ali KhalidNo ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- On Sch-III Ucc - Division-IDocument58 pagesOn Sch-III Ucc - Division-IAman MiddhaNo ratings yet

- Business Law Questions Sem 3Document32 pagesBusiness Law Questions Sem 3Aashna JainNo ratings yet

- 731 - 740 Fa-6Document17 pages731 - 740 Fa-6738 Lavanya JadhavNo ratings yet

- Op Cred Ban U8Document12 pagesOp Cred Ban U8Fer RamirezNo ratings yet

- Golden Notes MercantileDocument351 pagesGolden Notes MercantileRodel De Guzman100% (1)

- Banking Law Internal AnswersDocument4 pagesBanking Law Internal AnswersbabludassNo ratings yet

- Unit7 BondsDocument21 pagesUnit7 BondsVinay Gowda D MNo ratings yet

- Narrative Report On International Financial ManagementDocument8 pagesNarrative Report On International Financial ManagementWang TomasNo ratings yet

- Legal Status of Bitcoins in IndiaDocument4 pagesLegal Status of Bitcoins in IndiaVarsha ThampiNo ratings yet

- Format Due DiligenceDocument48 pagesFormat Due DiligenceUmeshNo ratings yet

- GIP-Syllabus 2022Document4 pagesGIP-Syllabus 2022aadilkhan15082009No ratings yet

- SuggestionDocument6 pagesSuggestionMeheraf ShamimNo ratings yet

- National Law School of India University, BangaloreDocument0 pagesNational Law School of India University, BangaloreNeha JayaramanNo ratings yet

- Chapter 2 - Investments Schemes PPT-EDITEDDocument51 pagesChapter 2 - Investments Schemes PPT-EDITEDjiny benNo ratings yet

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- Hedging of Fixed Income Securities Using Interest Rate Swap: Presented byDocument43 pagesHedging of Fixed Income Securities Using Interest Rate Swap: Presented byAbhijeet SinghNo ratings yet

- Documentary Credits and CollectionDocument50 pagesDocumentary Credits and CollectionSava VijakNo ratings yet

- China Interbank Bond Market and FX MarketDocument60 pagesChina Interbank Bond Market and FX MarketbondbondNo ratings yet

- Trade Finance 1Document59 pagesTrade Finance 1Mohiddin ghouseNo ratings yet

- NI-Full NotesDocument27 pagesNI-Full NotesArchana PurohitNo ratings yet

- 201743-2016-InG Bank N.V. v. Commissioner of InternalDocument11 pages201743-2016-InG Bank N.V. v. Commissioner of Internalaspiringlawyer1234No ratings yet

- RR 09-94Document12 pagesRR 09-94kimoymoy7No ratings yet

- Civil Law and Common Law: Two Different Paths Leading To The Same GoalDocument25 pagesCivil Law and Common Law: Two Different Paths Leading To The Same Goalpeanut47100% (2)

- Draft Loan AgreementDocument5 pagesDraft Loan Agreementlos dos ojosNo ratings yet

- IAChap013PPT LIABILITIES - 2023Document10 pagesIAChap013PPT LIABILITIES - 2023lqviettNo ratings yet

- Discounted Promissory Notes 4.2Document11 pagesDiscounted Promissory Notes 4.2Brynne UrreraNo ratings yet

- Garcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934Document1 pageGarcia vs. Lim Chu Sing, 59 PHIL. 562, NO. 39427 FEBRUARY 24, 1934mark gil alpasNo ratings yet

- Difference Between Cheque Promissory Note and Bill of ExchangeDocument2 pagesDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Betty Gabionza and Isabelita TanDocument21 pagesBetty Gabionza and Isabelita TanGada AbdulcaderNo ratings yet

- The Bangladesh Bank Order, 1972Document25 pagesThe Bangladesh Bank Order, 1972Md. TashirNo ratings yet

- To Business Finance and Philippine Financial SystemDocument85 pagesTo Business Finance and Philippine Financial SystemSanson OrozcoNo ratings yet

- Attachment 1Document8 pagesAttachment 1buddymoorNo ratings yet

- Sample Answers of Famous Bar TopnotchersDocument12 pagesSample Answers of Famous Bar Topnotchersdheck13100% (6)

- Blo .... 2017-18Document51 pagesBlo .... 2017-18shanthala mNo ratings yet

- Noting and ProtestDocument16 pagesNoting and ProtestJiaNo ratings yet

- 49 Agro Conglomerate Vs CADocument5 pages49 Agro Conglomerate Vs CACharm Divina LascotaNo ratings yet

- RBI Lender of Last ResortDocument18 pagesRBI Lender of Last ResortHemantVermaNo ratings yet

- Corporation Law After Midterms ReviewerDocument140 pagesCorporation Law After Midterms ReviewerJoseph Plazo, Ph.D100% (6)

- PBCom vs. Sps. Go (February 14, 2011)Document1 pagePBCom vs. Sps. Go (February 14, 2011)Irene PacaoNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- Chapter 4 Commercial BanksDocument33 pagesChapter 4 Commercial BanksChichay KarenJoyNo ratings yet

- Security Bank and Trust Co vs. RTC MakatiDocument3 pagesSecurity Bank and Trust Co vs. RTC Makaticmv mendozaNo ratings yet

- 1definition To Breach1A (In General-Kinds of Obligsd1)Document2 pages1definition To Breach1A (In General-Kinds of Obligsd1)Cars CarandangNo ratings yet

- Credits Digest CompilationDocument89 pagesCredits Digest CompilationGee Ann BerdinNo ratings yet

- Complaint For ReplevinDocument7 pagesComplaint For ReplevinCarlo ItaoNo ratings yet

- C O M P L A I N T: Marietta LemeryDocument6 pagesC O M P L A I N T: Marietta LemeryJane SudarioNo ratings yet

- Commercial LawDocument121 pagesCommercial Lawjbsayad100% (1)

- Accounting 101 Monopoly Game Practice Set Your Name CompanyDocument10 pagesAccounting 101 Monopoly Game Practice Set Your Name CompanyjhouvanNo ratings yet

- Delos Santos Vs VibarDocument2 pagesDelos Santos Vs VibarDeborahAttiwMolitasNo ratings yet

- Bar Questions and Suggested AnswersDocument57 pagesBar Questions and Suggested AnswersPilacan Karyl100% (4)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomFrom EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomRating: 4.5 out of 5 stars4.5/5 (2)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Contract Law in America: A Social and Economic Case StudyFrom EverandContract Law in America: A Social and Economic Case StudyNo ratings yet

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet

- Law of Leverage: The Key to Exponential WealthFrom EverandLaw of Leverage: The Key to Exponential WealthRating: 4.5 out of 5 stars4.5/5 (6)

- International Trade and FDI: An Advanced Introduction to Regulation and FacilitationFrom EverandInternational Trade and FDI: An Advanced Introduction to Regulation and FacilitationNo ratings yet

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet